US stock market has rallied +25% in just 60 trading days

This has only happened 8 times since the 1970s

Here’s what typically happens next

A thread 🧵

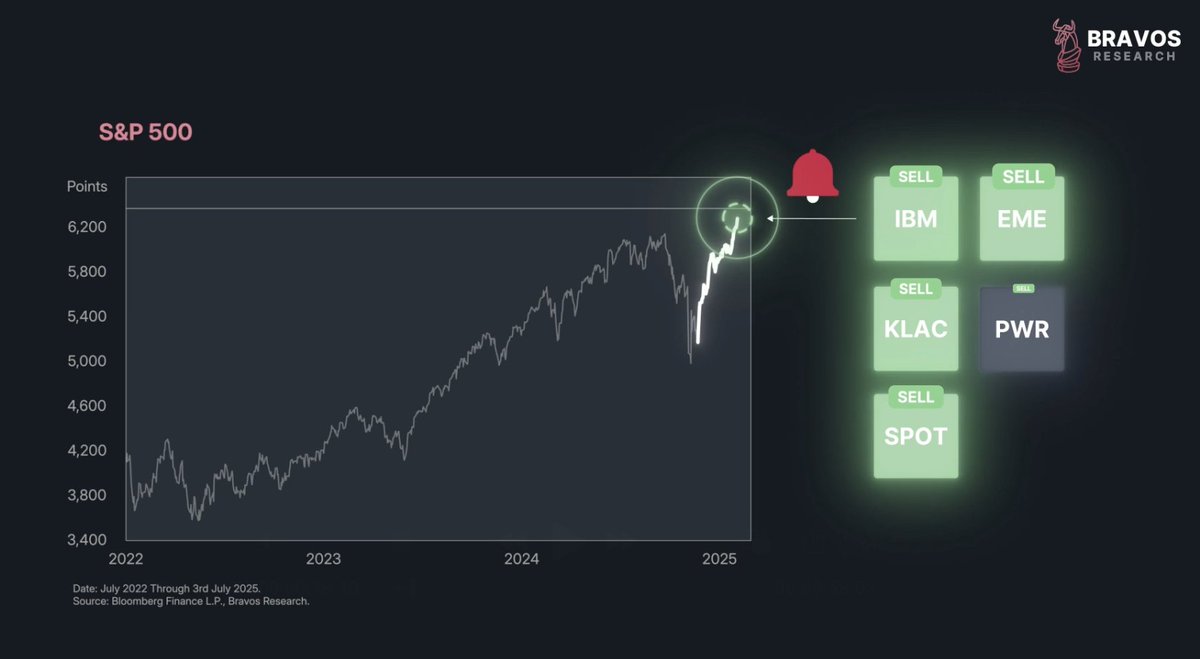

2/ We just sold most of our US stock market exposure on our website

The S&P 500 is at all-time highs after a spectacular melt-up

We've been holding multiple tech and industrial trades over the last few months

But we've now sent out sell alerts to all of our clients

3/ We're making this move because we believe a major opportunity is coming in the next month

