The buzz around yield-bearing stablecoins is still loud especially with stablecoins crusing new daily ATHs. More protocols are popping up, yields are high, and the risk level is minimal.

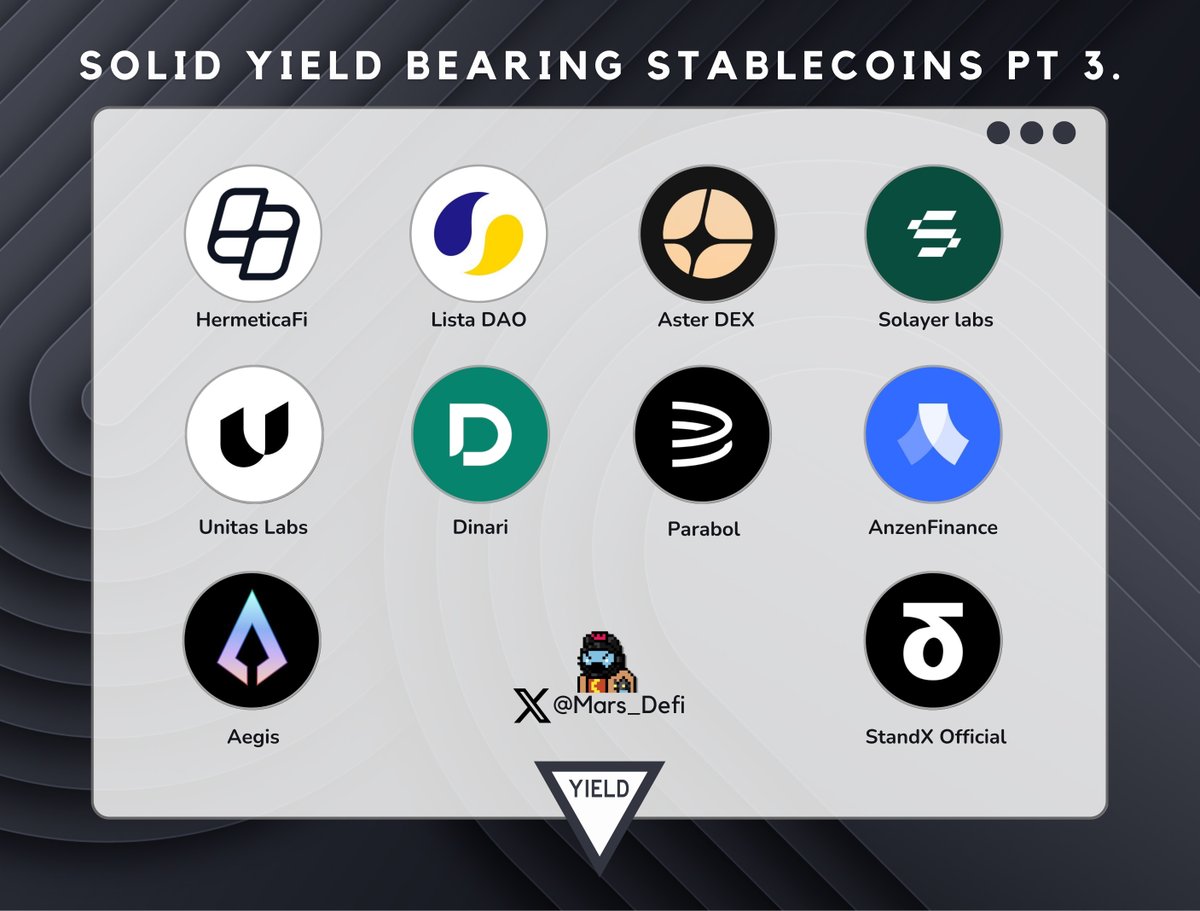

We keep up with trends over here, so here's the part 3 guide on yield-bearing stablecoins.

