Ethereum 1.9 billion unstaking wave: profit-taking or a new ecological starting point?

Original author: TechFlow

Whenever the market is good, FUD is indispensable.

Today, a piece of news has once again made everyone worry about the price of ETH:

Validators on the Ethereum network are lining up to unstake ETH.

As a representative of the PoS consensus mechanism, staking ETH is technically used to maintain the security of the entire Ethereum network and economically obtain additional benefits generated by staking, locking ETH's liquidity in the staking pool.

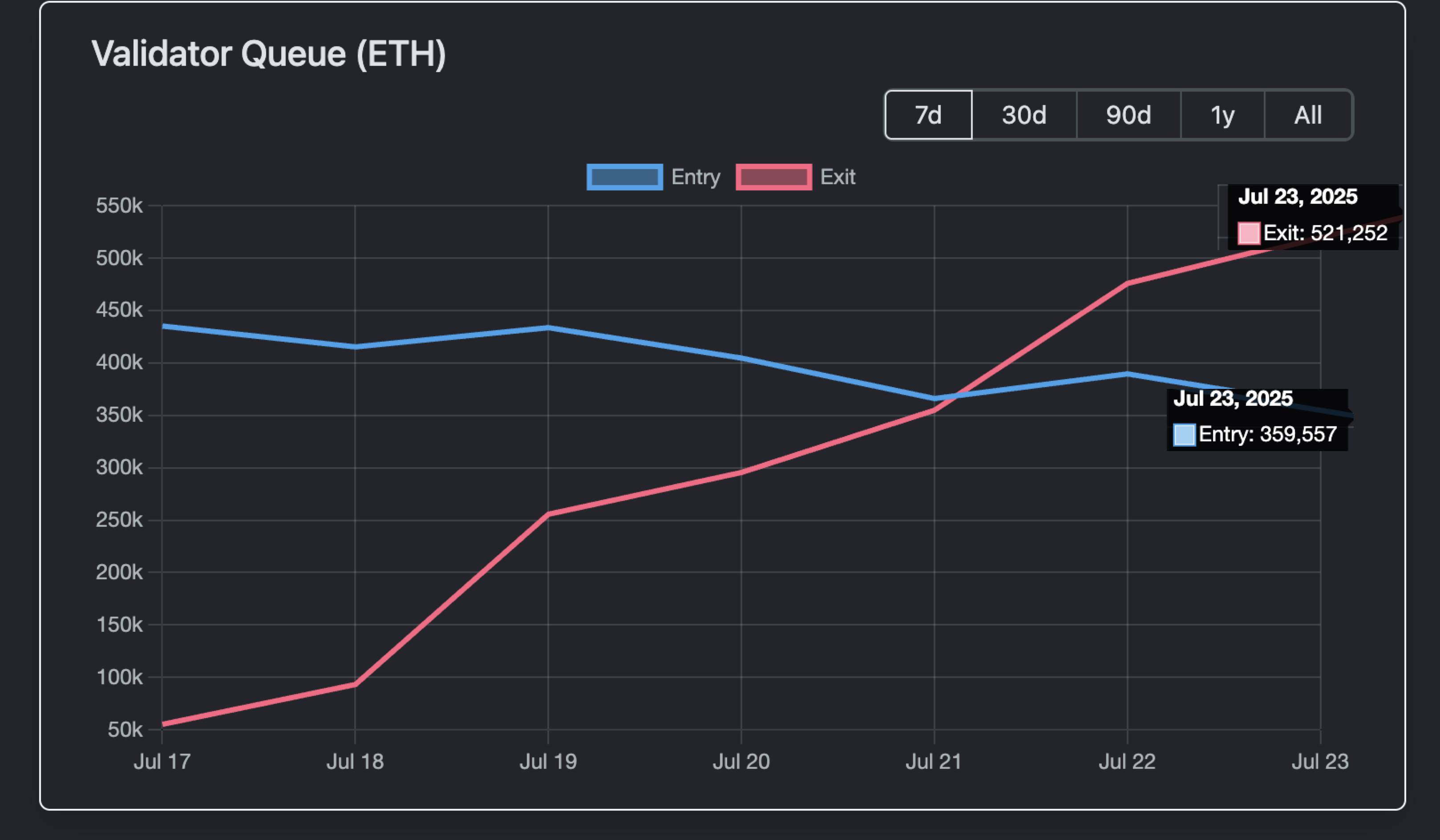

However, according to data from Validator Queue, as of July 23, about 521, 252 ETH have accumulated in the exit queue of Ethereum validators and are unstaking, with a market price equivalent value of about $1.93 billion, and the waiting time in the queue for unstaking is more than 9 days and 1 hour.

