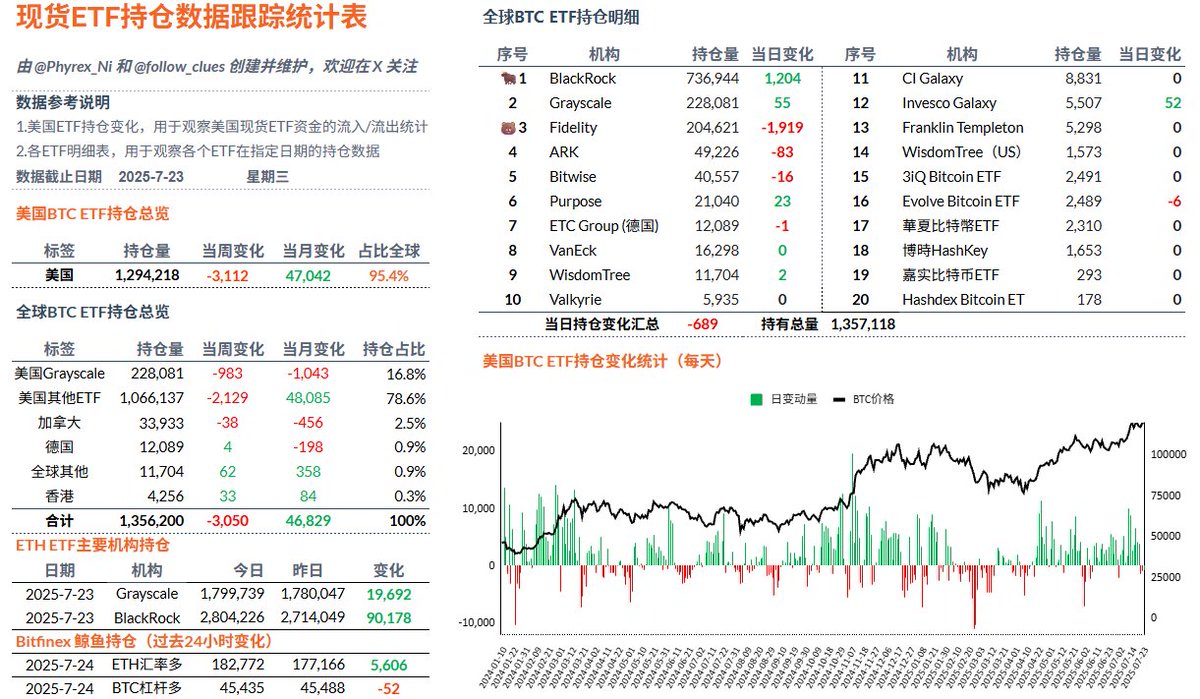

Wednesday's $BTC spot ETF was not very good, with net outflows for the third day in a row, even though BlackRock's investors had more than 1,200 Bitcoin inflows, which were beaten by Fidelity's outflows of nearly 2,000 BTC.

Although it has been an outflow in the past two days, the outflow is not much, it should be at a relatively normal level, and some investors have lifted the FOMO state, but there has been no large sell-off, mainly maintaining a wait-and-see situation.

Data Address:

This article is sponsored by #Bitget | @Bitget_zh

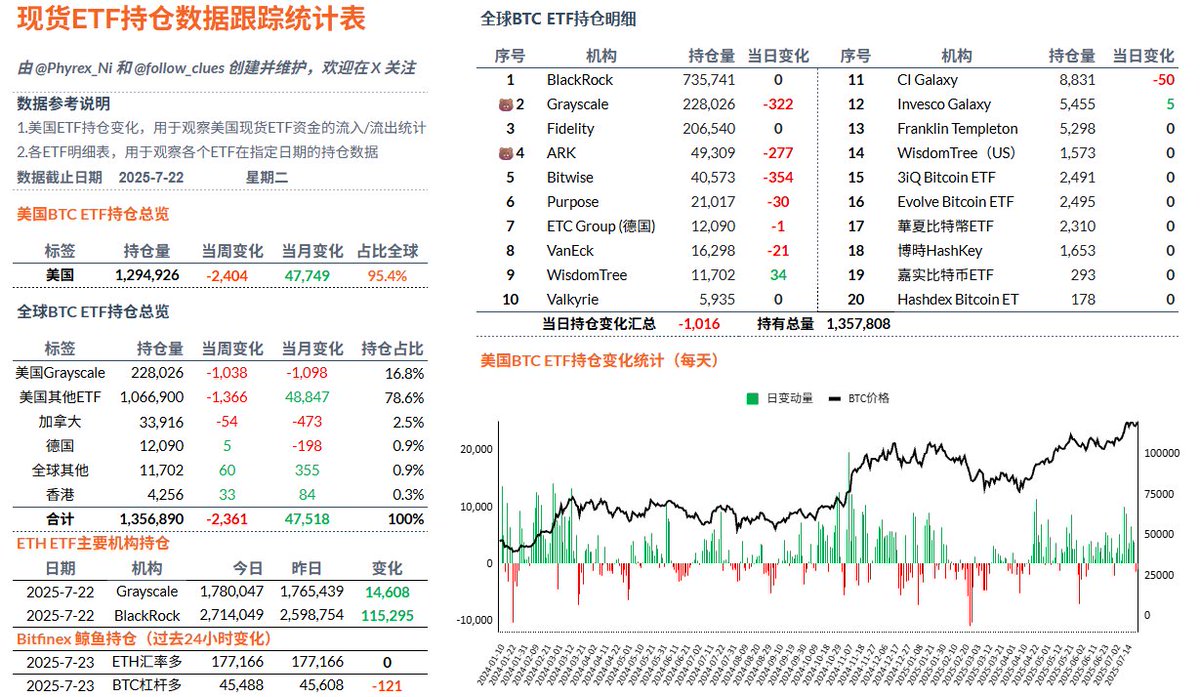

For the second day in a row, there was a net outflow of $BTC spot ETF data, although the outflow was not large, but it also showed that investors' FOMO sentiment was gradually fading, and the frequency of price fluctuations would be higher, and the main reason for the net outflow was that BlackRock investors did not have inflows for the second day in a row, and the net outflow of hundreds of Bitcoins would not have any impact on BTC spot.

But as mentioned in the weekly report, the current rise of BTC is not because of how strong the purchasing power is, but because of the decrease in sell-offs, so when selling rises and purchasing power decreases, the price will naturally fluctuate more, but not to the extent of changing the BTC narrative, and the main game of the market is still on tariffs and monetary policy.

Data Address:

This article is sponsored by #Bitget | @Bitget_zh

76.94K

38

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.