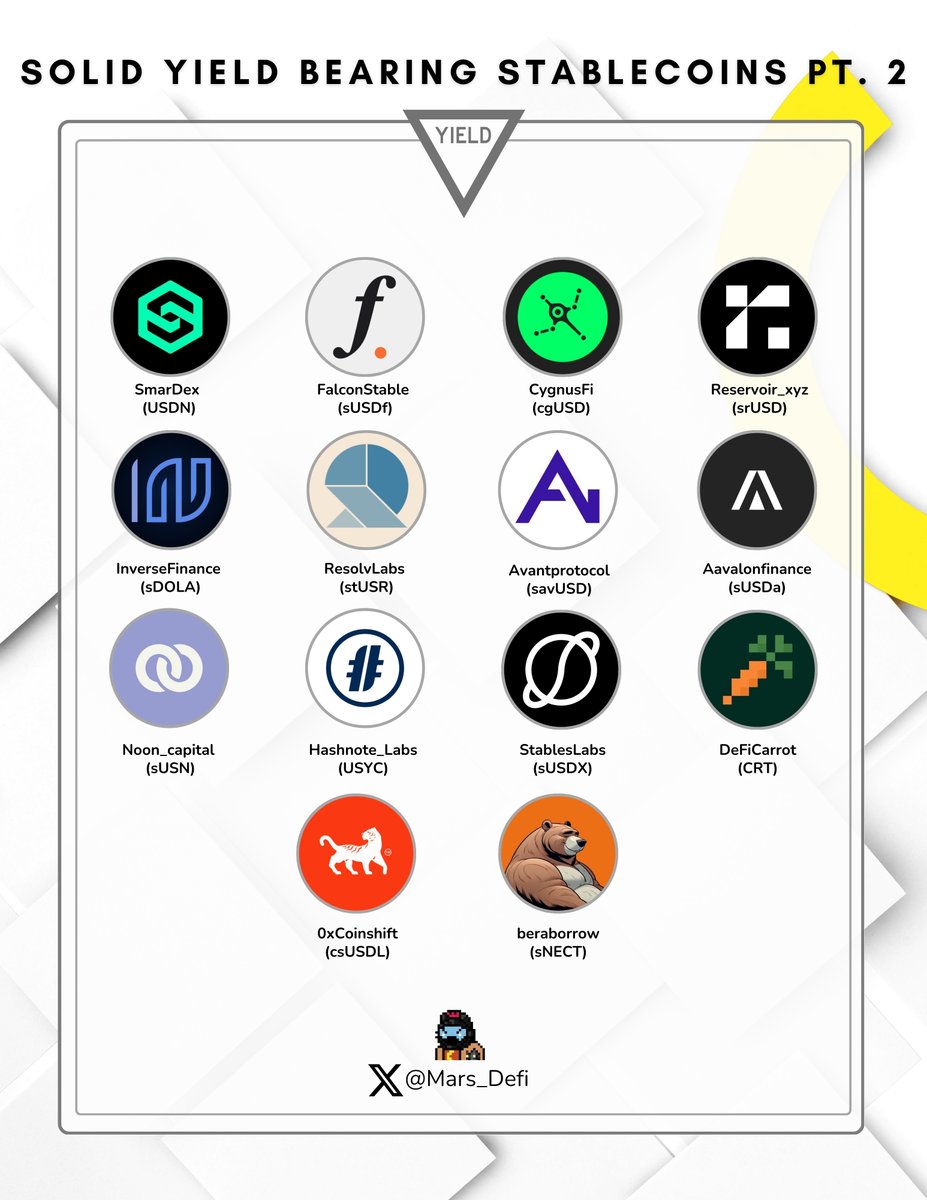

The first 2 parts just might have something that piques your interest, so check them out

