PicWe: A full-chain liquidity engine and value capture paradigm in the Movement ecosystem

Movement Labs' @movementlabsxyz mainnet is about to go live, and its early-stage project PicWe @PicWeGlobal is gradually becoming the focus of market attention. As a project directly invested by Movement and won the Hackathon Championship, PicWe's positioning is far beyond a single ecological DEX, but a full-chain liquidity infrastructure built on the basis of the Move language. Its core logic lies in solving the current industry pain points of scattered cross-chain liquidity and low capital efficiency, and forming a unique value capture mechanism through the deep binding of the innovative economic model and the Movement ecosystem.

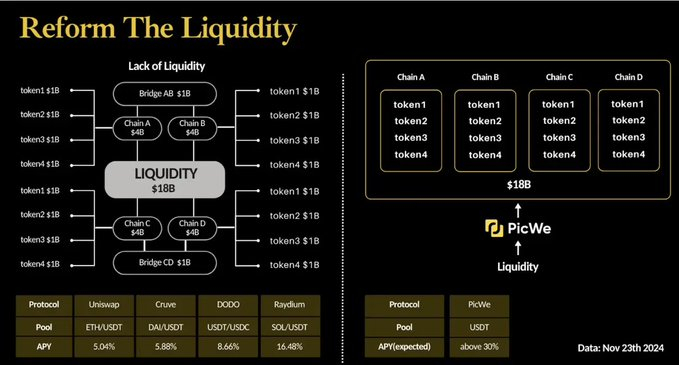

Liquidity integration: from fragmentation to matrixing

The core problem of current cross-chain transactions is the fragmentation of liquidity. In the traditional cross-chain bridge model, the liquidity pool of each chain operates independently, and users often face the dilemma of high slippage or insufficient liquidity when making large-value cross-chain transactions. According to industry data, the size of liquidity scattered across chains and bridges exceeds $18 billion, but the utilization rate is extremely low. The Dynamic Liquidity Matrix technology proposed by PicWe integrates multi-chain assets into a unified pool through chain abstraction, so that the liquidity of assets such as Token1 and Token2 on different chains can be called globally.

The immediate advantage of this design is capital efficiency. For example, when a user initiates a large transaction on Chain A, PicWe can dynamically allocate the liquidity of Chain B and Chain C to participate in the quotation, thereby reducing slippage and increasing the depth of the transaction. For liquidity providers (LPs), this means higher fee yields and arbitrage opportunities. If PicWe can integrate 10% of the fragmented liquidity in the current market, its assets under management will exceed $1.8 billion, becoming the leading protocol in the full-chain DEX field.

WEUSD: A stablecoin innovation bound to the Movement ecosystem

Another key design of #PicWe is the decentralized stablecoin WEUSD, whose minting mechanism directly incorporates the #Movement ecological token $MOVE into its value support. 1 WEUSD consists of $0.9 equivalent of USDT and $0.1 equivalent of $MOVE, and when the price of $MOVE rises, the excess part is injected into the treasury for market repurchase to curb the risk of de-anchoring. This mechanism achieves a twofold objective:

1. Ecological synergy: The growth of demand for WEUSD directly drives the purchase pressure of $MOVE. If PicWe becomes a mainstream trading pair in the Movement ecosystem (such as WEUSD/USDC), holders of the $MOVE can earn additional income by minting WEUSD, forming a positive cycle.

2. Stablecoin premium capture: Traditional algorithmic stablecoins often fail due to a lack of value support, while WEUSD provides potential upside for holders through partial collateral and value binding of $MOVE. Even in extreme cases, the floor price of WEUSD is still anchored at $0.9, and the risk is manageable.

Notably, PicWe offers WEUSD minters a reward of $PIPI tokens. $PIPI As a meme coin in the ecosystem, it is possible to further amplify the liquidity supply through community incentives. If the speculative demand for $PIPI heats up, the willingness to mint WEUSD will increase simultaneously, driving more $MOVE to be locked.

