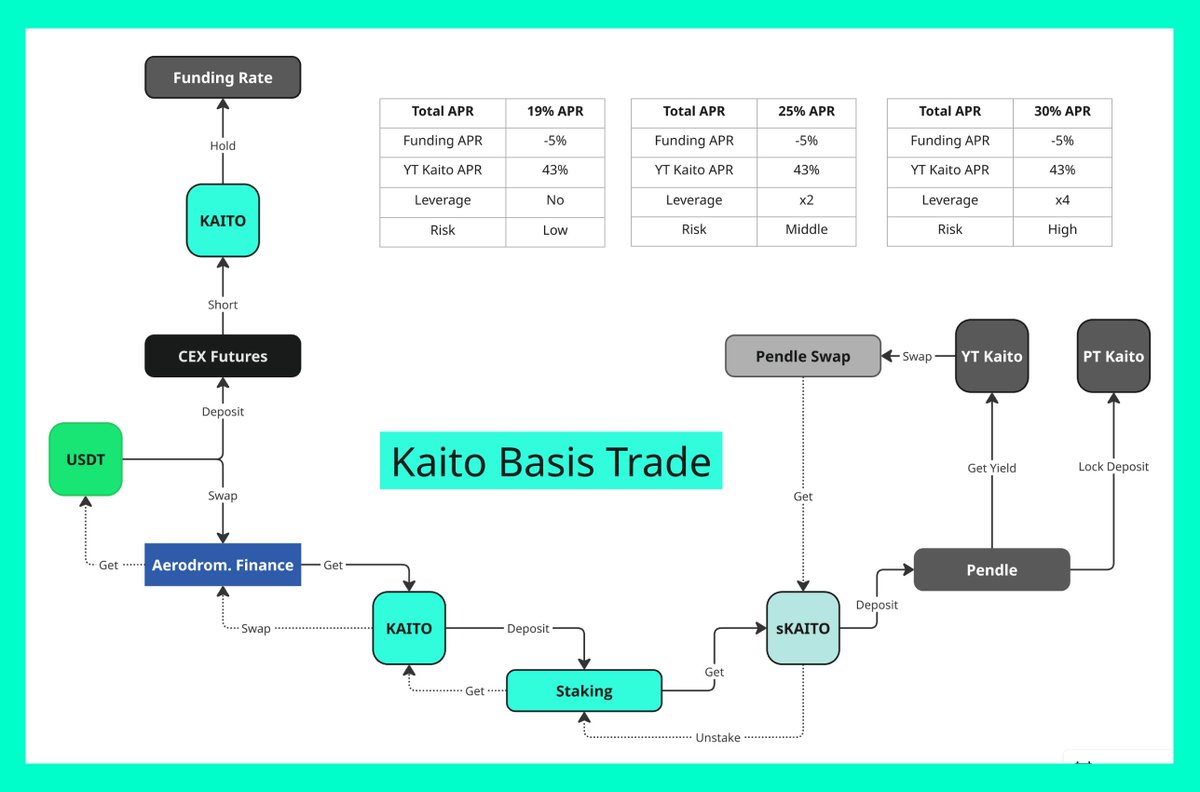

Basis Trade strategy with a yield of up to 30% APR

I choose $KAITO as an asset for this strategy for one reason - the high yield of the YT token on the Pendle platform (43% at the moment). All this will look like this:

1. Buy KAITO for USDT

2. Open short on KAITO for 2 part of USDT

3. Send KAITO to staking and receive sKAITO

4. On Pendle, split sKAITO into YT Kaito and PT Kaito

5. Sell YT Kaito for sKAITO on PendleSwap

6. Unstake sKAITO and receive Kaito (in 7 days)

7. Sell KAITO for USDT

The yield on stables will be 19% APR

You can reduce the amount of liquidity for short by taking leverage x2 - the yield will increase to 25% APR

Leverage x4 will give a yield of 30% APR

In this case, the main risk lies in the Funding Rate area, at the moment it is negative and has stabilized around 3% APR. Funding Rate calculation was based on Binance data.

In case of growth of the FR, partial sale of the PT Kaito token is possible so that the strategy remains profitable.

Theoretically, it is possible to transfer the short to any other exchange, including Hyperliquid. Due to the miscorrelation between these exchanges, funding rate arbitrage is possible, which can mitigate the risks.

What do you think about this strategy, guys?

@DefiIgnas

@TheDeFinvestor

@Deebs_DeFi

@Defi_Warhol

@Mars_DeFi

@DeFi_Finestt

@DeFi_Dad

@eli5_defi

@PendleIntern

@0xCheeezzyyyy

@ProofOfTravis

@DoggfatherCrew

3.3K

45

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.