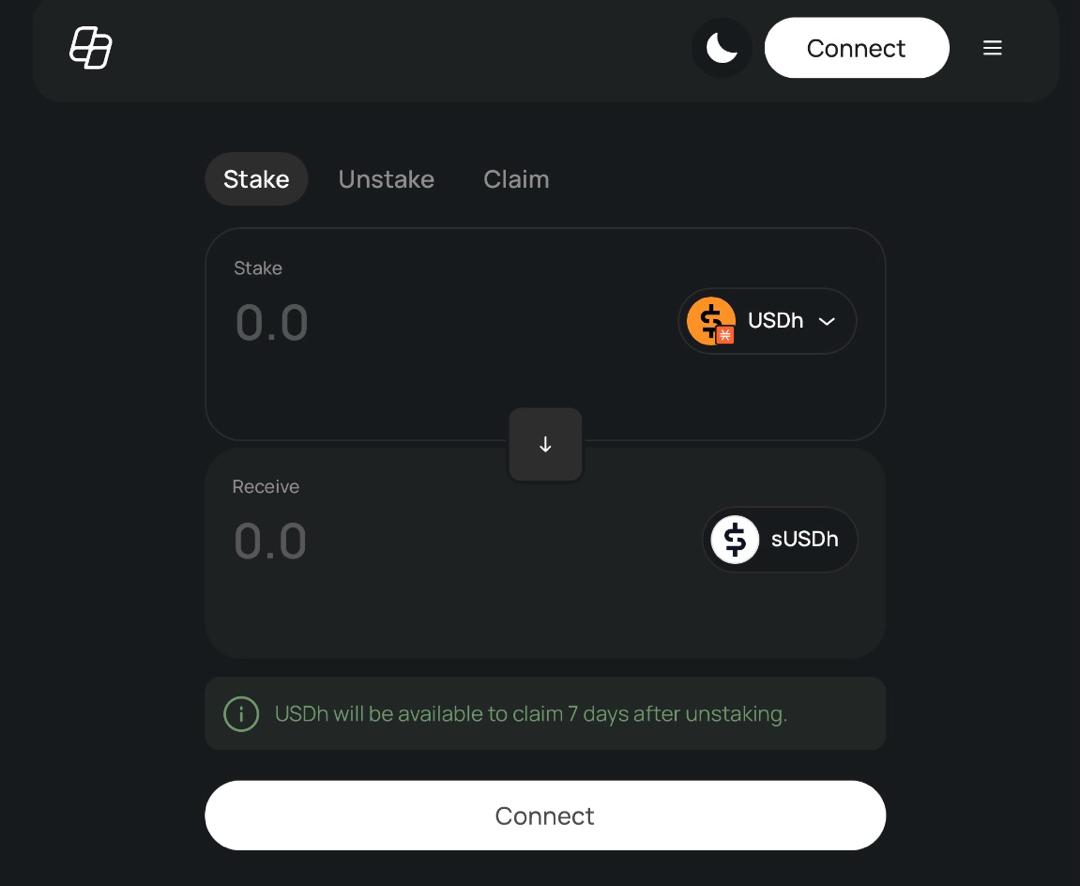

@HermeticaFi

❉ Visit

❉ Swap USDC for USDh

❉ Stake USDh to receive sUSDh (18% APY).

USDh is a synthetic dollar backed by Bitcoin. Hermetically generated yield for USDh stakers through funding rate payments earned on a short Bitcoin perpetual futures position.

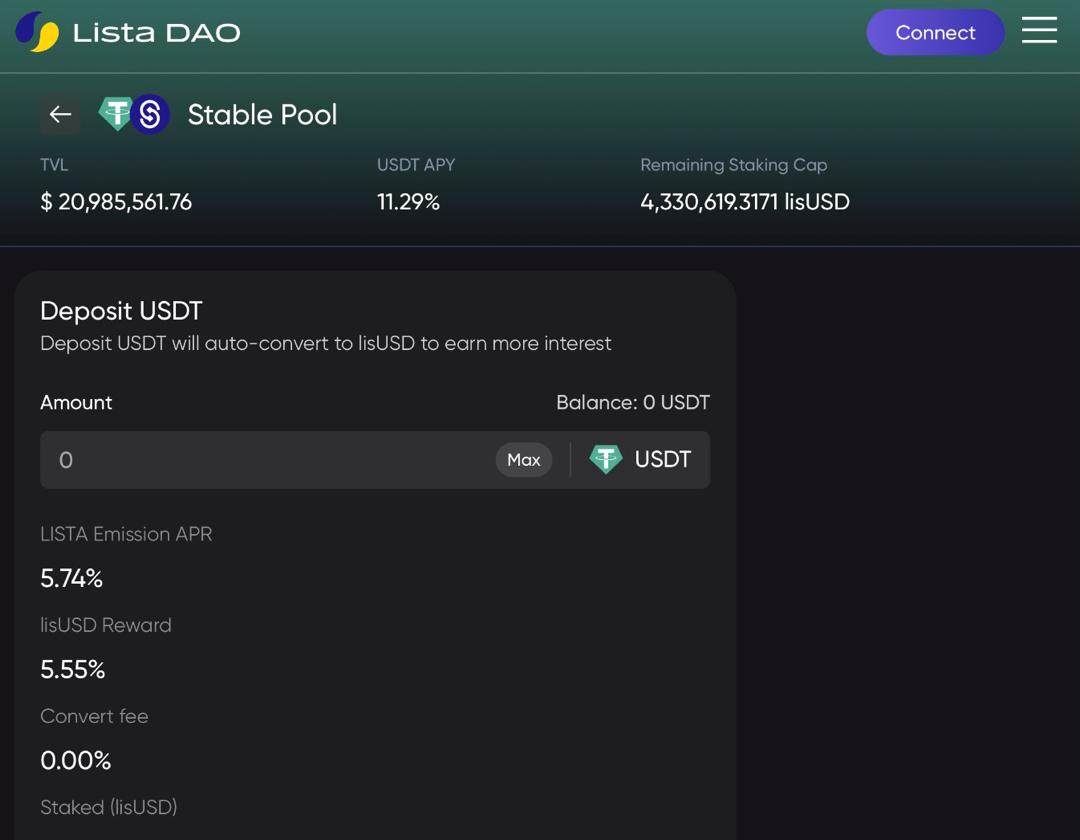

@lista_dao

❉ Visit

❉ Deposit USDT into the stable pool to receive lisUSD (5.74% APR)

❉ Stake lisUSD for more yield (5.5% APY).

lisUSD is an overcollateralized stablecoin pegged to the US dollar and backed by on-chain assets. Lista generates yield through borrowing interests and $LISTA emissions.

