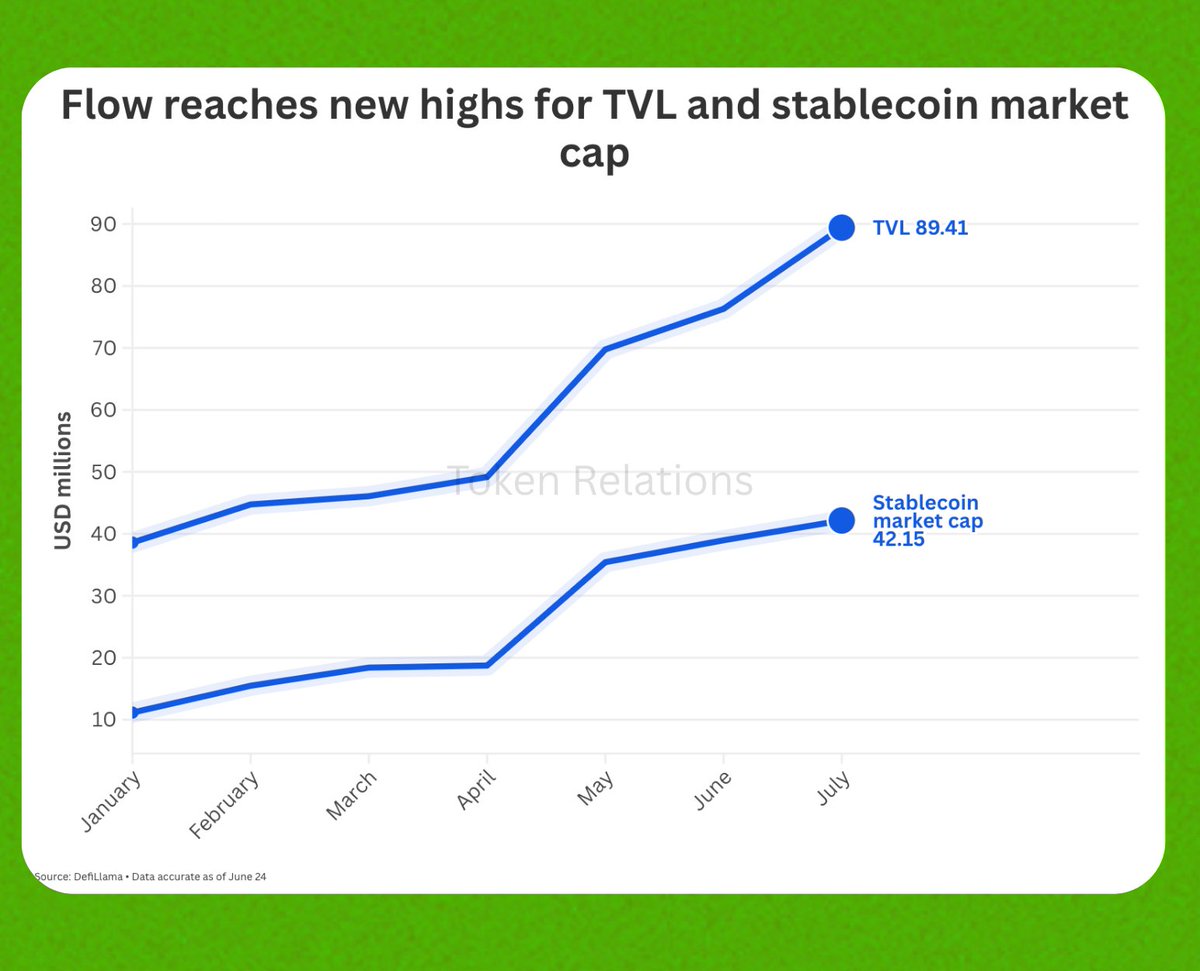

.@flow_blockchain reached an all-time high in stablecoin market cap and TVL

Let's dive into what its combined growth means for the ecosystem 👇

Traditionally, stablecoins provide liquidity in order to fuel various DeFi protocols whereas a high TVL can indicate users are confident enough in the network to deposit their assets

Flow’s stablecoin ecosystem, including Flow USD, supports liquidity for transactions and cross-platform collaborations

Combined with its rise in TVL, these growth metrics may encourage more stablecoin issuance and usage to meet demand for the digital asset

With the recently passed GENIUS Act, which establishes a US regulatory framework for stablecoins, the integration of RWAs in everyday lives is advancing rapidly

And Flow’s rising stablecoin market cap and TVL reflect growing ecosystem adoption

20.31K

30

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.