And we want to be ready to take advantage of it

Also, this is your last chance to use our 4th of July 30% DISCOUNT

Only a few hours left before it expires

5/ This marks our biggest portfolio shift since March

When we also exited most of our stock exposure due to rising trade war risks

But the current situation is very different from back then

6/ First of all, trade war tensions were escalating back in March

Today, they’ve cooled off significantly

And you can see this shift clearly in the market’s price action

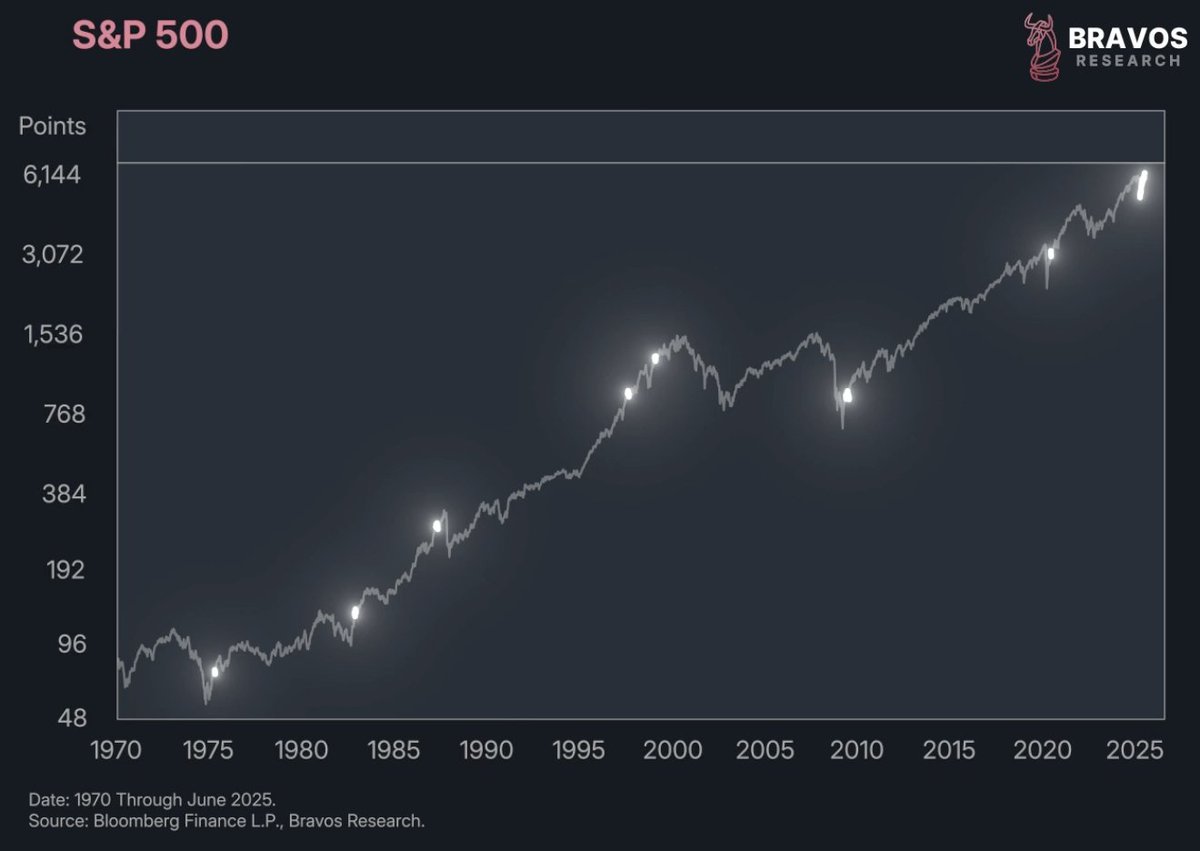

7/ In March, the S&P 500 had broken below key moving averages

