做了两个 DEFI 策略的调整。

👉一、在 RATEX 上买入了 FragSOL 的 PT

币圈玩了一段时间,其实感觉收益最高的部分,都来自于流动性溢价,为什么说哪里有注意力哪里就有资金?

因为一个具有共识的“跑得快”游戏,还是需要一点天时地利人和的,大家始终有点想参与公平赌博的赌性在里面。

对于项目方来说, TGE 阶段通常也是流动性溢价最好的时候,这种时候,一般也会通过 DEFI 的链条,传导到链上。

另外一方面,71 天,18%APY +4X RATE X 积分,在久期、收益、潜在空投上都还可以,算是一个小型的六边形战士。

毛估估20% APY 的SOL 本位收益吧,不过我的 SOL 是以 U本位借来的。

反正算来算去,最后差不多以我的全部 U本位计算, APY 波动 10%-20%之间,还行吧,比不上 @OpenEden_X CUSDO 的PT,但是那个稳定币的 KYC 真的反人类。

没有洋人的命,就不赚那个洋人的钱了,多吐槽一句,没有这个 KYC 拦着,PT 收益也不会这么高。

👉二、准备撤出 USDS 在 PENDLE 的 LP

其实早就该撤了,pendle 上 USDS 的规模超过 2亿之后,性价比就急速下降,目前规模已经往 4亿去了,每天新增接近 200亿积分。

加上项目方又不发币, SPK staking 的积分也算进去,真实APY收益往 usds-pt 4.5 的真实收益去了,甚至有可能更低。

目前唯一还有希望的就是嘴撸 @cookiedotfun 上的 @sparkdotfi 了,还剩下那么几天时间,能不能最后给我加点分?SNAP~SNAP~SNAP~😛

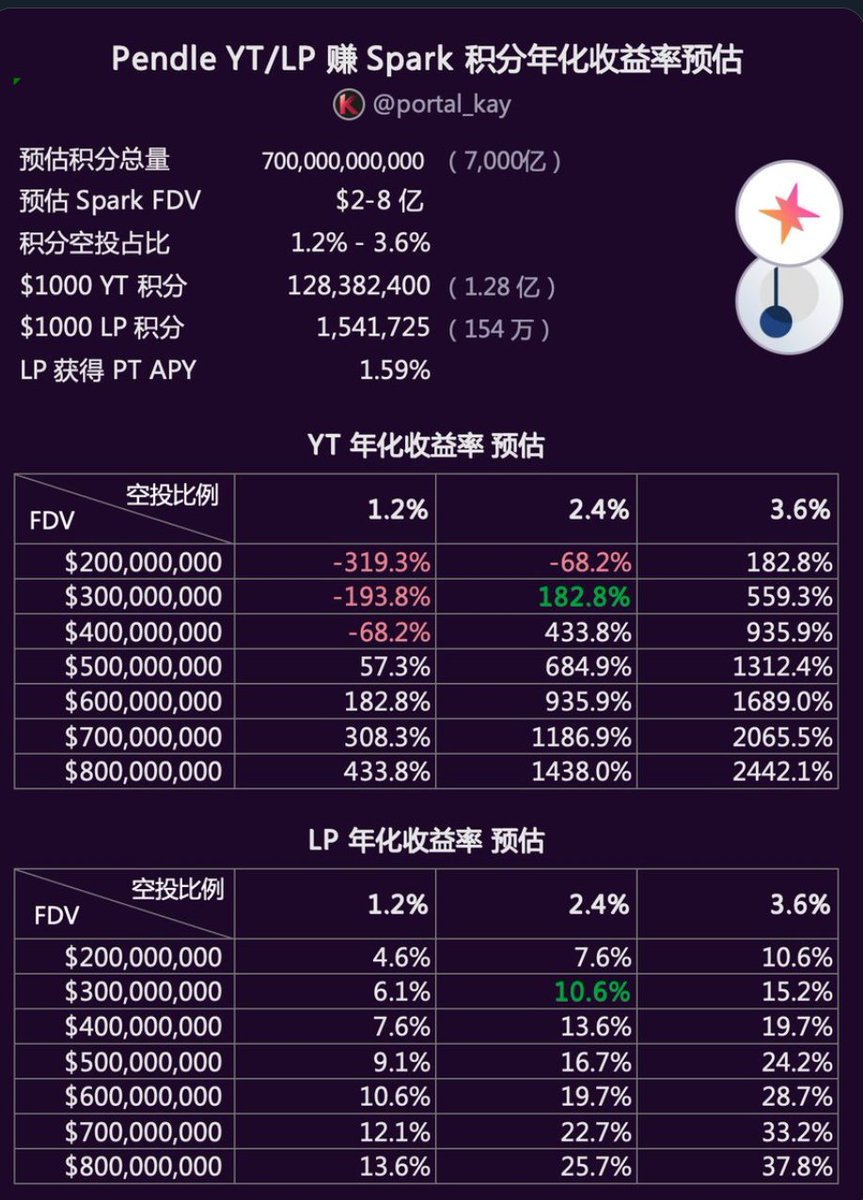

之前很多人做过 USDS 在 PENDLE 上的空投测算。

这里借用一下 @portal_kay 老师的图,里面预估的积分总量是7000亿,但是预估会往 1万4千亿去。

按照这个积分规模,即便是最乐观的 2.4%空投量, FDV 5亿,实际APY也只有 8%,实在鸡肋,弃了去其他地方了。

——

说到这里,还想说一个方向:

