Poland’s Digital Finance Moment: Reflections from Warsaw Finance Week 2025

By OKX Europe

A Market on the Edge of Transformation

Poland stands at an inflection point in its financial evolution. Over the past decade, the country has built one of Central and Eastern Europe’s most dynamic financial sectors — technologically advanced, highly digitised, and deeply trusted by consumers.

When it comes to the regulated adoption of digital assets, however, Poland reflects a broader regional trend: a market with significant potential where progress is shaped by measured regulatory prudence and private-sector readiness alike.

At Warsaw Finance Week 2025, organised by Fintech Poland, this dynamic was a key topic of discussion. More than 700 participants — from banks, payment providers, and fintechs to venture funds and regulators — came together to discuss the future of digital finance. What emerged was not hesitation, but readiness: a collective recognition that the time to move from exploration to execution has arrived.

From Regulation to Readiness

The defining theme of the week was MiCA — the EU’s landmark Markets in Crypto-Assets Regulation. For Poland, MiCA represents both opportunity and urgency. While the framework promises to harmonise standards across Europe, the Polish financial sector is in the process of aligning with national implementation.

This has created a temporary period of anticipation for institutions eager to innovate while awaiting formal guidance.

Yet, in conversation after conversation, a consistent message emerged: Polish banks and financial institutions no longer question if digital assets belong in finance — they’re asking how to participate responsibly.This sentiment signals a maturing market — one where institutions are looking beyond speculation and focusing on infrastructure, compliance, and customer trust.

Institutional Confidence Through Regulated Infrastructure

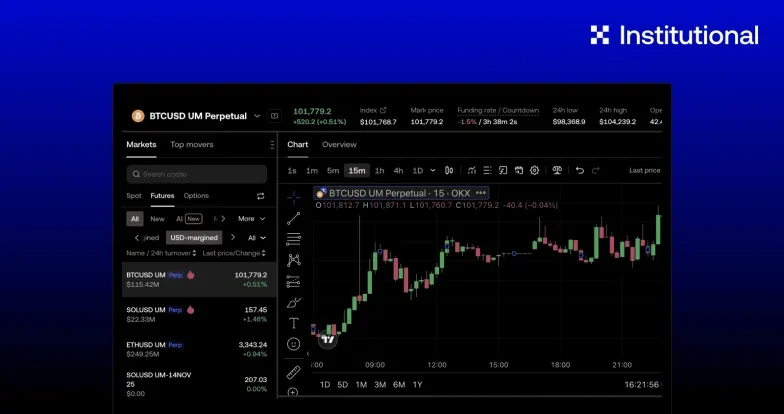

At OKX, we believe the next phase of digital finance in Poland will be driven by infrastructure, not hype — by enabling regulated institutions to integrate digital assets within their existing governance, risk, and compliance frameworks.

That’s where OKX Rubix, our digital-assets-as-a-service, comes in. Rubix is a modular digital-asset workflow built for banks, brokers, and other regulated financial institutions that want to seamlessly extend their offerings to include digital assets. It prioritises operating-model fit, connecting directly to existing trading systems, custodians, and internal governance processes.

Through a suite of secure APIs, Rubix embeds selected digital-asset capabilities — from custody and liquidity to settlement and reporting — directly into a firm’s existing infrastructure. The result is a regulated workflow that allows institutions to operate confidently under MiCA while maintaining the transparency, control, and oversight they expect from traditional markets.

For Polish institutions navigating an evolving and prudently regulated landscape, this workflow-driven approach represents more than technical integration — it’s a trusted bridge between compliance and innovation, enabling them to meet client demand and lead in Europe’s emerging tokenised economy.

Reflections from Warsaw: What We Heard

Warsaw Finance Week revealed a number of insights that highlight how Poland’s digital finance journey is evolving:

Regulated engagement is accelerating. Institutions are ready to act — but only within clearly defined legal frameworks. MiCA’s rollout will be a turning point.

Custody-first models are now the baseline. Banks view regulated custody as the safest and most strategic entry point into digital assets.

Collaboration over competition. Instead of building in isolation, Polish financial institutions are seeking technology partners to integrate crypto and tokenised assets securely.

Compliance as innovation. Regulation is no longer seen as a barrier — but as the foundation for sustainable growth.

The tone in Warsaw was pragmatic, not speculative. The market understands that digital assets are here to stay, but also that the winners will be those who can integrate them responsibly.

Why Poland Matters to Europe’s Digital Future

Poland’s importance extends beyond its borders. As one of the EU’s largest banking markets, its regulatory and technological approach will shape digital asset adoption across the entire CEE region. The country’s combination of high retail participation, strong fintech talent, and institutional depth creates a powerful base for innovation. As MiCA progresses toward full domestic implementation, Poland has the potential to become a regional hub for tokenised finance, connecting liquidity, compliance, and customer reach.

OKX is committed to supporting that journey. Through Rubix, we’re working to help European institutions — including those in Poland — move from exploration to implementation, safely and at scale.

Looking Ahead: A Collaborative Path Forward

The conversations in Warsaw made one thing clear: Poland’s digital finance moment has arrived, but its success will depend on collaboration. Regulators, banks, and fintechs must work together to turn policy frameworks into practical solutions.

At OKX Europe, we believe that the future of finance will be regulated, tokenised, and institutionally led. Rubix embodies this vision — a secure foundation upon which Europe’s next generation of financial products can be built.

With a strong banking base, deep fintech expertise, and growing regulatory clarity, Poland is positioned to translate intent into leadership in Europe’s digital finance landscape.

To learn more about OKX in Poland contact us here.

Related articles: 9/10 MiCA Services. One of Europe's Broadest MiCA licenses. Why it matters.