Цена USD Coin

в USD

О USD Coin

Дисклеймер

OKX не дает рекомендаций по инвестированию и хранению активов. Тщательно оцените свою финансовую ситуацию и определите, подходит ли вам торговля и владение цифровыми активами. По вопросам, связанным с вашими конкретными обстоятельствами, обращайтесь к специалистам в области законодательства, налогов или инвестиций. С подробностями можно ознакомиться, изучив Условия использования и Предупреждение о рисках. Переходя на сайты третьих сторон («Сторонние сайты»), вы принимаете их условия использования. OKX и ее партнеры («OKX») не связаны с владельцами и руководителями Сторонних сайтов, если иное не указано в письменной форме. Вы соглашаетесь с тем, что OKX не несет ответственности за убытки, ущерб и любые другие последствия использования Сторонних сайтов. Помните, что использование Сторонних сайтов может привести к полной или частичной потере активов. Продукт может быть доступен не во всех юрисдикциях.

Динамика цен USD Coin

USD Coin в соцсетях

Руководства

Создание бесплатного аккаунта OKX.

Пополнение аккаунта.

Выбор криптовалюты.

Вопросы и ответы о USD Coin

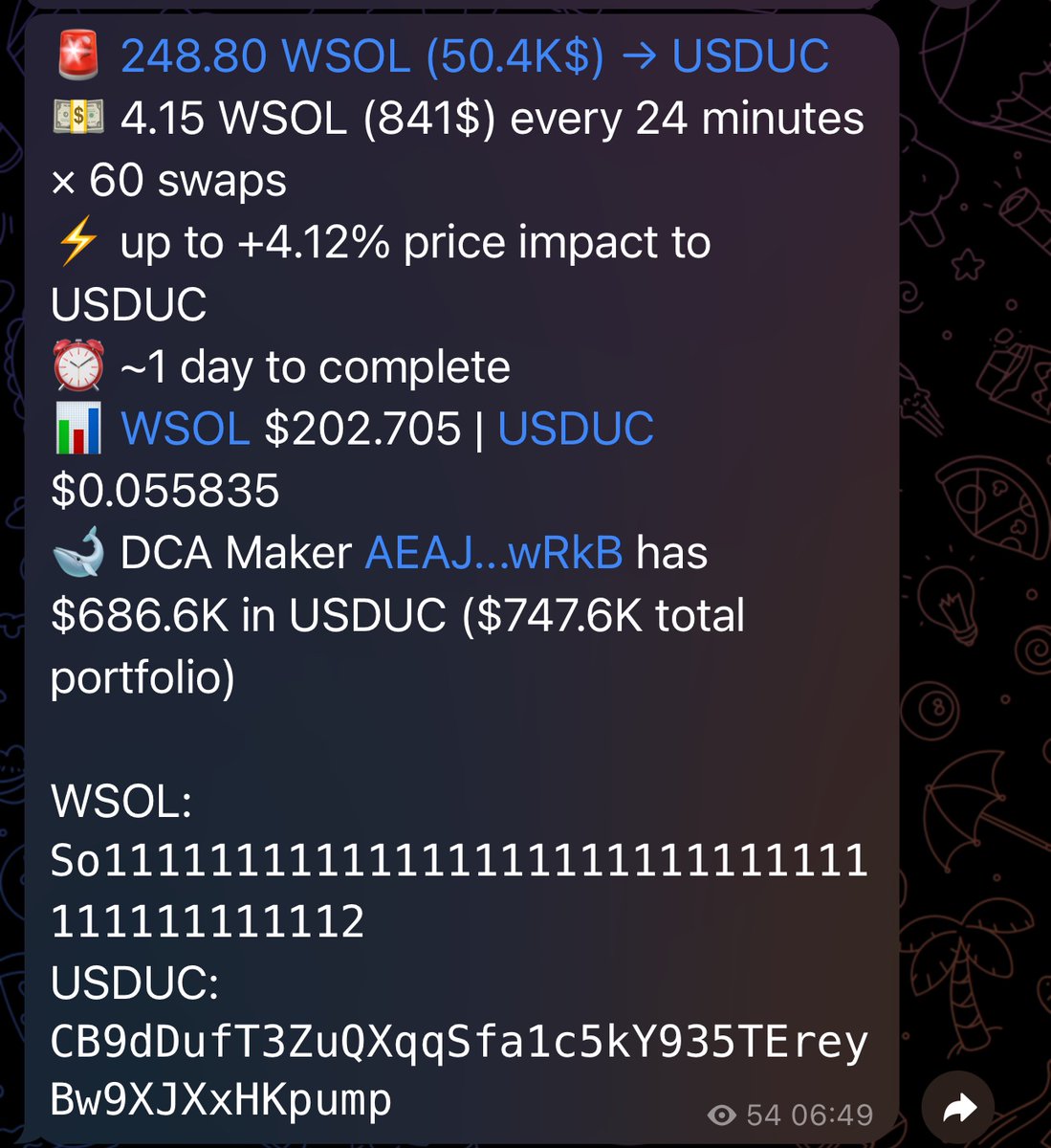

Пользователи могут купить USDC на надежных криптовалютных биржах, например OKX. Сначала нужно купить USDC с помощью действительной кредитной или дебетовой карты, выбрав параметр «Купить с помощью карты» в меню заголовка «Купить криптовалюту».

Кроме того, пользователи могут получить USDC с помощью различных торговых пар в терминале спотовой торговли OKX. Также можно зайти в раздел «Конвертация OKX» и выполнить своп имеющейся криптовалюты на USDC с нулевой комиссией и без проскальзывания цены.

Наконец, пользователи могут приобрести токены USDC на торговой платформе P2P-торговли OKX. P2P-торговля — это покупка и продажа криптовалюты напрямую между пользователями, без посредников.

Биржа OKX рекомендует объективно изучить любую криптовалюту перед инвестированием. Криптовалюта считается активом с высоким уровнем риска и подвержена резким колебаниям цен. Поэтому мы советуем инвестировать только те средства, которые вы можете позволить себе потерять.

