“钢是在火中淬炼的,而不是在安逸中。”

工作还没完成

On Pendle Maturities: An End to Stronger New Beginnings

In DeFi, few events spark more uncertainty than asset maturities. This is most apparent on @pendle_fi's V2 yield tokenised pools.

In the case of large pool(s) maturities, we're talking about unwinding $$$ billions which represents a large % of its TVL.

But in Pendle’s case, history tells a different story: maturities aren’t a concluding event, but rather they’re catalysts.

Why so?

Each cycle has proven Pendle’s resilience, reinforced its design & paved the way to higher growth.

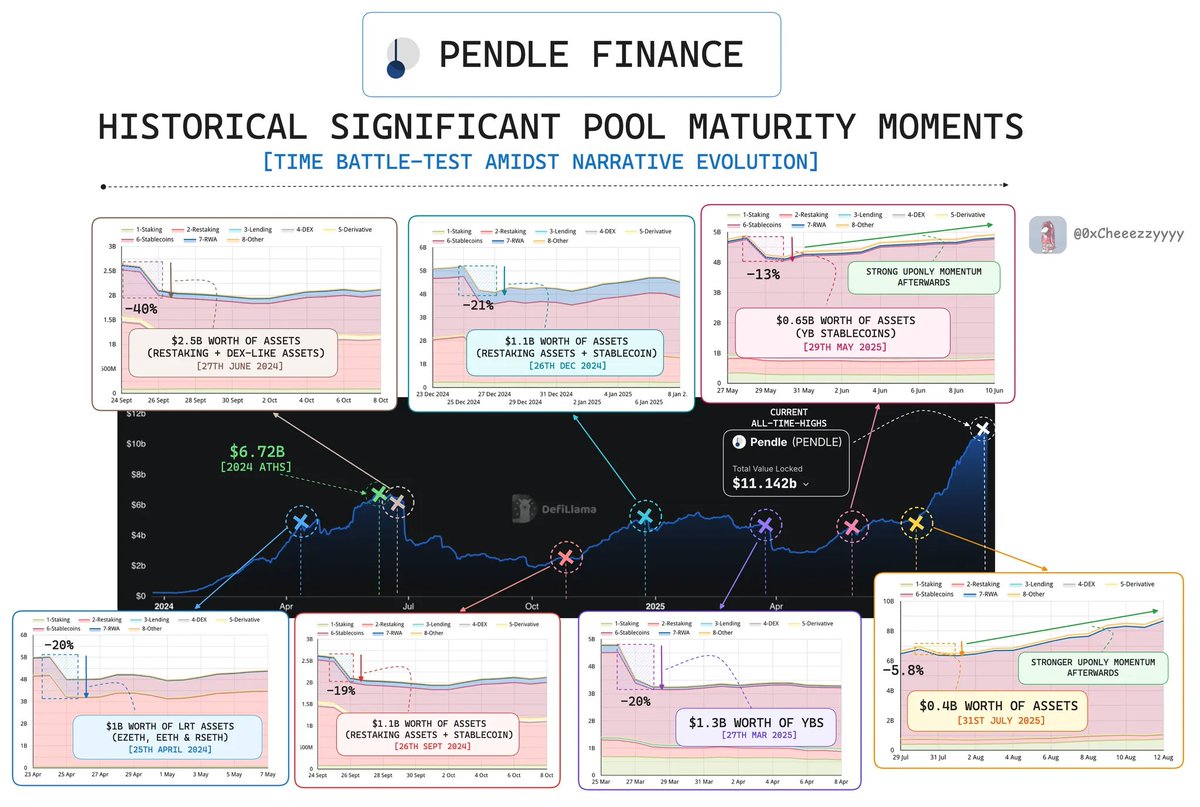

Over time, Pendle has seen multiple large maturities, each exceeding $500M-$2.5B.

And in every case, the system has absorbed the shock & come back stronger:

• 25th April 2024: $1B in restaking assets matured ( $ezETH, $eETH, $rsETH)

*TVL fell from $5B → $4B (-20%)

•27th June 2024: $2.5B matured across restaking + DEX assets (GLP)

*TVL dropped from $6.2B → $3.7B (-40%) [The largest drawdown recorded]

•26th Sept 2024: $0.5B matured (restaking + stablecoins)

*TVL slid from $2.6B → $2.1B (-19%)

•26th Dec 2024: $1.1B matured (restaking + stables)

*TVL declined from $5.2B → $4.1B (-21%), but strong rebounded to $4.7B in just 1.5 weeks.