我们可能不仅等不来币圈的山寨季,甚至都等不来美股上链了。

现在最暗流涌动的,反而是“币上美股”。

微策略的 BTC 方案,被复用到了其他公链代币上。

而在美股搞一个 SPV (特殊目的公司实体)的门槛非常低。

币圈山寨季发生在美股可能不是一句谶言。

难道我要捡起我的老本行...以后给大家分析美股的财报了吗,哈哈哈

时间不多了,先写到这里,后面再讲讲“币上美股”这个事情,有哪些逻辑支撑。

————————

Made Two Adjustments to My DeFi Strategies

👉 1. Bought FragSOL PT on RATEX

After playing in crypto for a while, I’ve realized the highest returns often come from liquidity premiums. There's a reason why people say “where attention goes, money follows.”

That’s because even in a so-called "fast runner" game with strong consensus, there’s always an element of timing, luck, and human nature. People are inherently drawn to participate in what feels like a fair gamble.

For project teams, the TGE (Token Generation Event) phase is usually when liquidity premiums are at their peak. During this period, those premiums often flow through the DeFi pipeline onto the chain.

On the other hand, FragSOL’s PT has a 71-day duration, 18% APY + 4X RATE X points. From the perspective of duration, yield, and potential airdrops, it’s pretty solid—a little six-dimensional warrior, if you will.

A rough estimate puts the SOL-denominated yield at around 20% APY. However, my SOL was borrowed in USD terms.

After crunching the numbers, the overall APY based on my entire USD portfolio fluctuates between 10% and 20%. Not bad—though it doesn’t beat @OpenEden_X’s CUSDO PT. But honestly, that stablecoin’s KYC is just anti-human.

If you weren’t born to be a Westerner, maybe don’t chase Western money. Just saying—if it weren’t for that KYC wall, PT yields wouldn’t be so high in the first place.

👉 2. Preparing to Exit the USDS LP Position on PENDLE

Honestly, I should’ve exited a while ago. Once the USDS pool on Pendle surpassed $200 million, the risk-reward ratio began dropping sharply. Now it’s approaching $400 million, with nearly 20 billion new points being added daily.

To make matters worse, the project hasn’t launched a token yet, and SPK staking points are also counted—so the real APY on USDS-PT 4.5 is much lower, maybe even below that.

My only remaining hope is farming points on @sparkdotfi via @cookiedotfun. A few days left—will they give me a last-minute point boost? SNAPSNAPSNAP~ 😛

Many people have already calculated the USDS airdrop potential on PENDLE.

Here, I’ll borrow a chart from @portal_kay. The projected total points were 700 billion, but now estimates are going as high as 1.4 trillion.

At that point scale, even in the most optimistic scenario of a 2.4% airdrop with a $500 million FDV, the real APY would only be around 8%. Pretty underwhelming. I’m moving on to better opportunities.

On that note, here’s another thought:

We might not only miss out on the altcoin season—we might never even get tokenized US stocks on-chain.

Ironically, the biggest undercurrents right now are in the direction of US stocks on-chain.

MicroStrategy’s BTC treasury model is being mimicked by tokens on other chains.

And it’s surprisingly easy to create an SPV (Special Purpose Vehicle) to hold U.S. stocks.

Maybe the idea of an altcoin season... happening in the U.S. stock market instead of crypto isn’t a joke.

Am I really about to pick up my old profession again and start analyzing U.S. stock earnings reports for everyone? 😂

Time’s tight—more on this “on-chain U.S. stocks” thesis later, including the logic behind it.

19

1.6万

本页面内容由第三方提供。除非另有说明,欧易不是所引用文章的作者,也不对此类材料主张任何版权。该内容仅供参考,并不代表欧易观点,不作为任何形式的认可,也不应被视为投资建议或购买或出售数字资产的招揽。在使用生成式人工智能提供摘要或其他信息的情况下,此类人工智能生成的内容可能不准确或不一致。请阅读链接文章,了解更多详情和信息。欧易不对第三方网站上的内容负责。包含稳定币、NFTs 等在内的数字资产涉及较高程度的风险,其价值可能会产生较大波动。请根据自身财务状况,仔细考虑交易或持有数字资产是否适合您。