$SUI / $BTC chart is still one of the cleanest out there.

- Mill City Ventures announced a new $450M SUI treasury strategy last week.

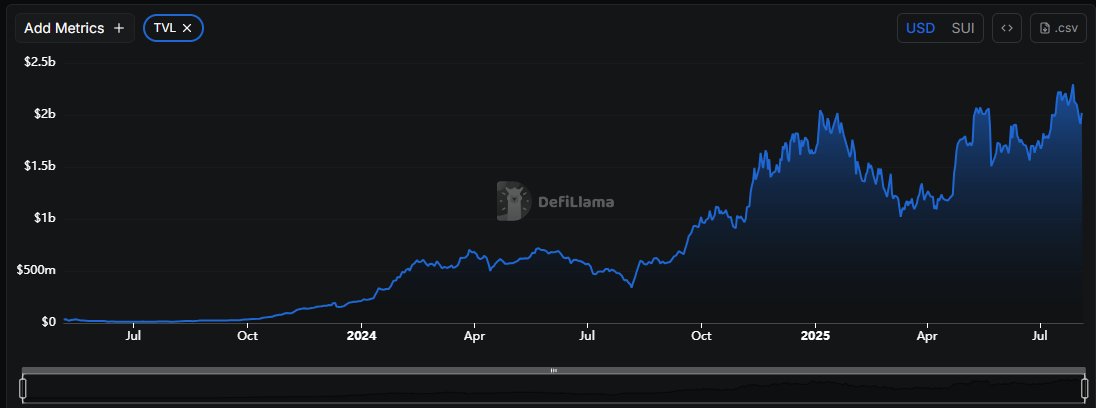

- SUI TVL hit new ATHs last week

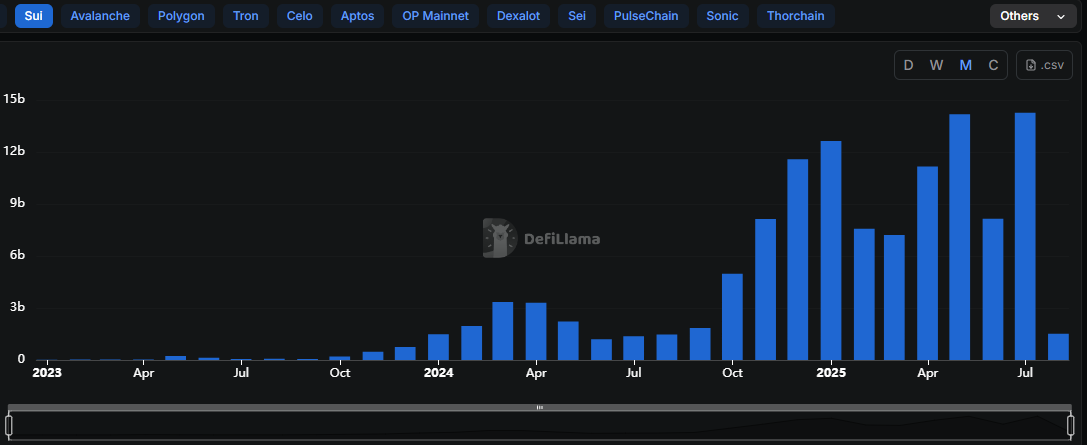

- DEX volume hit a new ATH in July

Still a huge opportunity gap in the monolithic L1 space. Don't fade momentum.

Think we see L1 ecos cook when BTC makes the next leg up.

Only a matter of time.

#Bitcoin / $BTC

Up only szn is almost here.

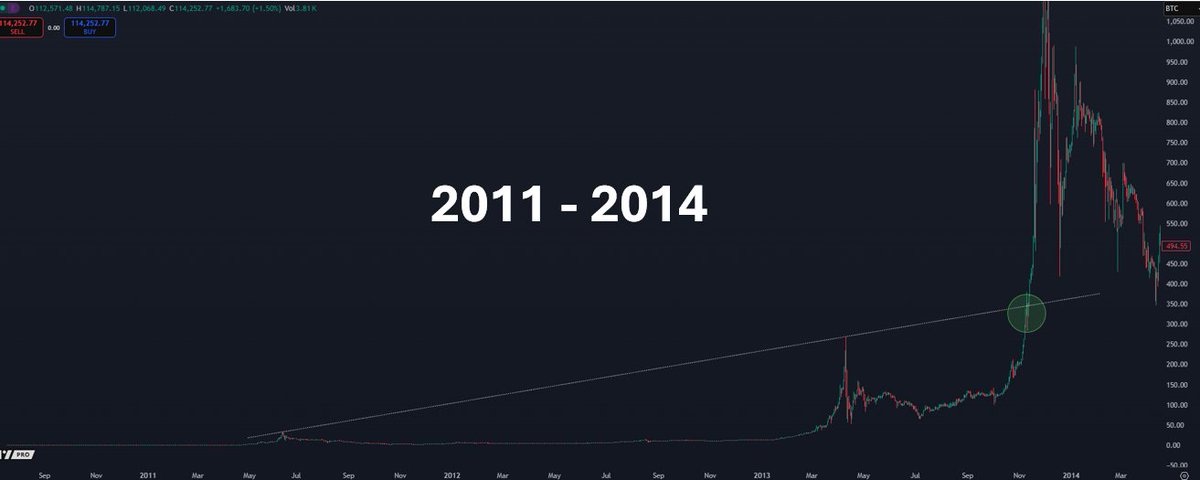

Each bull markets saw significant acceleration higher at inflection points tracing back to trendlines touching previous cycle's highs.

Let's take a look.

Example 1: 2011 - 2014

Example 2: 2013 - 2017

Example 3: 2014 - 2021

_________________

Looking back at the first chart I shared of recent price action, Bitcoin recently was reject precisely at the inflection point tracing back to the 2017 - 2021 bull market highs.

Bears will try and convince you the top is in and the bull market is over, when in all reality - the real fun hasn't even started yet.

Be more bullish.

56.18K

108

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.