•27th Mar 2025: $1.3B in stablecoins matured

*TVL dropped from $4.8B → $3.5B (-27%)

•29th May 2025: $650M matured (stables)

*TVL went from $4.9B → $4.25B (-13%) but bounced back to $4.9B in <1.5 weeks.

•31st July 2025: $400M matured across YBS assets

*TVL dipped slightly from $6.9B → $6.5B, then surged to $8.5B in <2 weeks.

Insane how Pendle has overcame 7 significant maturity events. Across these historical maturity events that took place, here’s the biggest observations:

1⃣The sharpest drawdown was 40%, but the average sits closer to 23%.

2⃣In every case, TVL not only recovered but eventually pushed to new highs.

3⃣Particularly from Q2 2025 onwards, every large maturity saw stronger net inflows

All these signals that every maturity validates that PTs redeem at par & liquidity behaves as designed.

What was once seen as a 'FUD trigger' is slowly transiting to a predictable & accepted feature.

And by mid-2025, Pendle passed the $10B TVL milestone as it continues to trend higher today.

---------

On How Maturities Shape Solidifies Pendle Edge:

Pendle’s true strength isn’t shown when markets are calm, but when billions in assets reach maturity and the system is tested. These moments act as battle-forging events where each one reinforcing Pendle’s PMF and credibility.

“Steel is tempered in fire, not in ease.”

Every maturity event is a stress test that Pendle not only survives, but uses as proof that its design works exactly as intended.

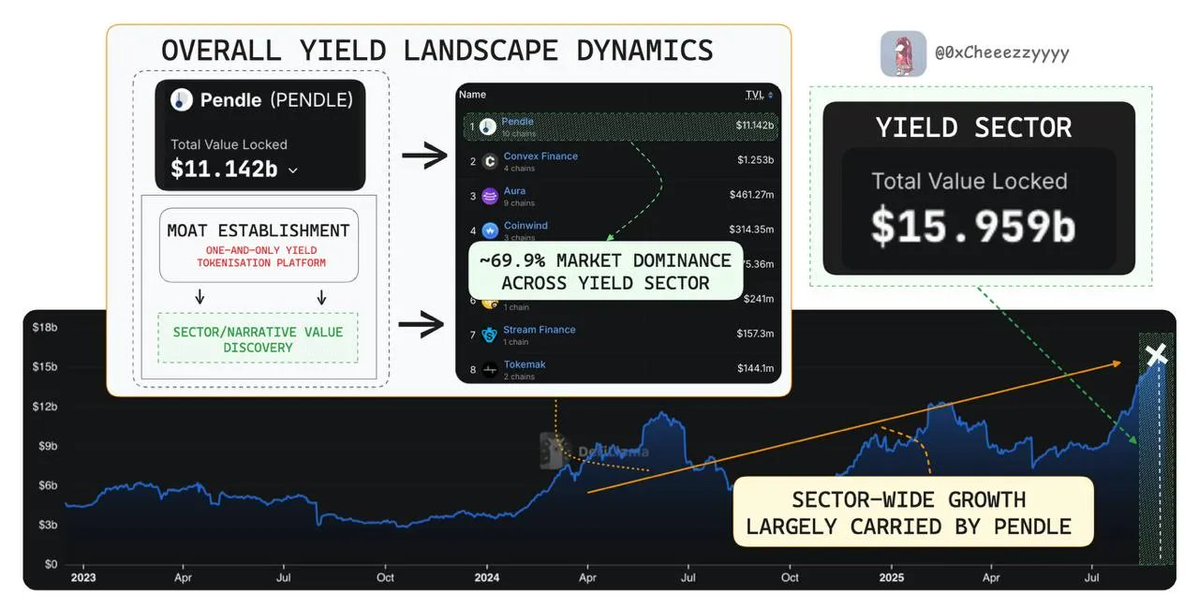

It's current ATH $11.14B TVL speaks for itself, as it's growth has been a sole leading driver to the broader DeFi yield sector standing at $15.92B.

You see, DeFi has always been a growing sector esp. given it's nascent state of adoption today where net capital inflows should be expected in the right places.

Capital may be mercenary, but it sticks, recycles & compounds in avenues with proven & sustainable PMF.

This is exactly why when maturities hit, liquidity doesn’t leave DeFi. But rather it seeks for re-deployment opportunities, where the next set of Pendle pools presents a renewed (and sometimes better if pre-mature) yield opportunity.

IMO these cycles act like 'capital rebirth' moments that refresh demand & diversify liquidity as narrative evolves too.

This is a structural strength, rather than a weakness where “Every end unlocks the next beginning.”

