Quick Explain & Personal Though on Pendle's @boros_fi

1. Funding rates are periodic payments between long and short prep traders. If the market is bullish (perp price > spot), longs pay shorts (positive funding rate)

2. Boros "tokenizes" these funding rates into assets called Yield Units (YU). Example: 1 YU-ETH = the funding yield from 1 ETH notional in Binance's ETH/USDT perp

3. If you think funding will go up ▶︎ Long YU. If you think funding will go down ▶︎ Short YU.

4. Use Case Example: Ethena, which relies on positive funding for stablecoin yields, can short YUs to lock in rates and protect against drops

---- thoughts:

1. This product is targeting the funding rate arbs and protocol, but not normal retail user. I don't think much retails really care about how much they are paying to the funding rate. For funding rate stablecoin protocol like Ethena, they may have huge demand on "Short YU", not sure about the liquidity for them to hedge if buy side is not enough.

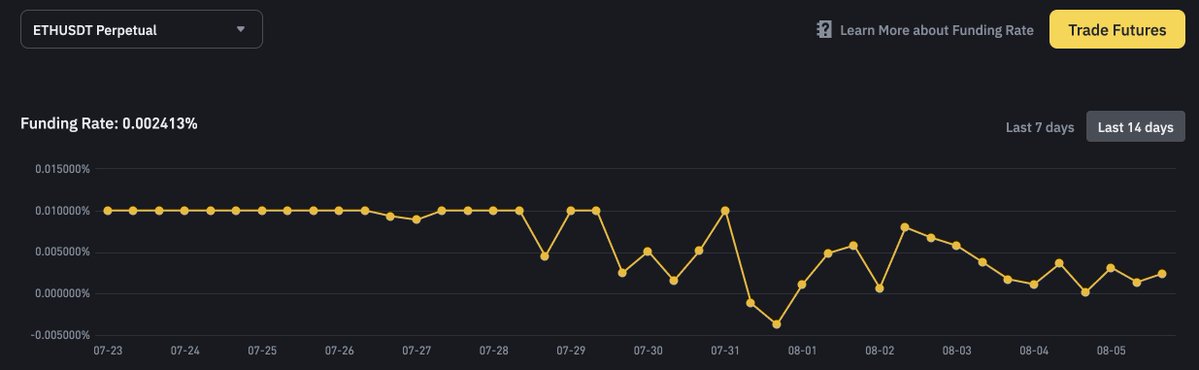

2. Funding rate formula can be adjusted by CEX. From below chart, you can actually observe the recent funding rate for $ETH is pretty consistent to stay on/below 0.01%, even during a bull market. Exchange generally now encourage more AUM so they tend to not make their funding rate too high.

The result is more smart users (who actually who play with trading funding rate) will also likely to sell YU as well. So I'm not too sure who will be the buy sides of YU.

3. Pendle Team always deliver a great product, I'm a pendle user and I'm willing to trust them have a proper mechan on this product, including risk control.

查看原文

1.47万

86

本页面内容由第三方提供。除非另有说明,欧易不是所引用文章的作者,也不对此类材料主张任何版权。该内容仅供参考,并不代表欧易观点,不作为任何形式的认可,也不应被视为投资建议或购买或出售数字资产的招揽。在使用生成式人工智能提供摘要或其他信息的情况下,此类人工智能生成的内容可能不准确或不一致。请阅读链接文章,了解更多详情和信息。欧易不对第三方网站上的内容负责。包含稳定币、NFTs 等在内的数字资产涉及较高程度的风险,其价值可能会产生较大波动。请根据自身财务状况,仔细考虑交易或持有数字资产是否适合您。