JUST IN: @chainlink has officially launched the Chainlink Reserve 👀

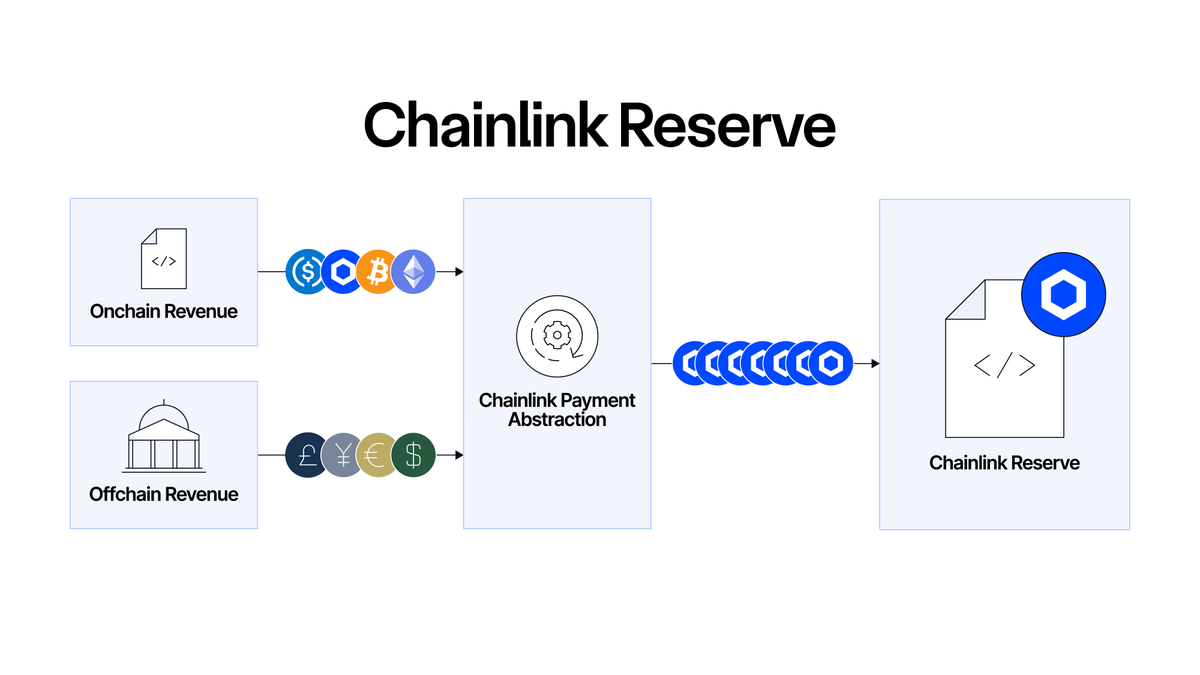

This economic upgrade creates a strategic LINK reserve funded by onchain & offchain revenue

Institutional adoption → protocol revenue → LINK purchases → Reserve

Here's what this means for $LINK 🧵👇

TL;DR

The Chainlink Reserve is an onchain strategic reserve of $LINK, designed to support the long-term growth & sustainability of the Chainlink Network

The Reserve is being built up by converting offchain and onchain revenue into LINK using DEX infra (initially @Uniswap)

This upgrade was made possible via expanding Chainlink's Payment Abstraction to support additional services and offchain payments

This enables users to pay for Chainlink in their preferred form of payment (e.g., fiat and crypto), which is programmatically converted to LINK

Demand for Chainlink services has generated hundreds of millions of dollars in revenue, substantially from large enterprises

