In addition, this is not without pits, the current 4.2% can be given because the interest rate of short-term U.S. bonds is about 4.2%, but if the U.S. monetary policy enters a state of easing, then theoretically the income of RWUSD will decrease.

So for U.S. Treasury-based income, it should be the happiest period at present, this year is not bad, it is estimated that it will fall below 4% at the end of the year, there is a high probability that it will be around 2-3% in 2026, and it will be less than 2% in 2027.

However, for this year, it is indeed not a good choice, especially the maximum limit of $5 million per person, which is more convenient than buying U.S. bonds directly, and the money Binance makes is a T+3 fee of 5/10,000 and a T+0 early redemption fee of 1/1000, which is equivalent to pure arbitrage, but for more than 99% of retail investors, it is a good deal.

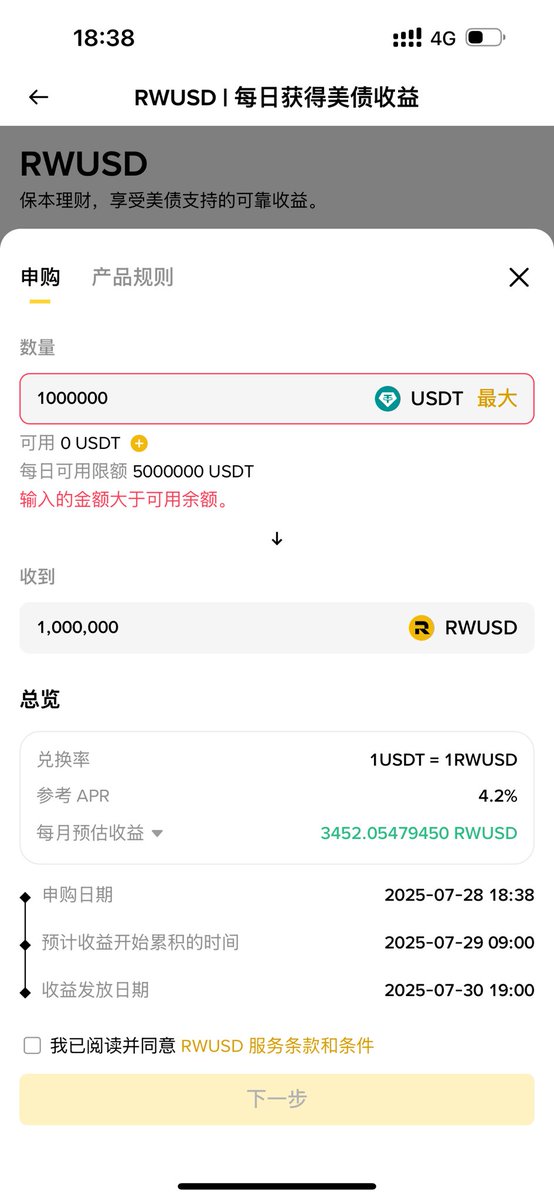

US Treasury yields have finally gone online, and you can directly use USDT to purchase RWUSD. The yield of about 1 million dollars is a monthly return of 3,452 dollars, which can be exchanged for USDC and redeemed at any time. This is truly earning interest, and it can already compete with Coinbase's USDC interest, plus it has very high stability.

25.11K

21

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.