This is also the longest queue for validators to opt out in the past year.

Since each validator typically stakes 32 ETH, this theoretically equates to more than 16, 000 validators seeking to exit staking. The large-scale queue to choose to unstake makes people smell some danger.

Take profits?

Are whales and institutions going to sell ETH to take profits?

The surge in Ethereum's unstaking may be partly related to the recent price increase.

From its low point in early April 2025 (around the $1, 500-$2, 000 range), ETH has experienced a strong rebound, with a cumulative increase of 160% so far. Specifically, ETH hit a high of $3,812 on July 21, the highest level in the past seven months.

This rapid rise often prompts some investors to choose to take profits, especially those who staked early, who may decide to lock in profits instead of continuing to hold after seeing the benefits.

From a historical point of view, this pattern is not new.

From January to February 2024, when the ETH/BTC ratio rose by 25% in a week, a wave of unstaking of a similar scale occurred, leading to a short-term price drop of 10%-15%. However, it was also around the same time, coinciding with the bankruptcy liquidation of Celsius, and 460,000 ETH were centrally unpledged in a short period of time, causing queue congestion for about a week for validators to exit the entire ETH network.

Not selling pressure

Unlike before, although the queue for ETH unstaking this time is long and the amount of unstaking is large, it does not mean direct selling pressure.

First of all, according to data from Validator Queue, 520,000 ETH were queued to unstake on July 23, but 360,000 ETH also entered the staking queue.

The two offset each other, and the net exit of ETH from the Ethereum network is significantly reduced.

Secondly, institutional behavior also plays a certain buffer role.

According to data on July 22, the total inflow of ETH spot ETFs from various institutions in the open market reached $3.1 billion, which was significantly larger than the 520,000 ETH ($1.9 billion) queued to unstake on the same day.

And that's a one-day net ETF inflow, not to mention the 9-day queue period for validators to exit the queue.

At the same time, unstaking does not mean that it will definitely be sold.

In this round of ETH rise, the centralized unstaking is likely due to adjusting custody services for institutions or turning to crypto treasury strategies.

On the chain, partially unstaked ETH is more likely to be used for DeFi and NFT-related activities. For example, providing liquidity as collateral, or a whale sweeping the floor of Crypto Punks yesterday;

In addition, LST tokens on the chain often de-peg, which also provides ETH with arbitrage opportunities--- For example, the recent stETH-to-ETH ratio has dropped to 0.996 (a discount of about 0.04%), and weETH has also experienced similar fluctuations. Arbitrageurs profit by buying discounted LST and waiting for the recovery of 1:1 pegging to profit, a process that increases ETH demand.

Overall, unstaking is more like an internal adjustment in the Ethereum ecosystem than a direct selling signal.

However, there are also a variety of speculations on social media, although centralized unpledge does not mean selling pressure, it is likely to point to a phenomenon, that is, "changing banks".

As of July, BlackRock has accumulated more than 2 million ETH (worth about $69-8.9 billion), accounting for about 1.5%-2% of the total ETH supply (about 120 million ETH).

This is not a secret, but an open ETF asset management behavior, so this is more like an institutional-level "Ming Zhuang" - promoting institutional adoption of ETH through public holding and accumulation through ETFs, rather than manipulating the market.

The logic of the change is that when Ethereum changes from a consensus of value in the circle to a consensus on financial instruments in a broader sense, it is already a very obvious trend that Wall Street is ready to make a big move.

This speculation is not unreasonable, and staking and unstaking may also be a conversion of the chip structure.

But regardless, Ethereum's growth will continue to support its leadership in the crypto space, and this wave of de-staking may just be the beginning of a new cycle.