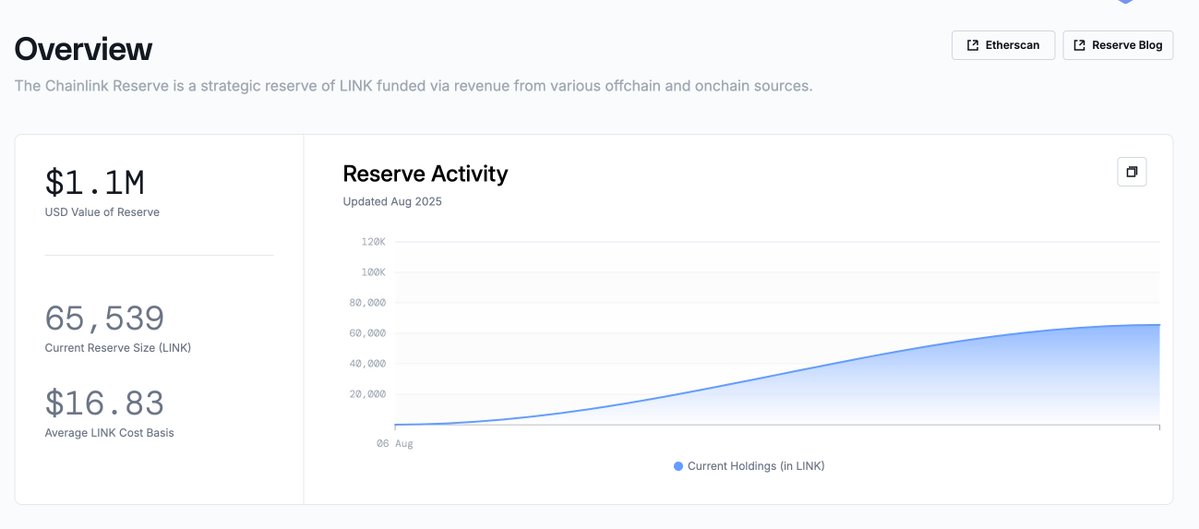

At launch, the Reserve has already accumulated $1.1M of LINK, and is expected to grow as more revenue is converted to $LINK

No withdrawals are expected from the Reserve for multiple years, meaning the strategic $LINK stockpile becomes an accumulation machine driven by adoption

As industry demand for the Chainlink platform increases, the growth of the Reserve can accelerate faster

Funding the growth of the Chainlink Reserve through onchain and offchain revenue makes the $LINK token central to the value capture of the Chainlink Network

