Can Bitcoin maintain its dominance for a long time?

Written by: Huang Shiliang

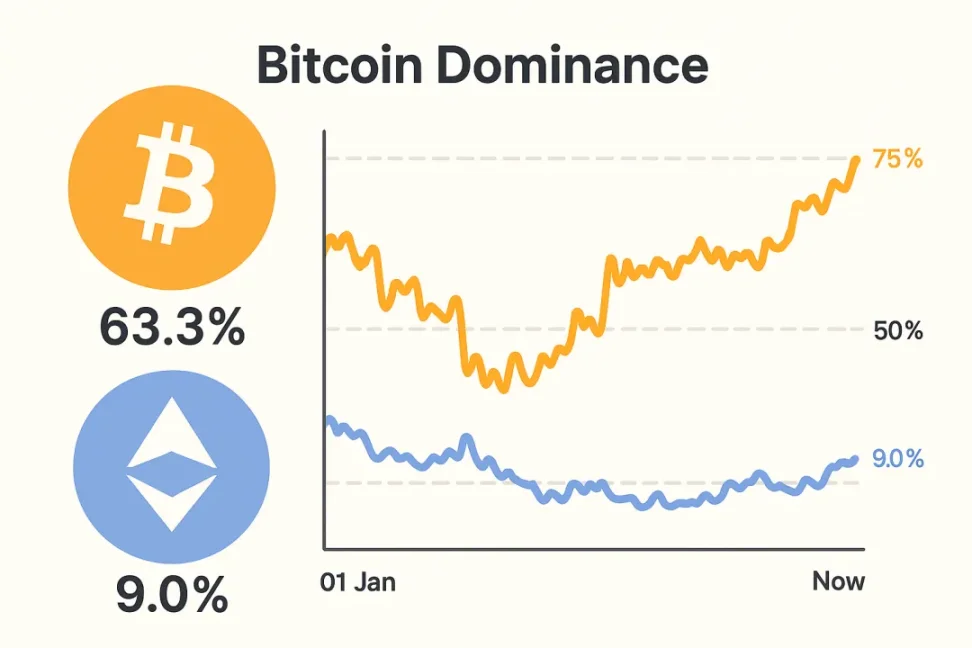

Over the past year, Bitcoin's market capitalisation in the cryptocurrency space has been expanding, and now it is now the highest in the past five years, exceeding 63%.

Maybe this number is the biggest blow to ETH investors, not the ETH price itself, at least it hit me to the point where I can almost hide under the covers and cry, if I started lying flat five years ago, how can I be like this today.

Ever since the ETH/BTC exchange rate dropped by 4%, I've been asking myself, is this thing going to go down any longer? What should I do? TMD, I was so angry that I kept asking until it was less than 2%, completely speechless.

We need to think hard about this question, will Bitcoin's market capitalisation lead remain the same for a long time? Investing in cryptocurrencies is not lying flat on BTC and pulling down, don't look into anything else.

I would like to compare the situation in other areas and whether the leading companies in other industries have been dominant for a long time.

