Monad has:

• $250M in funding

• Claims of 10,000 TPS

• Ultra farmed testnet

• The lowest L1 sentiment on Ethos

What's wrong with @monad?

[Research series] ↓

I found this on @ethos_network.

If you haven’t seen it, on Ethos, users lock ETH to back their judgments. If the community disagrees, they lose it.

Here’s how Monad’s looking right now:

📉 79% bearish

📈 Only 21% bullish

This thread explains the "Why".

The criticism and FUD aren’t coming from one place. It’s a cocktail of delays, Discord drama, VC fatigue, and transparency gaps.

Let’s start with what’s fueling the shift:

High expectations, missed timelines, and a community strategy that’s backfiring.

Monad set out to solve a real technical bottleneck:

⟶ Make EVM execution faster

⟶ Unlock parallelism

⟶ Achieve 10,000 TPS without giving up compatibility

But in doing so, it entered a space where code alone isn’t enough and what began as a mission to optimize execution is now tangled in perception, trust, and tone.

Monad nightmare begins.

What was supposed to be the fastest, most efficient chain… is now haunted by poor optics and deeper questions.

Decentralization? Questioned.

Community vibes? Distorted.

Narrative? Hijacked.

When you build a chain for the people, you must carry the weight of responsibility. Every meme, every message matters.

Speed is powerful but trust is sacred.

We wanted innovation.

Not intimidation.

We deserve better.

@monad_xyz @aedan_xyz @Indianads_

Now the questions aren’t just about throughput. They’re about who’s funding it, how it's being marketed, and what kind of community it’s building.

• Perception: Is this a truly novel chain or a recycled pitch with better benchmarks?

• Trust: Can users believe in a team that’s delayed mainnet while Discord gamification thrives?

• Tone: Is the culture being shaped by users or orchestrated by meme accounts and paid KOLs?

The more capital involved, the higher the bar for clarity!

