Crypto Derivatives 17 December 2024

Keep up with the latest in crypto market commentary as we share the insights from our institutional research partners.

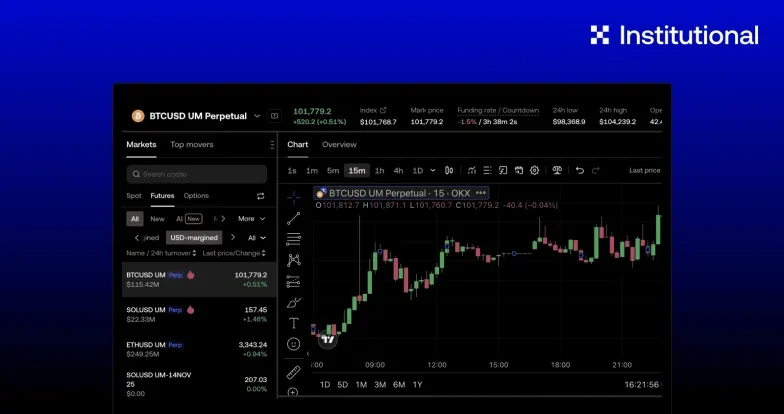

In this edition, we share the latest crypto derivatives weekly from Block Scholes.

The derivatives market has recently behaved in contrast to what we observed post-election. BTC spot price has repeatedly broken all-time highs, now reaching $107K, but its short dated implied volatility has been trending lower, decreasing sharply after the rally in line with drifting realized volatility. Skew initially indicated increased interest in OTM puts as volatility was falling, but it has since returned to positive territory, with OTM calls now trading at a volatility premium again. The period of strong inversions coinciding with spot rallies appears to have come to an end, as traders have not yet reopened overly leveraged positions during drastic spot price moves. Sentiment has slowed, with futures implied yields being the only signal that continues to ramp up for short tenors.

ATM Implied Volatility, 1-Month Tenor

BTC Options

BTC SVI ATM Implied Volatility

The term structure of implied volatility has steepened after the rally that brought BTC to a new ATH.

BTC 25-Delta Risk Reversal

Skew levels have been on a decline across tenors, with short-tenors dipping negative briefly after the rally.

ETH Options

ETH SVI ATM Implied Volatility

ETH's implied volatility term structure has steepened, mirroring BTC’s movements.

ETH 25-Delta Risk Reversal

Short-tenor smiles have lost much of their bullish skew, with short tenors assigning a volatility premium to OTM puts.

Market Composite Volatility Surface

Listed Expiry Volatility Smiles

Constant Maturity Volatility Smiles

The information provided in this document by Block Scholes Ltd is for informational purposes only and does not necessarily represent the views of OKX. Any additional disclaimers issued by these third parties are also applicable and should be considered as part of this document.

This report is not intended as financial advice, investment recommendation, or an endorsement of specific trading strategies. The contents of this report, including but not limited to any graphs, charts, and numerical data, are provided “as is” without warranty of any kind, express or implied. The warranties disclaimed include but are not limited to performance, merchantability, fitness for a particular purpose, accuracy, omissions, completeness, currentness, and delays.

The cryptocurrency markets are highly volatile and unpredictable, subject to substantial market risks including significant price fluctuations. The strategies, opinions, and analyses included are based on information available at the time of writing and may change without notice. They are also based on certain assumptions and historical data that may not be accurate or applicable in the future. Therefore, reliance on this report for the purpose of making investment decisions is at your own risk.

Past performance is not indicative of future results. While we strive to provide accurate and timely information, we cannot guarantee the accuracy or completeness of any data or information contained in this report. We are not responsible for any losses or damages arising from the use of this report, including but not limited to, lost profits or investment losses.

Investors should conduct their own research and consult with a qualified financial advisor before making any investment decisions. The inclusion of any specific cryptocurrencies or trading strategies does not constitute an endorsement or recommendation by OKX.

© 2025 OKX. Se permite la reproducción o distribución de este artículo completo, o pueden usarse extractos de 100 palabras o menos, siempre y cuando no sea para uso comercial. La reproducción o distribución del artículo en su totalidad también debe indicar claramente lo siguiente: "Este artículo es © 2025 OKX y se usa con autorización". Los fragmentos autorizados deben hacer referencia al nombre del artículo e incluir la atribución, por ejemplo, "Nombre del artículo, [nombre del autor, si corresponde], © 2025 OKX". Algunos contenidos pueden ser generados o ayudados por herramientas de inteligencia artificial (IA). No se permiten obras derivadas ni otros usos de este artículo.