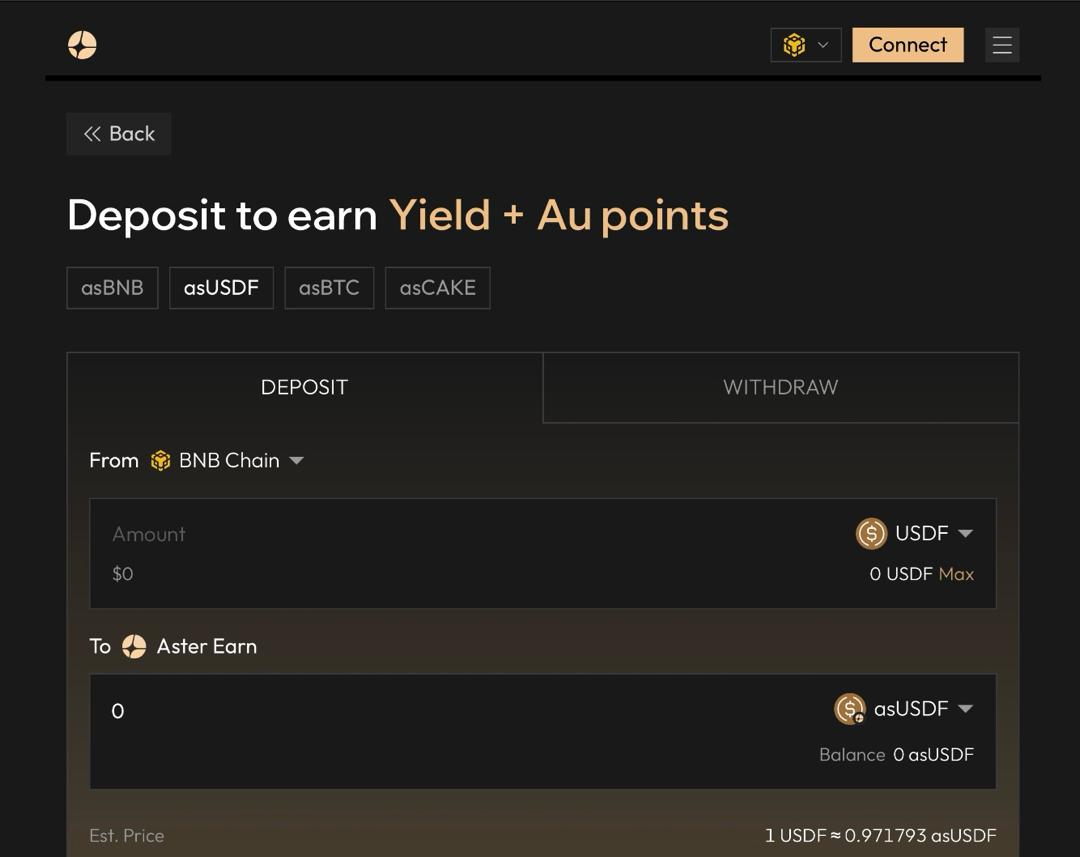

@Aster_DEX

❉ Visit

❉ Deposit USDT to mint USDF

❉ Stake USDF for asUSDF (9.7% APY).

Aster generates yield from trading fees and delta neutral strategies and distributes to USDF stakers.

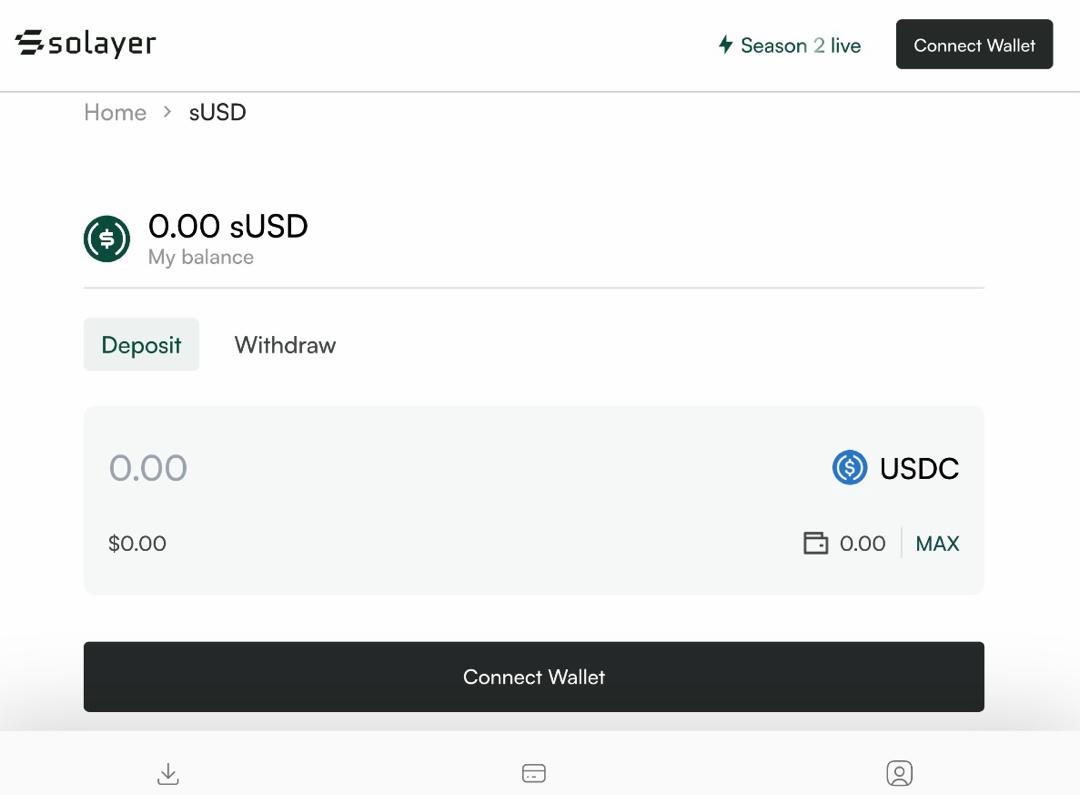

@solayer_labs

❉ Visit

❉ Stake USDC to receive sUSD (3.99% APY). sUSD can be used across DeFi on protocols like @RateX_Dex.