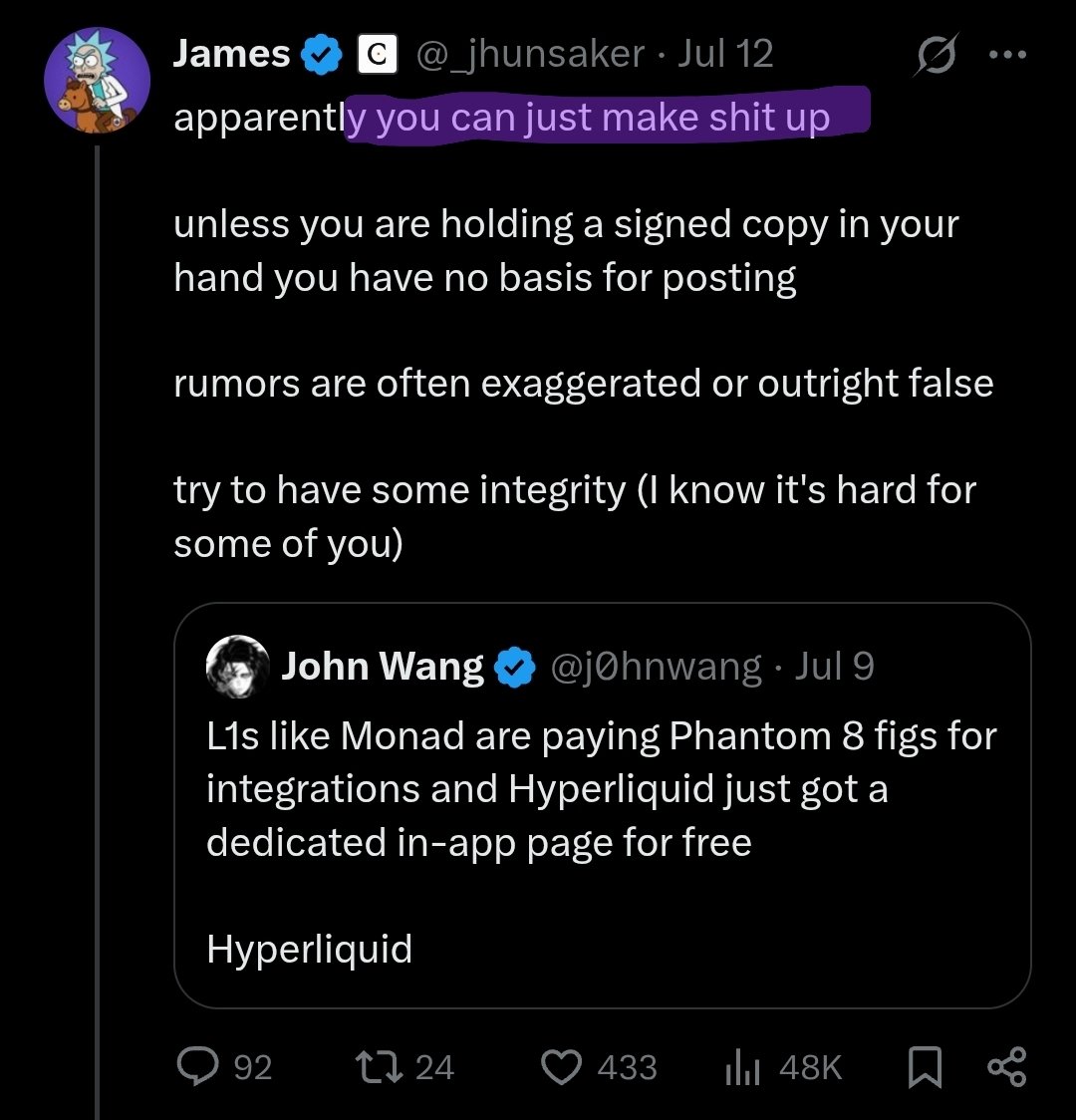

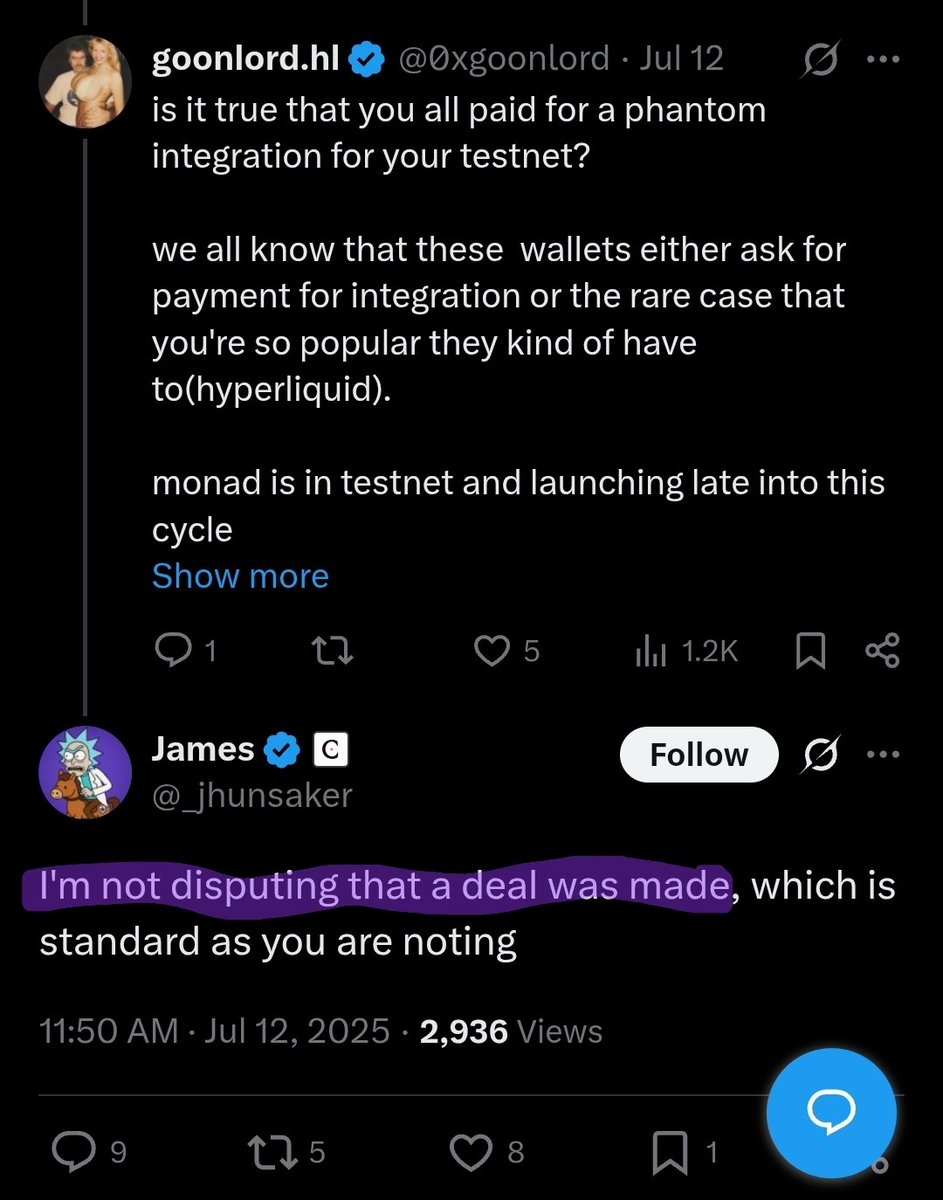

And when money’s this loud, people start watching where every dollar goes. That’s how you end up with co-founders denying deals…

while the receipts float around on CT.

Add in rumors of 8-figure wallet integrations and a battalion of paid KOLs...the credibility gap widens.

A chain without a mainnet doesn’t just risk missing timelines, it risks letting others define the narrative.

Because when trust erodes, even lazy assumptions can gain traction.

You can’t just build fast, you also have to build familiar and Monad’s still working on that part.

