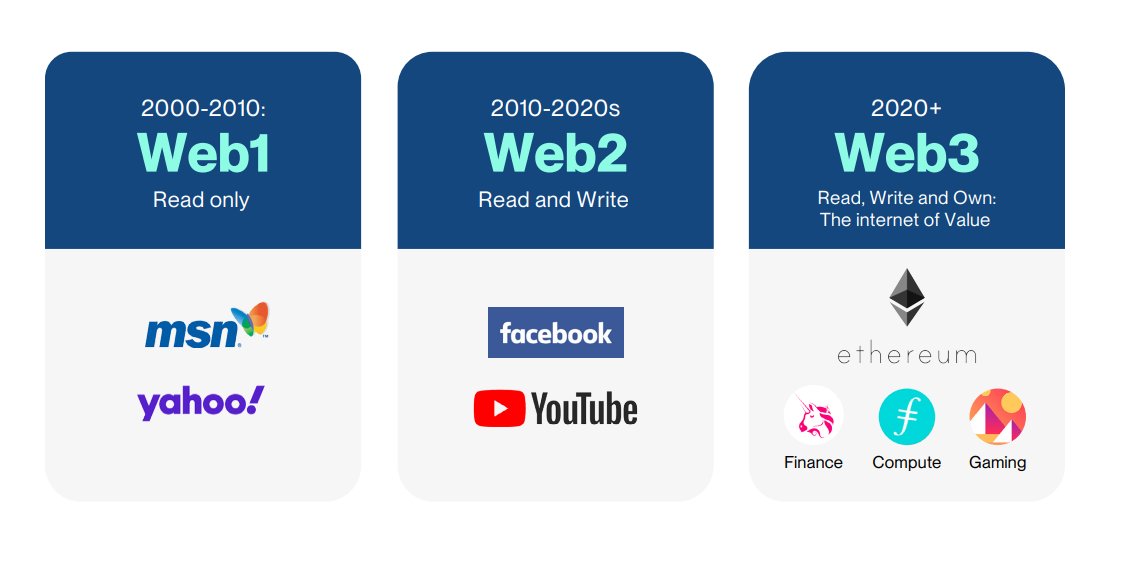

Ethereum is no longer just a blockchain.

It’s a global financial engine, quietly matching or beating the world’s biggest companies.

Here’s how $ETH stacks up against Big Tech, Wall Street, and the internet itself.

( a thread )

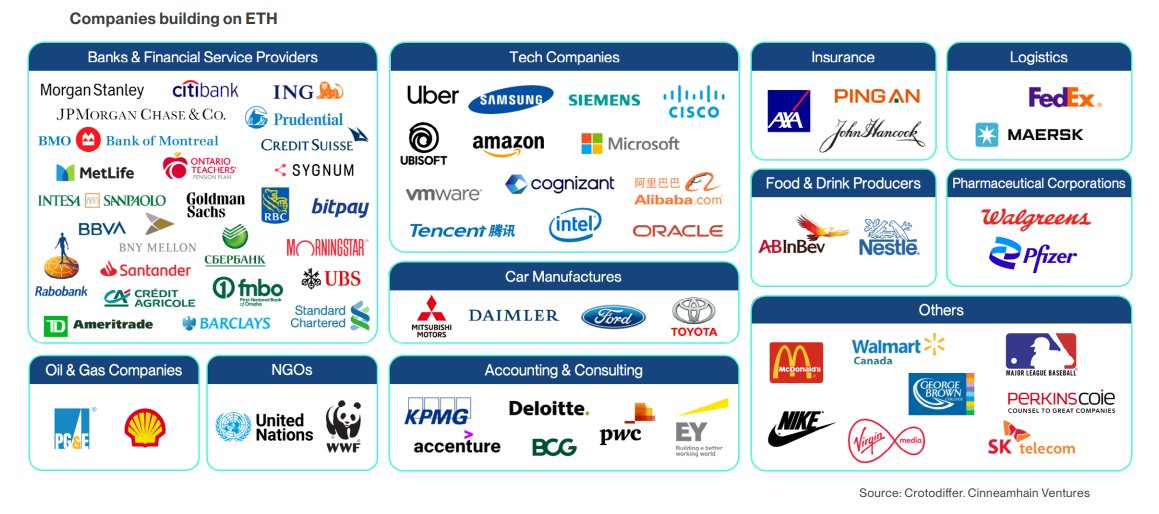

@ethereum Everyone’s building on Ethereum.

