With Tron now handling over 50% of all USDT transactions and achieving record-high revenue, it's worth keeping an eye on their ecosystem.

They quietly experienced one of their strongest first halves ever in 2025, as measured by user metrics, stablecoin dominance, and protocol revenue.

Here's what's happening in the ecosystem.

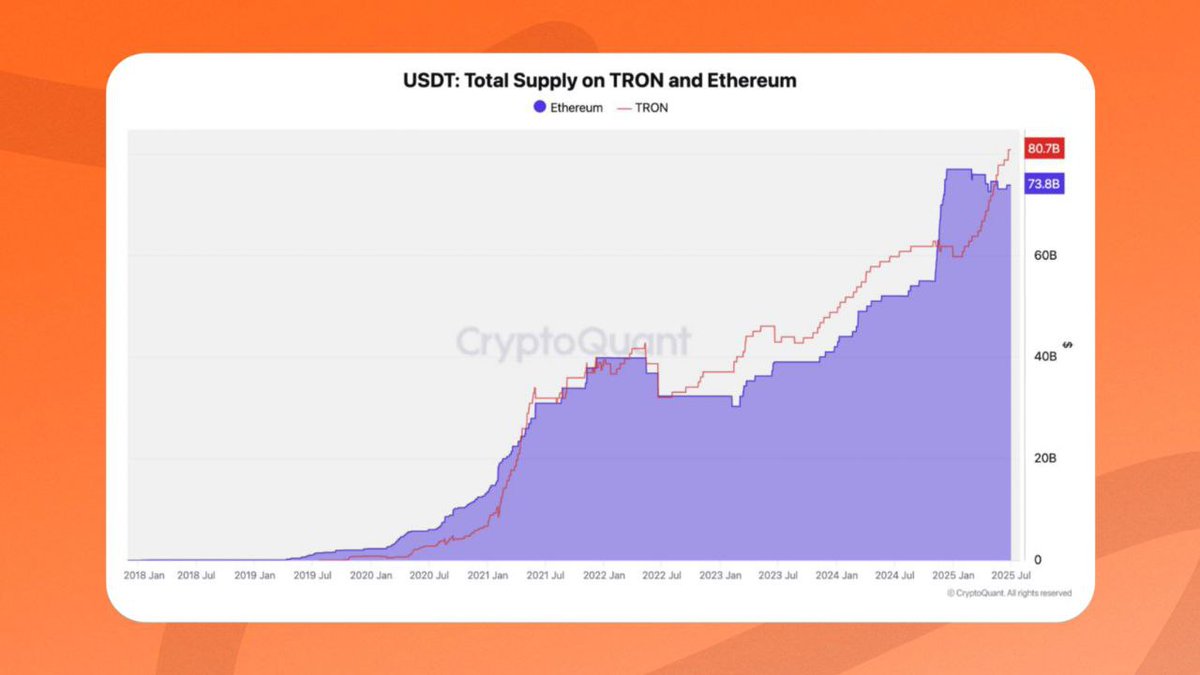

TRON now handles over 50% of all USDT transactions and holds 51% of all USDT in circulation, totaling $81 billion in USDT supply, surpassing Ethereum.

It commands over 30% of the global stablecoin market cap, with approximately 1 million USDT transfers daily.

In Q2, they processed 780 million transactions and recorded 28.7 million active addresses in June, the highest since 2023. There were 2.5 million daily active addresses and over $600 billion in stablecoin transfer volume in June. TRX now accounts for 41% of total network activity.

Their Q2 revenue reached $915.9M, a 20.5% increase, while their market cap rose 17% to $26.5B. They generated $1.4M in daily protocol fees, which is excellent for their ecosystem.

They consistently ranked in the top 2 for daily users and transaction count, just behind Solana.

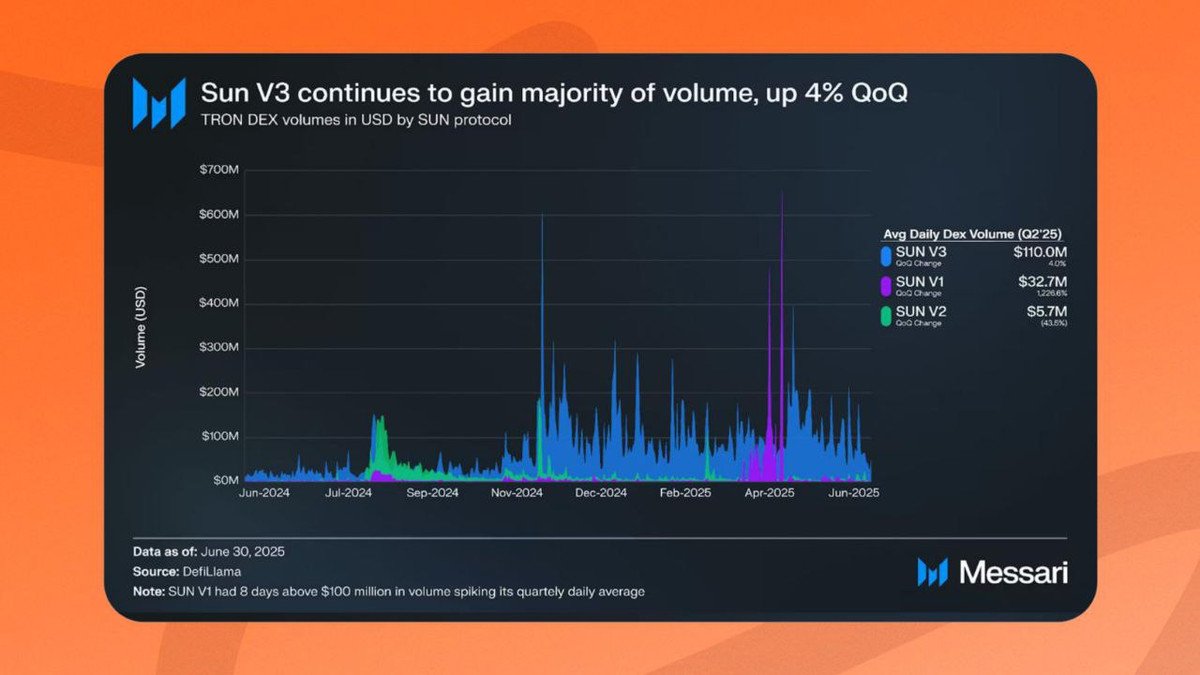

Additionally, their SunSwap dex's monthly volume peaked at $3.8B in May, indicating that their coins are also performing well. Furthermore, their daily DEX volume has increased by 25%, and Tron ranks fifth in TVL at $4.6B.

They have integrated with THORChain to enable native BTC, ETH, and ATOM swaps and have deployed Chainlink oracles to enhance their platform's functionality.

Their expansion continues through partnerships with AEON Pay, Privy, SRM, and Bridge (Stripe). Additionally, they have launched USD1, a TRON-native stablecoin, to facilitate on-chain payments.

Their 3-second block time and low fees continue to drive adoption among most web3 users, especially for low-value stablecoin transfers. On average, there were 2.3 million new wallets added daily.

TRON may not always make the headlines, but its growth in infrastructure, usage, and compliance is clear.

It is emerging as a core layer for stablecoin transfers, low-cost payments, and global DeFi.

That's all for now.

15.42K

31

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.