The ETH bet this cycle is institutional.

Let me explain.

The crypto bull market has been defined by one thing - institutional flows to BTC.

BTC caught a bid as an institutional grade asset this cycle. This unlocked the largest capital pool in the world and propelled BTC to $2.5 trillion.

BTC is going higher too.

Because of BTC's explosive growth and dominance people started to assume BTC would be the only institutional grade crypto asset, maybe forever.

Narrative follows price.

As a result buyers sidelined the second largest crypto asset and the network leading on tokenization, stablecoins, and bank ledger chains (L2s).

They sidelined ETH.

Even while the institutions continued to build on Ethereum:

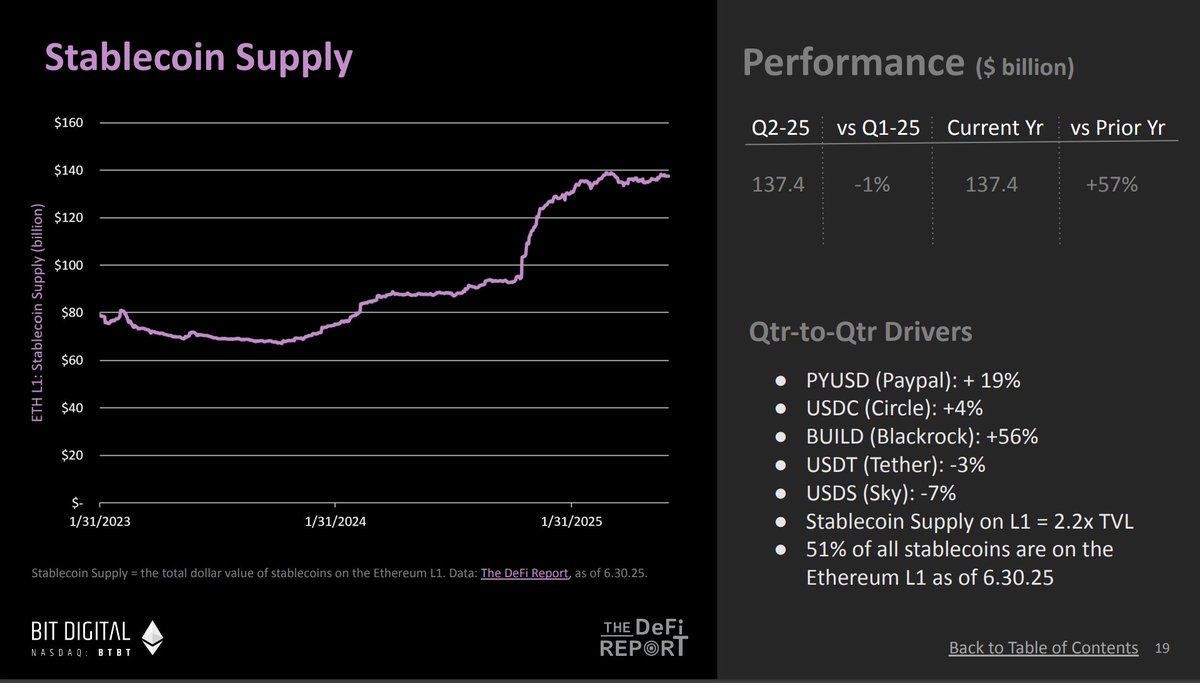

1) Stablecoins hitting all time highs - and that's before GENIUS act which will bring supply to trillions