From Nike to JPMorgan. Visa to Adidas.

It’s becoming the backend for money, identity, and ownership across the Fortune 500.

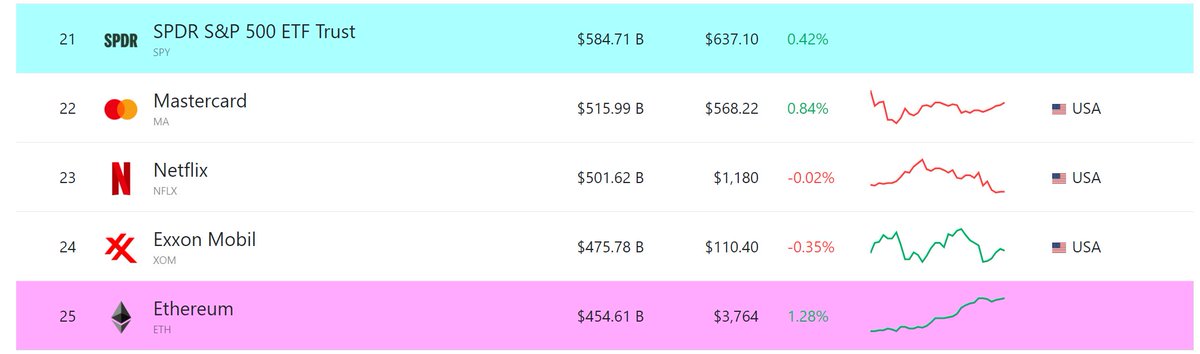

$ETH is now worth $450 billion+.

But zoom out, and it’s still tiny compared to the world’s biggest asset classes.

We are still early.

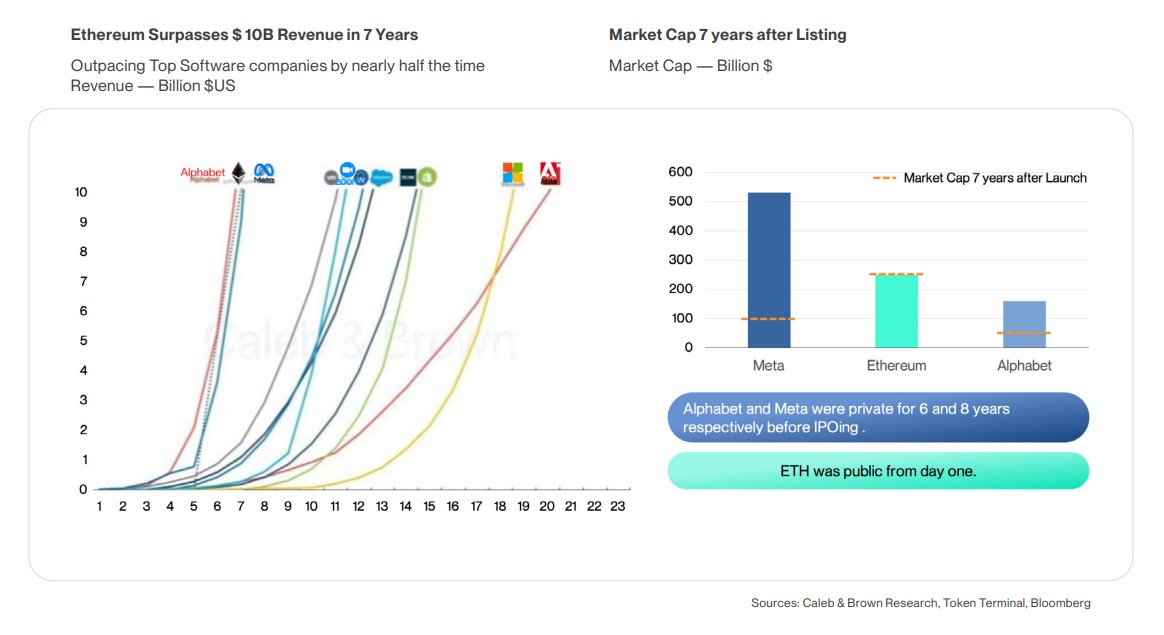

Ethereum reached $10 billion in cumulative revenue faster than Meta or Microsoft did.

