The Overlooked Catalyst Set to Ignite Bitcoin—and Why the Fed's Next Move Could Shock Markets

Welcome to our Institutional Top of Mind with 10x Research, with our Macro Shifts series examining the forces reshaping the crypto landscape in 2025. Each analysis offers institutional investors a data-driven perspective on the regulatory environment, political influences, market infrastructure development, and macroeconomic drivers that matter most. Join us as we analyze these macro shifts through an institutional lens, providing deeper insights for sophisticated market participants navigating this rapidly evolving space.

In our seventh installment, 10x Research examines how declining oil prices could become Bitcoin's unexpected bullish catalyst as the Fed eyes September rate cuts. This overlooked factor is steering inflation lower while a $100B wave of crypto IPOs forms on the horizon. 10x's analysis shows Bitcoin approaching all time highs amid rising bond yields and persistent U.S. Deficits, creating an inflection point where understanding these competing forces could determine which investors capture the next major market move.

Amid conflicting market signals, one overlooked catalyst could dramatically reshape Bitcoin’s trajectory. As the Federal Reserve contemplates rate cuts, a hidden force is quietly steering inflation lower—yet most analysts are missing it. Meanwhile, a new wave of crypto IPOs is gearing up, with $100 billion in valuations poised to enter the market, reshaping the dynamics of digital assets. But beneath the surface, rising bond yields and a persistent U.S. budget deficit may pose a greater risk than many realize.

We maintain our outlook that the Federal Reserve will begin cutting interest rates from September onward, as a feared inflation spike may not occur. Instead, a decline in oil prices is an “overlooked bullish catalyst for Bitcoin” that could drive lower inflation. Simultaneously, tariffs may suppress consumer spending, creating a deflationary environment.

While markets may preemptively price in a dovish Fed narrative, stronger-than-expected growth could shift inflation concerns, particularly if Trump-era tax cuts are extended. Despite efforts by DOGE and Elon Musk's brief involvement, the U.S. budget deficit shows no signs of shrinking. Instead, excessive government spending could once again weaken the fiscal impulse.

Exhibit 1: The expectations of U.S. rate cuts is declining based on our indicator

The two-year bond yield’s rise from 3.60% to 4.06% reflects reduced recession fears and upside growth expectations, which could limit the scope for rate cuts. As the Q2 earnings season begins in mid-July, coinciding with the 90-day tariff deadline and a peak in our proprietary global liquidity model, investors will closely watch market developments. Unlike widely followed metrics with inconsistent lag periods, our preferred market structure model uses real-time liquidity data, providing a clearer picture of liquidity trends.

Additional catalysts are also emerging. The second wave of FTX creditor payouts, between $7-11 billion by May 30, is set to surpass the first round. We also anticipate a wave of crypto IPOs, with $100 billion in companies aiming to go public by late 2025. This IPO push is driving M&A activity, with Animoca Brands approaching a $10 billion valuation, Ripple expanding via acquisitions, and Coinbase acquiring Deribit for $2.9 billion.

Bitcoin is approaching all time highs, with $122,000 as the next target. Bitcoin has advanced in $16,000 increments, driven by multiple catalysts, including low implied volatility (42%), making call options an attractive upside bet. However, a key risk remains: if the market reprices stronger U.S. growth expectations due to potential tax cuts and deregulation, rising interest rates could create headwinds for risk assets. Bitcoin's strong positive correlation with Treasury yields highlights its dual nature as both a risk-on and risk-off asset, influenced by the market’s response to growth shocks from tariffs.

However, a surge above 5.0% on the 10-year yield could threaten Bitcoin’s upward momentum if fears of Fed rate hikes resurface—a scenario that currently seems distant. Alternatively, if rising long-term yields are viewed as a signal of U.S. fiscal deterioration due to a persistent budget deficit, Bitcoin could serve as a hedge. In this case, the positive correlation between Bitcoin and 10-year Treasury yields is likely to persist.

Exhibit 2: Bitcoin (LHS) vs. U.S. 10-year Treasury Yield (RHS)

Bitcoin is at a critical juncture, with multiple catalysts aligning to drive its next big move. From an overlooked inflation trigger to a massive wave of crypto initial public offerings (IPOs), the market is primed for volatility. With bond yields rising, the stakes couldn’t be higher. This is the moment to stay ahead—understand the forces shaping the market before they become headlines.

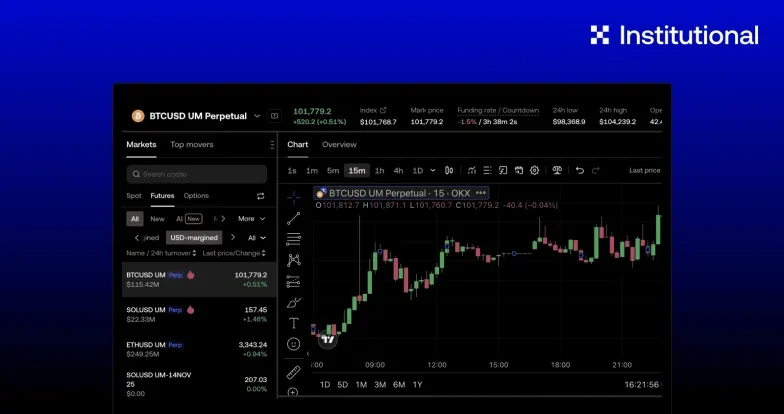

OKX conversation on Telegram

For the latest insights, updates, and announcements beyond what's included in our bi-weekly newsletter, head over to our OKX Institutional Telegram channel.

As a private, members-only group, our Telegram channel allows for real-time dialogue where we can discuss and share market coloring, product roadmaps, and more with our valued institutional clients and partners.

Disclaimer: This publication is issued in 10x Labs Limited (“10x Research”). The information provided in the publications are meant purely for informational purposes and should not be relied upon as financial advice. None of the information contained here constitutes an offer, or a solicitation of an offer, to purchase or sell any securities, financial instruments or strategies, or to make any investments. Any opinions expressed are intended to be mere opinions and not investment advice, and nothing herein should be construed as financial, investment, legal or tax advice or advice of any sort. 10x Research does not provide individually tailored investment advice. You are advised to consult with your own professional advisers and to make your own independent decisions regarding any securities, financial instruments, strategies or investments. Any opinions are personal to the author and may be subject to change. These may not necessarily reflect the opinion of 10x Research or its affiliates, officers or employees. This publication has been prepared based upon information, including market prices, data and other information, from sources believed to be reliable and we make no representation and assume no liability as to the accuracy or completeness of the information nor for any loss arising from any investment made in reliance of this publication. This publication may contain data from third party sources and may contain inaccurate or out-of-date data. The analysis of political events and their potential impact on digital assets is speculative and should not be considered definitive or predictive. Investment in digital assets carries a high level of risk and may lead to a total loss of capital. To the extent applicable, 10x Research asserts legal ownership and copyright over this publication. This publication may not be used, redistributed or retransmitted, in whole or in part, or in any form or manner, without the express written consent of 10x Research. Any unauthorized use is prohibited. Receipt and review of this information constitutes your agreement not to use, redistribute or retransmit the contents and information contained in this publication without first obtaining express permission from an authorized officer of 10x Research. Copyright 2025 10x Labs Limited. All rights reserved.