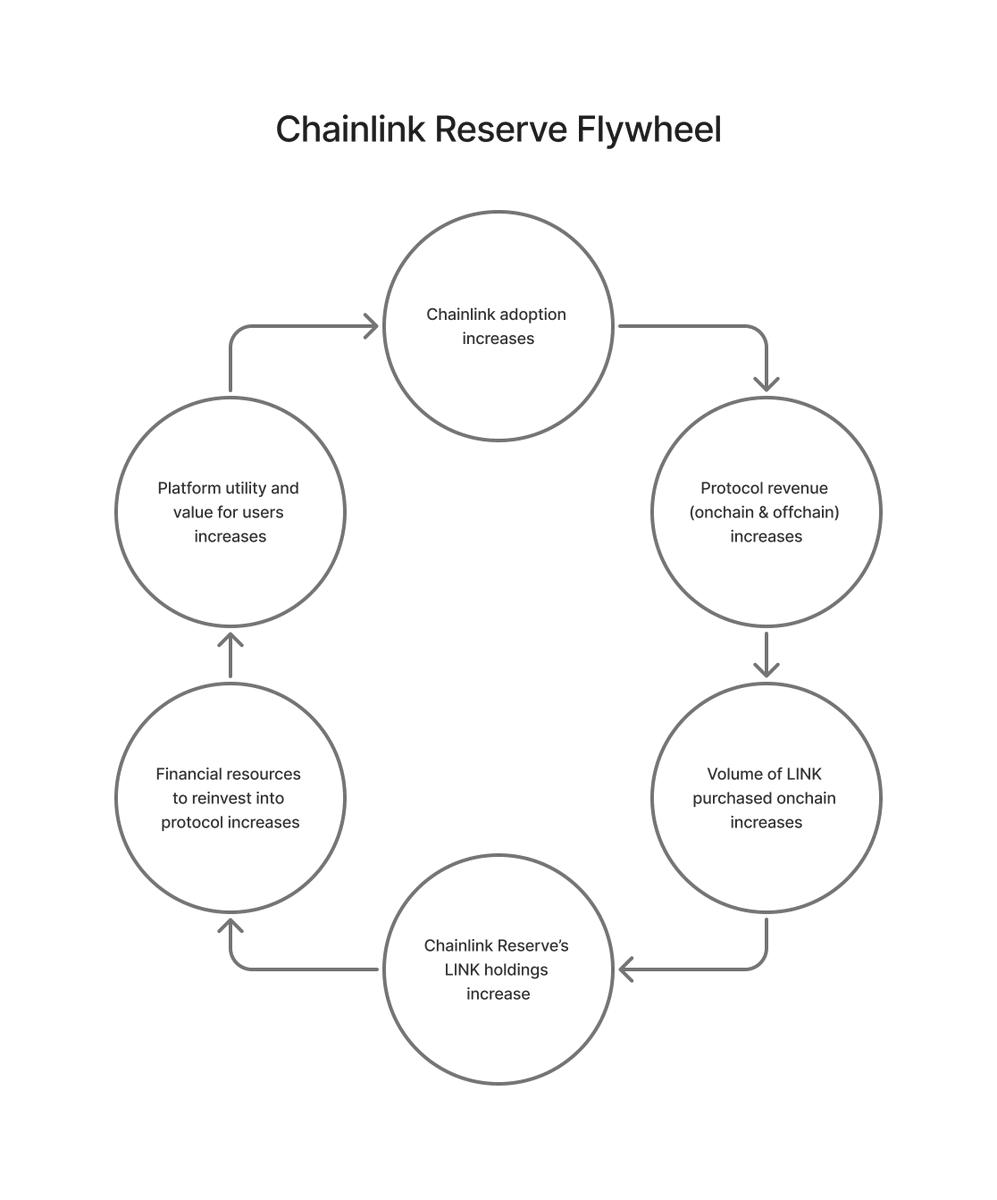

This creates a powerful flywheel effect of adoption

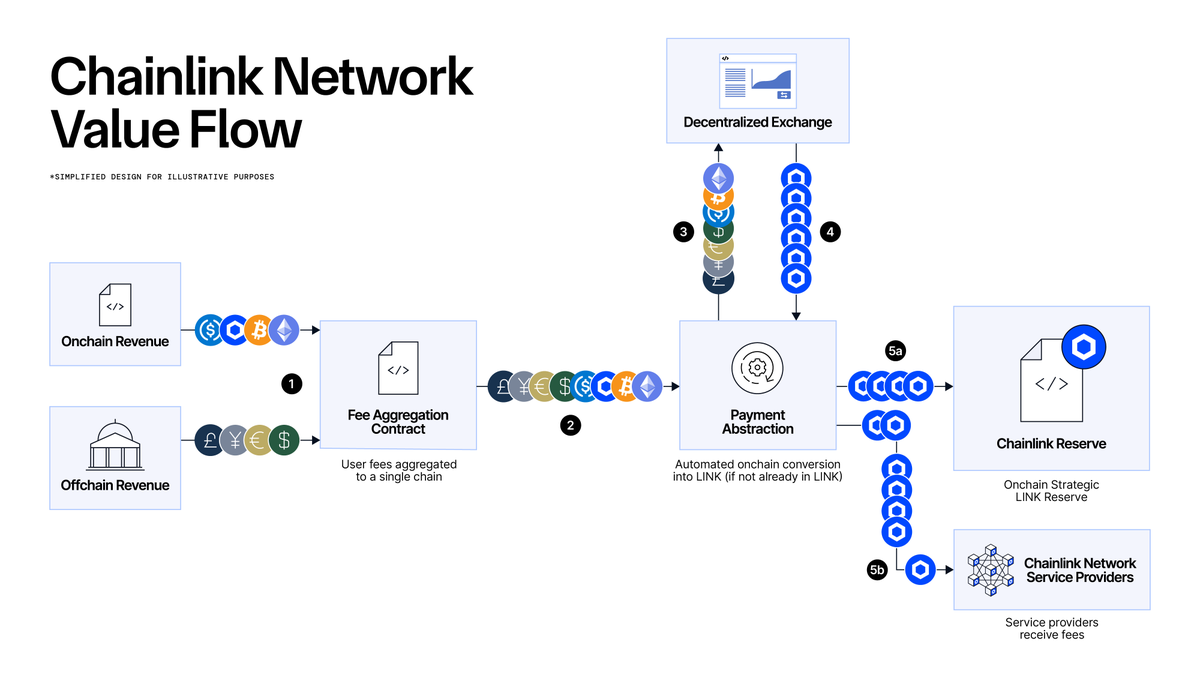

• An increase in protocol adoption (by DeFi and TradFi) leads to increased onchain & offchain revenue

• This revenue flows onchain through Payment Abstraction and is converted into LINK, if not already in LINK, via a DEX (on market purchases)

• This revenue fuels the growth of the Chainlink Reserve, creating an onchain accumulation machine of LINK

• In multiple years when the Reserve is used, these financial resources can be used to expand the network's utility and value for users

• A more useful and valuable network attracts more users and adoption, leading to more revenue, a growing Reserve, and the flywheel accelerates

Where do the fees come from?

Onchain revenue includes fees paid onchain by users or dApps when consuming Chainlink services

Think usage-based payments (per-call fees & subscription contracts) and other payment structures where users pay in crypto onchain, where fees are largely standardized across users

Users can pay natively in LINK (and get a discount, e.g., 10% discount with CCIP), or pay in their preferred form of crypto asset (e.g., ETH & USDC), which is programmatically converted to LINK

Take for example Chainlink's MEV recapture solution (SVR)

Just a week ago, $200K in non-toxic liquidation MEV was recaptured in one day, including $100K in a single transaction

SVR total recapture is now $450K, this is a single product initially used by just a single user for a single lending market on a single chain (@aave Ethereum core market)