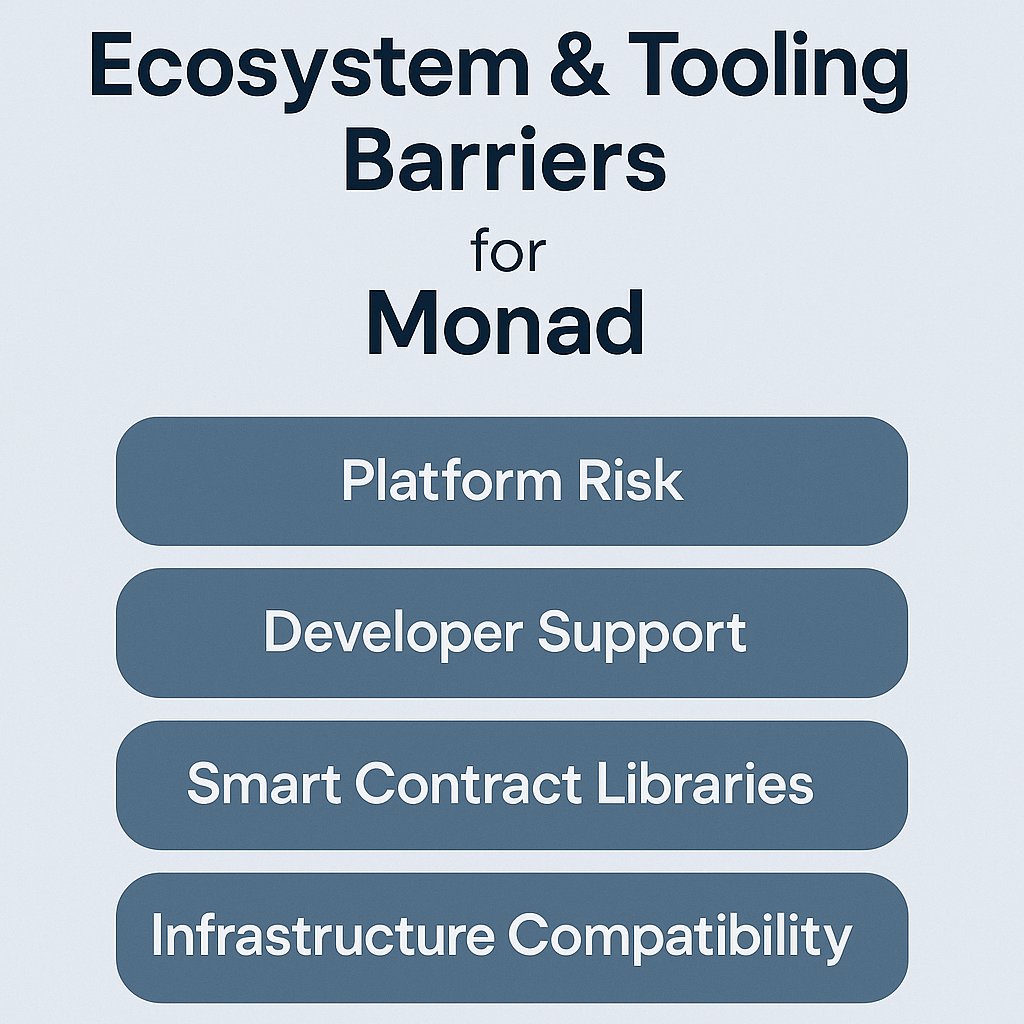

It wants to push performance boundaries but until the dev experience is less of a maze, that ambition may stay theoretical. For developers, Monad still feels like uncharted territory especially when the tooling isn’t fully there.

Even if developers get past the learning curve, Monad’s design adds new challenges.

Its use of parallel processing and async execution boosts speed but also makes it harder to test, audit, and understand how smart contracts will behave.

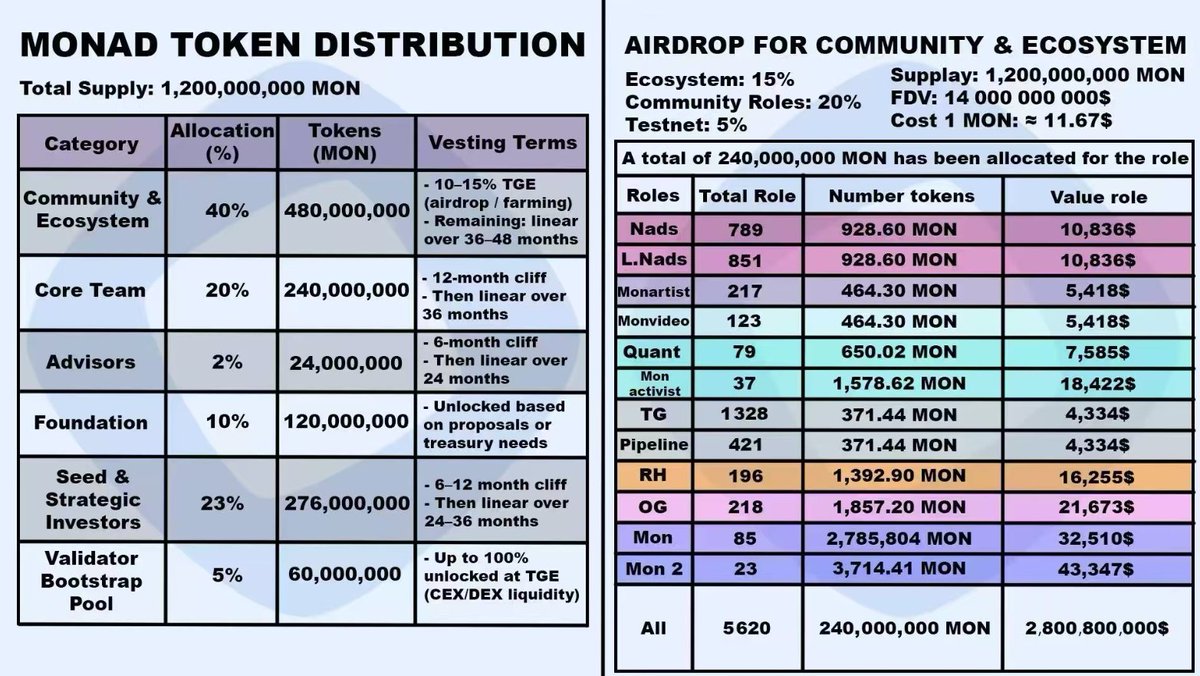

And on top of that, complexity in tokenomics has become another FUD magnet.

Critics see a heavily VC-weighted cap table. Supporters point to a structured airdrop plan with detailed role rewards.

