1/ Hylo is building a new DeFi primitive on Solana.

Where stablecoins earn real yield and leverage comes with zero liquidation risk.. It offers:

✅ A fully backed, yield-generating stablecoin

✅ Leverage with no funding costs, no liquidations, and no active management

Hylo is designed to stay resilient through volatility while remaining capital efficient and fully on-chain… Let’s explore how it works🧵↓

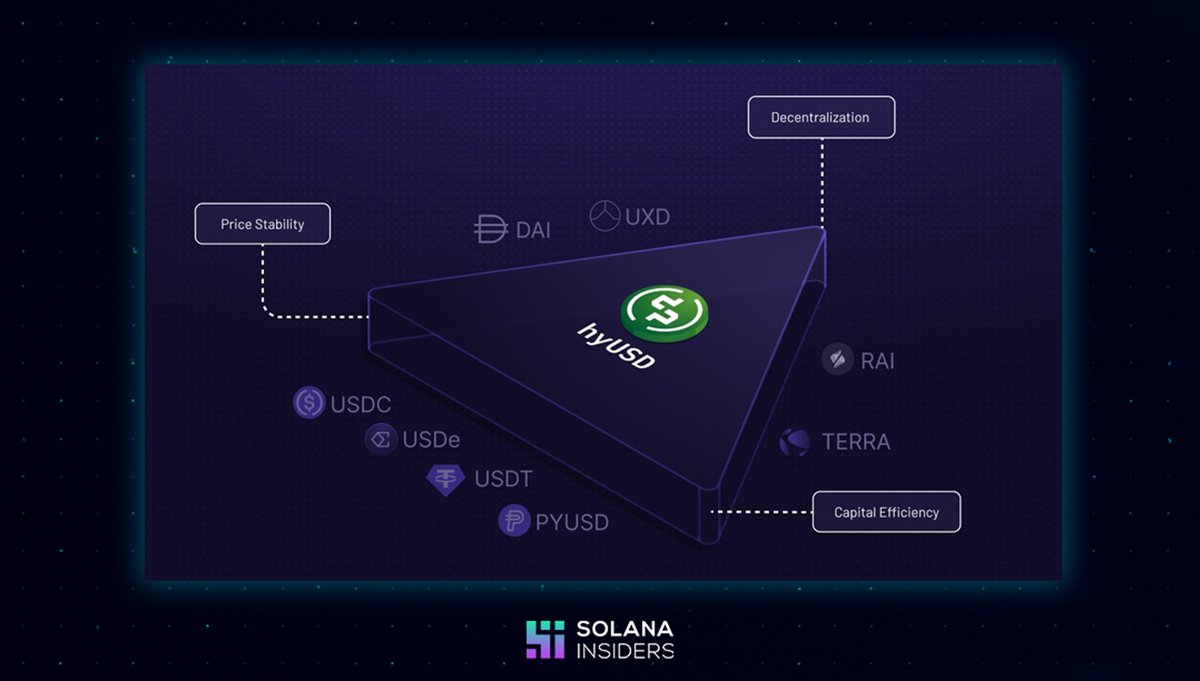

2/ The Problem: Traditional Leverage and Centralized Stablecoins Have Weak Points

Over 90% of Solana’s $11B stablecoin supply is dominated by USDC and USDT.. both centralized, off-chain, and fully custodial.

They move massive volume but offer no native yield and carry counterparty risk.

At the same time, DeFi leverage is burdened by perpetual fees and forced liquidations.

@hylo_so removes both weak points:

It introduces a fully backed, yield-bearing stablecoin (hyUSD) and a liquidation-free leverage system (xSOL), all built natively on Solana’s staking layer.

No liquidations. No funding costs. No off-chain trust. Just a resilient, capital-efficient engine designed to hold through volatility.

6/ How Hylo Balances Risk: Capital Efficiency in Action

When SOL’s price increases, xSOL captures amplified gains.

When SOL’s price drops, xSOL absorbs the losses to preserve hyUSD’s stability.

The system continuously rebalances exposure between hyUSD and xSOL using protocol-controlled pricing.