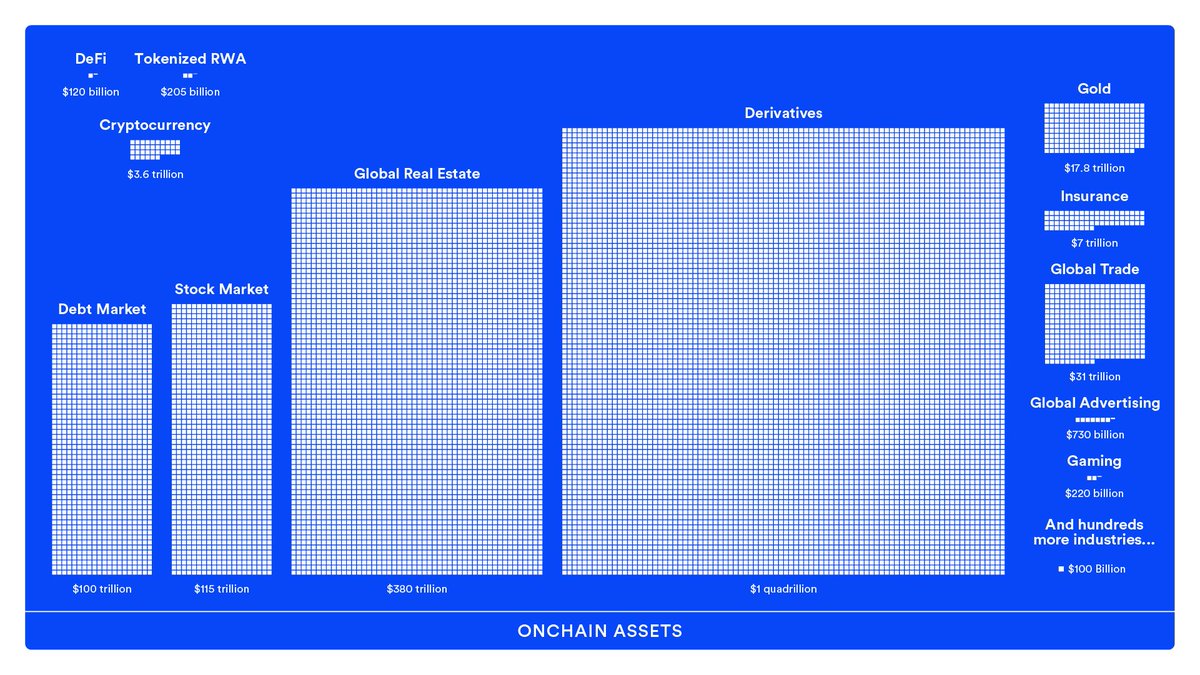

More SVR-activated markets and protocols to come (imagine when there's trillions in RWAs in lending protocols...)

Offchain revenue includes enterprise deals (integrations, usage, and maintenance) that facilitate institutional access to the Chainlink platform, as well as various other sources such as chain integration deals (Scale) and revenue-sharing deals (e.g. GMX).

These are often more bespoke deals that may involve an offchain agreement (where payment is made onchain in crypto or offchain in fiat)

Capital markets adoption of Chainlink is rapidly accelerating, with a number of in-production use cases and pre-production use cases approaching live deployments

For various legal or business reasons, enterprises often can't or prefer not to pay in digital assets / crypto, but instead in fiat (e.g., USD)

Should Chainlink say "no, sorry, your money is no good here, go somewhere else"?

Definitely not, that revenue can simply be put onchain and get converted to LINK, abstracting the entire onchain payment process away from the user and fueling the Reserve

Ever wondered how institutional adoption of Chainlink, where users pay in fiat, ties back into the protocol's economics and the token?

The Reserve is the answer

The revenue is put onchain, converted into $LINK (via onchain DEX purchases), funding the growth of the strategic reserve

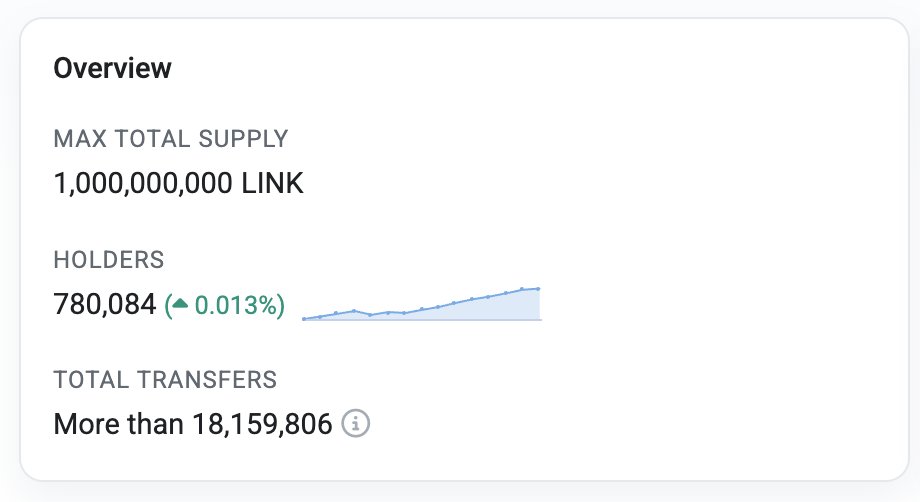

Remember, the LINK token has a capped total supply of one billion, and most of that is circulating already, so subsidized oracle rewards cannot last forever

The long-term economic success of Chainlink is an ecosystem that runs entirely on user fee revenue

In a future world, where there are trillions in tokenized assets and Chainlink is the global standard for modern finance...