sUSD is the first ever yield-bearing stablecoin on Solana. Solayer generates yield through safe short-term U.S. T-bills.

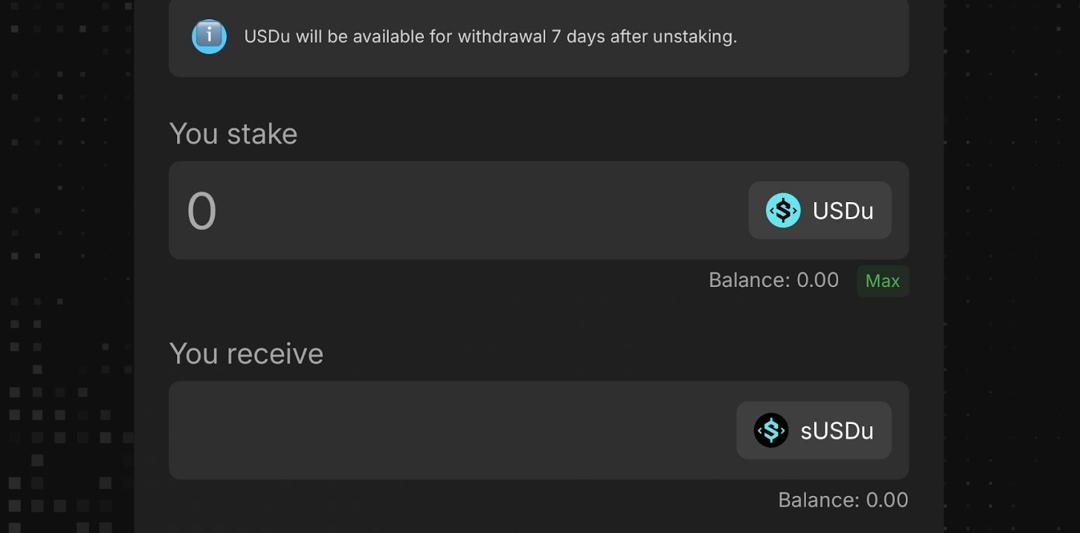

@UnitasLabs

❉ Visit

❉ Connect wallet and buy USDu

❉ Stake USDu did sUSDu (16.85% APY).

Yield is generated through protocol fees from Unitas’ multi-strategy delta neutral vaults. The value of sUSDs increases as rewards are added to the staking pool.

