After watching the $huma for a long time, I will report it to everyone

1. This protocol is very similar to P2P in the early years, where retail investors and institutions can invest money, and then the agreement lends the money to those who need it more, and the interest is the APY for your savings

2. From the perspective of empowering Circle, it is a beggar version of Anchor for UST, and it is one of the few business products that can broaden USTC channels

3. Theoretically, it can benefit from the growth of stablecoins in the cross-border payment track, β and the current growth rate is relatively close to the growth rate of USDC in payments

4. The team seems to be more close to the people, and it is also delivering after issuing coins, and the business can make money, and it seems that it will also engage in repurchase dividends

5. The data published by Dune is okay, the business growth curve is steep, and the annualized revenue can reach 10m+, but I can't figure out whether this is retained or the entire LP is included. Based on GPT's analysis, I tend to think of it as the meaning of annual projected revenue.

But there are a few doubts

1. Stablecoins for B-side cross-border payments may be false propositions, for example, USTC's payment business accounts for less than 1% of revenue, not to mention Tether

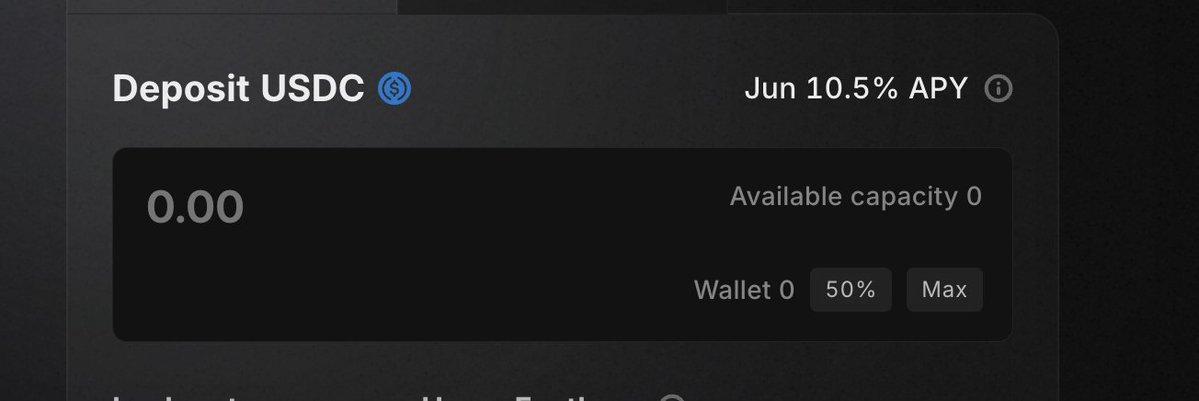

2. The problem with P2P is that the early idea is beautiful, and there are few people who want to borrow high-interest money later, and there are many high-interest people who want to save money, so the back is all fake business, using new deposits to repay the old interest. So I'm worried that there are still rice behind huma with so many asset packages coming out, after all, who doesn't like the APY of 10.5

To sum up, a safer way is to keep an eye on data, focus on new sources of asset packages, and invest in a fundamental way

Either just lie down and wait, and in the future, there may be hype about the payment function of stablecoins, then Huma will usher in its own wind

Show original

56.27K

9

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.