" #BTC shows signs of rising ahead of the Fed's policy change"

As the possibility of a shift in the Fed's monetary policy increases, there may be a preference for risk assets. In particular, an unexpected drop in employment indicators raises the likelihood that the Fed will revert to easing policies, which could positively impact assets like Bitcoin.

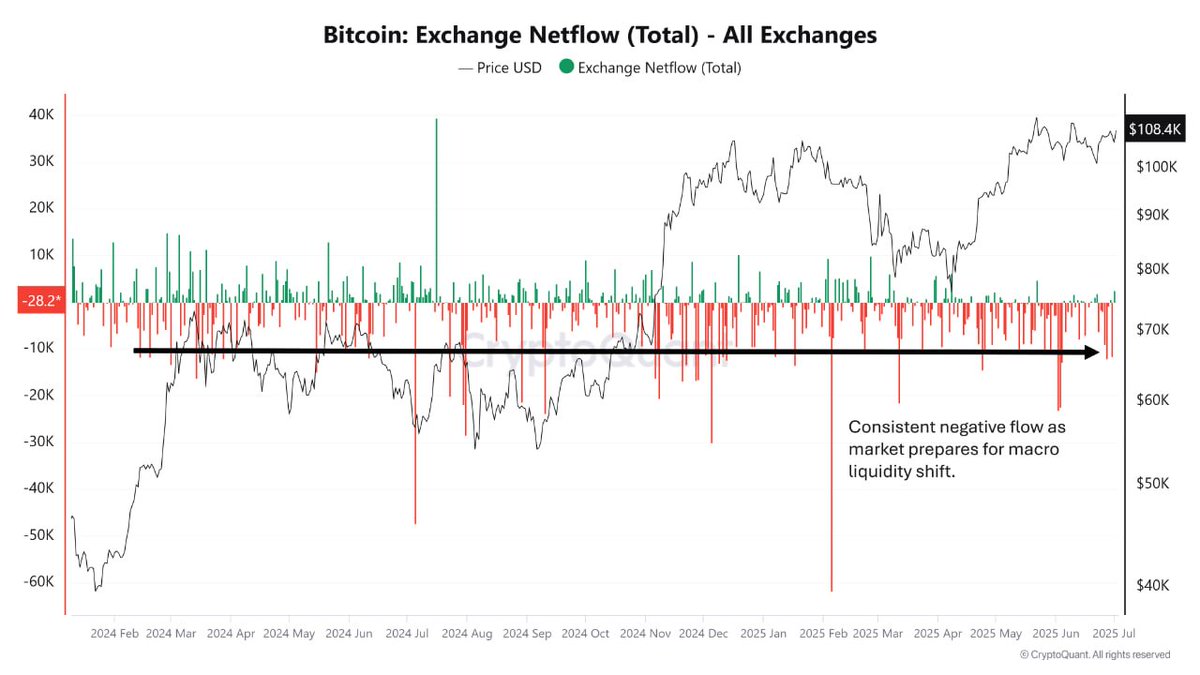

In the latter half of June, the amount of Bitcoin withdrawn from exchanges reached its highest level of the year, with some days seeing over 10,000 BTC leaving. This indicates that investors are moving their assets from exchanges to personal wallets or cold storage. Continuous outflows suggest a reduction in selling pressure and an accumulation of capital, a pattern often seen when expectations for monetary easing grow.

While the price of Bitcoin has consistently remained above $100,000, miners are showing a cautious attitude and not mass-selling their coins. This reflects confidence that prices will remain stable and expectations for a more accommodating financial environment.

