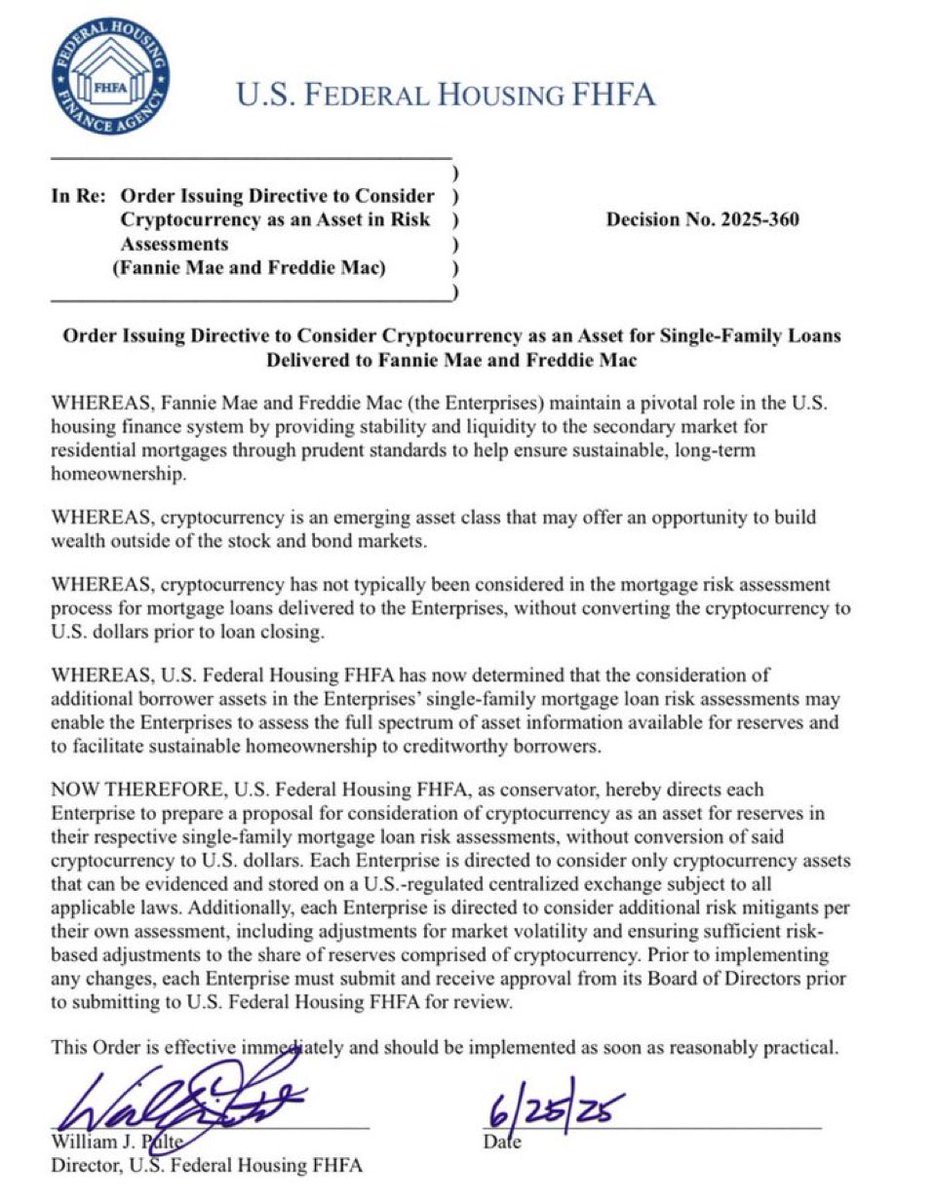

U.S. Federal Housing FHFA just signed off on a new directive:

Fannie Mae & Freddie Mac are officially ordered to consider crypto as an asset in mortgage loan risk assessments.

No, you don’t need to sell it. Just hold it right. 🧵

Until now, if you had $500k in BTC, ETH or even stables it didn’t count.

Why? Because TradFi doesn’t “understand magic internet money”.

So you had to dump it into USD before closing.

That changes now.

If your crypto is:

• Held on a U.S.-regulated centralized exchange

• Verifiable & stored under your name

Then it can count for:

✅ Down payment reserves

✅ Risk assessment

✅ Loan qualification

Each Enterprise (Fannie/Freddie) must:

• Propose how they’ll assess crypto

• Factor in market volatility

• Adjust reserves for the risk

• Get their plan approved before rollout

They still won’t count your chillhouse LPs on pumpswap, sorry.

But ETH on Coinbase? Yes.

USDC on Kraken? Valid.

BTC on Binance? Of course.

Hype on Hyperliquid? Yes please.

This is one of the most significant TradFi validations of crypto as a serious, usable asset class.

Not just speculation. Not just yield.

Now?

A path to homeownership.(not imaginary metaverse)

Effective immediately.

Signed 6/25/2025.

Remember the date.

TradFi now forced to read the chain.

ngl my fartcoin bag being mortgage collateral wasn’t on my 2025 bingo card

1.79K

0

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.