10/ Hylo’s Yield Engine: Transparent, Sustainable Rewards

Hylo’s rewards are simple and sustainable:

🔹 SOL staking rewards flow from the collateral pool

🔹 Protocol fees from minting and redeeming provide additional revenue

🔹 Rewards automatically flow to sHYUSD holders

There are no artificial emissions or inflationary rewards. The system is powered by real staking income and real on-chain fees.

11/ Slippage-Free Minting and Redemption

Hylo users mint and redeem hyUSD and xSOL directly from the protocol at Net Asset Value (NAV) with zero slippage.

Conversions are handled entirely within the protocol’s internal pool... Hylo does not rely on AMMs or external liquidity for these core operations.

This keeps conversions fast, accurate, and efficient at all times.

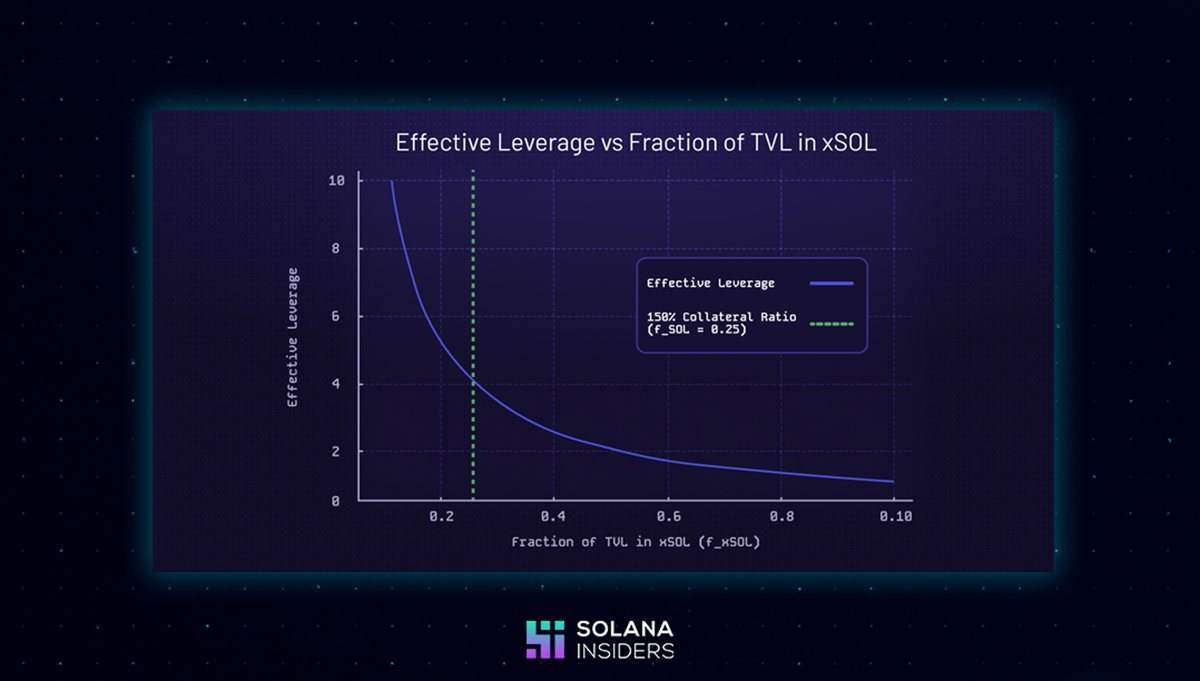

12/ xSOL: Dynamic Leverage That Self-Adjusts

xSOL’s leverage ratio automatically adjusts based on system health.. when the system is overcollateralized, xSOL offers higher leverage.

When CR drops, the leverage ratio reduces to protect the system.

14/ Zero-Liquidation Architecture: How It Works

Most DeFi protocols liquidate positions when collateral drops below a threshold.

Hylo does not use liquidations. Instead, the system shares losses across xSOL holders when needed.

This protects users from forced closures... Hylo absorbs volatility at the protocol level, not the individual level, creating a safer environment for everyone.