Full-chain transaction paradigm: the competitive advantage of bridgeless cross-chain

PicWe's core selling point is the Cross-Chain Atomic Transaction Model (CATM), which allows users to directly complete cross-chain exchanges without relying on third-party bridges. Traditional cross-chain transactions need to go through multiple steps such as bridging, waiting, and confirmation of the target chain, while CATAM ensures that all transactions are either completed or rolled back through the atomicity of smart contracts, greatly improving security and efficiency.

The implementation of this technology will significantly reduce the cross-chain cost for users. Based on the average cost (about $5-15) and time (2-10 minutes) of the current mainstream cross-chain bridges, PicWe can seize a large market share if it can achieve second-level confirmation and the fee is less than $1. In addition, the bridgeless design reduces the risk of hacking (the loss caused by the cross-chain bridge vulnerability exceeded $1.5 billion in 2023), making it more attractive to institutional users.

Investment value: from ecological dividends to full-chain expansion

PicWe's investment logic can be developed at three levels:

1. Movement Ecological Dividend: As an official key support project, PicWe will benefit from the traffic dividend in the early stage of the mainnet launch. The endorsement effect is further strengthened by the public support of Rushi Manche @rushimanche, co-founder of Movement Labs. If Movement's TVL reaches the $5 billion level within half a year, PicWe, as the underlying DEX, is expected to capture 10%-20% of the trading volume.

2. Full-chain liquidity aggregation: PicWe's whitepaper clearly proposes plans to expand to non-Move chains (e.g., EVM, Solana). If its technology is compatible with multiple chains, the scale effect of the liquidity matrix will grow exponentially, becoming a full-chain middleware similar to THORChain.

3. Token economic potential: Although the details of the distribution of $PIPI have not yet been fully disclosed, the combination of meme attributes and stablecoin minting rewards may make it more explosive in the short term than expected. If the WEUSD mint reaches $100 million, based on a 10% $MOVE percentage, this alone can lock in a $10 million $MOVE buy order.

From the perspective of industry trends, cross-chain demand is still growing rapidly. In 2023, the cross-chain transaction volume will exceed $500 billion, but the user experience is still a pain point. If PicWe can verify its model in the Movement ecosystem, and then replicate it in multi-chain ecosystems such as Cosmos and Polkadot, the valuation ceiling will be significantly higher than that of a single-chain DEX.

Data validation and market space

According to DeFi Llama statistics, the TVL of the top full-chain DEX is generally in the range of $5-5 billion, and the annualized trading volume can reach the level of 100 billion. If PicWe's dynamic liquidity matrix can cover 10 mainstream chains, even if it only occupies 1% of the market share, its annual trading volume will exceed $10 billion, and the corresponding fee income (calculated at 0.3%) will be about $30 million. If LP incentives and stablecoin minting shares are further introduced, the protocol revenue may be doubled.

For early-stage investors, the value of PicWe lies in its technical feasibility and ecological positioning. Movement Labs' modular blockchain architecture is a natural fit for high-frequency trading scenarios, and PicWe, as one of the first native #DeFi projects, has taken a strategic position at the infrastructure layer. Once its liquidity network is scaled up, it will be difficult for latecomers to replicate its first-mover advantage.

In terms of valuation, you can refer to the full float market capitalization of similar protocols (e.g., THORChain is about $2 billion, and LayerZero is not issued but valued at $3 billion). If PicWe can achieve a cumulative trading volume of $5 billion within 12 months, its FDV is expected to hit the range of $5-1 billion, which is several times higher than the early valuation.

Technical team and community momentum

PicWe's core team is made up of Move language development experts and DeFi protocol architects, and its hackathon victory is a testament to technical execution. In terms of community, the project team has accumulated more than 20,000 followers in the Movement ecosystem, and WEUSD's early testing activities have a high level of participation. This combination of technology-driven + community cold start is similar to the growth path of Uniswap and dYdX in the early days.

To sum up, the differentiated advantage of PicWe lies in the combination of Movement ecological resources, full-chain liquidity aggregation and stablecoin economic model to form a self-reinforcing flywheel effect. For investors looking for high growth potential, the progress of its technology and the adoption rate of WEUSD will be key observations.

Meet PicWe, Movement's DeFi BFF! 🎵💗

Seamless Omni-Chain Swaps, easy liquidity, and more! Any chain, any asset - all welcome to the Movement party!

36.01K

44

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.