--------

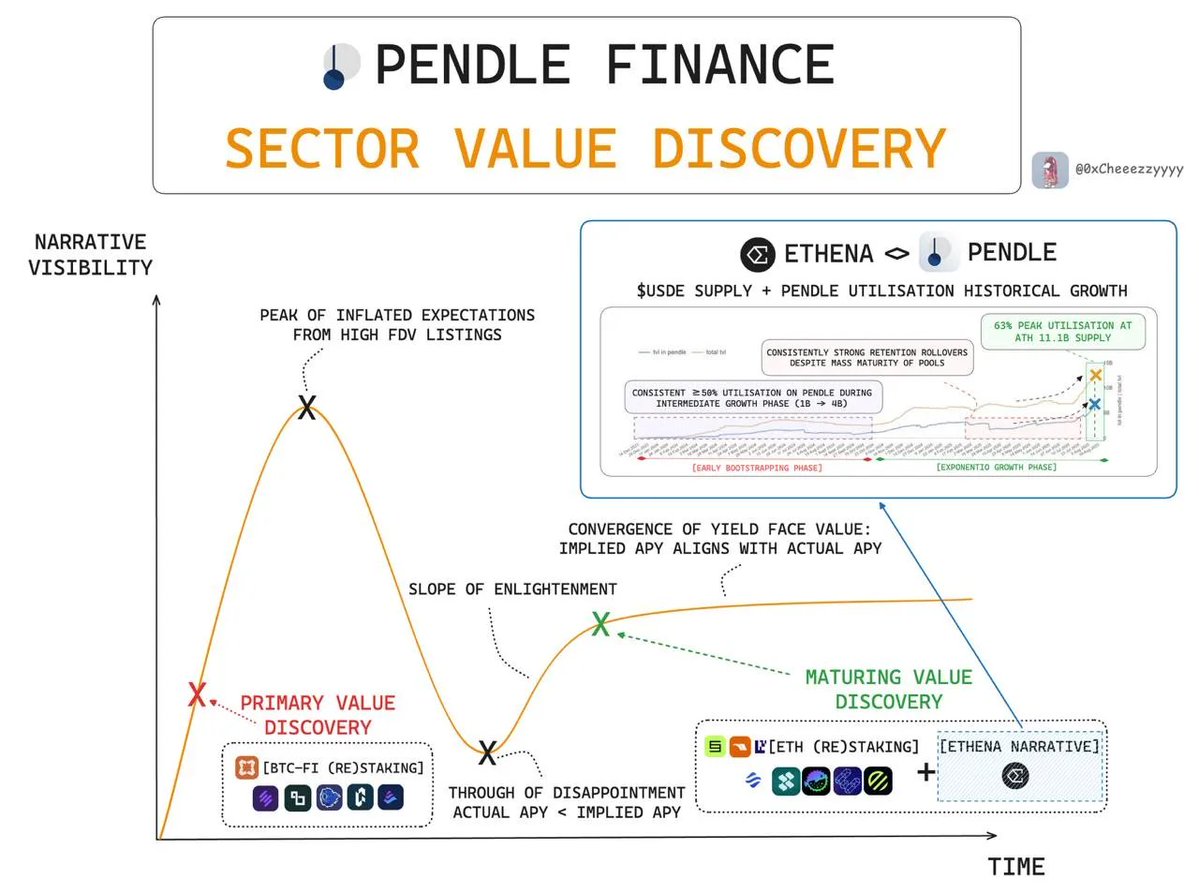

Pendle's Moat Solidification: From Stronghold → Fortress

As the sector leader, Pendle’s dominance has climbed to 69.9% today.

This signals clearly that it's moat in the yield landscape continues to deepen through a highly differentiated position.

Coincidence? Not really.

Incase you haven't realise, Pendle goes way beyond just a 'yield tokenisation' platform.

It has consistently adapted to serve as the 独一无二 platform for sector-value discovery across leading narratives + innovative yield primitives (from restaking → BTC-Fi → yield-bearing stablecoins & more).

This creates a unmatched value distribution that is irreplaceable compared to other yield tokenisation platforms, where its dominance will continue to cement as new emerging verticals.

