$LQTY is undervalued .

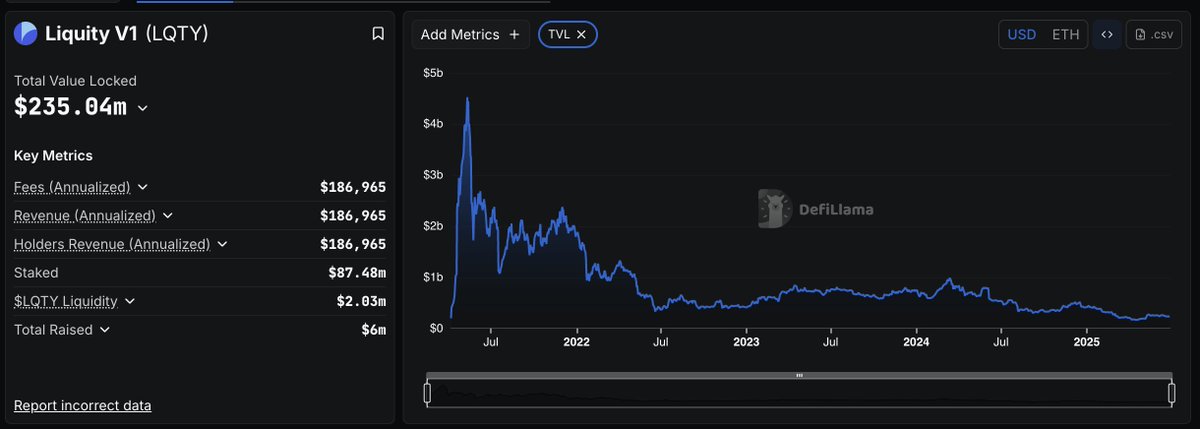

Staked LQTY earns all the fees from Liquity v1

AND AT THE SAME TIME directs 25% of revenue from v2 to LP pools

AND AT THE SAME TIME earns bribes from gauges

AND AT THE SAME TIME earns airdrops from forks.

Long list of bullish facts on @LiquityProtocol's $LQTY:

Liquity V1 went up to $4.5B in TVL, but didnt scale because every redemption raised minimum over-collateralization requirements, lowering demand.

Every redemption in V2 increases stablecoin yield APY, increasing demand.