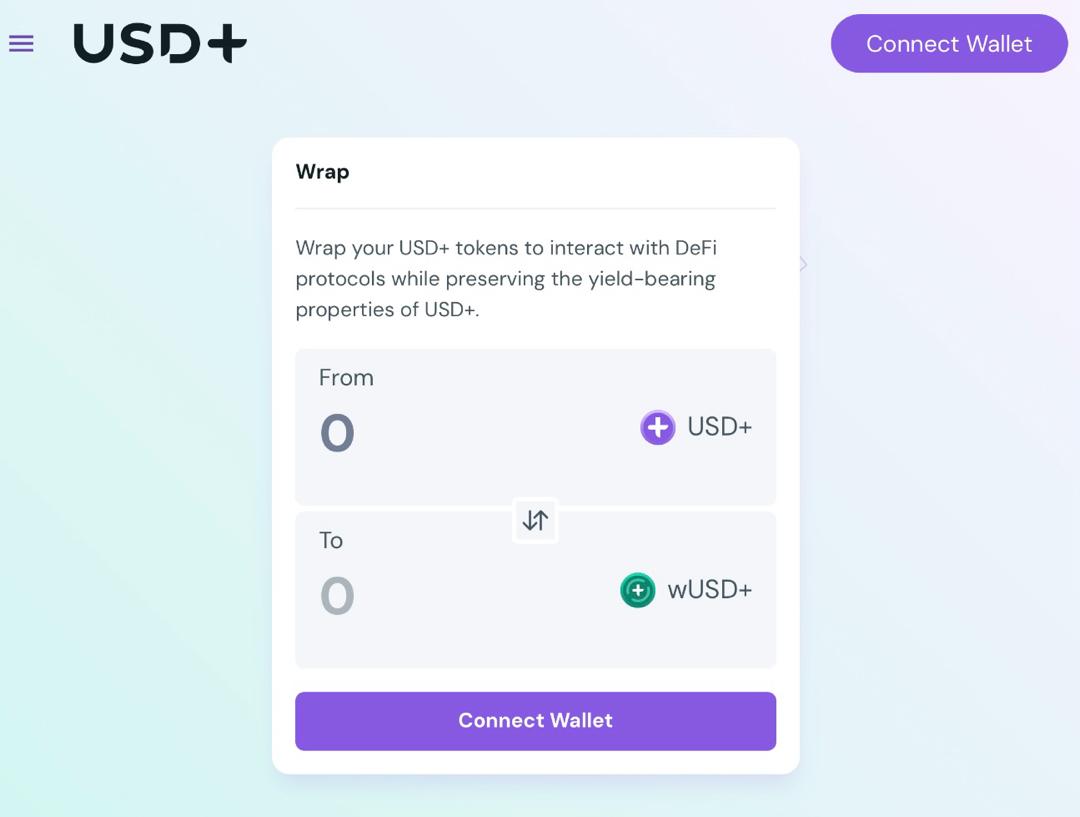

@DinariGlobal

❉ Visit

❉ Deposit USDC to receive USD+ (4.02% APY)

❉ Wrap USD+ into wUSD+ to interact with DeFi protocols.

USD+ is backed by short-term US Treasuries. Yield on USD+ automatically accrues without the need for manual staking.

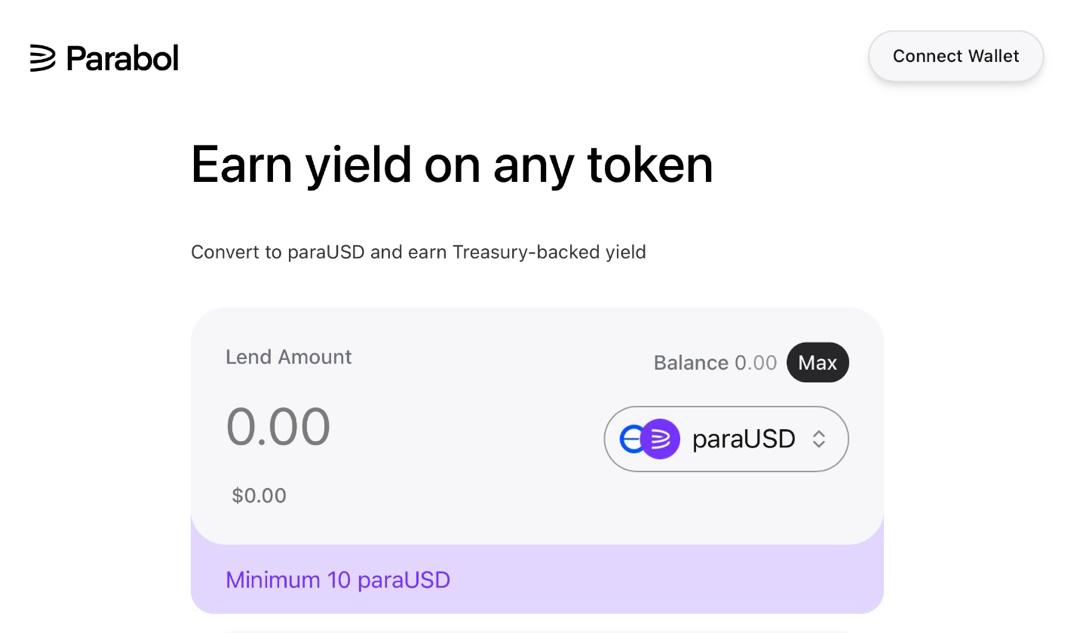

@parabolfi

❉ Visit

❉ Convert USDC to paraUSD

❉ Lend paraUSD into Parabol’s Reserve stability pool (current APR is 11% at max lending period).

paraUSD is backed by US TBills and repo reserves. Lenders earn both fixed and floating income on their loan.

