DeFi, EVM, 10s blocks, Bitcoin-backed gas.

@rootstock_io checks the boxes but doesn’t talk much.

[Product report] ↓

Rootstock is a Bitcoin sidechain that brings smart contracts and DeFi to BTC.

It uses a 1:1 pegged asset called rBTC, and runs an EVM, so anything you can build on Ethereum, you can build on Rootstock.

But with Bitcoin’s security underneath!

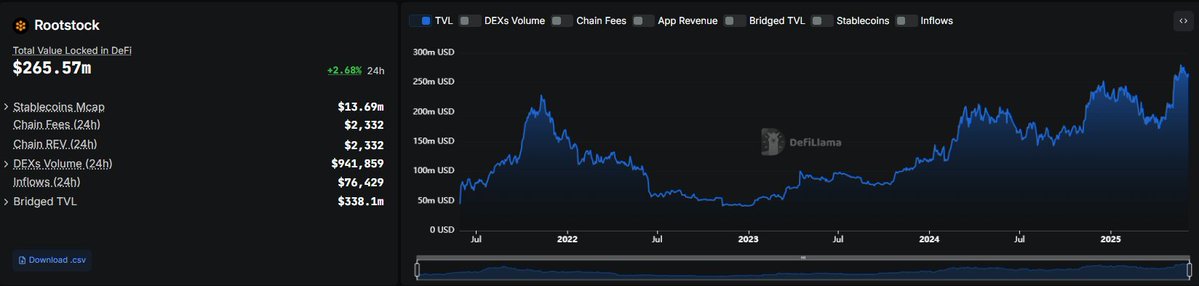

Rootstock has been live for 6 years. And its metrics look healthier than most “new L2s.” Here’s where it stands now:

• TVL up

• Bridging up

• Usage steady

That’s worth a look!

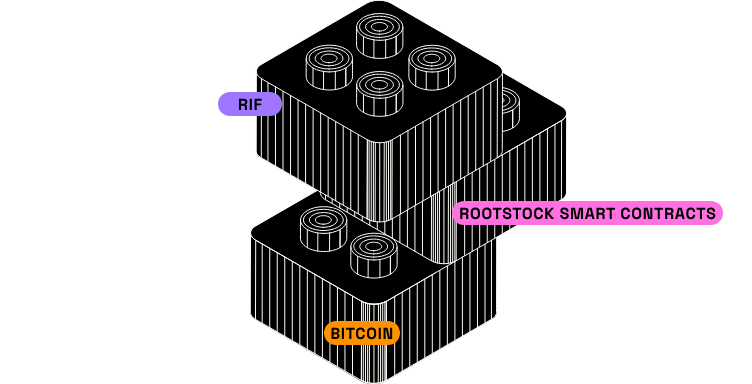

But to understand @rootstock_io's edge, we have to look at its stack.

• Base: Bitcoin, value and security

• Middle: Rootstock, smart contracts on BTC

• Top: RIF, the application layer, handling naming, payments, and off-chain storage.

Think of it like modular Bitcoin without changing Bitcoin itself.

And it isn’t just EVM-compatible, it’s merge-mined with Bitcoin. That means BTC miners secure it using the same hardware, at no extra cost.

• BTC-level security

• ETH-style dev flexibility

• Live bridging and composability

The architecture hits a sweet spot!

While smart contracts on @rootstock_io use $rBTC, $RIF is used to access services on Rootstock.

$RIF also plays a role in governance. Through the Rootstock Collective DAO, $RIF holders can help shape funding proposals and ecosystem direction.

Think of it as Rootstock’s coordination layer for builders.

