Projects like PUMP generally mark the end of a narrative. Solana may soon come to an end, memes are also coming to an end, innovation on the platform is drying up, and the market is experiencing meme fatigue; it's almost time to shift gears.

No matter how you look at it, Ethereum will win.

1. DeFi leaders: morpho, aave, and the ETF IP leader in altcoins, pengu, also originates from Ethereum.

2. Looking at the narrative outside the circle from the market trends of 2020 to 2022, the market cap limit for altcoins will greatly increase.

3. The PoS yield attribute can accommodate large funds from outside the circle.

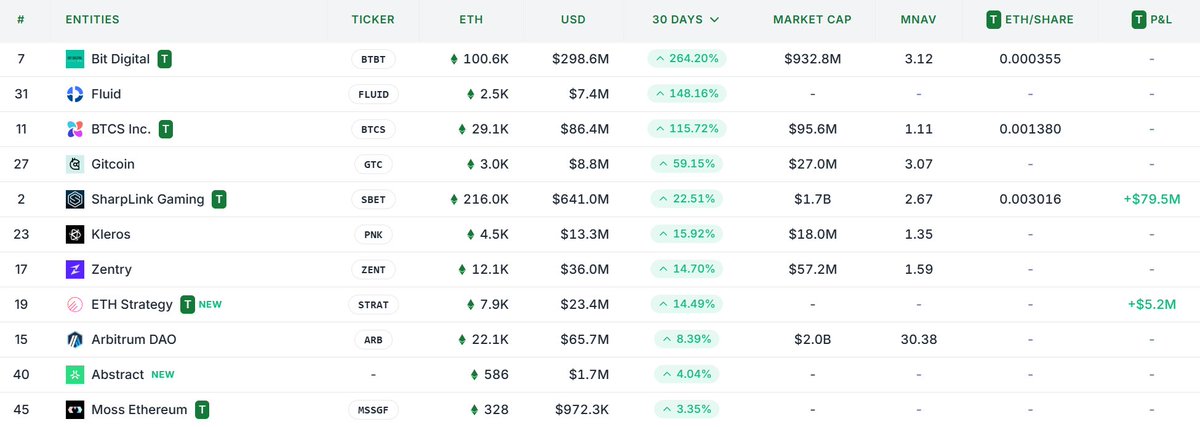

4. The current price hasn't exceeded the cost line of the major player sharplink by much (excluding discounted OTC prices, public data averages between 2667 and 2900), and several major players are continuously increasing their positions. A bunch of micro-strategy clones that only have ETH seem reliable.

5. The Sol/Eth exchange rate is at a high from the end of 2021, while the Eth/Btc exchange rate is at a low.

6. Base is essentially a child of Ethereum, combined with the resources of its parent Coinbase; this is the relationship between the US and the UK, with Ethereum being the British Empire of the early 19th century, and the last hundred years being its glorious era of the sun never setting.

7. All RWA and stablecoin narratives are favorable for Ethereum.

8. The foundation's strategic shift and change in attitude have brought urgency and motivation.

When the narrative within the circle prevails, it's Solana; when the narrative outside the circle prevails, it's Ethereum.

For the past two years, PvP has essentially been due to the lack of liquidity from outside the circle, with the market only able to support a cap of around 1 billion. Once the interest rate cut expectations materialize and TradFi enters in large numbers, Ethereum will still be the one that can accommodate the most.

3100 should just be the beginning; a new high for Ethereum is inevitable.

Show original

24.55K

4

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.