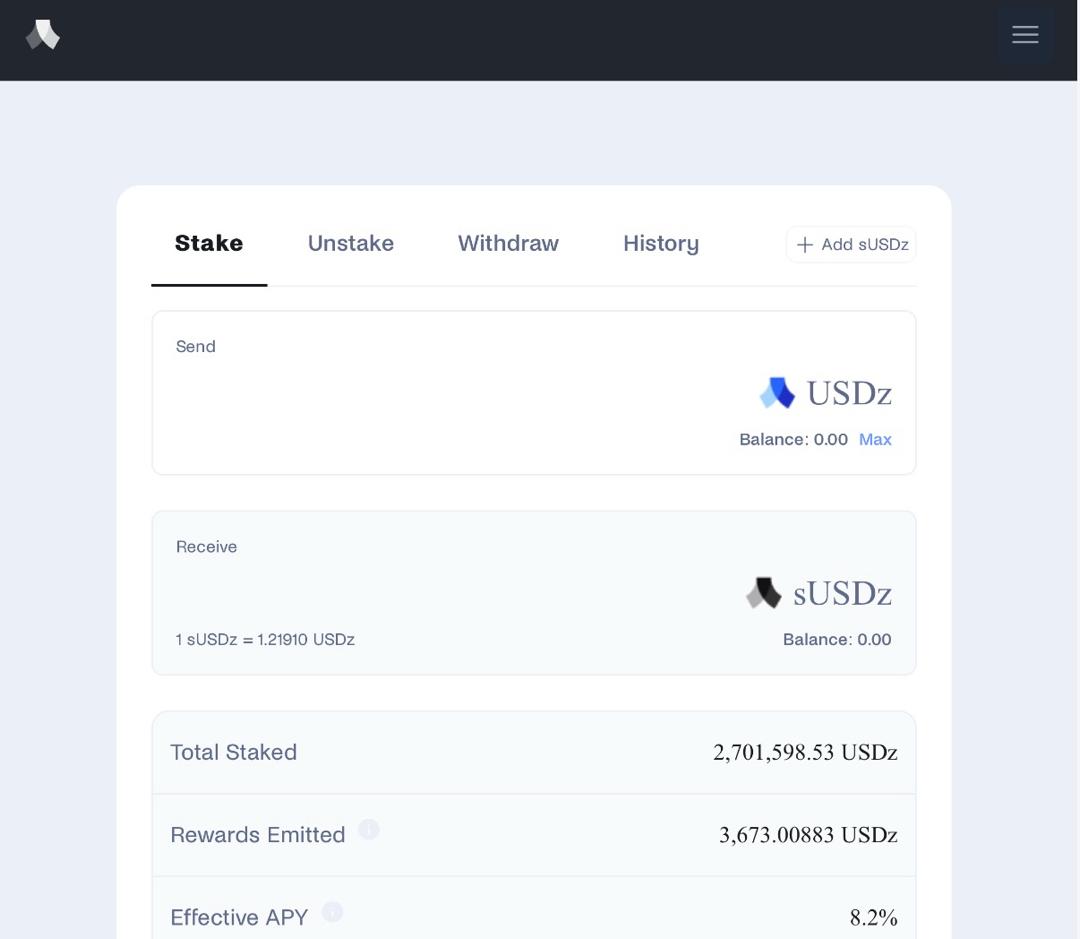

@AnzenFinance

❉ Visit

❉ Buy USDz using USDC

❉ Stake USDz for sUSDz (8.2% APY).

Anzen generates yield for USDz stakers through RWA private credit assets. The yield reflects in the value of sUSDz as rewards accumulate over time.

