Great read on $Fxsave and its value to @protocol_fx

$fxSAVE is the engine. $FXN is the play.

While most protocols chase TVL with inflation and mercenary yield, @protocol_fx has taken the hard road:

Build the most trusted decentralised stablecoin, backed by real fees and long-term alignment.

Here’s why the next phase of Protocol f(x) puts $FXN in prime position...

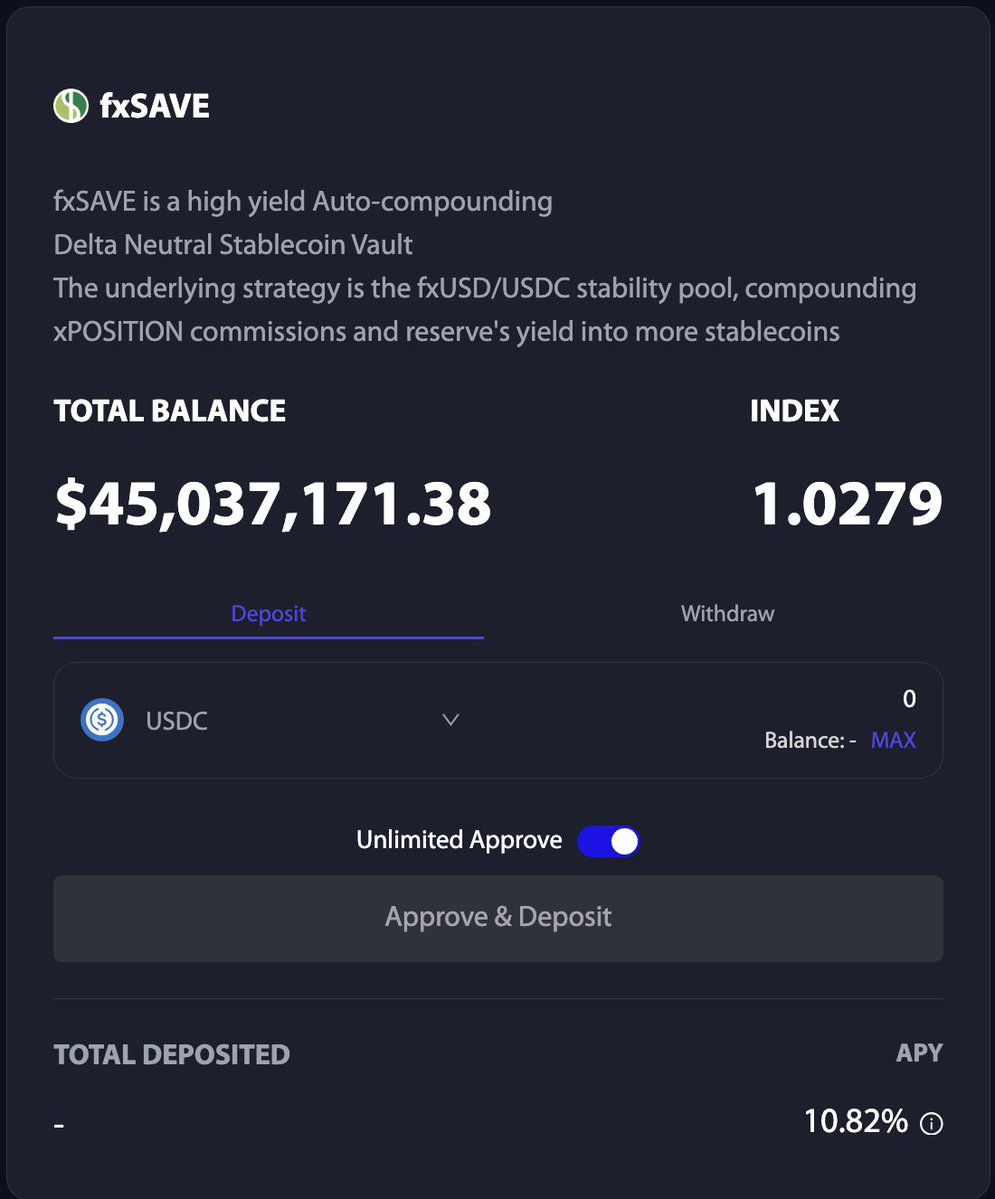

➠ What is fxSAVE?

» It’s the protocol’s stability vault.

» Users deposit $fxUSD or $USDC to keep $fxUSD pegged and liquid.

» They earn real yield from protocol fees... not emissions.

» $fxSAVE doesn’t gamble against users.

» It earns like a counterparty, but without the risk.