Signaling the end of the uptrend from the previous year

The moving averages were also curling downward

Showing momentum was shifting to the downside

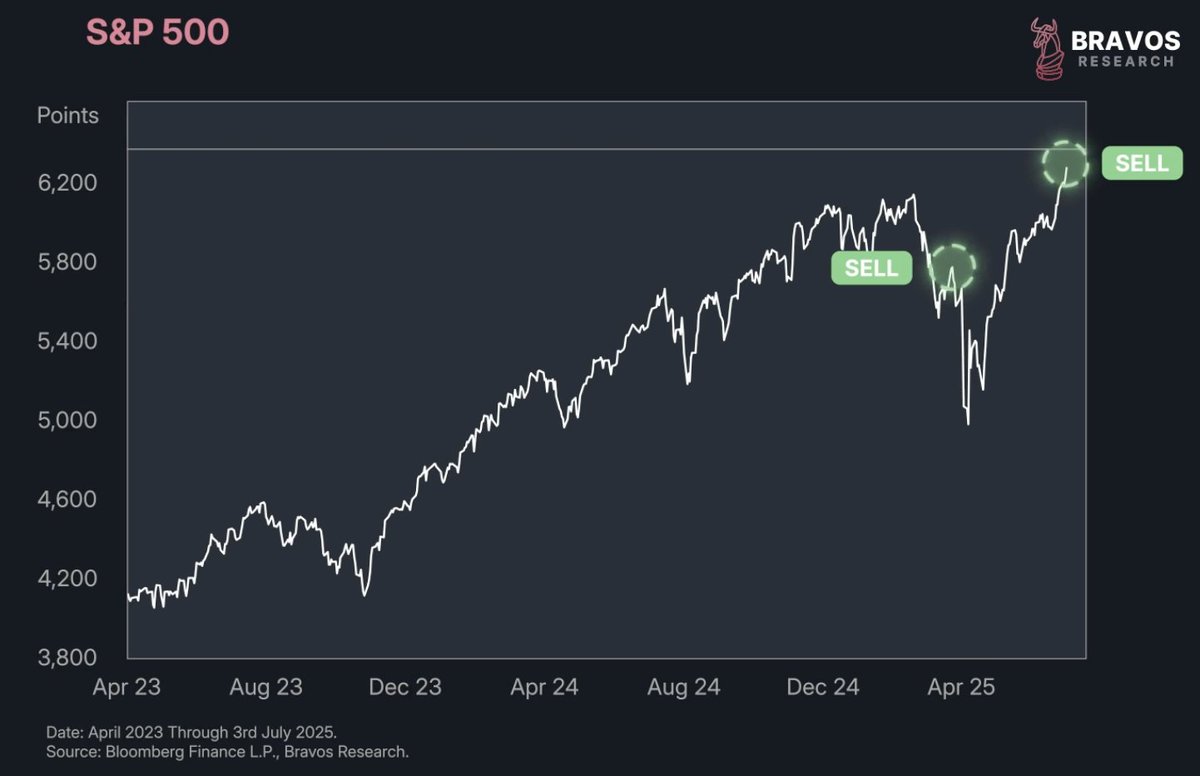

8/ Today, we’re seeing the opposite

The S&P 500 has crossed back above those same moving averages

Which are now curling upward

We’ve even seen a golden cross, where the 50-day MA crosses above the 200-day MA

9/ The golden cross is a well-known technical signal that typically suggests momentum is returning and prices can keep rising

The last one occurred in early 2023, right at the start of a major rally that lasted through 2024