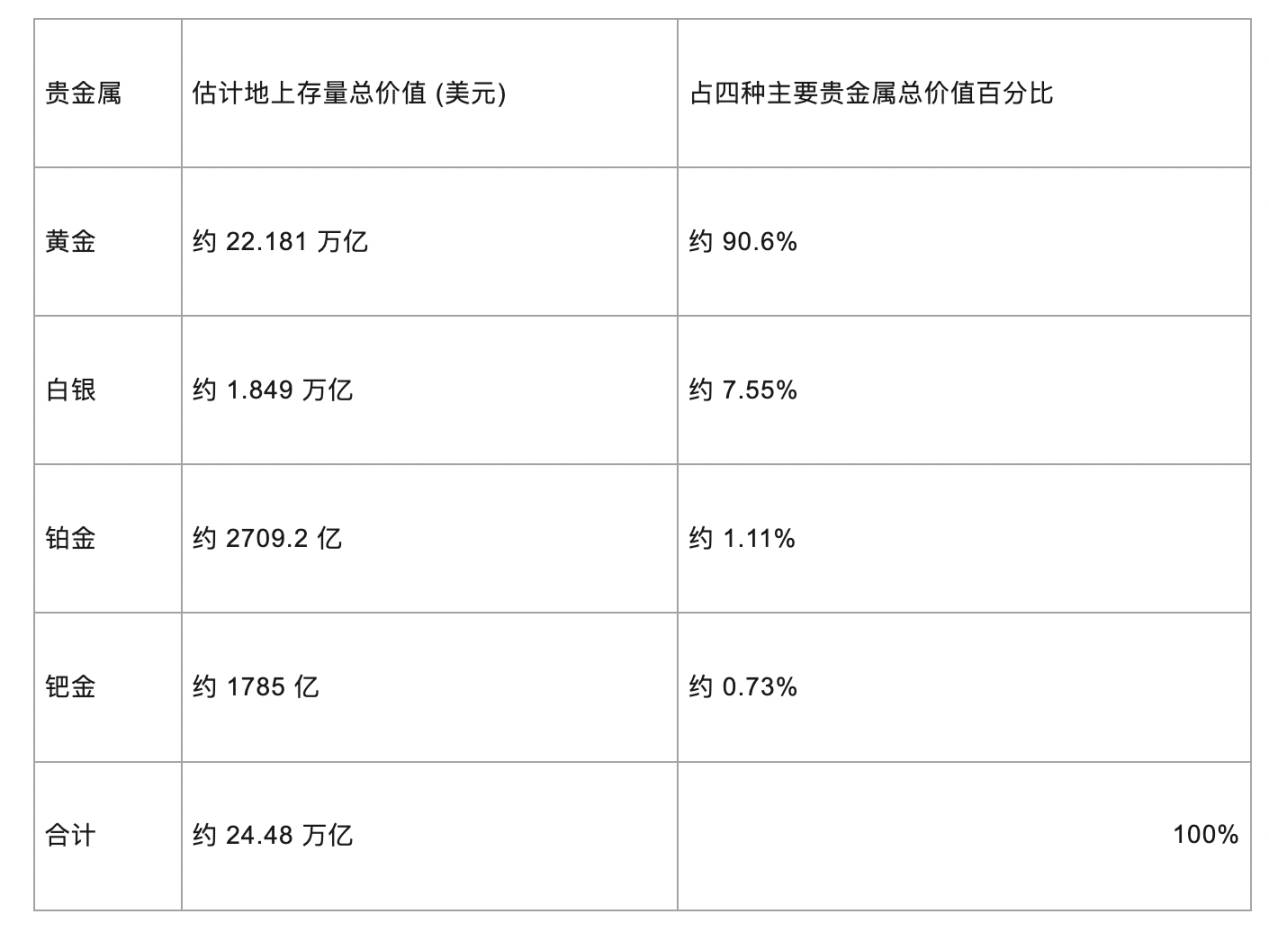

The easiest thing to think of is, of course, gold, and I asked ChatGPT and Gemini to investigate the market value distribution of precious metals separately, as shown in the following table:

Table 1: Distribution of market capitalisation of precious metals

Gold's market capitalisation dominance is largely due to its brand, which has been used as a currency and store of value for thousands of years. Brand is an inherent imagination in the hearts of human beings, and this barrier is very high.

I feel like Bitcoin is more like this.

