What Happens When MicroStrategy’s Bitcoin Yield Hits a Wall?

Actionable Market Insights

Why this report matters

Bitcoin has delivered a staggering 66% average annual return over the past decade, outpacing nearly every stock on the planet.

Out of the entire S&P 500, only Nvidia has kept pace, which begs a provocative question: Should companies even bother operating if they can’t outperform Bitcoin?

MicroStrategy seems to think not, and their $43 billion capital raise strategy is turning heads.

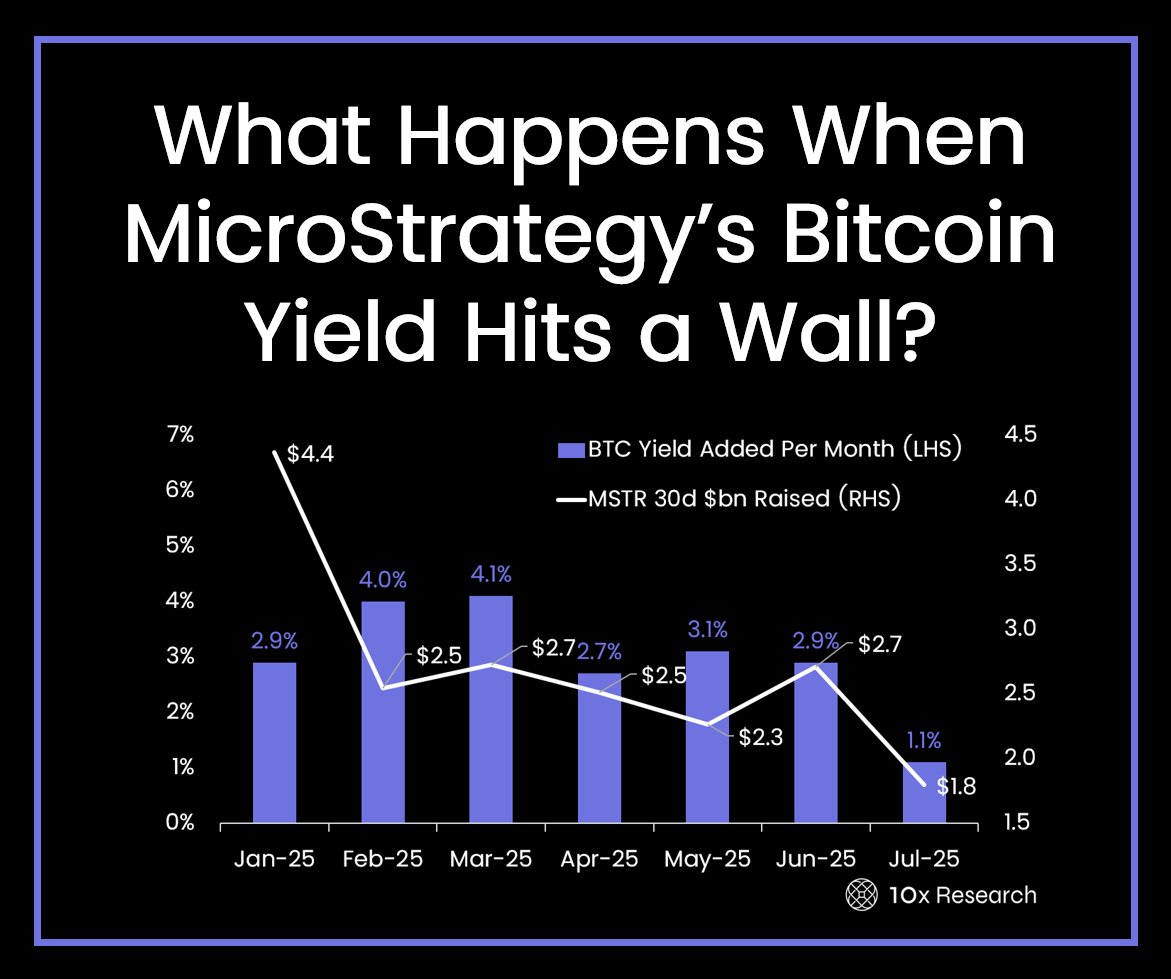

But here’s what most investors miss: MicroStrategy’s model depends on high volatility and inflated NAV premiums, and both are vanishing.

As volatility compresses, so does their ability to raise capital, issue debt, or generate BTC per share yield.

The story unfolding now may signal a major shift in how Bitcoin-holding companies survive, scale, or stumble.

Main argument

From a Bitcoin maximalist standpoint, one could argue that unless a company can consistently outperform Bitcoin’s long-term returns (+66% per annum), it should abandon traditional operations altogether and function purely as a Bitcoin-holding vehicle with minimal overhead.

This is essentially the direction MicroStrategy has taken, especially now that the original 2020 rationale — zero interest rates and rampant money printing — no longer applies.

But Bitcoin, as always, continues to evolve—and so does the narrative surrounding it.

Out of the entire S&P 500, only Nvidia has delivered a 10-year compound annual growth rate (CAGR) that rivals Bitcoin’s staggering ~66% average return.

The vast majority of companies posted more modest 10–20% yearly returns, far below Bitcoin’s performance.

The implication is clear: if a company consistently fails to outperform Bitcoin, perhaps its most rational strategy is to cease operations altogether and simply hold Bitcoin instead.

Please see our report: link in the bio/on our website.

1.52K

3

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.