It took Ethereum ~7.5 years to hit that mark, compared to just over 7.5 years for Meta and 19 years for Microsoft.

Unlike them, $ETH was public and permissionless from day one.

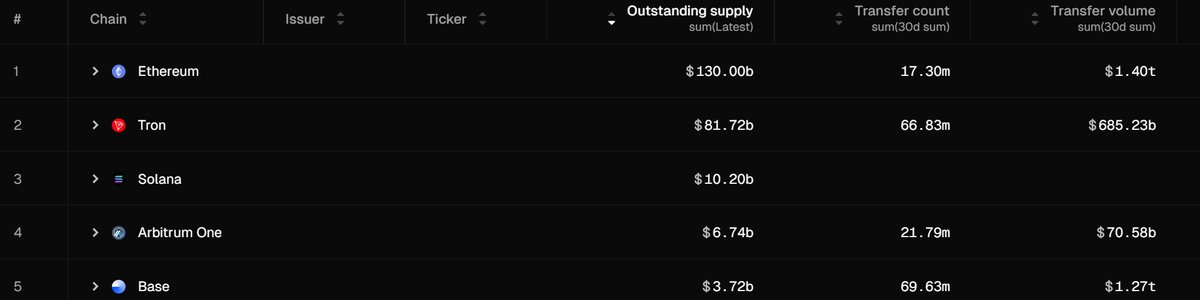

$ETH is already doing the jobs legacy institutions were built for:

- Moves money like Visa

- Coordinates finance like a bank

- Powers culture like a global auction house.

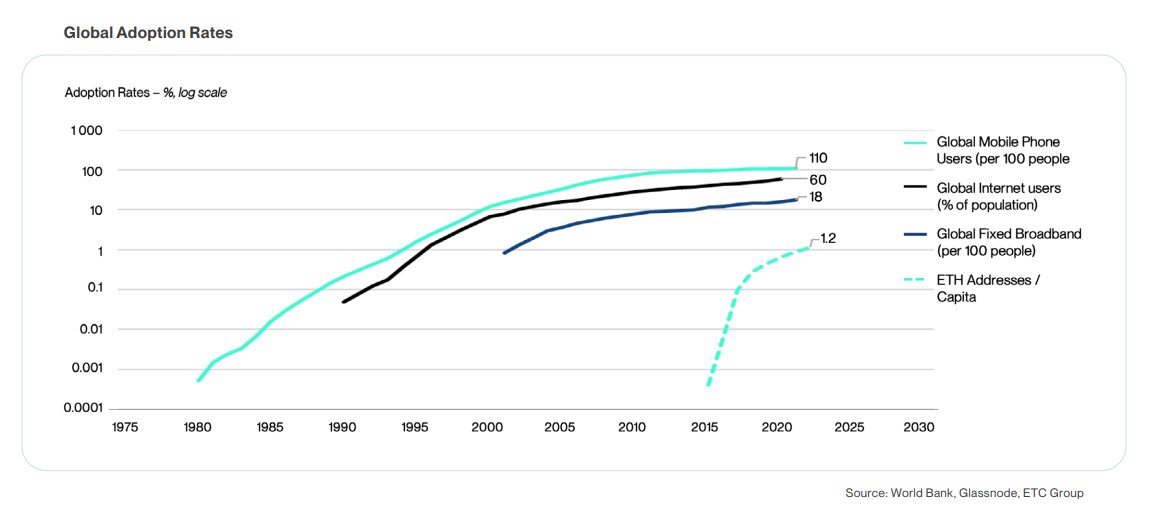

$ETH adoption is tracking the early growth of the internet and mobile phones.

The curve looks small now (but so did broadband in 2002).

If this pattern holds, the biggest gains are yet to come.

If you found value in this and would like to give back.

You can follow us @MIlkRoadDaily.

Or consider subscribing to our newsletter.

It's free ⤵️

@ethereum Get smarter about crypto with our daily 5-minute newsletter

We give you the lowdown on what matters in crypto and make you laugh in the process

Join 300,000+ daily readers:

29.57K

157

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.