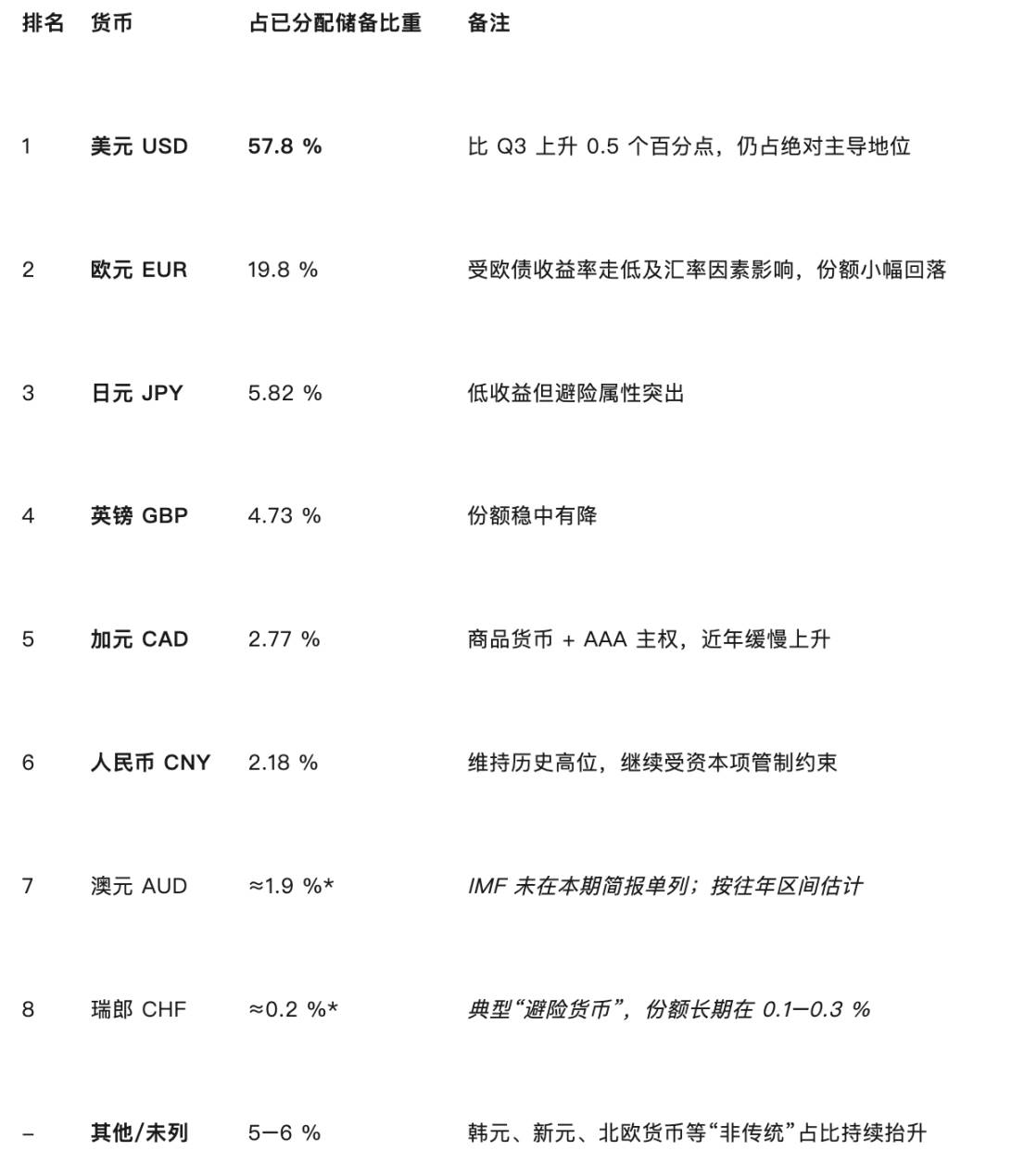

Second, it is worth comparing the proportion of fiat currencies in the global foreign exchange reserve currencies. ChatGPT and Gemini are out again.

Table 2: Currency structure of global foreign exchange reserves for the fourth quarter of 2024

The core reason for the absolute monopoly of the US dollar is that the United States is the world's largest economy, the depth of the US bond market is irreplaceable, and the world's major international trade, especially oil, is denominated in US dollars. In addition, the auxiliary factors are the politics, culture, and Fed of the United States, which are too awesome.

But the trend now may be to decline the monopoly of the dollar, mainly challenged by the yuan.

Compared to Bitcoin's market capitalisation in the cryptocurrency space, Bitcoin does not have the advantage of the US dollar, and Bitcoin does not create the most useful thing in the blockchain world. On the contrary, Ethereum, the second in the market, is a bit like the US dollar, providing various infrastructure and use cases for the entire industry.

Let's take a look at the situation of the major well-known companies.