17/ The Hylo Team: Builders Behind the Protocol

Hylo is built by a team with deep Solana DeFi experience:

🔸Shoom (@Shoomsol ) – Protocol architect and risk management

🔸0xPlish (@0xPlish ) – Engineering and smart contract development

🔸Sape (@sape_sol ) – Growth and user experience lead

Their focus is on building capital-efficient, resilient products that expand Solana’s DeFi stack.

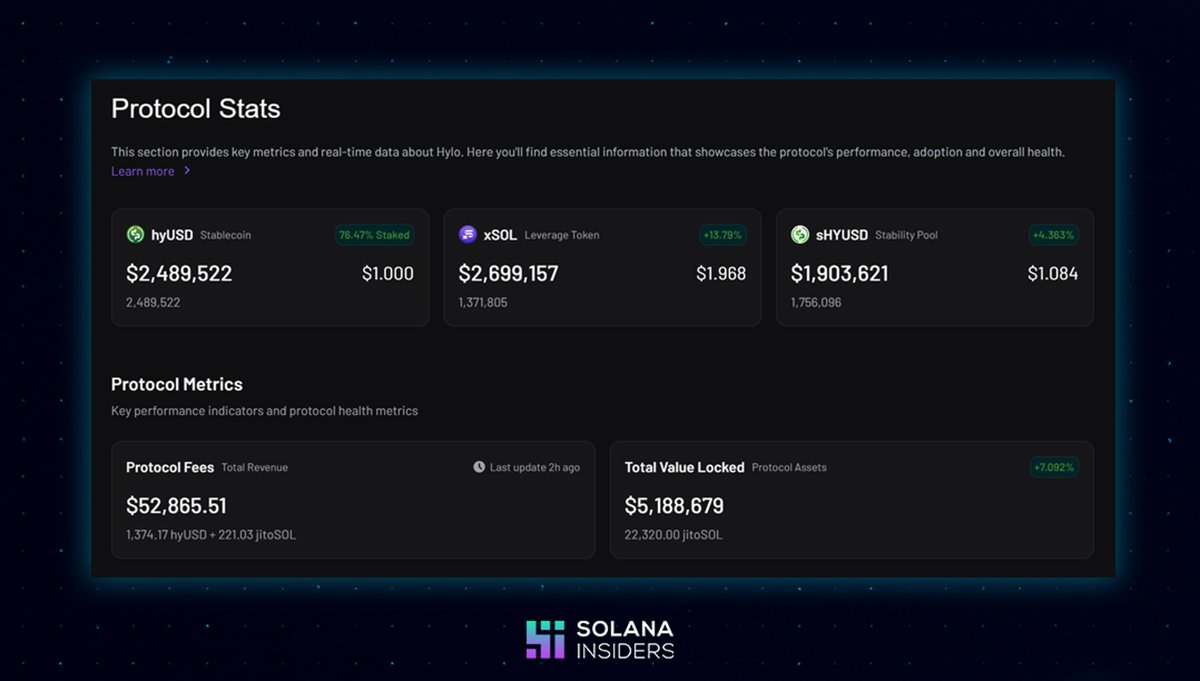

18/ Early Adoption: Key Growth Metrics

Hylo is currently in beta and already showing strong organic growth:

🟢 Total hyUSD circulating: around $2.5 million

🟢 Total xSOL circulating: around $2.7m

🟢 Total Value Locked: around $5 million

19/ Why Hylo Matters for Solana’s Future

Solana’s stablecoin economy is booming.. stablecoin supply doubled to over $11B in early 2025... But 90% of that activity relies on USDC and USDT: off-chain, centralized, and yield-less.

Hylo fills the missing layer with a fully decentralized, on-chain alternative:

✅ A native, yield-bearing stablecoin (hyUSD)

✅ Liquidation-free leverage (xSOL)

✅ Full integration with Solana’s staking layer

This dual-engine system turns LSTs into productive capital.. bootstrapping a resilient, Solana-native stablecoin layer built for sustainable growth.

16.29K

430

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.