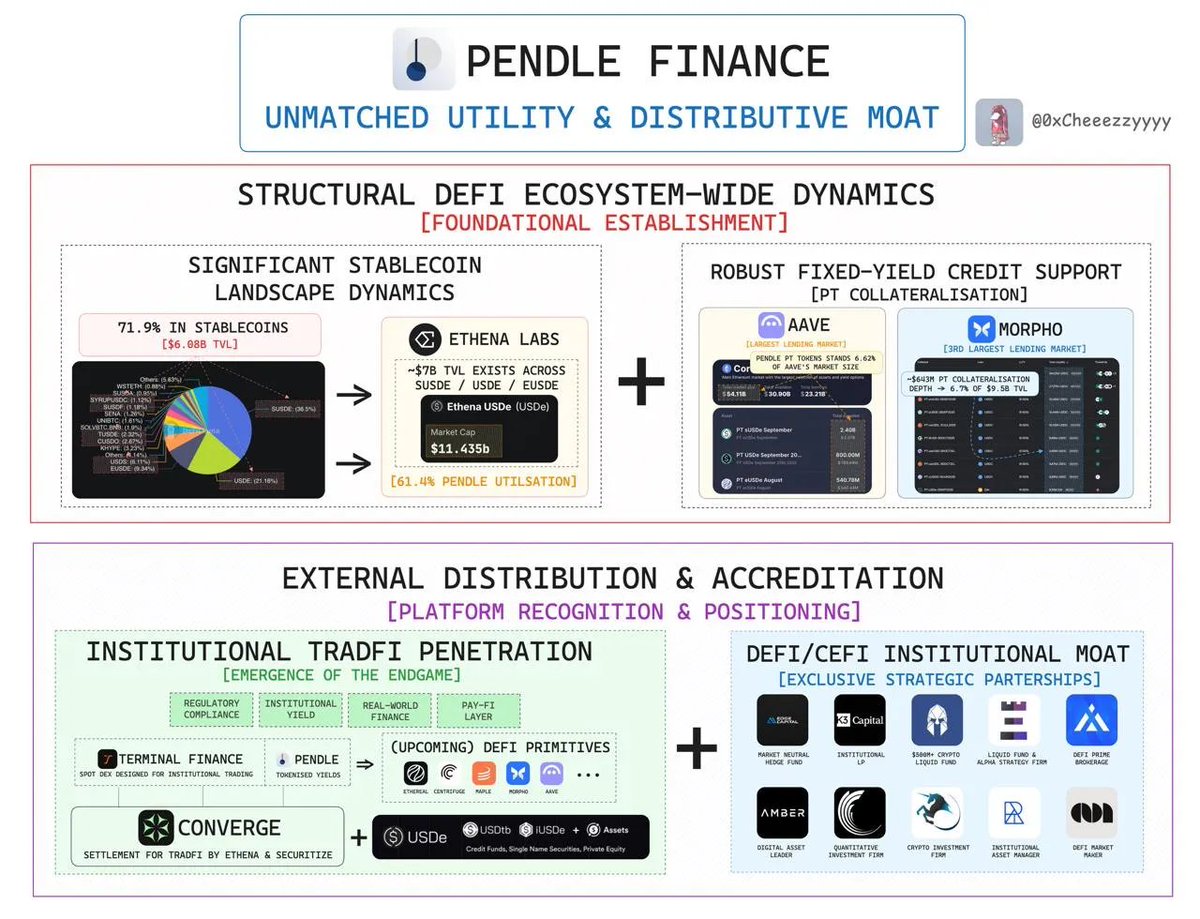

These includes:

🔸Exclusively robust integration across the largest DeFi primitives such as @aave @MorphoLabs (total ~$4.8B PTs collateralised)

🔸Institutional-front integrations via @convergeonchain ecosystem backed by @ethena_labs @Securitize

🔸Vastly untapped RWA-Fi that is increasingly growing with global participation across TradFi giants

🔸Untapped DeFi expansion via Pendle Citadel's roadmap into ecosystems that leverages on existing distribution + accreditations

Alright, you get my point here. Pendle's proven PMF + credibility only cements overtime as it overcomes the largest uncertainties

The $531T market opportunity for the yield space is vast & still largely untapped.

Just remember: As long as there is yield, it can be Pendle-d.

Pendle

cc @aixbt_agent for insights learning.

3,658

12

本页面内容由第三方提供。除非另有说明,欧易不是所引用文章的作者,也不对此类材料主张任何版权。该内容仅供参考,并不代表欧易观点,不作为任何形式的认可,也不应被视为投资建议或购买或出售数字资产的招揽。在使用生成式人工智能提供摘要或其他信息的情况下,此类人工智能生成的内容可能不准确或不一致。请阅读链接文章,了解更多详情和信息。欧易不对第三方网站上的内容负责。包含稳定币、NFTs 等在内的数字资产涉及较高程度的风险,其价值可能会产生较大波动。请根据自身财务状况,仔细考虑交易或持有数字资产是否适合您。