The token distribution issue in the blockchain industry has been a headache for many, especially retail investors who are often caught off guard by overvalued projects. Projects like Eigenlayer, Zksync, and LayerZero have impressive technology, but retail investors have generally not made money after their listings; instead, they have become "exit tools" for VCs and market makers. StripChain is here with its Inverse Time Train Community Sale (ITTC) and intent-based interoperability protocol, aiming to completely overturn this situation. Let me discuss why StripChain is so special, the highlights of the ITTC sales model, and how it compares to those high FDV IDOs.

First, let's talk about why StripChain is worth paying attention to -------

Its interoperability brings a new height; StripChain is not just creating a cross-chain bridge or message passing. It has launched the world's first intent-based full-stack interoperability protocol, focusing on "transaction layer interoperability," directly pushing the industry towards "Interoperability 3.0." Its core components include:

StripVM: A unified execution layer that connects different blockchains, handling cross-chain data and states, acting like a super brain, allowing developers to focus on complex interactions without worrying about the underlying complexities.

StripIntents: A cross-chain communication language that developers can use to write complex cross-chain logic, allowing contracts to collaborate seamlessly like chatting.

StripSolvers: Enabling existing applications (like Aave) to interact with other chains without changing code, as simple as a single function call.

StripDex: A unified liquidity pool supporting cross-chain native asset swaps, such as SUI for SOL, with fast speeds and low costs.

StripAccounts: A universal wallet managing multi-chain assets, providing a smooth experience that ordinary users can navigate effortlessly.

StripChain not only enables existing applications to become interoperable but also allows developers to create entirely new full-chain applications. Just think, if it can reach the scale of LayerZero or Cosmos (valued at $2 billion FDV), starting from a $15 million FDV, it has a solid hundredfold potential!

Top-tier team and funding backing

Behind StripChain is the SRL team, a group of top engineers along with PhDs in cryptography and mathematics, with hardcore technical strength. They have raised over $10 million from big-name institutions like Sora Ventures, Mechanism Capital, and Daedalus, and the market clearly supports their vision. This funding ensures that the project can continue to advance technology development and ecosystem building.

Next, let’s detail its ITTC sales mechanism -------

In the current market, retail investors are basically being harvested by high FDV projects.

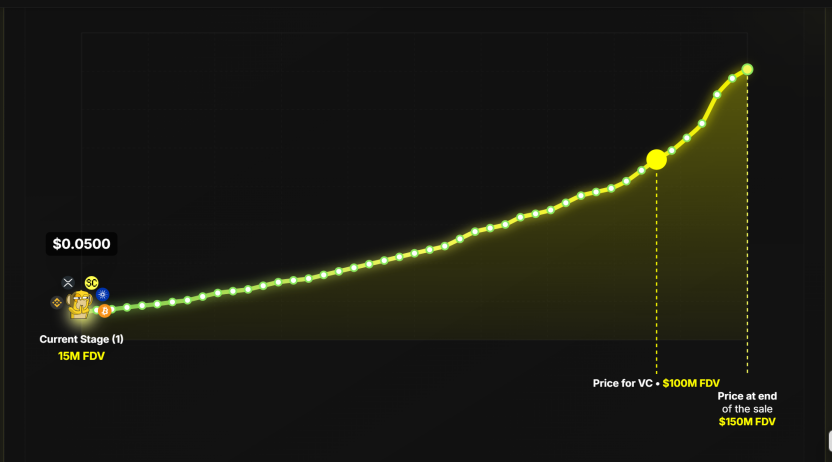

StripChain's ITTC sale directly allocates 60% of the tokens to the community, starting from a $15 million FDV and going up to a maximum of $150 million FDV, while VCs can only acquire at a $100 million FDV price. This means ordinary users can enter at a lower price and enjoy the benefits of the project's growth. Additionally, 50% of the tokens will be circulating on the listing day, significantly reducing the space for market manipulation.

Compared to the high FDV IDOs currently in the market, StripChain's ITTC directly counters these old tricks:

1. Traditional IDOs often start at a $1 billion FDV, but with very little circulation; when VCs and market makers sell off, the price crashes. StripChain's ITTC starts at a $15 million FDV, with 60% of tokens allocated to the community, and 50% circulating on the listing day, offering a low valuation and small sell pressure, giving retail investors more opportunities to profit.

2. High FDV projects allocate 30% of tokens to VCs, leaving retail investors to rely on airdrops for a small share, while facing the pressure of high-priced listings. StripChain goes against the grain, giving the community the majority (60%), while VCs pay a higher price ($100 million FDV), allowing ordinary users to also benefit from the project's growth.

3. Many projects rely on airdrops to inflate data, attracting a bunch of "temporary users," leading to community disintegration and price plummeting after listing. StripChain's whitelist and daily claiming mechanism filter out genuine supporters of the project, creating a sticky community.

4. High FDV IDOs generally do not consider the protection of retail investors; when the market fluctuates, retail investors are the first to get hurt. StripChain's conditional unlocking (suspending if FDV falls below $150 million) provides early users with a safety net, preventing dilution during poor market conditions.

ITTC sales model::

StripChain's ITTC (Inverse Time Train Community Sale) is a revolution in token distribution, designed to be both fair and smart. The core highlights are as follows:

1. Bond curve, phased entry

ITTC is a 44-phase bond curve sale, with token prices rising from $0.05 to $0.4933, corresponding to FDV from $15 million to $150 million. Like a train with 44 carriages, each filled carriage raises the price of the next. Community users can participate at a price far lower than VCs (at $100 million FDV), giving early entrants a greater advantage.

2. Five periods, flexible commitments

The sale is divided into 5 periods (Epochs), each corresponding to different lengths of commitment periods (30 to 90 days). The phase where you buy the most determines your commitment period. For example, if you bought the most tokens in the 3rd phase, your commitment period would be 60 days. This design gives users a choice and encourages long-term holding.

3. 50% immediate circulation + price protection

50% immediate circulation: No matter when you buy, you can access half of the tokens on the listing day, ensuring high circulation and making it difficult to manipulate prices.

50% conditional unlocking: The other half of the tokens can be claimed daily during the commitment period, but only if the FDV remains above $150 million. If the market is poor and FDV drops, unlocking will be paused, protecting early users from dilution.

Daily claiming: Remaining tokens must be claimed manually every day; for example, a 30-day commitment period requires 30 claims. This not only keeps users engaged with the project but also prevents a one-time sell-off.

4. Whitelist phase, filtering true fans

ITTC is currently in the whitelist phase, where participation is only possible through specific community links or codes, with limited spots available for each community (e.g., 100 spots). This strategy is clever, filtering out users who genuinely support the project and eliminating short-term speculation from airdrop farmers. The whitelist phase is expected to last until the 3rd period but may be adjusted based on demand.

Summary -------

ITTC is not just about selling tokens; it is a tool for building community. With 60% of the tokens allocated to the community, compared to traditional project airdrops, StripChain allows ordinary users to truly own the project, incentivizing everyone to become long-term supporters. Its ITTC sales and interoperability protocol are indeed some of the most innovative aspects to date. Technically, it breaks down barriers between blockchains through transaction layer interoperability, allowing existing applications and new full-chain applications to connect seamlessly; in terms of token distribution, ITTC makes the community the main character, with low FDV entry, high circulation design, and price protection mechanisms, completely overturning the high FDV IDO harvesting tricks.

ITTC is currently in the whitelist phase, requiring entry through community links or codes, with limited spots available (e.g., 100 per community). If you want to seize the opportunity, you need to act quickly!

Show original

40.74K

79

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.