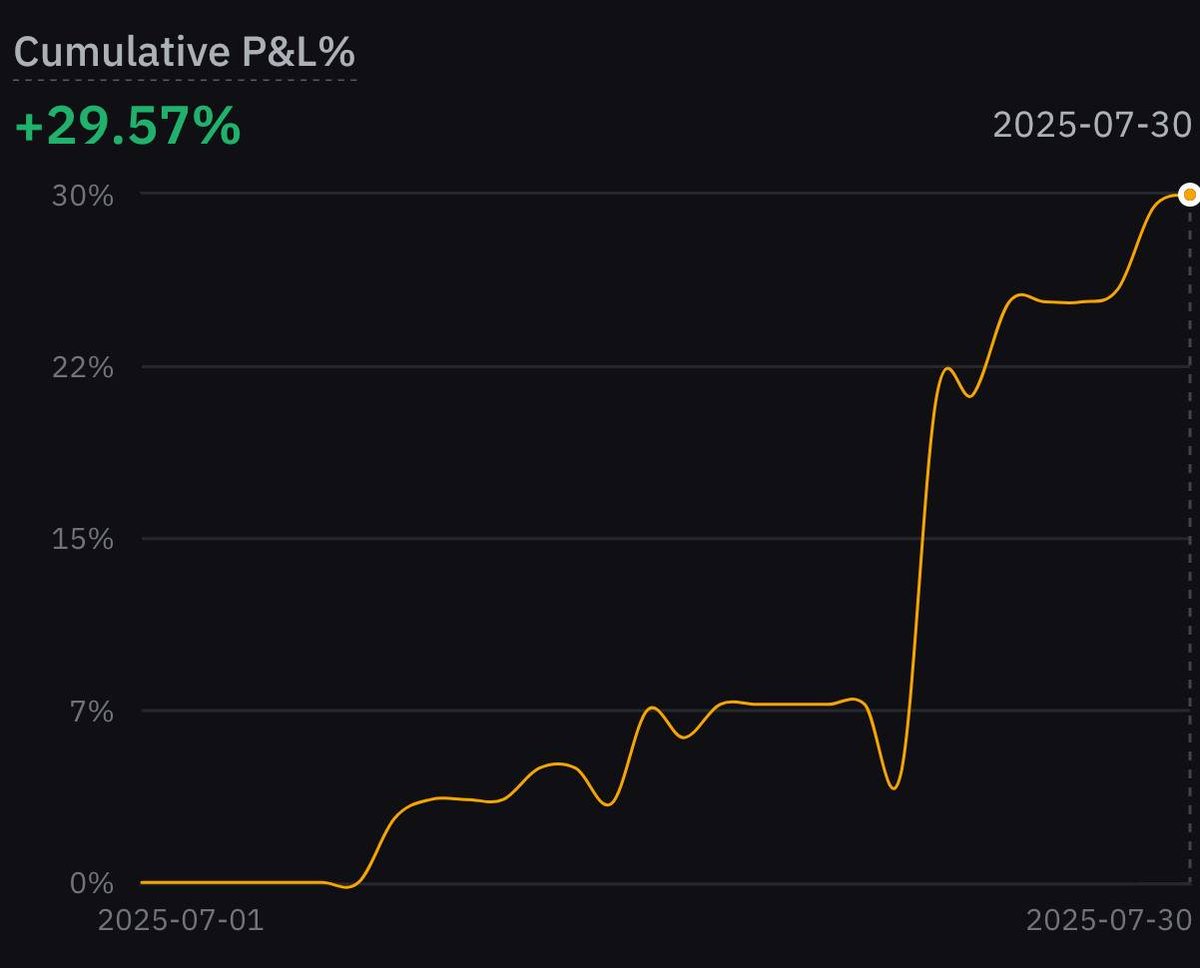

July 2025 [Trading Recap]

The perp book is up about 30% this month, pretty happy with the performance to be honest. I tend to underperform in the good times, and overperform during the bad times - so I'm not sure what that says about my trading style, but I'm more so very much a fan of a slow and steady PnL curve, rather than going for the home run. As well as being on the sit-on-your-hands train and picking free money off the floor 5 times a year.

The month was a full month of newstrades and scalps basically [really bad in hindsight]. The month started off quite slow, I had sharps around me telling me to get sized on $BTC and $ETH but I was just a little bit hesitant and was mostly sidelined on the move on BTC from $110k - $123k. I sometimes get too tunnel-visioned in my own thoughts and trading style, which is great, but sometimes limits me.

However, things started to accelerate into month end. Thankfully the market provided on news trades.

1) $PUMP: on the revenue front. DumpsterDao tweet of them tracking the revenue. The reason why I was willing to size up was any positive news would have caught people off guard and led me to hold this for 10-15 mins+. A mix of bottom shorters covering, catching people offside, and people having an emotional connection to the token and just blasting on any good news. Mistake: did not manage to hold for continuation towards $3B FDV - but system is a system, newstrades remain newstrades which is sharp execution and quick exiting.

2) $PUMP: also on the revenue front. I found that they started buying 100% of daily rev, which was a big change. Same idea as above, sized up as it felt like the market would be caught off guard and same dynamics would play out. Mistake again on not holding for continuation - but sticking to the system.

3) $SUI: There were some whispers of a $SUI vehicle coming early last week, and given some prior vehicles being announced after market close - I was a little more concentrated on flows each evening at close. $SUI on Friday was drastically outperforming relatively from 3:30-4:15 EST, along with some idiot with terrible execution blasting spot at the same time. I decided to just tail them, as I presumed they did actually know something so wanted to follow as it still felt relatively early, and the rest of the market was beginning to slip a little. Managed to hold most of the weekend, and got lucky with a few big shills from some big TG groups.

A mix of mini wins and *losses* here and there not worth mentioning (shorting ENA and closing for a small gain, longing OMNI on Upbit for a small gain)

August outlook:

TLDR: I don't know. Seeing some smaller circles who I trust flip a little bearish + one of my favourite macro guys also short, is leading me towards it being not a great month. However, I think it's fair to say "sell in May" was pushed and it was not the case.

I think it's also probably fair to say that the first phase of these TCO flows are nearly finished/if not done. The Saylor news last night is definitely a structural change in the short term as he literally outed a certain mNAV where he will sell common stock, which is never a good thing. I think news will be viewed as bearish until there is clarity as to how much he can raise from preferreds. Macro wise, key drivers for shorting USD and betting on fiat debasement are fading, at least for now, and maybe that trade will materialise a little more in August = USD/Risk ratio up. But I'm not entirely sure.

That is about it. I keep telling myself I will take a holiday/take time off, but I just don't think I will. Dont feel much of a need.

Market is still providing a heck of a lot, and until then I will milk the edge until it's no longer milkable. And also - "why not showing $ PnL", I don't care, I have nothing to prove to any of you. The 30% book PnL could be $474, $474,000, or $4,474,000. Who knows.

16.58K

107

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.