» Current APY: ~10.8%

» Backed by trading activity and collateral yield

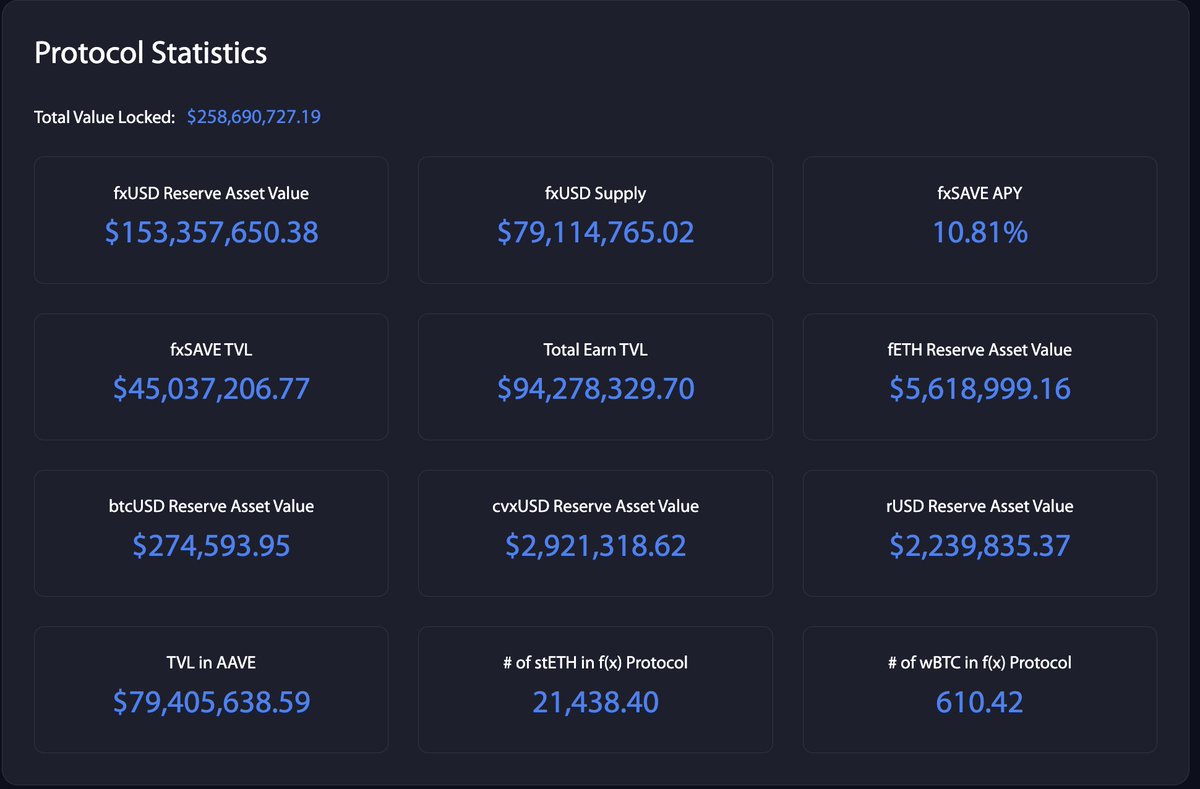

➠ Where does the yield come from?

» f(x) charges one-time fees on opening/closing leveraged trades

» It also earns from ETH/BTC collateral yields

» Soon: fees from shorts, limit orders, stop losses

This means $fxSAVE yield grows with usage... not token printing.

And the deeper the $fxSAVE pool, the more leverage the system can support.

More leverage = more fees = more rewards. (flywheel)

This is a positive sum loop between stability and growth.

➠ What’s coming next?

» sPOSITIONS «» allow users to short markets

» Adds buy pressure on $fxUSD, reducing fxSAVE strain

» Shorters churn more volume(traders typically hold shorts for less time) = more fee revenue.

Then:

» Limit Orders + Stop Losses... full trading suite

» @base deployment (more users)

» Upcoming integrations with forks like @RegnumAurum, @ZhenglongFi , and @sigmadotmoney..

These aren’t just features... they’re volume multipliers.

Volume = fees.

Fees = value to $fxSAVE and $FXN.

➠ How does this all benefit $FXN?

Right now, most fees go to $fxSAVE to bootstrap trust and liquidity..

That’s by design.

Stablecoins without trust die in silence.

But as trust builds, fee distribution can shift... massively.

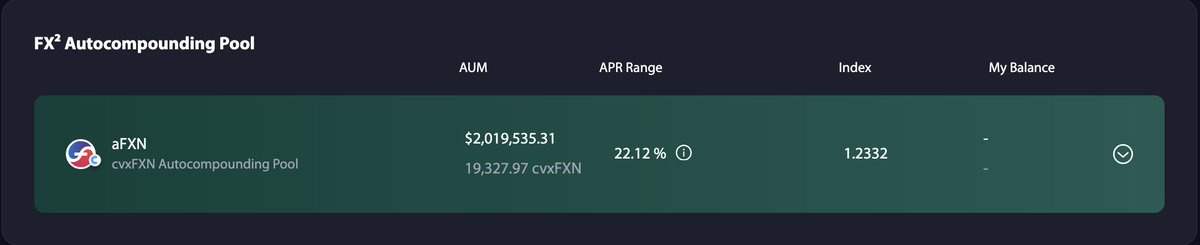

» $veFXN holders already earn voting bribes and incentives

» $fxSAVE won’t need as much yield to attract capital once $fxUSD is trusted

» That excess yield flows to $veFXN lockers

» Revenue share from friendly forks

» Current APY ~22.1%

And it compounds:

» More TVL → more leverage → more fees

» More fees → more rewards → stronger $FXN case

The long game is obvious.

Once $fxUSD becomes a top 10 stablecoin, $FXN becomes a cashflow monster...

➠ $fxSAVE is the protocol’s heartbeat.

It anchors the peg, attracts liquidity, and powers growth.

But $FXN is the long-term winner.

Because when trust catches up, the protocol can redirect the firehose of fees straight to lockers!

Betting on $FXN is betting on trust in on-chain money...

And it’s already happening.

26.78K

10

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.