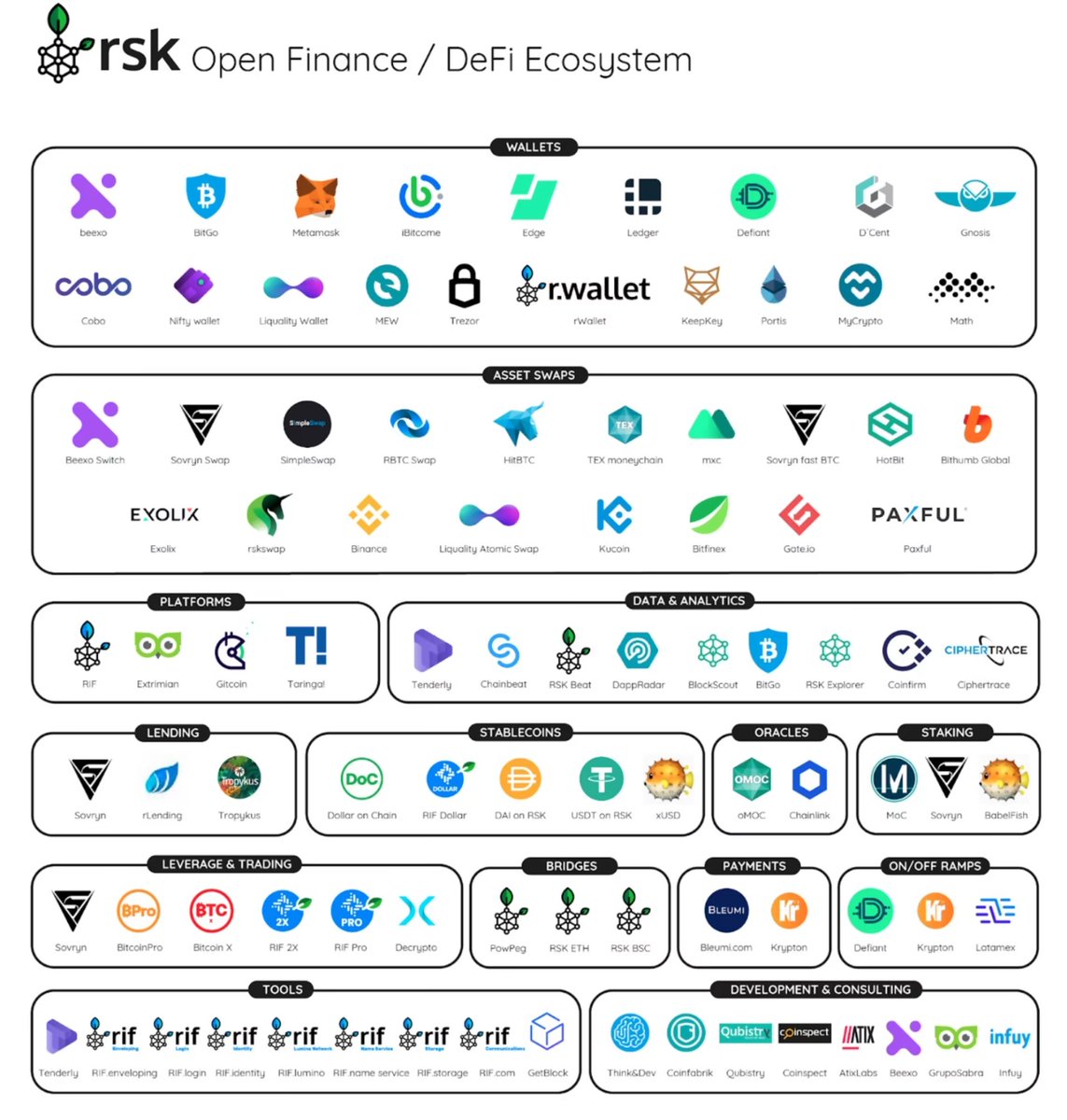

@binance @Gate_io @MEXC_Official @bitgetglobal @WEEX_Official But what’s all this infrastructure enabling?

A growing Open Finance ecosystem built directly on Bitcoin’s security, but with the flexibility of Ethereum.

DEXs, stablecoins, lending protocols, bridges, wallets...

Here’s the map ↓

So what can you actually do with Bitcoin on @rootstock_io?

Turns out: quite a lot!

• Lend with @SovrynBTC or @tropykus

• Trade via @SushiSwap

, @okutrade

, RSKSwap

• Earn yield through @beefyfinance

• Use stablecoins like DoC and USDRIF

• Bridge with PowPeg

• Pay via @kripton_la Market

• Govern with Rootstock Collective

Ohh! A new stack for BTC yield is also live on Rootstock.

• $RBTC → $SolvBTC → $xSolvBTC

• Stakeable, composable, and already earning on multiple DEXs

• Campaigns on Uniswap, Sushi, and WoodSwap show APRs from 8% to 83%

This might be the cleanest BTC-native yield path available today.

If Solv unlocks yield, @Pell_Network unlocks purpose by bringing EigenLayer-style restaking to Bitcoin via Rootstock.

• Restake $WRBTC

• Secure active validation services (AVSs)

• Earn rewards + bonus Pell + Solv points

→ $90,000 in prizes now live across both campaigns.

Stake, earn, and help bootstrap AVSs natively on Rootstock!

And it’s not just DeFi.

The @rootstock_io ecosystem now includes dev tools like @Alchemy

, cross-chain infra - , @JumperExchange , active liquidity managers, and global fintech apps like @RipioApp .

It appears to be evolving into more than a DeFi hub, kinda full-stack Bitcoin L2...

Ecosystem traction isn’t just about logos.

• @rootstock_io now processes over 219K transactions/month

• 2,696 BTC (~$180M) locked in its PowPeg, Rootstock’s 2-way BTC bridge

• And 79% of Bitcoin’s hashrate is merge-mining it

What does @rootstock_io adoption look like right now?

Something like this:

• $390k staking surge campaign

• Co-hosted with @SolvProtocol

, @Pell_Network

, @Galxe

• Usage-based tasks

• Live across chains, settled in $rBTC

Rootstock isn’t just building for users, it’s also building with them by activating the builder flywheel:

Infra → Apps → Incentives → Community.

The Ambassador Program brings together content creators, local organizers, and ecosystem moderators who help onboard the next wave of users. In return, they earn rewards, early access, and real visibility across the stack.

To know more:

And it’s not just users and ambassadors, @rootstock_io is also paying developers directly. The Hacktivator program rewards code contributions, tooling, SDKs, and tutorials.

Ship something valuable, get paid!

To know more:

If Bitcoin DeFi is the question, @rootstock_io may be the most complete working answer. It may not be the loudest, but the most grounded in design, security, and composability.

This is something people will check when they are done being distracted!

Again, NFA. DYOR!

16.48K

180

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.