STEPN价格

(巴西雷亚尔)R$0.24403

+R$0.0075334 (+3.18%)

BRL

无法搜索到该币种。请检查您的拼写或重新搜索币种名称。

市值

R$7.59亿

流通总量

31.09亿 / 60亿

历史最高价

R$23.67

24 小时成交量

R$1.38亿

2.5 / 5

了解STEPN

免责声明

本页面的社交内容 (包括由 LunarCrush 提供支持的推文和社交统计数据) 均来自第三方,并按“原样”提供,仅供参考。本文内容不代表对任何数字货币或投资的认可或推荐,也未获得欧易授权或撰写,也不代表我们的观点。我们不保证所显示的用户生成内容的准确性或可靠性。本文不应被解释为财务或投资建议。在做出投资决策之前,评估您的投资经验、财务状况、投资目标和风险承受能力并咨询独立财务顾问至关重要。过去的表现并不代表未来的结果。您的投资价值可能会波动,您可能无法收回您投资的金额。您对自己的投资选择自行承担全部责任,我们对因使用本信息而造成的任何损失或损害不承担任何责任。提供外部网站链接是为了用户方便,并不意味着对其内容的认可或控制。

请参阅我们的 使用条款 和 风险警告,了解更多详情。通过使用第三方网站(“第三方网站”),您同意对第三方网站的任何使用均受第三方网站条款的约束和管辖。除非书面明确说明,否则欧易及其关联方(“OKX”)与第三方网站的所有者或运营商没有任何关联。您同意欧易对您使用第三方网站而产生的任何损失、损害和任何其他后果不承担任何责任。请注意,使用第三方网站可能会导致您的资产损失或贬值。本产品可能无法在所有司法管辖区提供或适用。

请参阅我们的 使用条款 和 风险警告,了解更多详情。通过使用第三方网站(“第三方网站”),您同意对第三方网站的任何使用均受第三方网站条款的约束和管辖。除非书面明确说明,否则欧易及其关联方(“OKX”)与第三方网站的所有者或运营商没有任何关联。您同意欧易对您使用第三方网站而产生的任何损失、损害和任何其他后果不承担任何责任。请注意,使用第三方网站可能会导致您的资产损失或贬值。本产品可能无法在所有司法管辖区提供或适用。

STEPN 的价格表现

近 1 年

-66.90%

R$0.74

3 个月

-4.89%

R$0.26

30 天

+1.77%

R$0.24

7 天

+11.07%

R$0.22

STEPN 社交媒体动态

有次去西安唱歌 @BTCbaoan 身边坐了一个姑娘,就是打合约下海的...

当时差点我们没笑岔气...

合约害人,威猛说还有被西坦Rug的,我一想,我西安的伙计们都是被西坦Rug的....

当年伙计们都不做电影,看到链游赚钱,举全公司之力打链游...

从农民世界到传奇,到raca,到跑鞋,到西坦,到星鲨,到赛马,觉得链游改变世界....

然后信息流圈和影视圈全军覆没......

亏的裤衩子都没了...

记得一次喝酒,老周说:牛子啊,就喊王雨先去给咱先干短剧吧,咱都亏的没钱了,兄弟们闯一闯,找条活路....

我们说弄!

当时短剧,3天拍完,100集,大家累的都不成人样了...

比干跑鞋GMT都累...

一个月后,短剧跑通了。。。

后面慢慢的开始起量,每天从几十万到几百万...

然后到星光映美的九霄龙帅一周跑出千万...

大家才慢慢穷的缓过来....

后面,点众投了匣子,点通...

