🧮💰Financial Planning Analysis 🧠

Sell BTC vs Borrow against your BTC?

Depending on your cash needs the difference can be extreme. The more you might need the cash, the more borrowing makes sense.

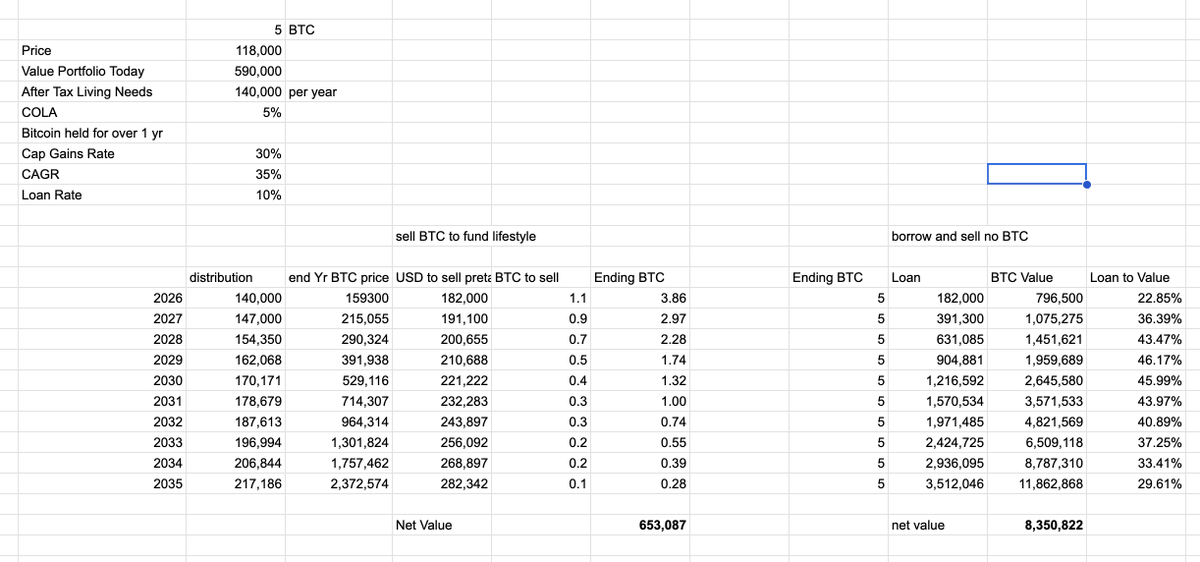

Scenario: You have 5 Bitcoin, bought a few years ago, but a need for $140K after tax next year. You also expect that number to increase at 5% per year.

If you take the cap gains hit every year, and sell enough BTC to make your cost of living payments you essentially have no Bitcoin in year 10, despite a 2.3 MM BTC price.

On the other hand if you borrow the money and roll the loan forward every year you end up with $8MM net after 10 years, and after paying back your loans.

If the ratio of your Bitcoin holdings to cash needs increases, the impact is less.

In other words, loans are for plebs, not whales. (unless they have huge lifestyles)

59.44K

445

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.