我喜欢 $CVX 的原因(除了锁定收益已经完全覆盖了我的原始成本基础)是作为代币持有者,我自动获得了 $CRV、$FXS、$FXN 以及现在的 $RSUP 的敞口。

这几乎就像是一些顶级 DeFi/稳定币协议的指数基金。

在当前价格下,它也被严重低估了。

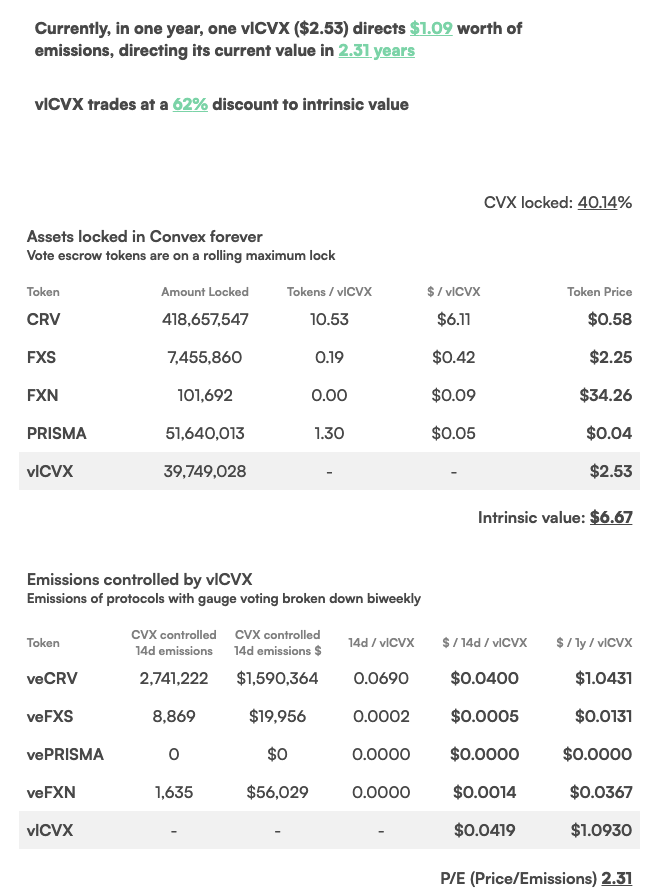

Let's look at the @ConvexFinance Balance Sheet.

418M $CRV ($.60) - $250.8M

7.45M $FXS ($2.25) - $16.76M

101,692 $FXN ($34.26) - $3.48M

(We didn't include $PRISMA as those tokens will be migrated to Resupply.)

Total Assets - $271M

How does that compare to the Convex Valuation?

Convex MC - $206M

Convex FDV -$251M

The Convex $CRV position is the same size as the entire $CVX FDV.

If you look at their circulating market cap they are trading at a 24% discount to their current balance sheet.

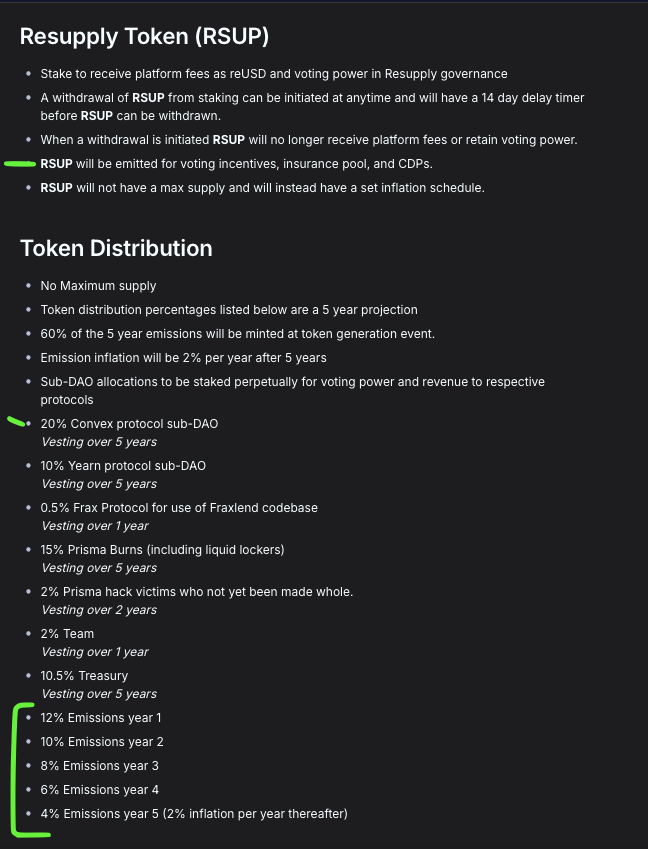

They are also the largest owners of $RSUP from Resupply.

Over five years, 20% of the total $RSUP supply will go to Convex vesting. $RSUP is currently $2.10 per token, which would value the Convex position at $62M.

Convex was significantly undervalued before @ResupplyFi went live. Adding Resupply to their arsenal of assets makes $CVX look like an absolute steal.

In addition to getting 20% of the $RSUP supply to the Convex Treasury, 50% of the resupply emissions will go directly to bribes.

At current prices, the year one $RSUP emissions alone will produce $12.6M in bribe income for $vlCVX.

If you want to bet on Stablecoin growth, @ConvexFinance gives you exposure to Frax, Curve, and Resupply.

It is hard to beat value like this in an exploding sector.

GL!

9.18万

400

本页面内容由第三方提供。除非另有说明,欧易不是所引用文章的作者,也不对此类材料主张任何版权。该内容仅供参考,并不代表欧易观点,不作为任何形式的认可,也不应被视为投资建议或购买或出售数字资产的招揽。在使用生成式人工智能提供摘要或其他信息的情况下,此类人工智能生成的内容可能不准确或不一致。请阅读链接文章,了解更多详情和信息。欧易不对第三方网站上的内容负责。包含稳定币、NFTs 等在内的数字资产涉及较高程度的风险,其价值可能会产生较大波动。请根据自身财务状况,仔细考虑交易或持有数字资产是否适合您。