Half a month after the production cut, the net deflationary rate of TRX increased by 41%

A few days ago, I posted a tweet about how important the production cut is to the optimization of the deflation model, but there is a lack of data support.

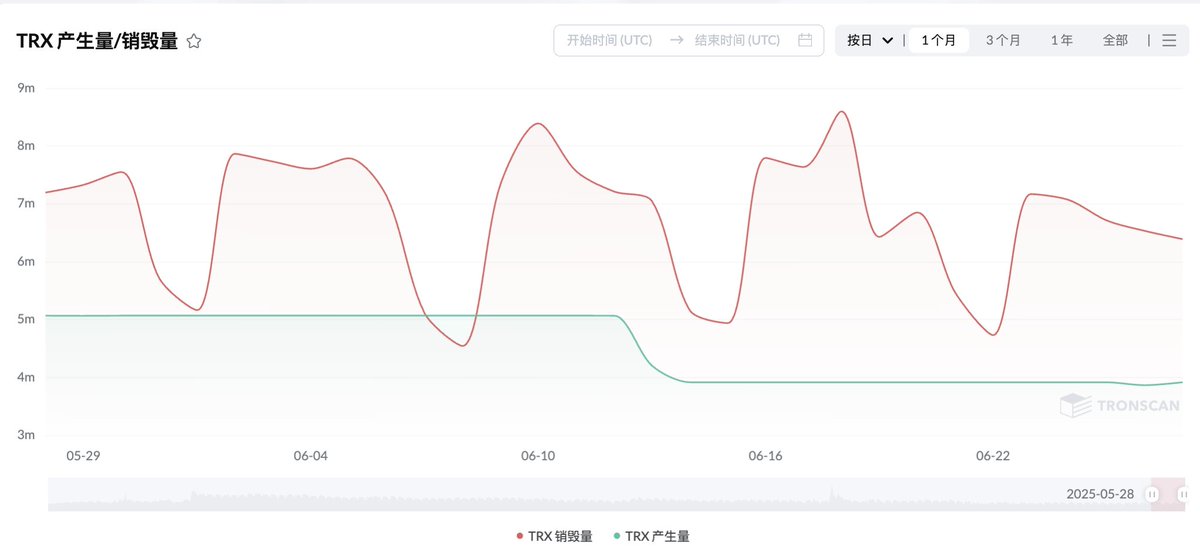

The first is the data chart of TRX supply and burning, from which we can clearly see that the amount of TRX generated per day has dropped significantly after the adoption of the production reduction proposal, and the amount of burn fluctuates normally according to the network situation.

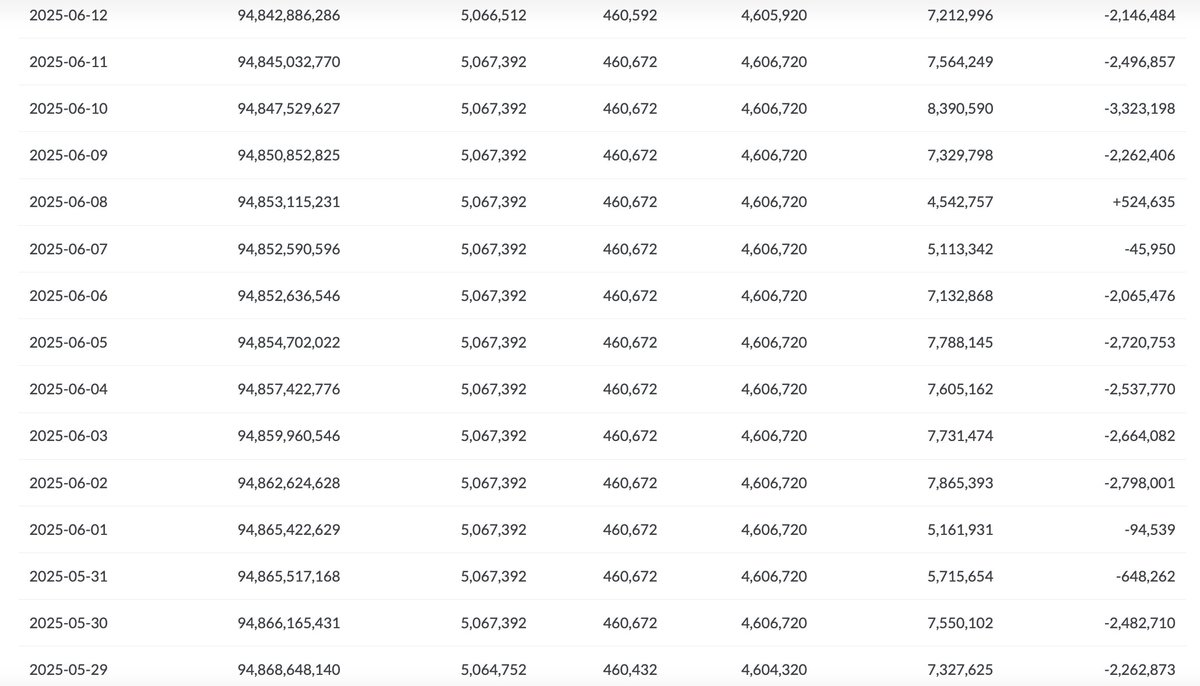

The following chart is the daily data of TRX after the TRX production reduction proposal was passed and took effect, including the total supply, generation volume, block rewards, voting rewards, burn volume and net growth, from the data in the chart, we can know that the net deflation of TRX in half a month was 39,544,873, equivalent to about 10.83 million US dollars.

The following chart is the daily data of TRX half a month before the adoption of the TRX production reduction proposal, from the data in the chart, we can know that the net deflation of TRX in half a month was 28,024,726, equivalent to about 7.68 million US dollars.

So in fact, after the production cut in the month, the number of TRX net deflation rose sharply, reaching 11,520,147, an increase of 41% compared with the production cut......

@justinsuntron @trondaoCN #TRONEcoStar

Show original

10.56K

26

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.