Everyone talks about fast blockchains. But the real question is: fast for what?

So let’s talk @Aptos vs @Injective, two of the fastest L1s out there, but built for very different reasons

Aptos is a general-purpose chain with deep regulatory focus. Think stablecoins, RWAs, real-world payments. It’s fast like 160K TPS testnet fast, thanks to Block-STM and parallel execution.

You get sub-second finality, deterministic gas pricing, and a developer experience built for fintech-scale apps.

Injective, on the other hand, is purpose-built for trading. It’s a Cosmos-based L1 with zero gas fees, native orderbooks, and real-time onchain execution. Perps, spot markets, vaults, RWAs—all deployed with modular plug-and-play infrastructure. It’s not just fas, it’s financially optimized.

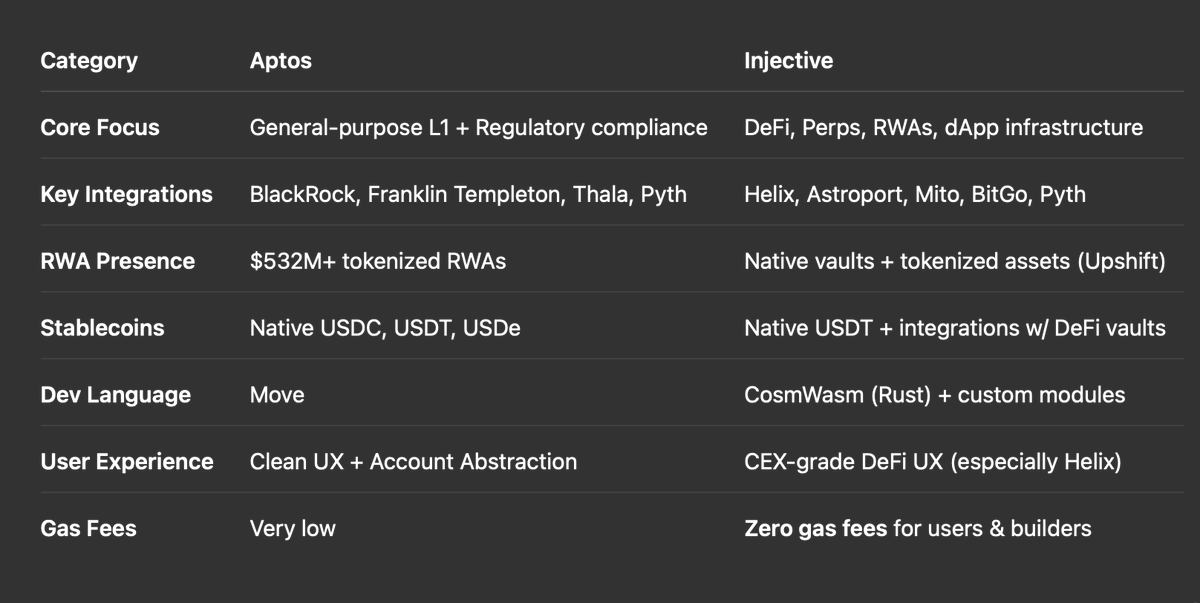

Let’s break down the core difference:

Aptos is fast like a bank regulatory-grade throughput, KYC-ready infra, and real-world compliance baked into the token standard.

Injective is fast like a trader low-latency, zero gas, and built for split-second execution under load.

--

In terms of ecosystem:

Aptos has integrations with BlackRock, Franklin Templeton, Apollo/Securitize, and is native to the GENIUS Act stablecoin framework.

Injective is home to apps like Helix, Mito, Astroport, and vault platforms like Upshift. It also brought BitGo and Twinstake on as validators—bringing $100B+ of institutional trust directly to its chain.

Stablecoin velocity? Aptos leads.

Real-time DeFi execution? Injective wins.

Both are fast. Both are smart.

But if you’re building for institutional money, your choice depends on what that money wants to do:

If it’s trading and earning yield → Injective

If it’s issuing stablecoins or tokenizing assets under compliance → Aptos

One’s a speedster with perps.

The other’s a banker with precision.

And both are defining the new wave of institutional-grade blockchains.

Institutions already chose Aptos

Aptos isn’t waiting for institutions, it’s already powering them:

BlackRock: BUIDL fund

Apollo/Securitize: Credit funds

Franklin Templeton: MMF

Yellowcard: African remittances

PACT Protocol: Tokenized credit

These aren’t test pilots, they’re real-world deployments. (5/6)

3.69K

32

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.