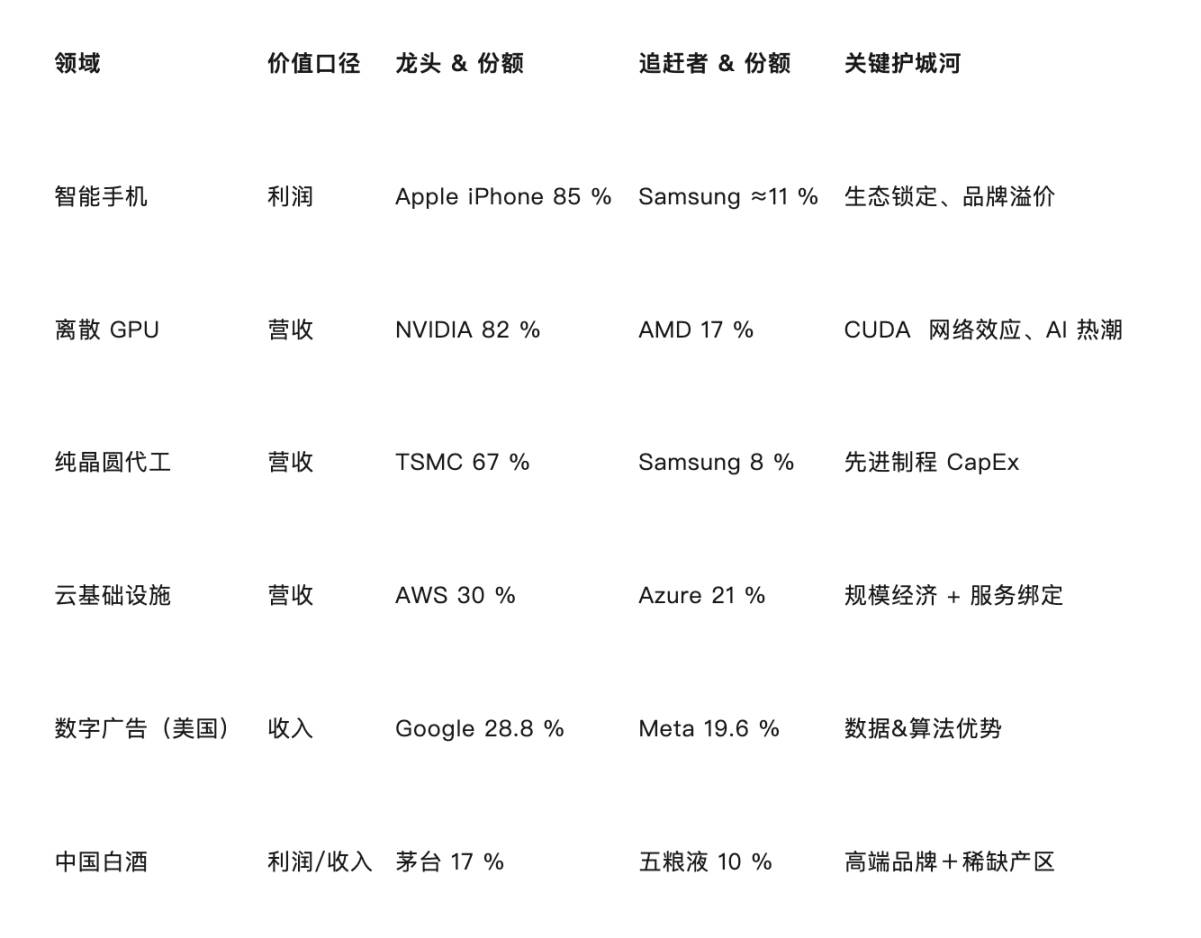

Note that for the sake of comparison, I'm using the company's share of "captured value", i.e., it's not market share (concepts like user volume) or the market capitalisation distribution of stocks that are directly related to making money.

Table 3: Share of well-known firms' earning power among their peers

From the above three types of cases, we can summarise several major mechanisms of value capture.

Brands and premiums: iPhone, Moutai, gold, BTC is undoubtedly the same

Technology/capital barriers: NVIDIA, TSMC

Network effects: AWS, Google

Resource scarcity or sovereign endorsement: gold, US dollar (Bitcoin may be related to this)

Economies of scale: Amazon Web Services, TSMC foundry, NVIDIA GPUs

I think the core factor that Bitcoin's market capitalisation occupies an absolute leading advantage in the blockchain is: brand.

The ability of brands to capture value in the same industry can be accounted for by iPhones at 85% and gold at 90%.

If the competition among currencies in the cryptocurrency industry ultimately depends on brands, then Bitcoin's current market capitalisation of 63% is not high.

If that's the case, the ETH Holder is really going to cry.

But can we believe that the brand is the core of the coin and blockchain?

Shouldn't it be decentralisation, network effects, user volume, application scenario landing, etc.?

I don't have a final answer yet.

But never underestimate the value of your brand.