mev (.) art

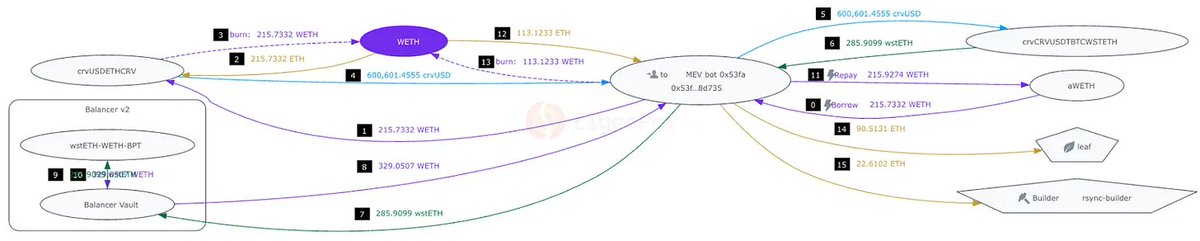

On 13 Apr 2024, ETH’s 15 % crash set off liquidations that warped the prices of a Curve pool.

In block 19649680, a flash-loan bot chained two arbitrages: borrowing 216 wETH and cycling crvUSD<>wstETH<>WETH in order to pocket 90.5 ETH ($271K, 2024’s highest profit from one transaction) in its second leg, proving mega-profits come from multi-pool sequences, not single mis-prices.

8.5K

21

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.