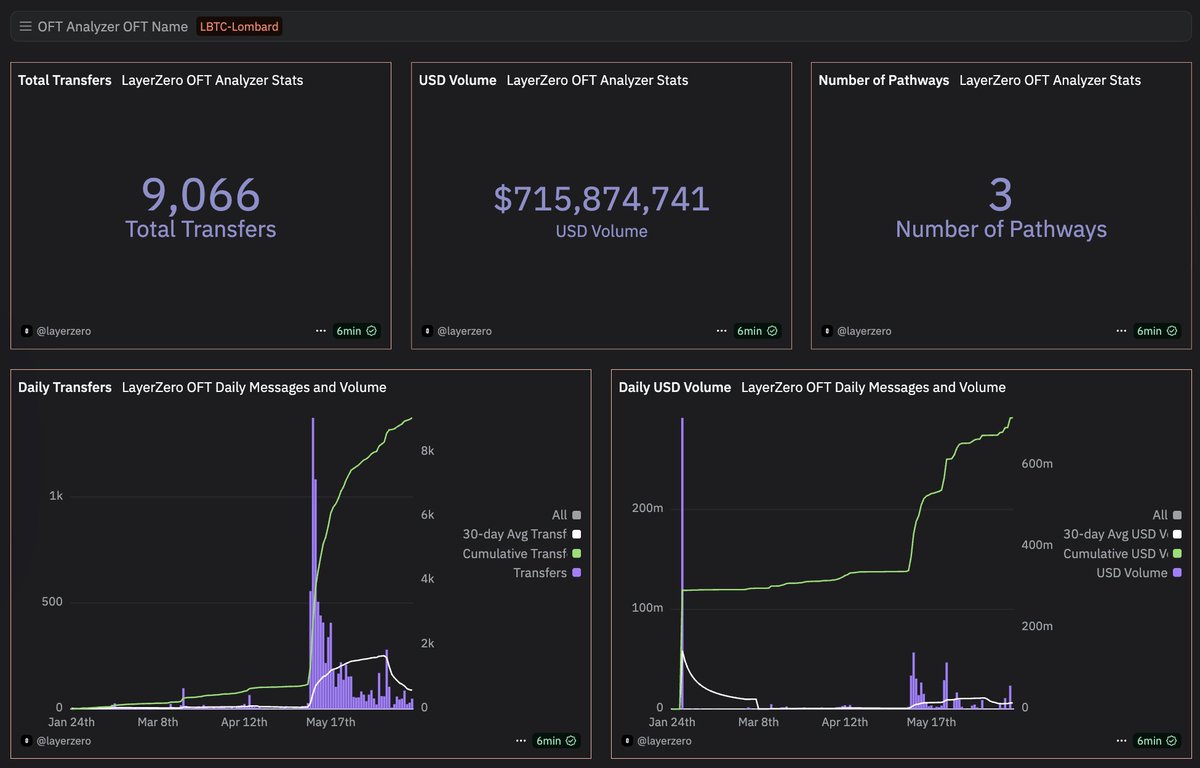

LBTC till ett värde av 715 miljoner dollar har flyttats mellan kedjor med hjälp av LayerZero.