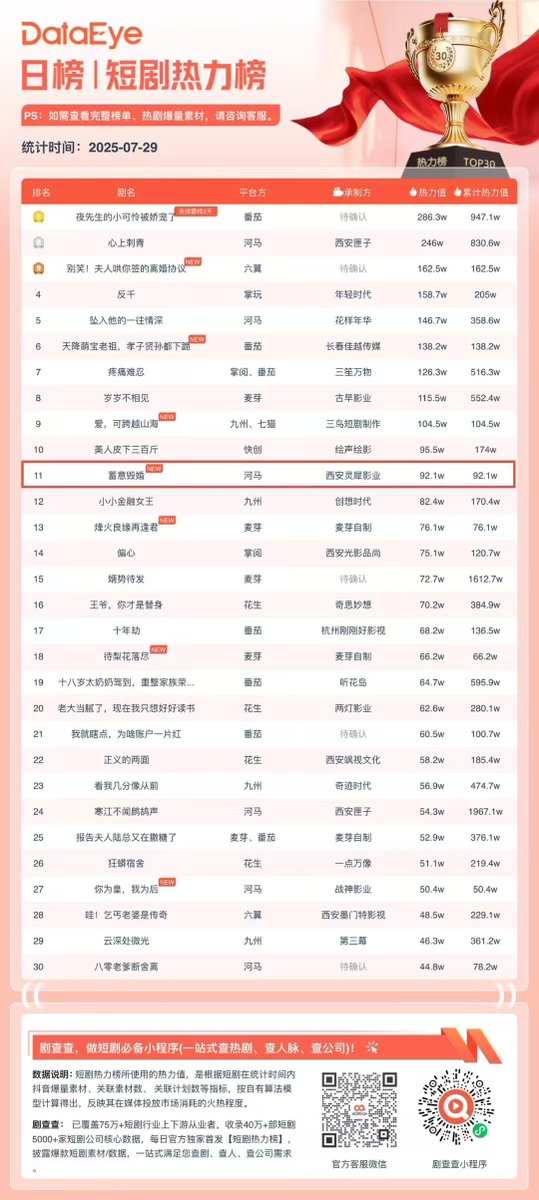

到现在还霸屏....

星光现在成为了番茄海外短剧最大的制作商...

王雨一直给红果短剧做...

之前公司干跑鞋,打游戏的这帮人,构成了中国短剧的最原始力量....

到现在还占着半壁江山....

有时候想想,要是他们不在币圈亏这么多的话,短剧是不是就得再晚一晚.....