The Chainlink Reserve can accumulate LINK tokens faster than they are withdrawn from, creating a growing token sink for LINK

The Reserve + Payment Abstraction complements existing econ initiatives like Staking, which serves as another token sink where LINK is locked up

I don't have any updates to provide on staking today, but it also plays a crucial role in Chainlink's economic success

All in all, this is a very exciting moment in time for Chainlink

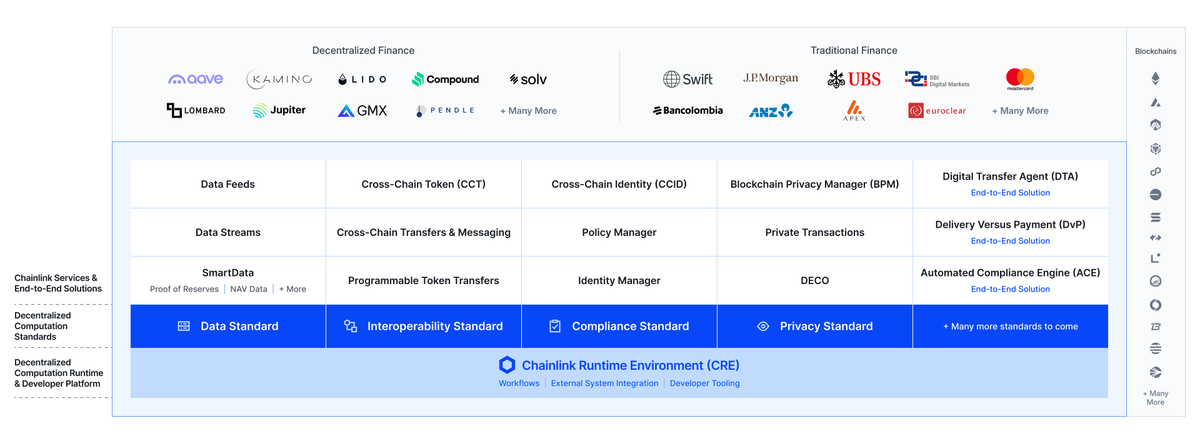

• We're seeing growing adoption of blockchain technology from the world's largest institutions as they move to tokenize trillions onchain and adopt stablecoins

• The U.S. government has pivoted from being anti-crypto toward being fully pro-crypto, providing regulatory clarity and relief for the industry, unlocking new economic innovations

