At the heart of all conversations in crypto is a struggle between attention & economic output. What we call a bear market is just a market trending towards complete efficiency.

It is a divergence between narrative and what works fiscally. Between economic output and hypotheticals.

The L2 playbook was refined in the boom era of 2021. Raise money from known VCs, list on a large exchange, pretend to build an ecosystem, and you have a shot at a high enough valuation. This worked at a time when the count of assets was scarce and attention was not commanded by meme assets.

In 2024, that playbook was ripped apart; first by meme assets, and then by the emission of large-cap assets with no bids.

All frontier technologies come with a bit of speculation. The forward-leaning prices are what you pay for an early-stage entry into what could be huge down the road. But between the multitude of networks and an inability to expand the user base that exists, much of crypto appears to be trending in only one direction. The exceptions are ventures that have been doing things differently.

Few come to mind.

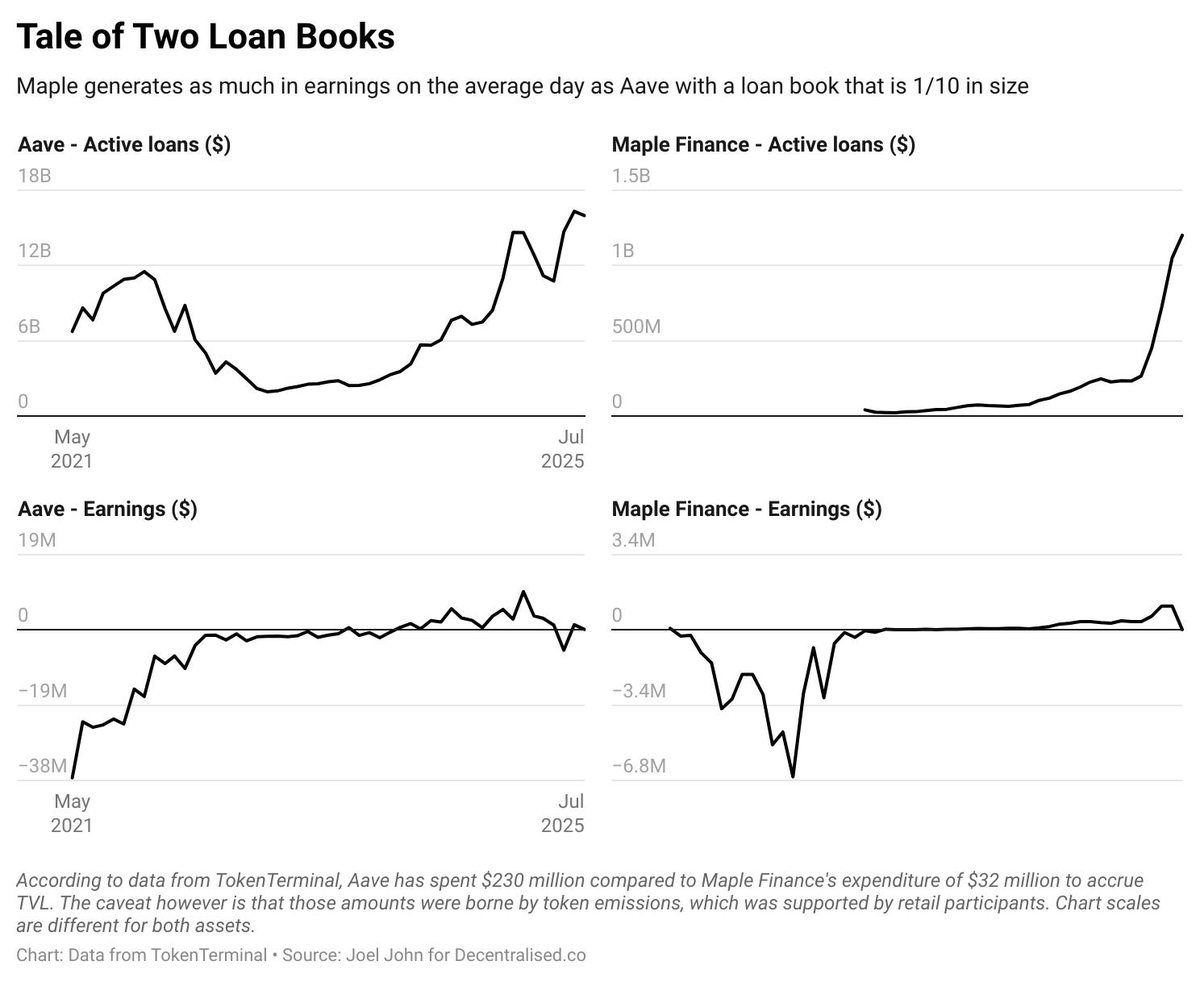

1. @maplefinance

Maple Finance does almost as much as Aave in fees each month, with a fraction of the capital in loans issued. Part of the reason is their focus on a single niche. Much of their yield comes from Bitcoin or USDC-based yield that is oriented towards lending to institutions. Their yield of 9.9% is a convincing enough value proposition compared to most.