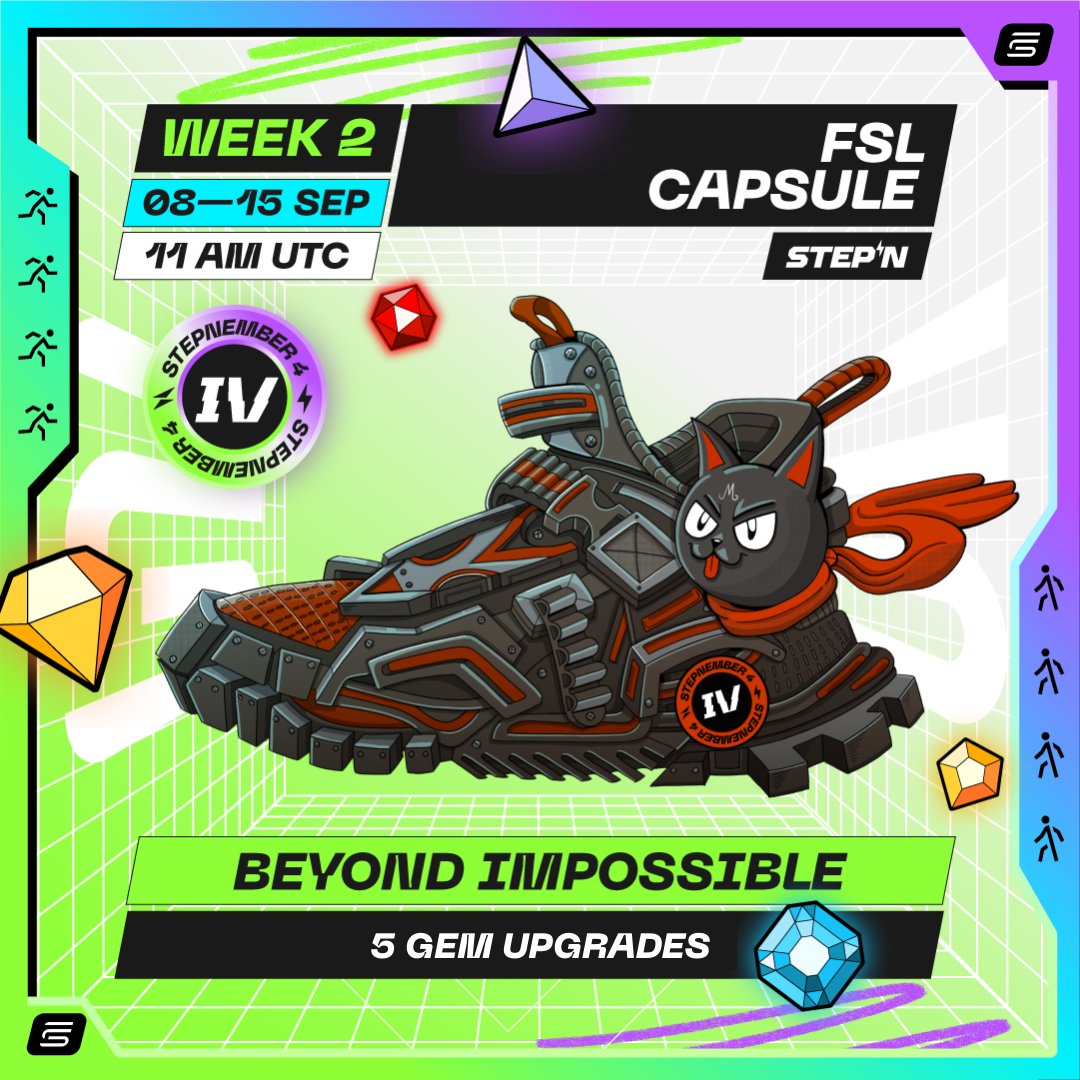

💥 STEPNEMBER4 | 设计展示 #4

👟 STEPN “超越不可能”

不可能不是STEPN。这款运动鞋庆祝我们走过的漫长旅程,做到了所有人说我们做不到的事情。

✅ 2项吉尼斯世界纪录。

✅ 与 @adidas 合作的实体联名鞋

✅ 大牌合作伙伴(@Argentina, @GSHOCK_OFFICIAL, @SnoopDogg…)

还有一个从未停止前进的社区 💚

那只超级英雄猫?这是对我们联合创始人 @yawn_rong 的致敬,以及我们所建立的一切背后的安静力量。

如何获得:

👟 在STEPN中进行5次宝石升级。

👉 任何等级,成功与否。

⚠️ 每个账户只能获得每种皮肤一次。

🍀 2% 概率获得不常见版本。

💠 在SOL领域绑定。周结束后分发。

🗓️ 作为Degen Capsule的一部分,9月8日至15日,UTC时间上午11点可用。

#STEPNEMBER4 庆祝超越不可能的4年。

#STEPN 和 #STEPNGO 九月市政厅回顾 🎉

这是一个特别的月份:STEPN 四周年,STEPN GO 一周年!从 #STEPNEMBER 4 到 STEPN 和 STEPN GO 的新功能,九月充满了精彩。

以下是我们涵盖的所有内容 👇

🔹 STEPNEMBER 4 来了!

🔹 新的 STEPN 和 STEPN GO 功能

🔹 STEPN 和 STEPN GO 更新

🔹 GG 盒子

🔹 GMT Pay 更新

🔹 FSL 游戏中心

🔹 卡利斯托项目

🔹 冠军活动

🔹 社区提问

错过了吗?别担心,这里是完整的回顾 🧵

STEPNEMBER 4 周年活动 🎂

我们最大的生日庆祝活动!

🔹 整个九月在 STEPN 和 STEPN GO 进行

🔹 总共收集 12 个皮肤(每个应用 6 个)

🔹 皮肤通过不同的机制解锁:铸造、增强、宝石升级、原石升级

🔹 在一个应用中收集所有 6 个皮肤 = 资格参加最终抽奖

🎁 最终抽奖奖励:

- 10 双 STEPN 创世纪运动鞋(针对 STEPN 皮肤收藏者)

- 10 双 STEPN GO 创世纪运动鞋(针对 STEPN GO 皮肤收藏者)

第一周已经开始,查看我们应用内的说明以获取所有细节!

新的 STEPN 和 STEPN GO 功能🏃

🔹 新游戏模式,适用于 STEPN 和 STEPN GO 玩家

🔹 主要目标:与其他玩家(和自己)竞争以获得奖励

🔹 最终内部测试正在进行中,我们下个月会分享更多细节

STEPN 和 STEPN GO 更新 ✨

我们推出了几项生活质量改进:

🔹 STEPN 中的所有皮肤现在都是永久的(世界杯皮肤除外)

🔹 STEPN GO 每日连续签到系统进行了改版 → 连续签到不会中断,除非失去强脚(已应用追溯修复 ✅)

🔹 STEPN 中新的基于距离的跑步徽章,以庆祝现实生活中的成就

GG 盒子 🎁

期待已久的 GG 盒子来了!它们在六月份已分发给所有 FSL ID 成员,自八月二十日起,您可以打开您的盒子以获得奖励,例如:

🔹 GGUSD 年化收益率提升券(最高 15%)

🔹 普通和 1/1 创世纪运动鞋

🔹 GGUSD 现金奖励

🔹 未来盒子的钥匙

🔥 这是奖励忠实生态系统玩家的好方法。

GMT Pay 💳

Web3 现实生活支付不断升级:

🔹 增加了以太坊和 BNB 链支持(Polygon 和 Solana 已经上线)

🔹 每次 GMT Pay 卡购买现在都附带一张抽奖券,可以赢得 STEPN 运动鞋或 GMT

🔹 使用简单:用加密货币购买卡 → 添加到 Apple/Google 钱包 → 立即消费

现实世界的实用性,由您的步伐驱动!

