Gonna let y'all fight for the @HyperliquidX dollar.

We'll just use it to fuel yoHYPE and optimize the yield for you.

Some day.

The Race for USDH on Hyperliquid

Hyperliquid’s exchange is soaring, hitting new highs with innovative network designs. Its latest move? The much-anticipated USDH stablecoin, set to reshape its ecosystem and boost efficiency.

What to know about the teams leading the bid 👇

~~ Analysis by @davewardonline ~~

What is USDH?

Last Wednesday's Request for Proposal invited stablecoin issuers to pitch Hyperliquid's community on issuing USDH, a move to stimulate spot markets, reduce USDC dependence, and boost exchange efficiency.

When launched, USDH will be used in select spot pairs, cutting trading fees by 80%. This strengthens HyperCore, Hyperliquid’s flagship exchange, by balancing its spot volumes, which lag behind its perps business.

Further, @HyperliquidX holds ~8% of Circle’s USDC in its bridge, creating reliance on a third party and leaking ~$100M annually to Coinbase, with no yield returning to its ecosystem. A native stablecoin would eliminate this drain and recycle ~$200M in USDC revenue to fuel Hyperliquid’s growth.

Why Teams Are Competing

Proposals closed yesterday, ending a fierce race to steward USDH.

Hyperliquid’s appeal is clear: it averages $57B in weekly volume, surpasses NASDAQ’s revenue rate, and accounts for 35% of blockchain revenue at times. It’s also the world’s most profitable company by revenue per employee as of August. Securing a role in USDH is a high-stakes opportunity.

The Leading Contenders

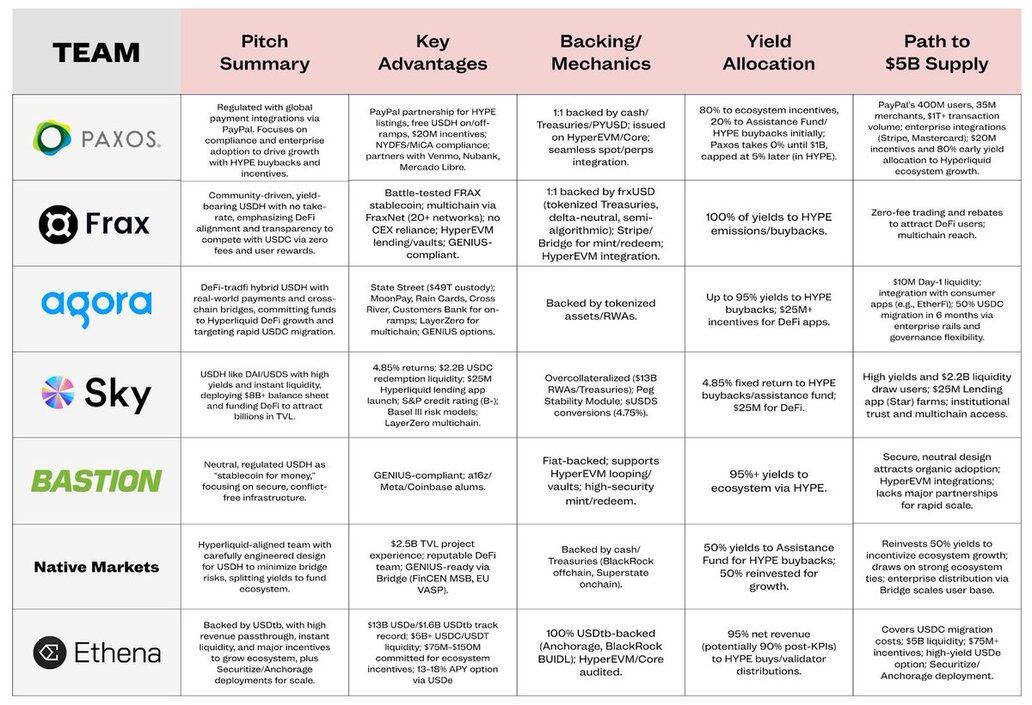

Three teams stand out for a Hyperliquid-first, compliant, natively minted USD stablecoin, per @jimbo_evans of Reciprocal Ventures:

➢ Is Hyperliquid their home base?

➢ Will USDH growth equal Hyperliquid growth?

➢ Will it reduce regulatory risk?

The top contenders here are Native Markets, Ethena, and Paxos.

Native Markets is Hyperliquid-native, led by @fiege_max (highly respected HL contributor), @Mclader (ex-Uniswap COO), and @_anishagnihotri (Paradigm researcher). Their proposal offers revenue splits for HYPE buybacks and growth incentives, with strong regulatory alignment. Their edge lies in Max’s social capital and bootstrapped approach, though some question if they had prior RFP knowledge.

@ethena_labs brings DeFi credibility, promising $75M to grow USDH and partnerships with Securitize and Anchorage Digital. However, their broader focus raises concerns about alignment with Hyperliquid’s ethos.

@Paxos gained traction with a V2 proposal, emphasizing a PayPal partnership, HYPE listings on PayPal/Venmo, free global on/off-ramps, and $20M in incentives. Their tiered revenue system starts at 0% fees until $1B TVL, scaling to 70% for Hyperliquid’s Assistance Fund, 25% for growth, and 5% for Paxos (in HYPE) above $5B. Paxos offers regulatory strength but feels more corporate.

Who Wins?

Regardless of who wins, these last few days have been something incredible to watch and should be seen as a moment of triumph for the crypto space.

Crypto has built a product so sought after and desired that we have institutions powering up Discord and writing out lengthy proposals, recognizing the enormous opportunity that is Hyperliquid, as well as the model that it sets.

Since USDH’s entry to the mainstage, we've seen MegaETH announce a native stablecoin as well, something which I expect we’ll see more and more of as ecosystems follow USDH’s suit and attempt to ingest, rather than pass on, the yield being generated by titans like Tether or USDC for themselves. It’s perhaps most surprising that we haven’t seen more of this previously.

No matter who Hyperliquid’s community backs, the choice will ripple far beyond a single stablecoin. If executed well, USDH won’t just bolster Hyperliquid — it will extend the exchange’s track record of showing how far crypto can go when something truly valuable is built organically.

459

0

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.