Imo with the current treasury companies meta being in full force, as long as they keep raising and have ammo, the downside is limited

But also, if you're entering rn either on BTC/ETH the r/r seems like just not there, so if you also believe that. These are the perfect conditions to be LP'ing on concentrated liq.

Wide range to the downside -> if we get a deep pullback not only you are getting yield but you can just pull LP and ride the coins spot if you believe the market has legs

Low range to the upside -> Yes IL risk but you can always rebalance on a new position + your objective here is getting the yield. 2-3 months in range is basically enough ROI to justify the LP

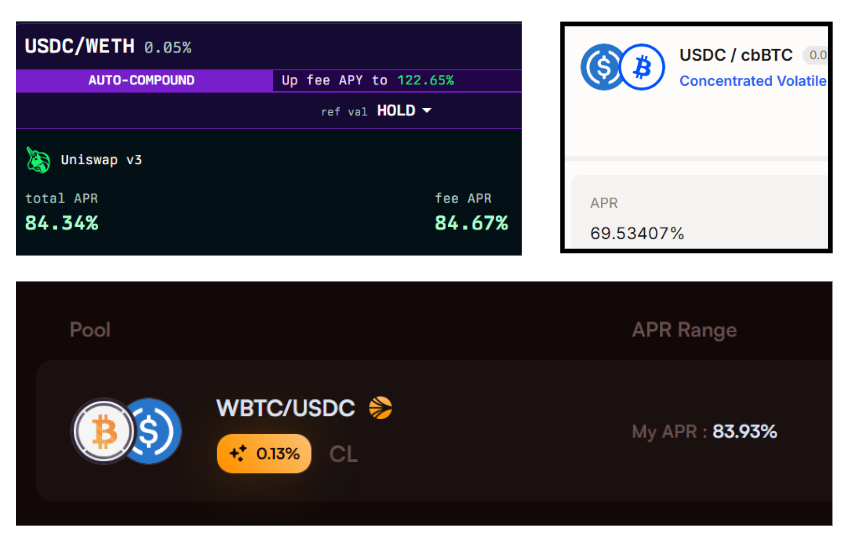

I have had multiple BTC positions in range for 2-3 months this year at 100%+ APY, tho I wouldn't go much further the risk curve other than BTC LPs (probably only ETH/SOL worth it)

Clear winning strategy to be getting triple digit (or close) APR on majors.

11.36K

48

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.