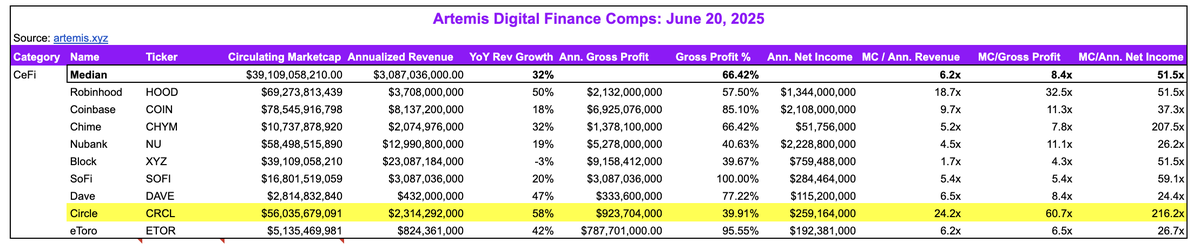

Circle keeps getting crazier now ~$65B.

In comparison

- Robinhood ~$69B, $1.3B of net income, 51.5x NI

- Coinbase is ~$78B, $2B of net income, 37.3x NI

- Circle is ~$65B, $259M of net income, 216x NI

Circle now trades for:

- 24.2x Q1'25 revenue run rate

- 60.7x Q1'25 gross profit run rate

- 216x Q1'25 net income run rate.

Investors clearly want stablecoin bets.

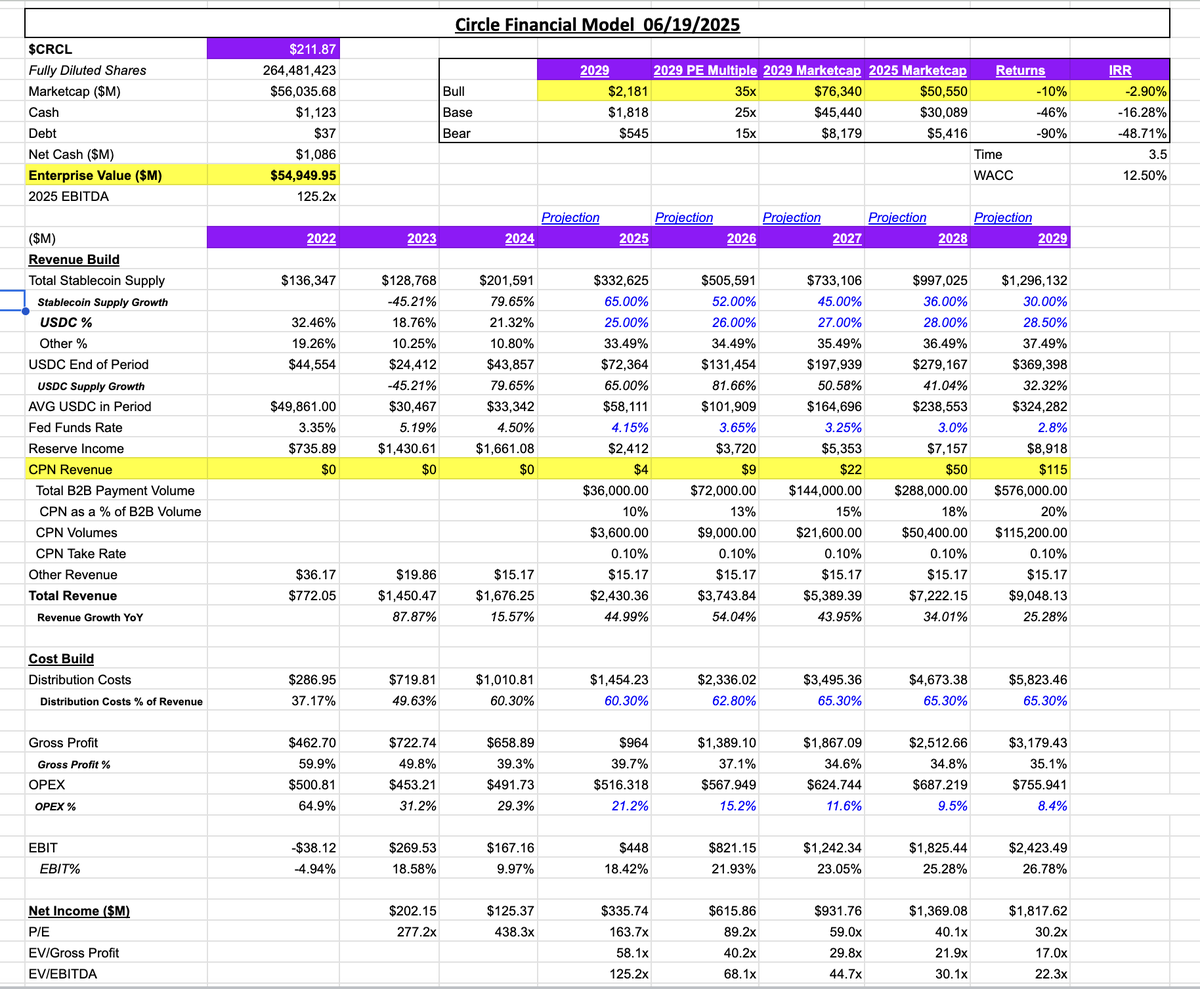

Circle is currently valued at $55B enterprise value.

That implies on 2025 numbers:

- 58.1x Gross Profit.

- 125.2x EBITDA

- 163.7x Net Income

I added Circle Payment Network as a revenue line item

- $570b+ B2B Payment Volume in 2029

- 20% of volume goes to CPN

- 0.10% of take rate to CPN revenue

Updated stablecoin growth assumptions

- Stablecoin supply growing 30% YoY in 2029 to $1.2T

- USDC takes 28.50% of marketshare

- USDC is $370B growing 32% YoY

- Distribution costs stay flat at 65% versus going to 70%

Where I end up in 2029:

- $9B revenue growing 25% YoY

- 35% Gross Margins

- $3.1B gross profit growing 26% YoY

- $2.4B EBITDA growing 32% YoY

Not a lot of upside in the current model.

0

8.08K

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.