According to data from @tokenterminal , Maple has spent ±33 million to get to this point. But the loan book has now begun showing a J-curve for growth, alongside earnings trends to positive, both of which mimic conventional start-up hockey sticks

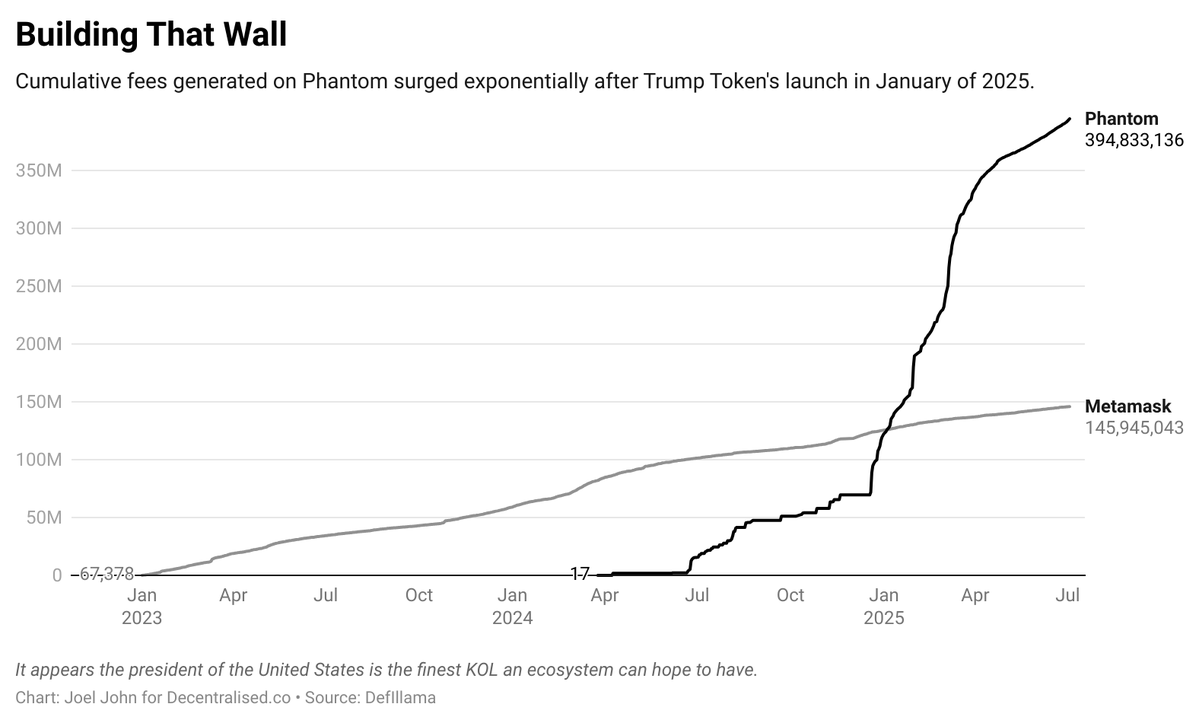

2. @phantom

According to data from @DefiLlama , Phantom Wallet has done close to $400 million in interface fees compared to Metamask’s ±145 million. One was an early entrant in the most established ecosystem. The other was a relatively nascent player in a smaller ecosystem. And yet, one has far surpassed the other quite possibly by building where the users are. Phantom, besides being an incredible wallet, focused on where the users were. On Solana. And then expanded the networks it supports.

You can see similar figures on @AxiomExchange (±$140 million) . Whether this sustains remains to be seen but it points towards where the money is being made in crypto.