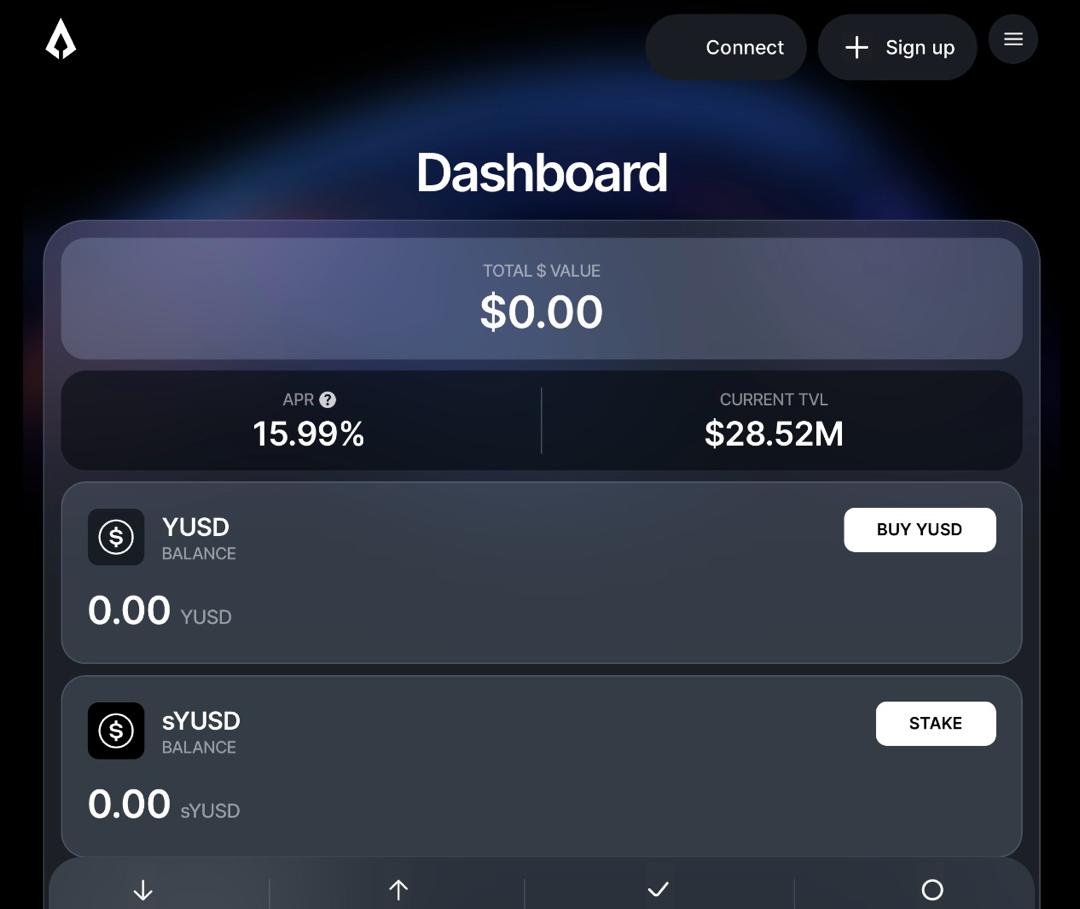

@aegis_im

❉ Visit

❉ Buy YUSD from any DEX using USDC

❉ Stake YUSD for sYUSD (15.99% APR).

Aegis generates yield from funding fees earned through delta-neutral spot and perpetual arbitrage. Rewards are distributed every 7 days.

PS - you can also earn yield without staking YUSD.

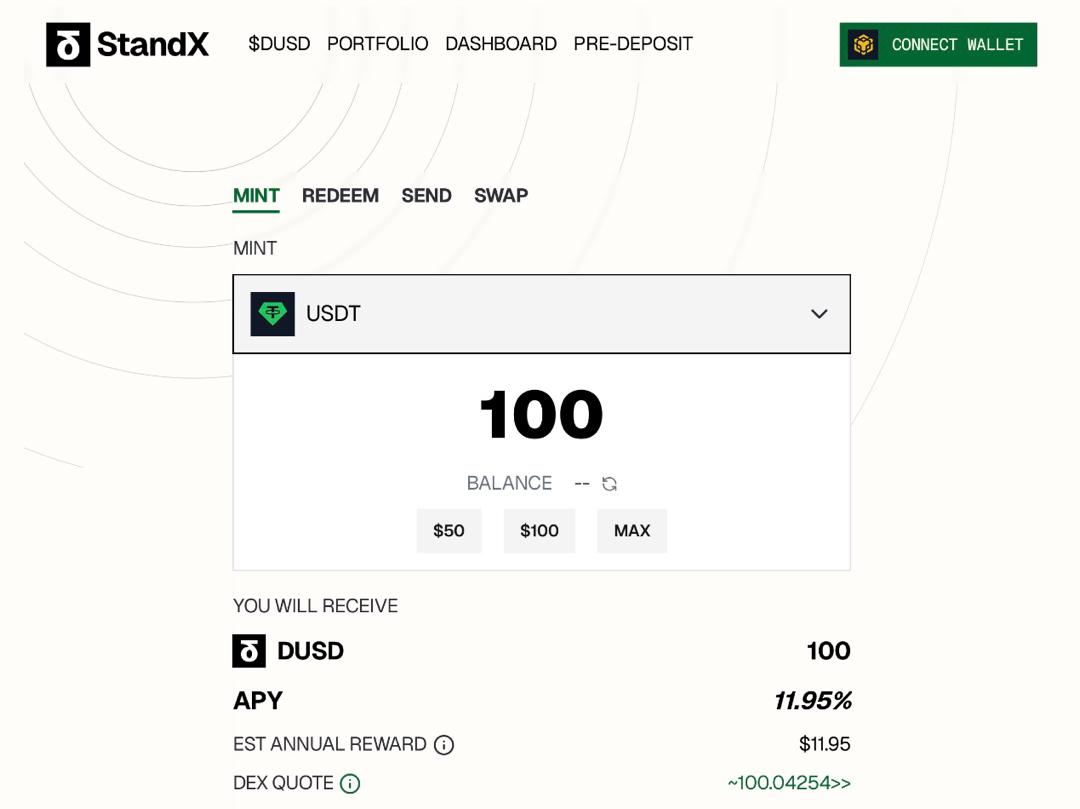

@StandX_Official

❉ Visit

❉ Deposit USDT to mint DUSD (11.95% APY).

StandX generates yield from staking and perpetual contract funding rates. Yield accrues daily and is claimable at the end of each 7-day cycle. DUSD does not need to be staked to earn yield.

Tagging top chads to keep you in all YBS loop

@phtevenstrong

@zerototom

@Degenerate_DeFi

@arndxt_xo

@eli5_defi

@0xAndrewMoh

@0xCheeezzyyyy

@Hercules_Defi

@TheDeFinvestor

@thedefiedge

@TheDeFiPlug

@twindoges

@the_smart_ape

@0xDefiLeo

@splinter0n

@Haylesdefi

@defi_mago

@Defi_Warhol

@Tanaka_L2

@thelearningpill

@poopmandefi

@kenodnb

@CryptoShiro_

@CryptoGideon_

@Louround_

@crypthoem

@YashasEdu

13.44K

97

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.