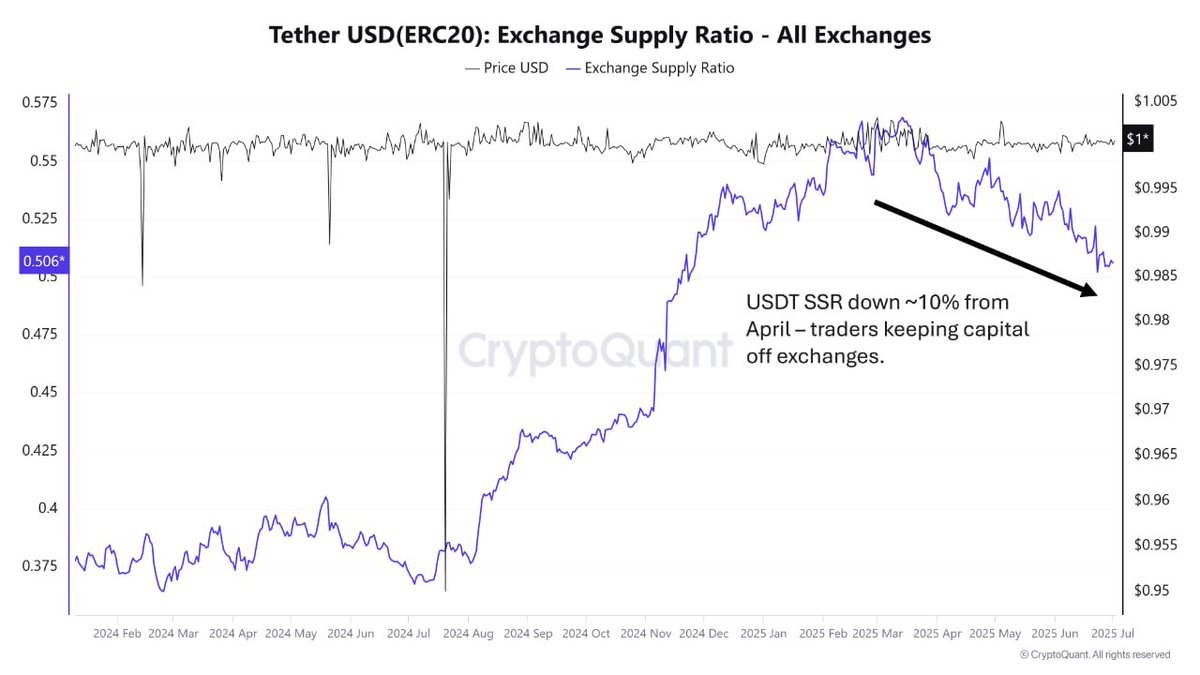

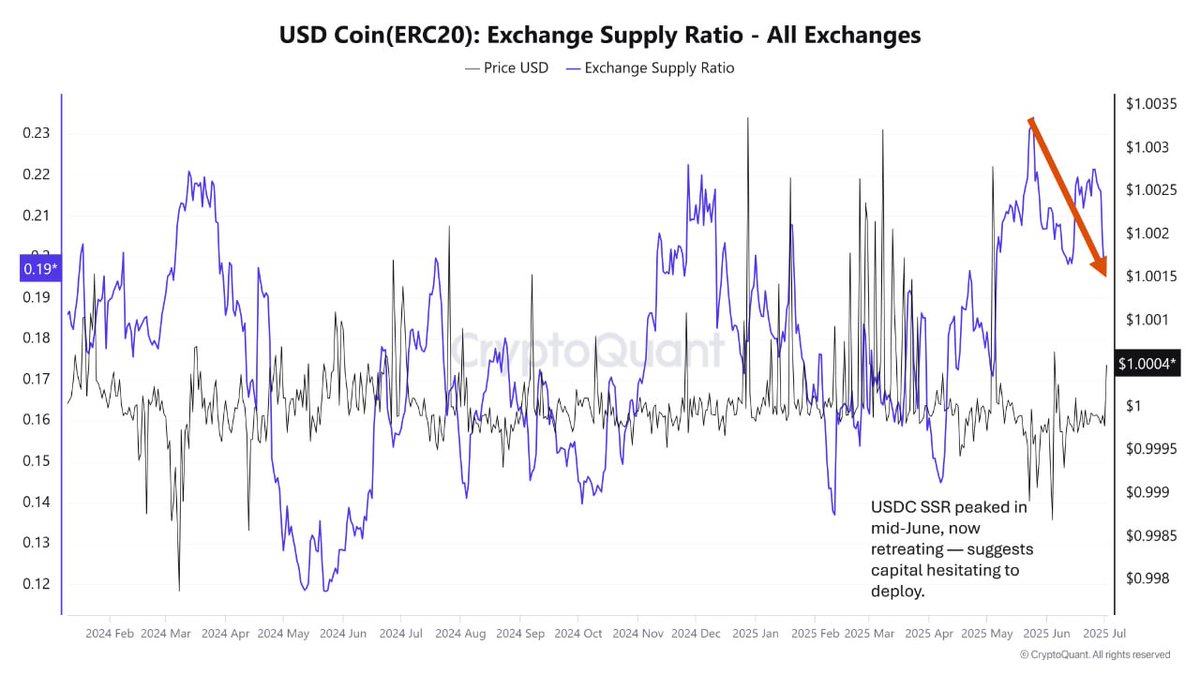

Since mid-June, the supply ratio of USDC and USDT on exchanges has been steadily decreasing. This means that capital is not being directly injected into the spot market but is accumulating on exchanges. Investors are likely waiting on the sidelines for clear market signals.

by: @NovaqueResearch

View original

[Sign up for a free CryptoQuant membership]

By signing up through the link, you will receive a +$39 credit, one month of free advanced tier after card registration, and an additional +$15 credit, so we encourage your participation!

Show original

8.94K

8

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.