SOL has been very strong since the breakout yesterday morning, and funds have continued to flow in.

In this short-term downward exploration that began last night, it may even undertake the rotation of BTC Ethereum.

Just now, the ultra-short-term slightly stepped back on the position of 195 on the upper track of the weekly line, and then continued to rise, breaking through 200.

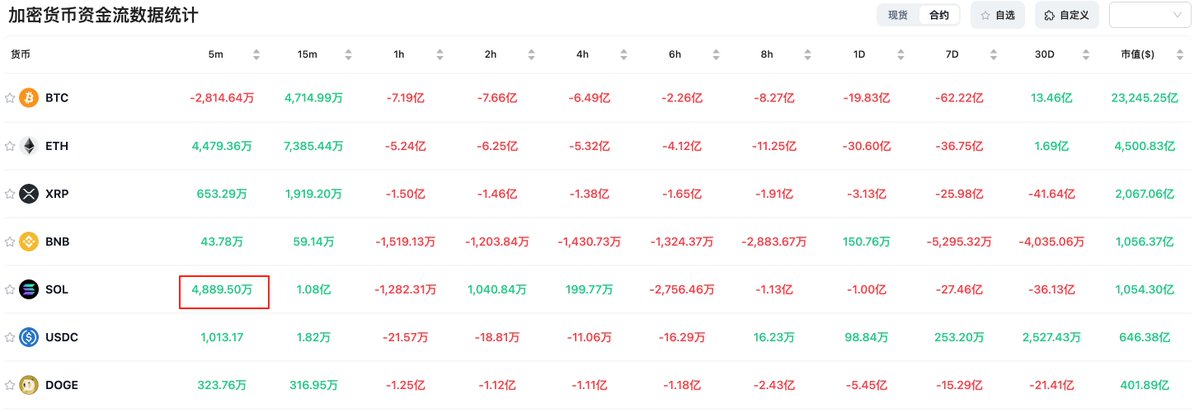

5M level funds are also net inflows.

It seems that the ecological niche of the E guard in this cycle will be inherited by the Suo guard, and the current pressure on SOL is near 186 on the weekly upper track. At present, I am personally observing what is the reason for the low rise of SOL:

1. Capital rotation logic: The typical rotation path of the crypto market is BTC (safe assets), then ETH (DeFi/L2 narrative), and finally altcoins such as SOL

2. Institutional change logic: ETH has risen sharply recently because large institutions have entered the market, bringing a large amount of funds and even completing the change to a certain extent. It is unknown whether institutions will replicate the reserve + bank change logic on SOL in the future.

As for the narrative of the project itself, it may not be that important, after all, after the rise, there will be great Confucians to distinguish the scriptures for you.

However, SOL is currently the best option for those who do not dare to chase high BTC ether and buy copycats in large positions.

Screenshot from @CoinankCN

98.81K

46

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.