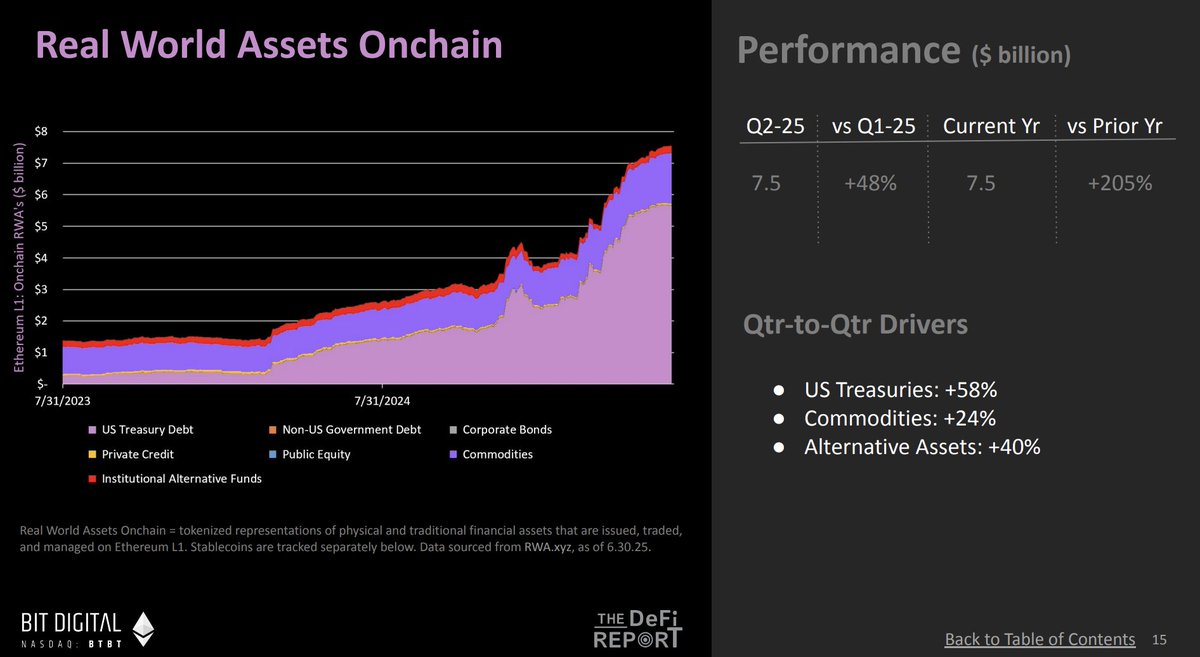

2) RWAs growing fast with Larry Fink talking about Tokenizing the world - the market for RWAs measures in the hundreds of trillions

3) Robinhood following Base in launching an L2 - the wealth of millenials and gen z secured by Ethereum

Then something strange happened.

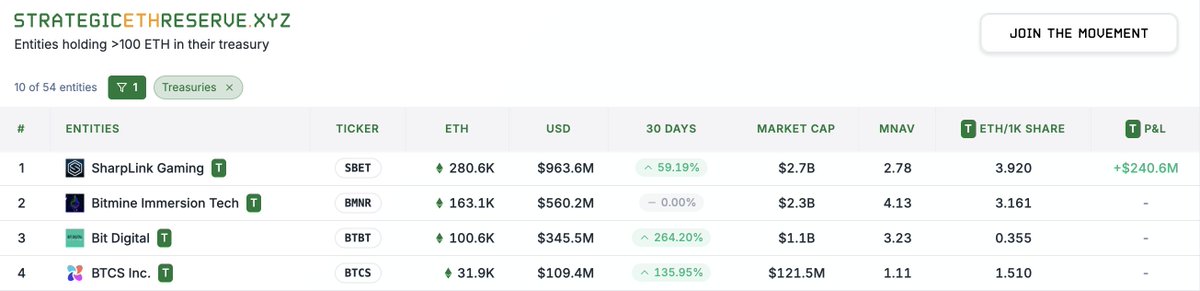

@ethereumJoseph launched @SharpLinkGaming - an initial boost of confidence for ETH as a treasury reserve asset.

A few weeks later Wall Street legend @fundstrat launched @BitMNR - his own ETH treasury company aiming to surpass all others - Peter Thiel owns 9%.

For the first time ETH the asset had bulls on traditional media and wall street talking about ETH as a reserve asset and backing it up with skin in the game.

The most bullish thing for ETH is to be understood.

We're just 1 month into a horse race between half a dozen ETH treasury companies trying to buy Michael Saylor levels of ETH. Some of the largest haven't yet launched.

In the background ETH ETFs are painting numbers.

Yesterday ETH ETF inflows exceeded $717m the largest in ETH history - on the cusp of flipping BTC flows.

This is what institutional demand looks like.

Still...there are many investors sidelined - after 4 years of lack luster price performance many lost conviction in ETH - even now we're still $1,200 down from 2021 all time highs.

But maybe all they needed was patience.

If ETH is the next institutional grade crypto asset then multi-trillion Ethereum is pre-programmed - the sideliners will be forced to catch up.

The bet for ETH is simple.

Institutional demand is the driver this cycle.

ETH is the next institutional asset.

Tom Lee said it best.

ETH is the next bitcoin.

50.91K

612

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.