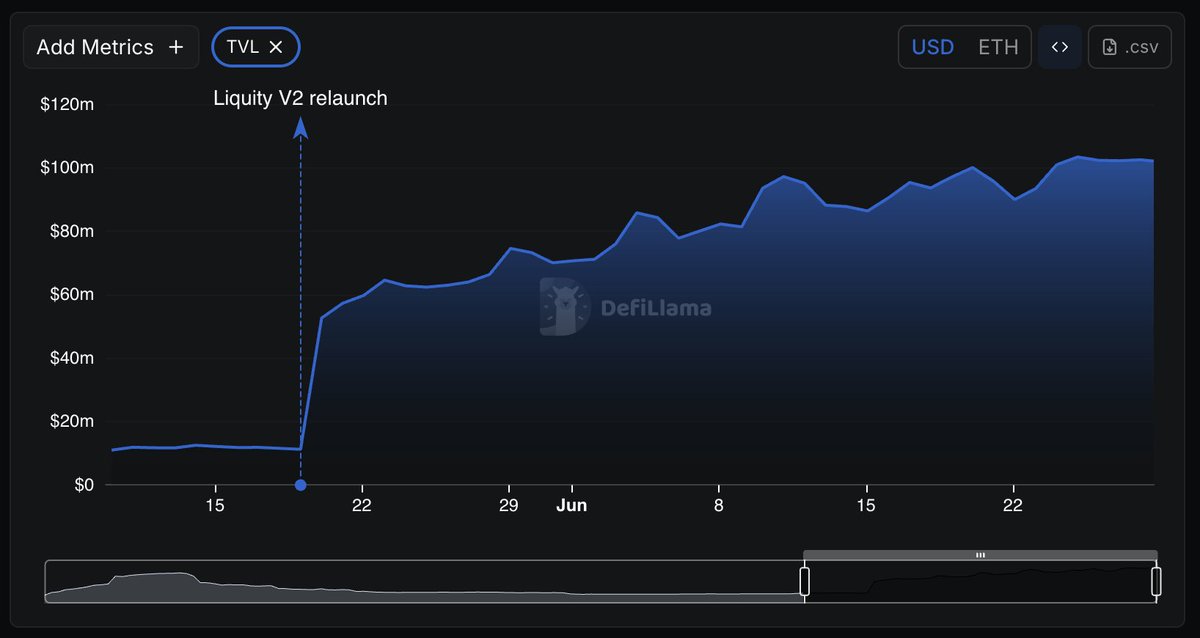

V2 is at $100M TVL after 39 days. One of the most organic growth charts for a protocol of this size ever.

Fastest integration into @Yearn, @spectra_finance, @pendle_fi, and @eulerfinance i've ever seen.

Long term-ism:

The team didnt launch a new token for V2, even though they could have because its an entirely new protocol. They decided to reward long term holders because they are long term builders.

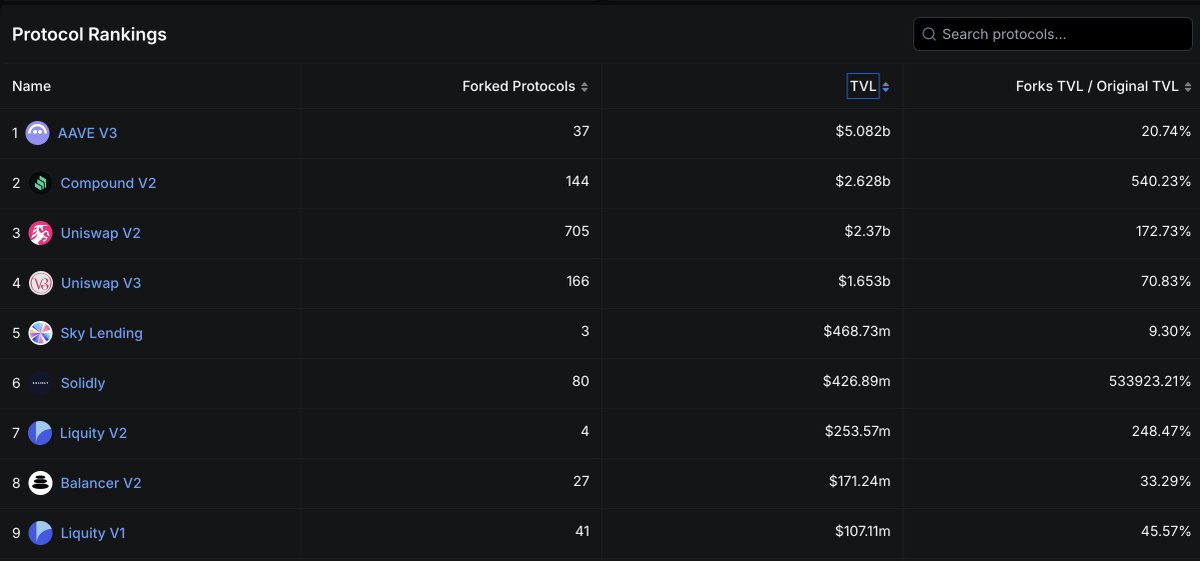

Forkonomics:

Liquity V1 is one of the single post forked protocols in crypto. More than 40 forks, more than that planned for V2.

With the new licensing setup, every fork has to kick back to Liquity users. Potentially LQTY holders too.

Staked LQTY earns all the fees from Liquity v1

AND AT THE SAME TIME

directs 25% of revenue from v2 to LP pools

AND AT THE SAME TIME

earns bribes from gauges

AND AT THE SAME TIME

earns airdrops from forks.

Study Forkonomics. Study long term builders. Study Liquity.

1.93K

18

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.