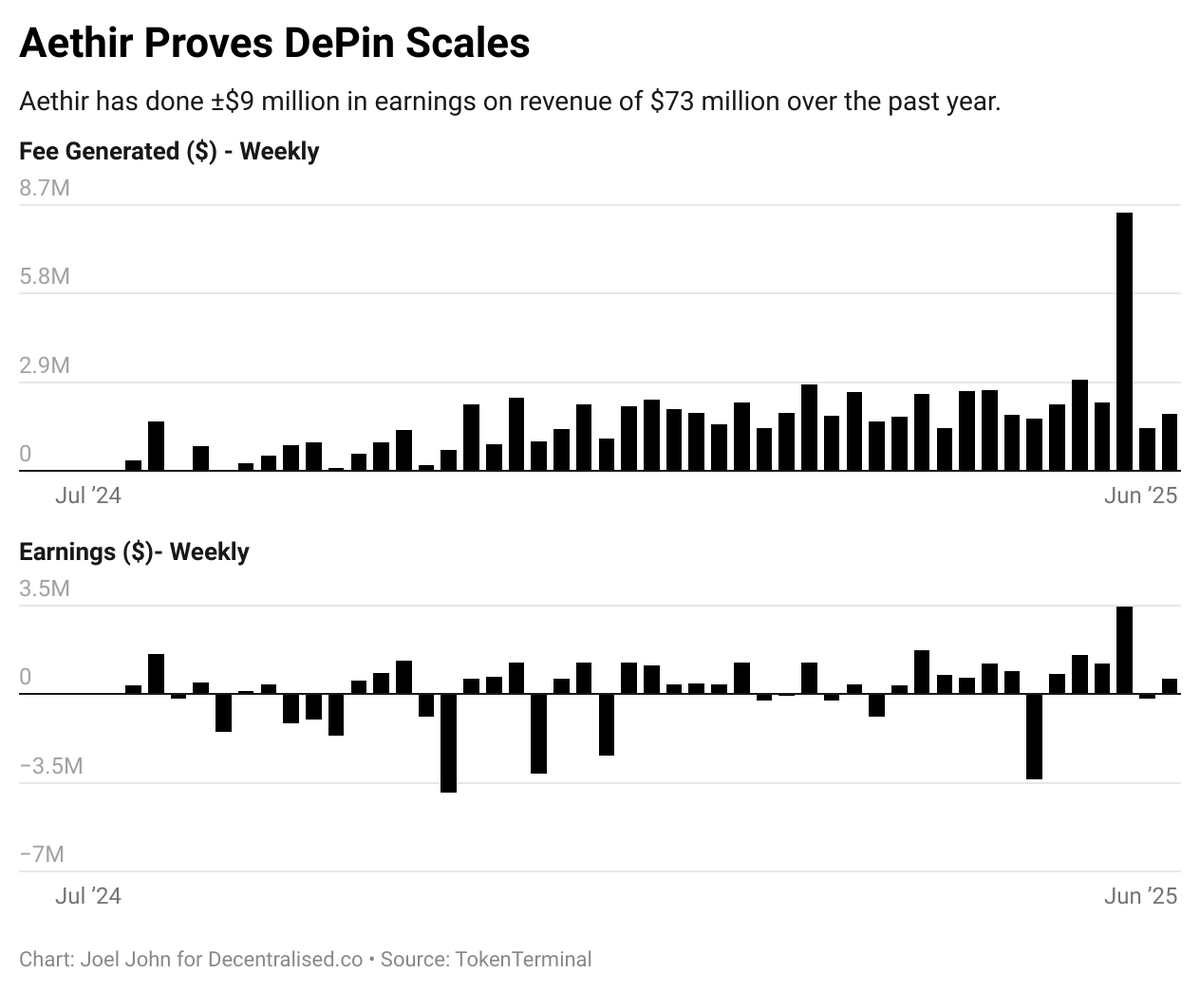

3. @AethirCloud

My favorite among this mix has been Aethir. They provide access to niche GPUs to aid the demand induced by rising interest in AI. According to data from Token Terminal, they have done ±9 million in earnings on revenue of $72 million over the course of the year. Does it make as much noise on crypto twitter? Probably not.

But it is focused on a niche segment where capital flows are heavy. And that reflects in how the network’s earnings are.

All frontier technologies are cursed to be valued wrongly. Either you are paying a premia for future growth, or a discount for fear in the markets. Much of crypto’s current crop of assets struggle to validate what they are worth. This would matter as two forces eat into the market

Meme assets eat into the historical bids that once came for the marginal asset on crypto exchanges.

Traditional capital allocators scrutinise the P/S ratios of these assets.

The revenue meta is not going away. It is here to stay. It is the mark of an asset class trending to efficiency. This has been the primary argument behind investors like @TraderNoah and @Arthur_0x .

Crypto’s great age of divergence is here, and much like all divisions, this will divide the industry into two— ecosystems that capture attention, and ones with economic flywheels. The ones that do both, will eventually dominate. It is a story that rhymes with how Google, Meta and Amazon came to dominate much of the web.

Wrote a long form on the topic last week

7.54K

16

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.