10/ The previous golden cross before that was in 2020

Again, right at the start of a huge bull run

And before that, in 2019, just ahead of another major move higher

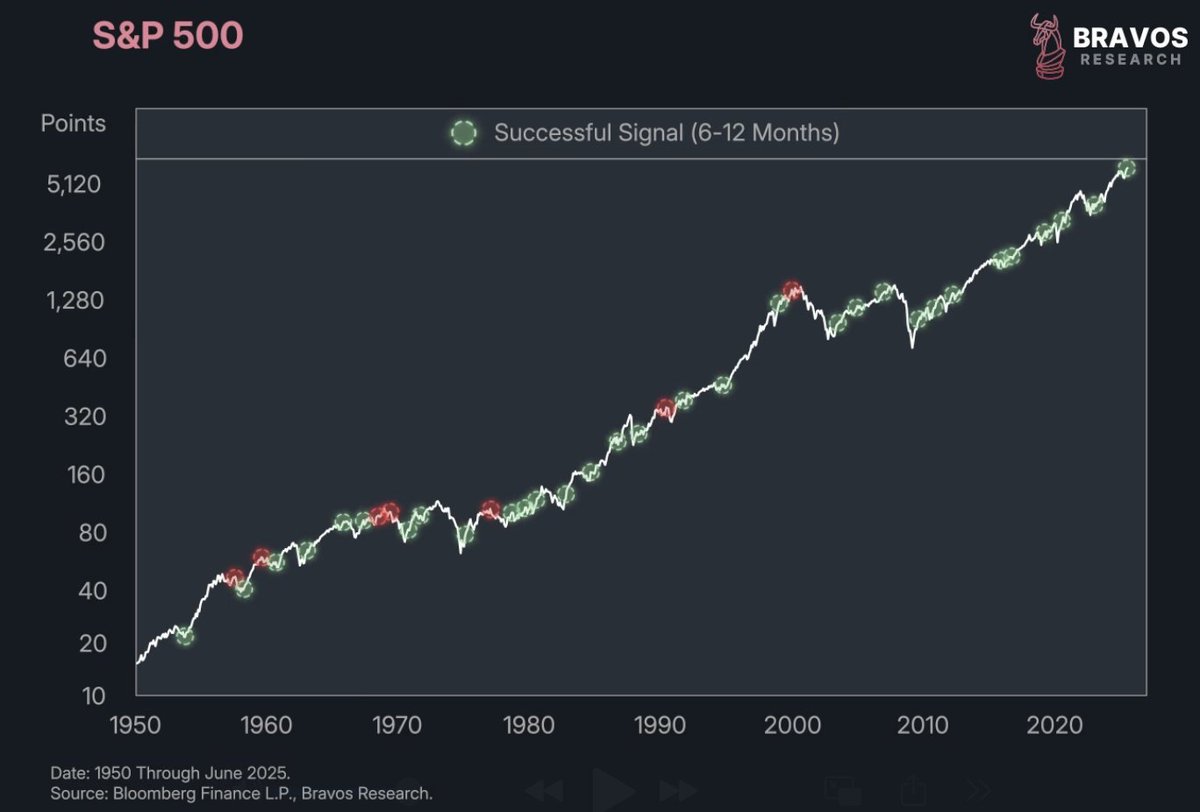

11/ Since the 1950s, there have been 37 golden crosses on the S&P 500

Of those, 30 led to higher prices over the following 6 to 12 months

It's a strong track record and aligns well with our view that the economy will stay resilient over the next 6-12 months

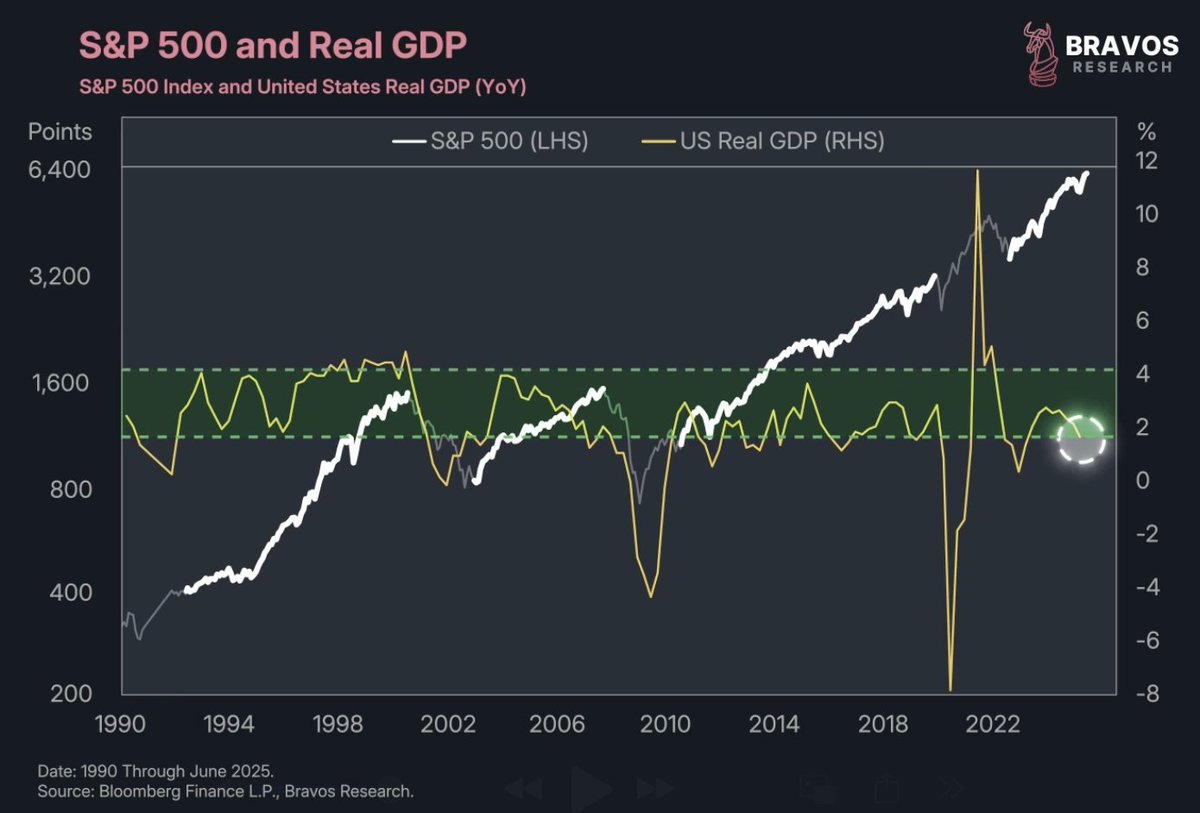

12/ Real GDP growth in the US remains in the 2–3% range

This is a healthy range that often supports steady and sustained bull markets

So if everything looks so constructive… why did we just exit most of our major long trades?