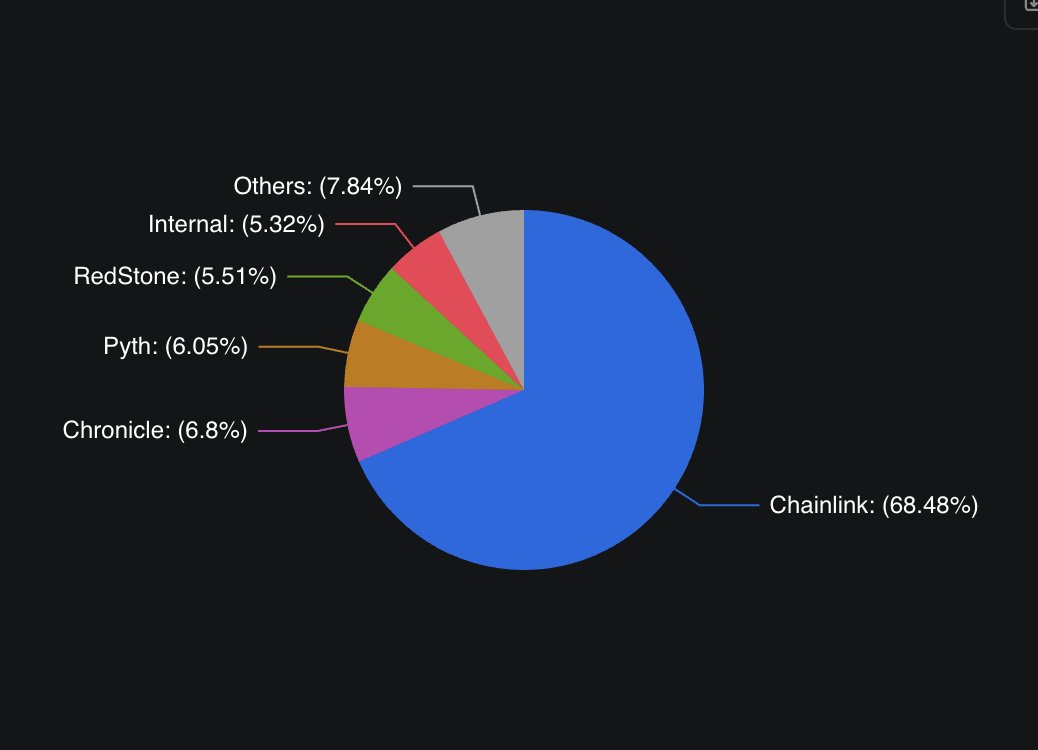

• Chainlink's marketshare in DeFi (68%+ overall, 84%+ on Ethereum) and TradFi (Swift, DTCC, JPM, UBS, SBI, etc) continues to expand

• New architectural upgrades to come, like the Chainlink Runtime Environment (CRE), will make Chainlink the operating system of blockchains

It's important to note that Chainlink is doing something that has never been done before:

The creation of decentralized oracle network infra spanning onchain data delivery, cross-chain interop, privacy-preserving compute, automated compliance, and legacy system connectivity (all in one platform)

As well as the orchestration of complex transactions across all these capabilities and onchain/offchain systems

That also means Chainlink is inventing the economics of oracle networks! Bringing offchain revenue onchain and into a token is unprecedented

I personally believe the Reserve is a logical decision, directly connecting protocol adoption to purchasing and accumulating LINK

What ultimately matters is that Chainlink is able to provide useful, valuable protocols and services that solve real-world problems, which grow in adoption over time

Without a robust product with growing adoption, it doesn’t matter what economic/tokenomic model you have, you won’t have the fees required to implement a sound value capture mechanism

The establishment of a Strategic LINK reserve is a clear step toward unifying Chainlink's economics

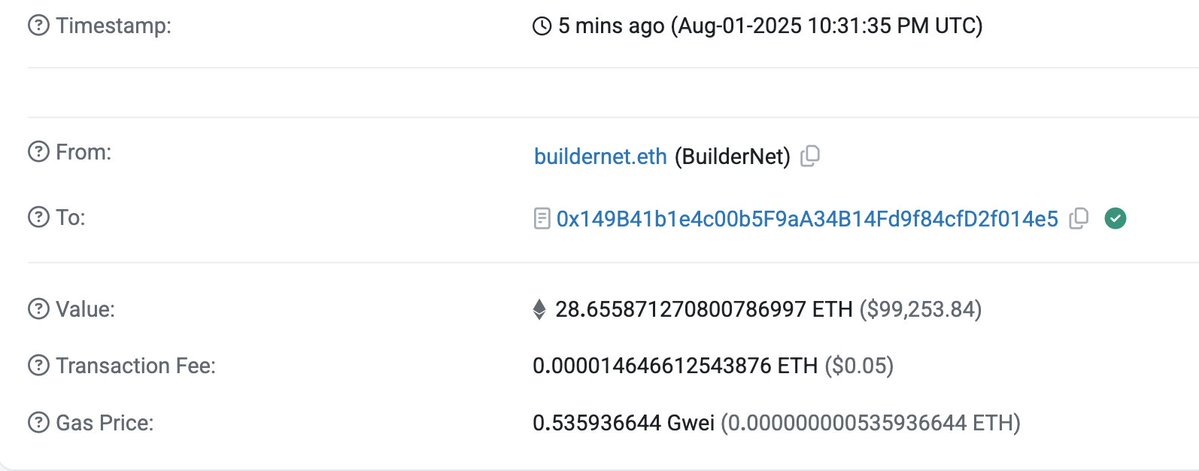

The Reserve contract itself can be found on Etherscan below, you can follow the transactions to see the swaps on Uniswap, as well as the portion that was funded by fees already in $LINK:

To learn more about the Chainlink Reserve, check out the recent @Chainlink blog post that dives into more detail about the new onchain strategic $LINK reserve:

You can also view the Chainlink Reserve dashboard below, which will update as more revenue is converted to $LINK (if not already in LINK) and put into the Reserve over time:

166.5K

2.52K

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.