But when roles like "TG" or "OG" outweigh builders, it sparks questions about who this ecosystem is really built for.

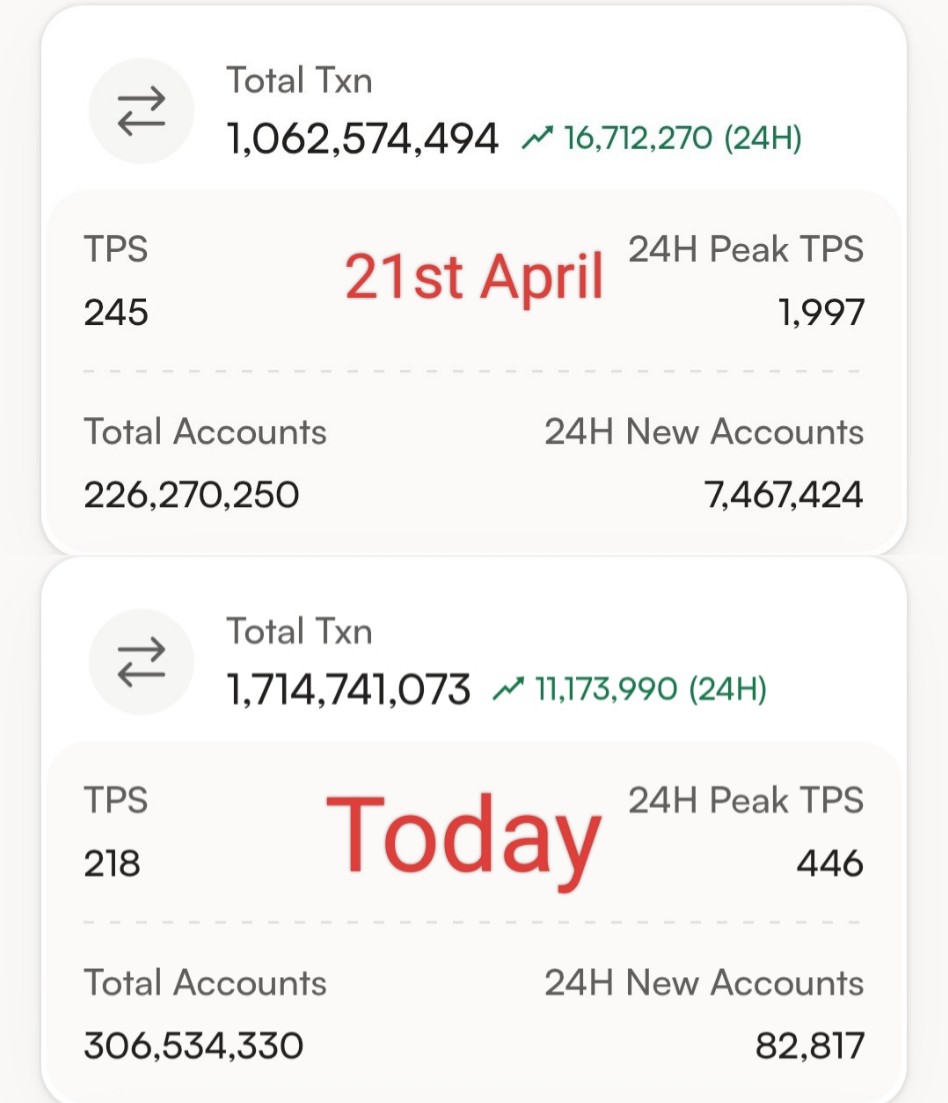

And then there’s the traction narrative, once used as proof of momentum, now under scrutiny.

Monad’s testnet crossed 300 million accounts but right after? A 99% drop in new accounts.

So does Monad deserve the hate and FUD?

Some of it, maybe.

High funding, slow shipping, questionable optics, it adds up.

But not all criticism is fair. Some is projection. Some is pattern-matching from past cycles.

Monad isn’t the first chain to face this kind of scrutiny and it won’t be the last.

But when the story becomes louder than the product, you don’t just need to ship; you need to reset the narrative.

And Mainnet will not just be a launch, it will be more of a reputation rehab.

76.62K

232

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.