FSL 游戏中心 🎮

游戏中心不断发展成为一个独立的生态系统:

🔹 Tadokami 现在提供日语,打开了一个全新的受众 🇯🇵

🔹 Starlets 获得现实世界的实用性 → 现在可以在市场上用于商品优惠券($25 和 $50,数量有限)

🔹 新的冻结连续签到选项 → 花费 Starlets 保护您的每日连续签到一天

游戏中心正成为发现游戏、赚取奖励和与更广泛的 FSL 生态系统连接的中心场所。这仅仅是个开始 👀

卡利斯托项目 🌌

推出一个新的多阶段运动鞋拍卖

🔹 计划 4 个阶段,每个阶段都有独特的机制和稀有性

🔹 拍卖 = 最高出价者获胜,但即使是非获胜者也可以收集奖励

🔹 所有运动鞋通过 MOOAR 拍卖发布

第一阶段:步行的起源 ✅

- 特色地球运动鞋(供应量 50,Solana)

- 拍卖时间:8 月 26 日 – 9 月 1 日

每个新阶段将通过新设计和更深的故事讲述扩展卡利斯托宇宙。

👉 关注 @Mooarofficial 以获取即将发布的消息。

冠军活动 🌍

我们的冠军通过精彩的现实生活活动保持了全球 STEPN 精神:

🇵🇹 8 月 24 日:与 @lourotrail 的葡萄牙见面会

🇯🇵 8 月 25 日:在 WebX 期间的东京,与 @yumakora_eth、@TANU_FSL、@cryptBBQ 和 @MetaXN_FSL

🇯🇵 8 月 31 日:与 @MetaXN_FSL、@qilin_move 和 @M_lllovolll_M 的北海道活动

即将到来:

📍 Token 2049(新加坡,10 月 1–2 日):重大存在 + 公告

📍 Blockchain Life 2025(迪拜,10 月 28–29 日)与生态系统负责人 @StepnEurope

👉 使用代码 FSL10 获得门票 10% 的折扣!

STEPN 四周年。STEPN GO 一周年。无数的步伐、里程碑和回忆。

在牛市、熊市、起伏中,我们的社区始终向前迈进。STEPNEMBER 4 是庆祝这些回忆并共同创造新回忆的时刻!

旅程继续。十月见 🚀

快捷导航

STEPN购买指南

开始入门数字货币可能会让人觉得不知所措,但学习如何购买比您想象的要简单。

预测 STEPN 的价格走势

STEPN 未来几年值多少?看看社区热议,参与讨论一波预测。

查看 STEPN 的价格历史

追踪 STEPN 代币的价格历史,实时关注持仓表现。您可以通过下方列表快捷查看开盘价、收盘价、最高价、最低价及交易量。

STEPN 常见问题

目前,一个 STEPN 价值是 R$0.24403。如果您想要了解 STEPN 价格走势与行情洞察,那么这里就是您的最佳选择。在欧易探索最新的 STEPN 图表,进行专业交易。

数字货币,例如 STEPN 是在称为区块链的公共分类账上运行的数字资产。了解有关欧易上提供的数字货币和代币及其不同属性的更多信息,其中包括实时价格和实时图表。

由于 2008 年金融危机,人们对去中心化金融的兴趣激增。比特币作为去中心化网络上的安全数字资产提供了一种新颖的解决方案。从那时起,许多其他代币 (例如 STEPN) 也诞生了。

查看 STEPN 价格预测页面,预测未来价格,帮助您设定价格目标。

深度了解STEPN

STEPN 是一个边动边赚的运动应用程序,GMT 是其治理代币。配备 NFT 运动鞋的用户可以到户外活动来赚取代币和 NFT 奖励。STEPN 有一个内置钱包、NFT 市场、兑换和一个可以让非加密用户也用起 STEPN 的租赁系统。

ESG 披露

ESG (环境、社会和治理) 法规针对数字资产,旨在应对其环境影响 (如高能耗挖矿)、提升透明度,并确保合规的治理实践。使数字代币行业与更广泛的可持续发展和社会目标保持一致。这些法规鼓励遵循相关标准,以降低风险并提高数字资产的可信度。

市值

R$7.59亿

流通总量

31.09亿 / 60亿

历史最高价

R$23.67

24 小时成交量

R$1.38亿

2.5 / 5