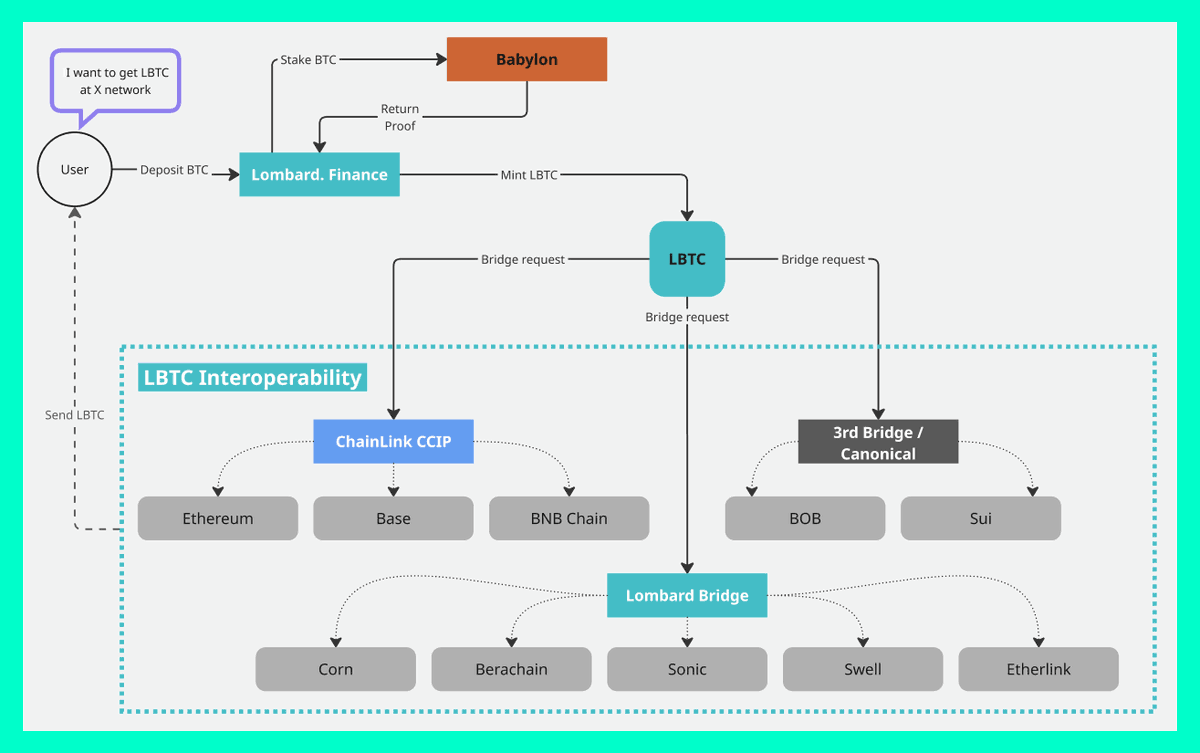

How LBTC Cross-Chain Interoperability Works

Lombard has built an incredibly intuitive and user-friendly product. Its UI/UX is polished to the highest standard, making complex DeFi functionality accessible even to less technical users. The team refers to it as a DeFi marketplace—and rightly so. Everything feels seamless and straightforward on the surface.

But behind this simplicity lies a highly sophisticated crosschain infrastructure. LBTC is already live on 11 networks, and it’s rapidly becoming the standard for BTC representation across ecosystems. Moving LBTC between chains feels nearly effortless—but under the hood, it’s powered by a layered and modular architecture.

Cross-Chain Architecture Breakdown

To enable LBTC's interoperability, Lombard has integrated three types of cross-chain protocols:

- Chainlink CCIP

- Lombard Bridge

- Canonical bridges

1. Chainlink CCIP

Chainlink CCIP is Lombard’s interoperability solution for Ethereum, Base, and BNB Chain. It works similarly to LayerZero by using cross-chain messaging routed through a unified hub.

This allows LBTC to move seamlessly and securely between these three ecosystems with no need for traditional bridging mechanics. Chainlink CCIP is already widely trusted in the industry and provides robust security guarantees.

2. Lombard Bridge

This is a custom-built, classic lock/mint bridge operated by @Lombard_Finance . When users move LBTC between chains via the Lombard Bridge, BTC is locked on the source network and a wrapped version is minted on the destination network.

Key details:

- Validation is handled through a PoA consensus, run by a 14-validator consortium.

- An additional security layer is provided by @cubistdev protective oracle, which monitors validator behavior.

- Currently supports: Sonic, Berachain, Corn, Swell, and Etherlink.

- Bridge architecture is two-way between Ethereum and each destination network, but not yet fully meshed—i.e., direct transfers between destination chains aren’t currently possible.

Some bridges within the Lombard ecosystem (e.g. Corn, Swell) were actually developed by the networks themselves—they wanted early LBTC integration to stimulate ecosystem growth. These bridges are audited by third parties, but not yet fully validated by Lombard’s internal team.

3. Canonical Bridges

Canonical bridges refer to natively supported bridges maintained by the base networks themselves (not by Lombard or Chainlink). These are considered highly secure, especially when bridging from Ethereum to its official L2s.

Currently integrated networks: @build_on_bob and @SuiNetwork

Security level: Generally higher, as these are native and often audited extensively by their respective ecosystems.

Current Limitations and Future Outlook

While $LBTC interoperability is not yet fully seamless, it’s already showing strong adoption—with over $2 billion in TVL. Some networks rely on third-party bridges or lack direct connections between each other. However, these are temporary limitations, and Lombard’s team is actively working toward full cross-chain composability.

In the near future, we’re likely to see:

- Deeper integration between destination chains

- Integration of advanced interop protocols like L0, Wormhole, or Axelar

- Consolidation of bridge infrastructure for easier maintenance and improved user trust

Conclusion

Lombard’s cross-chain design combines modularity, security, and scalability, making LBTC one of the most interoperable wrapped BTC assets in DeFi today. While there’s room for further improvement, the foundation is robust, and the momentum is clearly building. With continued innovation, Lombard is on track to make LBTC truly seamless across all major blockchains.

===================================

If you liked the research, plz like/retweet and follow to @Eugene_Bulltime

And follow on strong visioners and analysts:

@0xBreadguy

@poopmandefi

@TheDeFISaint

@DoggfatherCrew

@0xSalazar

@DefiIgnas

@Defi_Warhol

@Moomsxxx

@hmalviya9

@Mars_DeFi

@2lambro

@rektdiomedes

@eli5_defi

@JayLovesPotato

@Steve_4P

@TheDeFinvestor

@0xAndrewMoh

@0xCheeezzyyyy

@0xKaveh

@arndxt_xo

@ProofOfTravis

9,4 tn

5

Innehållet på den här sidan tillhandahålls av tredje part. Om inte annat anges är OKX inte författare till den eller de artiklar som citeras och hämtar inte någon upphovsrätt till materialet. Innehållet tillhandahålls endast i informationssyfte och representerar inte OKX:s åsikter. Det är inte avsett att vara ett godkännande av något slag och bör inte betraktas som investeringsrådgivning eller en uppmaning att köpa eller sälja digitala tillgångar. I den mån generativ AI används för att tillhandahålla sammanfattningar eller annan information kan sådant AI-genererat innehåll vara felaktigt eller inkonsekvent. Läs den länkade artikeln för mer detaljer och information. OKX ansvarar inte för innehåll som finns på tredje parts webbplatser. Innehav av digitala tillgångar, inklusive stabila kryptovalutor och NFT:er, innebär en hög grad av risk och kan fluktuera kraftigt. Du bör noga överväga om handel med eller innehav av digitala tillgångar är lämpligt för dig mot bakgrund av din ekonomiska situation.