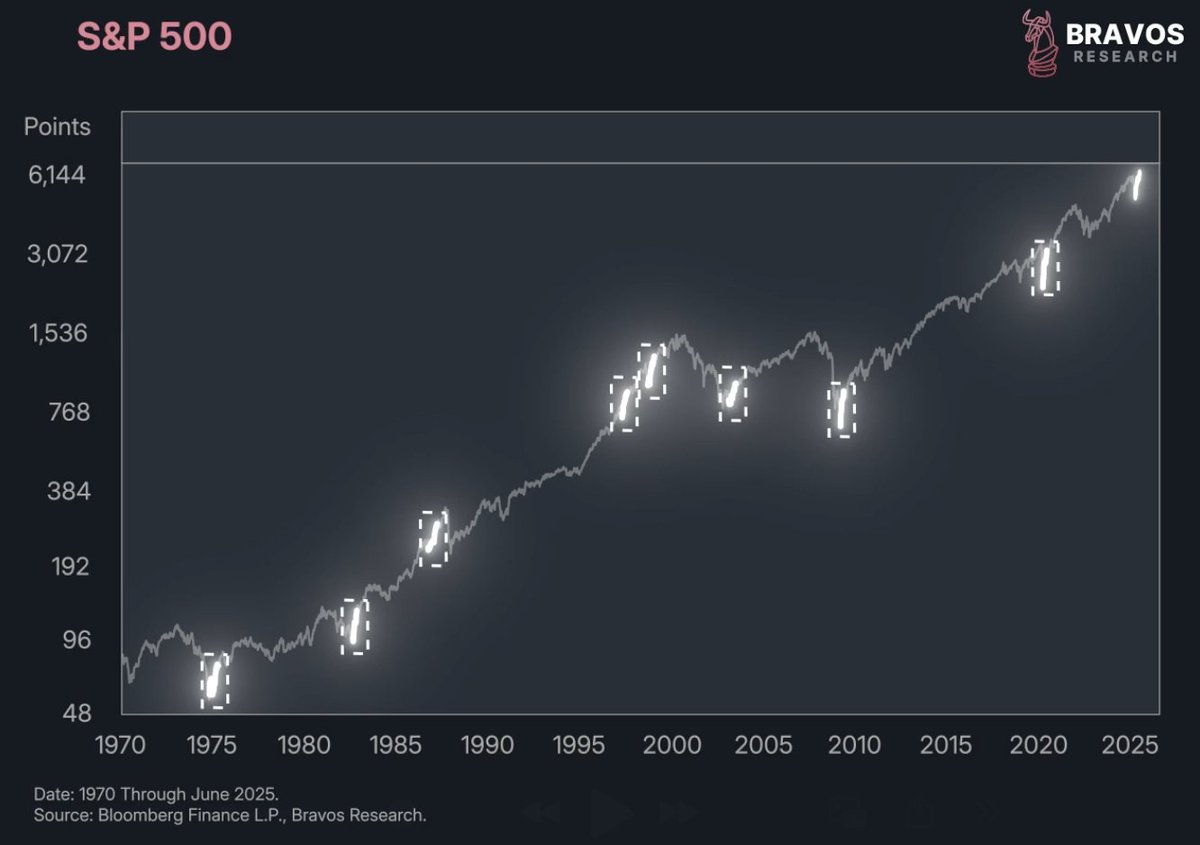

13/ Because in just 60 trading sessions, the S&P 500 has surged 25%

We’ve only seen this kind of return a handful of times

14/ Since 1970, this 25% surge over 60 sessions has only happened 8 times

And at first glance, all of them look like great times to be buying stocks

15/ But take the 2020 example: the S&P hit that 25% return on June 5

What happened next?

An 8% correction followed almost immediately after

16/ Same thing happened in 2009

After a similar 25% return in just 60 sessions, the S&P 500 corrected by around 8% over the following months

17/ We won’t go through every case here, but we’ve reviewed them all

And in 100% of the instances where the S&P had this kind of rapid rally, it pulled back in the next month or 2

Even if it was shallow or brief, some turbulence always followed

18/ In just a second, we’ll walk through how we plan to take advantage of this setup at Bravos Research

But first, one more thing that supports our short-term view:

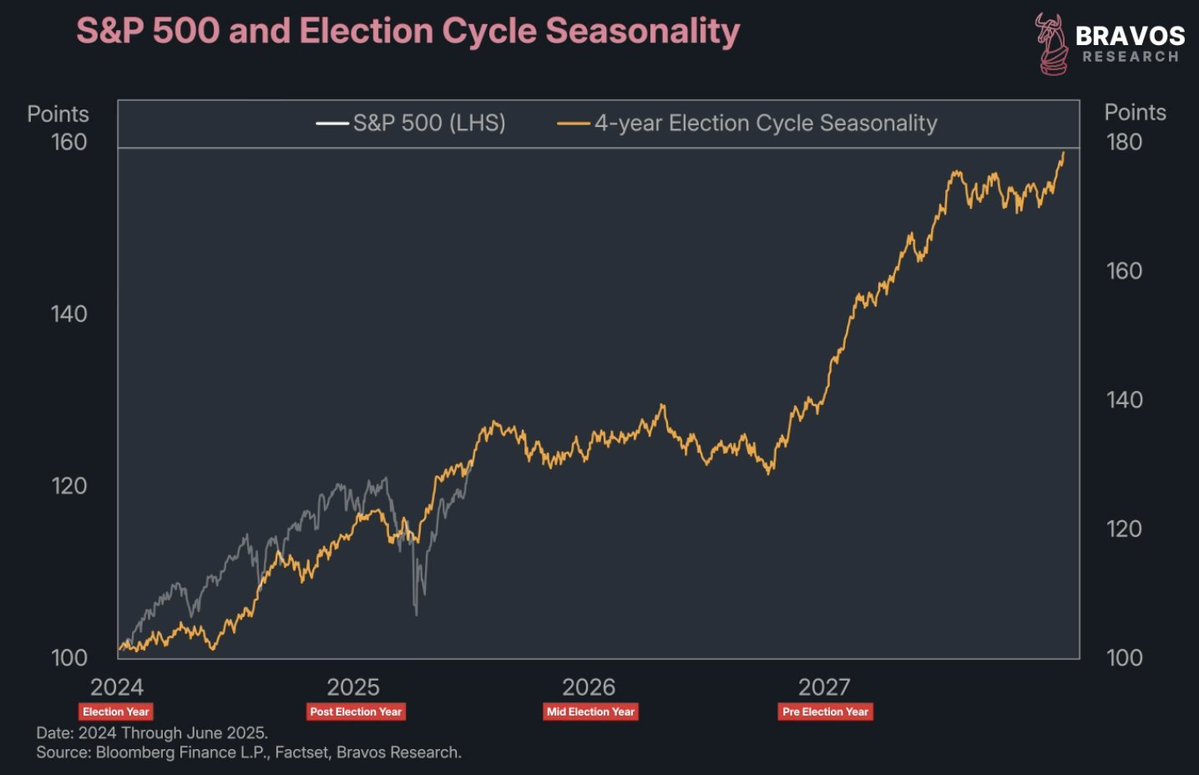

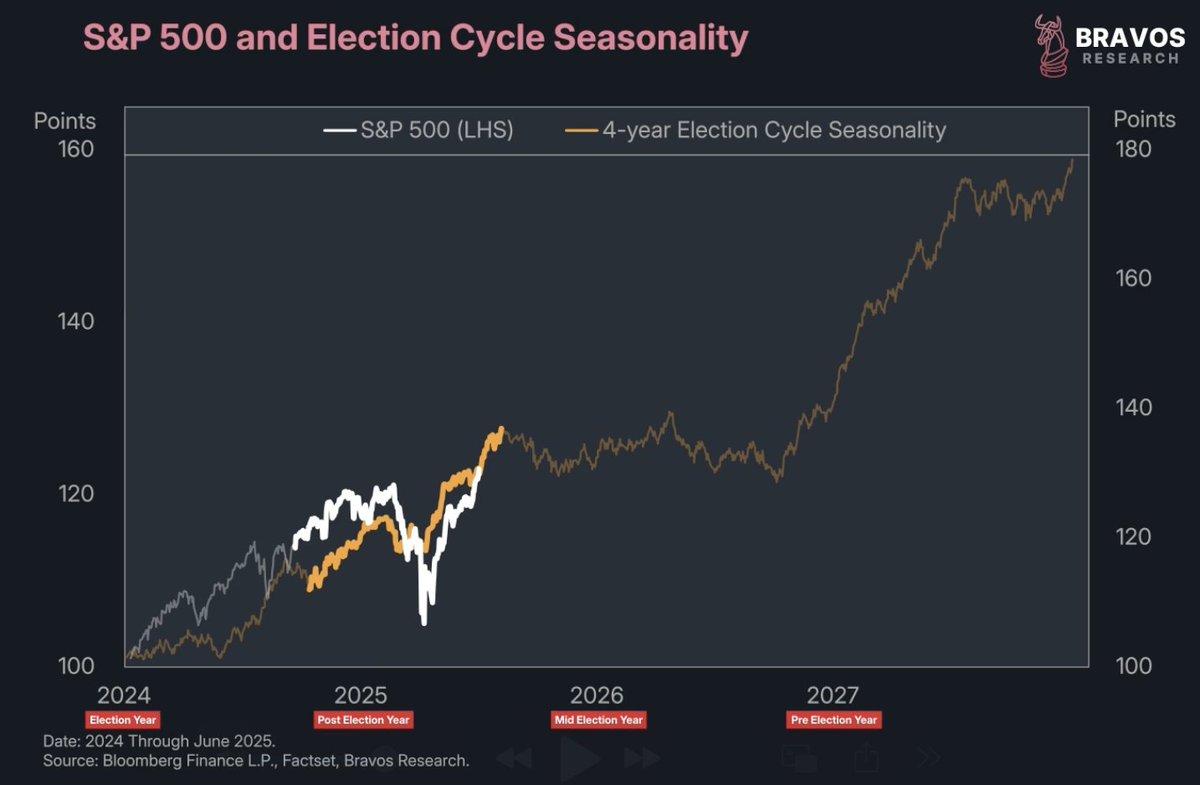

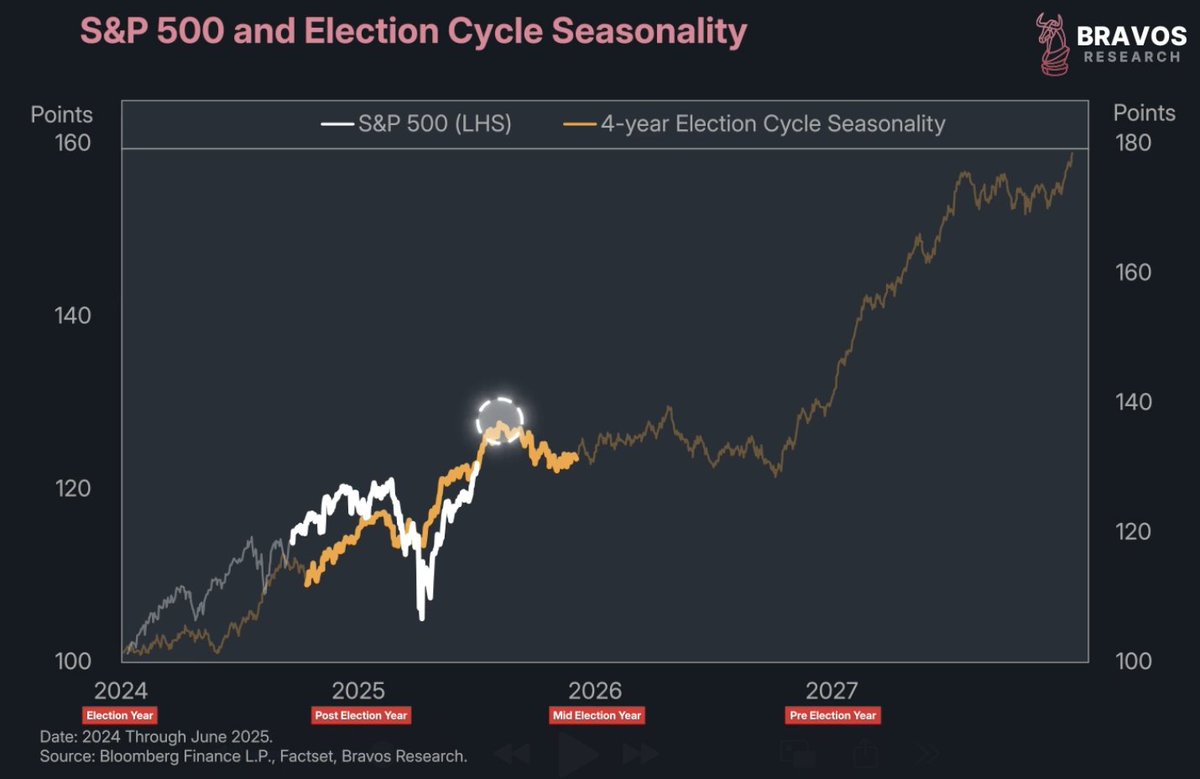

The S&P 500 has been tracking the 4-year presidential election market cycle almost perfectly