Кроме того, цена USDC, как и любой другой криптовалюты, волатильна и подразумевает инвестиционные риски. Поэтому, прежде чем инвестировать в эту криптовалюту, вам следует провести собственное исследование (DYOR) и оценить степень приемлемого риска.

Откройте для себя USD Coin

USD Coin (USDC) — это стейблкоин с открытым исходным кодом на основе смарт-контракта, выпущенный международной финансово-технологической компанией Circle и американской криптовалютной биржей Coinbase. Вместе они составляют Centre Consortium, который занимается генерацией и выводом всех токенов USDC.

Запущенный в октябре 2018 года, USDC обеспечен фиатными средствами и привязан к доллару США в соотношении 1:1. Это возможно благодаря сочетанию денежных средств, их эквивалентов и краткосрочных казначейских облигаций США, обеспечивающих USDC. Примерно 10% резервов USDC хранятся в виде денежных средств и их эквивалентов, а остальная часть — в краткосрочных казначейских облигациях США.

Centre Consortium считает, что подлинная финансовая совместимость между криптовалютами и фиатными валютами возможна только в том случае, если между ними есть стабильное средство обмена стоимости. USDC был создан для удовлетворения потребности в прозрачном и безопасном фиатном стейблкоине, которого в то время не хватало на рынке.

Его создатели Circle и Coinbase хотели предложить стейблкоин, обеспеченный реальными активами, проходящий регулярный аудит и обеспечивающий высокую прозрачность и эффективное управление. USDC был задуман как более понятный в финансовом и операционном плане актив по сравнению с другими стейблкоинами на рынке, что поможет укрепить доверие и стимулировать более широкое принятие.

Grant Thornton — независимая аудиторская фирма, которая проводит ежемесячную аттестацию стейблкоина USDC. Она осуществляет независимую проверку резервов, обеспечивающих USDC, и гарантирует, что они хранятся в соответствии с политикой резервов Centre Consortium.

Джереми Аллейр, генеральный директор Circle, подчеркнул важность прозрачности и подотчетности в работе USDC, а участие Grant Thornton является ключевым компонентом этих мер. Стремление USDC к прозрачности, подкрепленное независимой проверкой со стороны Grant Thornton, обеспечивает большую уверенность и доверие для пользователей, желающих приобрести стейблкоины.