19/ This cycle maps out how the stock market tends to behave during each year of a US presidential term:

Election year, post-election year, midterm year, and pre-election year - based on 100 years of data

20/ While we don’t treat market seasonality as a primary signal, it helps frame how investor behavior tends to shift around elections

And this year, the S&P has been following the seasonal pattern almost perfectly

21/ The typical pattern:

Strength going into and after an election

Then weakness in Q1 of the post-election year

Followed by a powerful Q2 rally

All of which we’ve seen

22/ Historically, Q3 tends to bring a local top and a pullback

That aligns perfectly with our current view that the market is overextended and due for a short-term correction

23/ Just to be clear: this is a tactical move within our trading strategy

We’re not recommending long-term investors try to time the market like this

One of the first lessons we teach our mentorship clients is to keep trading and investing completely separate

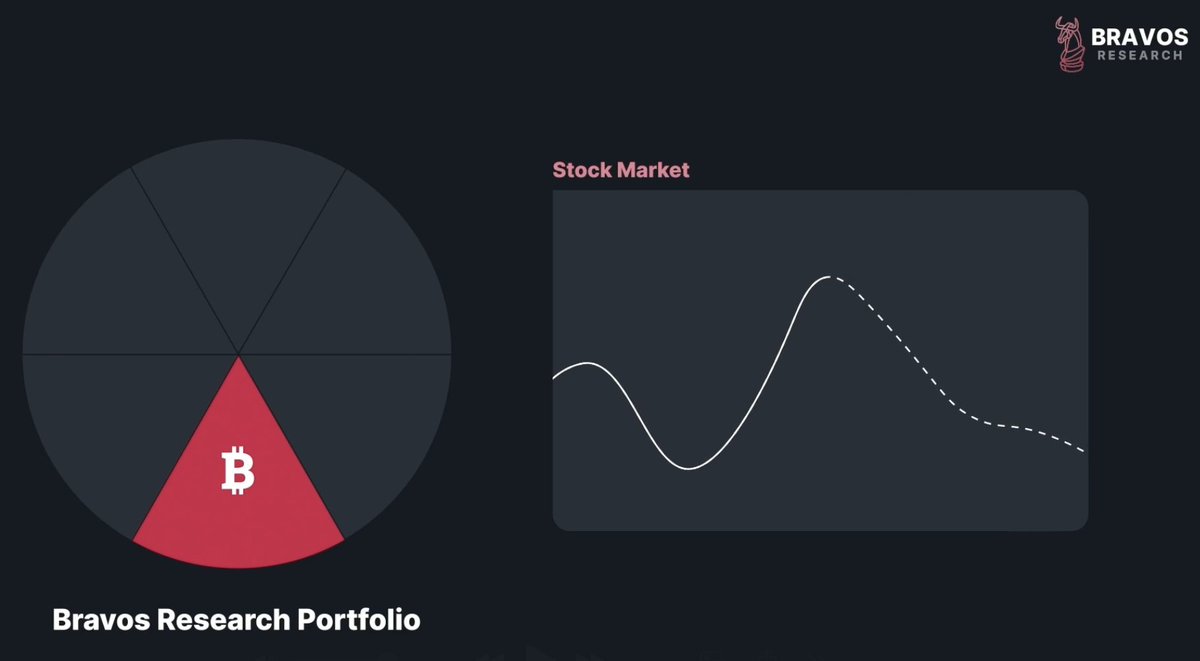

24/ In our trading strategy at Bravos Research, we've sharply reduced our US stock exposure

Our current portfolio is focused on trades that are uncorrelated with the US market

So, positions we think can hold up or even rise if stocks correct

Believe it or not, Bitcoin is one of those trades

25/ But if we’re right about a short-term pullback, we’ll be looking to quickly reload on high-conviction stocks for the next leg of the rally

We already have a watchlist of setups we’re tracking, ones with strong fundamentals and attractive price action

135.67K

842

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.