Принцип работы USDC

USDC создан на блокчейне Ethereum, децентрализованной платформе, позволяющей создавать смарт-контракты и децентрализованные приложения (dApps). USDC — это токен стандарта ERC-20, совместимый с любым кошельком Ethereum или биржей, поддерживающей токены стандарта ERC-20. Технология, лежащая в основе USDC, разработана для обеспечения стабильности и надежности для пользователей, что делает его популярным выбором среди криптовалютных трейдеров.

Каждый токен USDC обеспечен одним долларом США, то есть его стоимость напрямую связана со стоимостью этой валюты. Это обеспечивает высокий уровень стабильности, что может быть особенно полезно во время волатильности на рынках.

Centre Consortium контролирует создание токенов USDC и управляет ими. Этот консорциум гарантирует, что каждый токен USDC обеспечен соответствующим долларом США, и что предложение токенов USDC всегда равно количеству долларов США, хранящихся в резерве.

Сегодня USDC также выпускается в нескольких блокчейнах, включая Ethereum (формат ERC-20), Tron (формат TRC-20), Algorand (формат ASA), Avalanche (формат ERC-20), Flow (формат FT), Stellar (как актив Stellar), Solana (формат SPL) и Hedera (формат SDK).

Для чего используется USDC?

Будучи одним из самых популярных стейблкоинов, привязанных к USD, USDC находит широкое применение в качестве средства хранения стоимости во время нестабильных рыночных условий или просто среди тех, кто хочет иметь фиатные средства вне традиционных банковских систем. Так, многие трейдеры переводят свои криптовалюты в USDC, чтобы избежать влияния резких изменений цен. Это объясняет то, почему спрос на USDC значительно возрастает во время медвежьих тенденций на рынках.

USDC также широко используется многими биржевыми платформами для привлечения новых участников в криптовалютную индустрию и активно принимается в качестве средства оплаты товаров и услуг на онлайн- и офлайн-рынках.

USDC размещен в нескольких известных блокчейнах, включая Ethereum в качестве токена стандарта ERC-20. Благодаря этому его можно легко использовать в любых dApp, работающих в этих сетях, в том числе в популярных играх, где пользователи могут свободно покупать внутриигровые активы с помощью токенов USDC.

Еще один вариант использования токенов USDC — это перевод средств. Токены USDC все чаще используются с этой целью, поскольку они обладают рядом преимуществ по сравнению с традиционными способами перевода, включая большое ощущение безопасности, большую доступность, сниженные комиссии и повышенную скорость. Кроме того, некоторые компании, такие как финансово-технологическая Circle, предлагают специальные услуги, предназначенные для перевода средств с использованием USDC.

Незадействованные токены USDC могут генерировать пассивный доход на различных криптовалютных биржах, включая OKX. Пользователи могут посетить OKX Earn и выбрать один из доступных планов стейкинга USDC, чтобы получать проценты.

Цены и токеномика USDC

Как и большинство аналогов, USDC выпускается по требованию и не имеет ограничения на максимальный объем предложения. Количество токенов USDC, находящихся в обращении, меняется в зависимости от того, сколько их выпущено и сожжено коммерческими эмитентами.

Centre может сразу же выпустить новые USDC для покупателей по курсу 1:1 к доллару США в случае необходимости. Например, если покупатель хочет купить USDC на сумму 15 млн долл. США, Centre может немедленно создать для покупателя 15 млн новых USDC. Аналогичным образом, если пользователь с 15 миллионами USDC хочет вернуть его за доллары США, Centre платит ему 15 млн долл. США и уничтожает его токены (15 млн USDC), тем самым выводя их из обращения.

Об основателях

USDC был основан в 2018 году независимым консорциумом Centre, построенным на принципах членства. В его состав входят компания по предоставлению услуг P2P Circle и криптовалютная биржа Coinbase.

Он был создан для обеспечения доверия и прозрачности в индустрии стейблкоинов. USDC позволяет пользователям уверенно и безопасно работать на криптовалютном рынке благодаря тому, что при желании каждую удерживаемую единицу USDC можно обменять на 1 USD.

В отличие от большинства других криптовалютных и стейблкоин-проектов Circle и Coinbase полностью регулируются ведущими органами власти США. Это способствовало развитию USDC и помогло заложить основу для международной экспансии стейблкоинов.

Раскрытие данных ESG