EURC price

in USD$1.163

-$0.0001 (-0.01%)

USD

We can’t find that one.

Check your spelling or try another.

Check your spelling or try another.

Market cap

$238.14M

Circulating supply

204.56M / 204.56M

All-time high

$0.00

24h volume

$38.33M

About EURC

EURC, short for Euro Coin, is a euro-backed stablecoin issued by Circle, designed to bring the stability of the euro into the digital economy. As a stablecoin, EURC is pegged 1:1 to the euro, offering users a reliable and transparent way to transact, save, or invest in a currency they trust. Built on leading blockchain networks like Ethereum, Solana, Avalanche, and Base, EURC enables fast, low-cost, and borderless transactions. Its primary use cases include cross-border payments, decentralized finance (DeFi), and seamless integration into global financial systems. With institutional-grade backing and widespread adoption, EURC is paving the way for a more inclusive and efficient financial ecosystem, making it an essential tool for both crypto newcomers and seasoned investors.

AI-generated

EURC’s price performance

Past year

--

--

3 months

+1.94%

$1.14

30 days

+0.77%

$1.15

7 days

-0.29%

$1.17

EURC on socials

Returning to "payments", from Crypto to TradFi, what is the larger narrative of stablecoins?

Yiwu and USDT, these two seemingly unrelated terms, are now being put into the same context.

As the "World Small Commodity Capital", in the past, Yiwu merchants often had to go through layers of correspondent bank transfers to sell goods to the Middle East, Latin America and Africa, which not only took a long time and cost high, but also often encountered the risk of capital retention.

In recent years, the situation is quietly changing, according to Huatai Securities Research Report, in Yiwu, stablecoins have become one of the important tools for cross-border payments, buyers only need to complete the transfer on their mobile phones, and the funds can arrive in a few minutes, Chainalysis estimates that as early as 2023, the flow of stablecoins on the Yiwu market chain has exceeded 10 billion US dollars.

Although the 21st Century Business Herald's follow-up survey pointed out that most merchants in Yiwu have not heard of or understand stablecoins, and only a few merchants support stablecoin payments, this just shows that it is still in its early stages and has shown a trend of proliferation.

In other words, stablecoins are becoming the "new dollar" for small and micro traders around the world to receive cross-border payments - payment, which is not only the starting point of stablecoins, but also the most direct incision for them to enter the global financial system.

From "Payment" to "Global Payment"

Since the development of stablecoins, the application scenarios have diversified: some people use it to participate in DeFi mining, some people use it to earn interest, and some people use it as collateral assets. But behind these uses, payments are always the core function.

Especially in the cross-border payment scenario, "global payment" is a scene where stablecoins contrast with traditional finance.

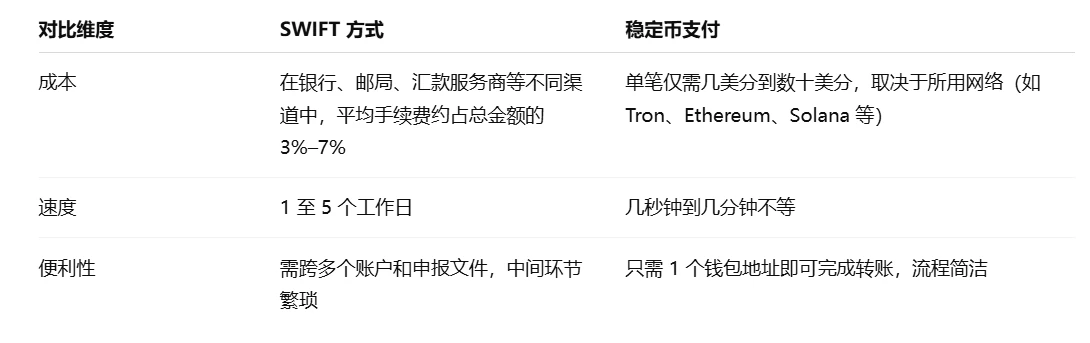

As we all know, the Society for Worldwide Interbank Financial Telecommunication (SWIFT) system has long been the core pillar of cross-border transactions, but its inefficiencies are unsustainable in modern financial needs - a cross-border remittance often goes through multiple correspondent banks, cumbersome procedures, slow settlement, and can take days to complete, during which the transaction costs remain high due to layers of fees.

For businesses that rely on cash flow, or individual users who need to send money home, these delays and costs are almost unbearable. To put it bluntly, while SWIFT still has a global reach, it is not designed for the efficient needs of the digital economy.

In this context, stablecoins offer a fast, low-cost, and borderless alternative path. They naturally have the attributes of low cost, borderless, and real-time arrival, and a cross-border transfer can be completed in just a few minutes without layers of agents, and the handling fee is also significantly reduced due to network differences.

For example, the current transfer of stablecoins such as USDT/USDC on the mainstream Ethereum L2 network has dropped to a few cents and can be almost ignored, which makes stablecoins naturally a viable solution for "global payments", especially in Southeast Asia, Latin America and other regions where cross-border funds are active and traditional channels are not smooth, gradually becoming the mainstream choice for micropayments.

More importantly, for underdeveloped and even turbulent economic and social development, stablecoins are not just "payment tools", they also function as short-term stores of value - in the eyes of these users who are at risk of depreciation of their local currency, holding stablecoins means more stable purchasing power protection.

This dual role of "payment + hedging" is the reason why "global payment stablecoins" are worth discussing separately.

Source: imToken Web (web.token.im)'s "global payment" (remittance) stablecoin

From the perspective of imToken, stablecoins are no longer a tool that can be summarized in a single narrative, but a multi-dimensional "asset aggregation" - different users and different needs will correspond to different stablecoin choices.

In this category, "global payment stablecoins" (USDT, USDC, FDUSD, TUSD, EURC, etc.) are a separate category dedicated to cross-border transfers and value circulation, and their role is becoming clearer: they are both the fast lane of global capital flows and the "new dollar" for users in volatile markets.

Why can't the global system avoid stablecoins?

If "payment" is the original intention of stablecoins, then "global payment" is their most competitive landing scenario. The reason is simple: stablecoins almost naturally fit into the three major pain points of cross-border payments - cost, efficiency and acceptability.

First of all, for payment scenarios, cost and efficiency are the core.

As mentioned above, traditional cross-border remittances often need to go through multiple correspondent banks, which can take "days" and cost tens of dollars. In contrast, the advantages of stablecoins are clear at a glance, with a single transfer fee of far less than $1 on the Ethereum L2 network, which has become a common tool for cross-border micropayments in Southeast Asia, Latin America, and other places.

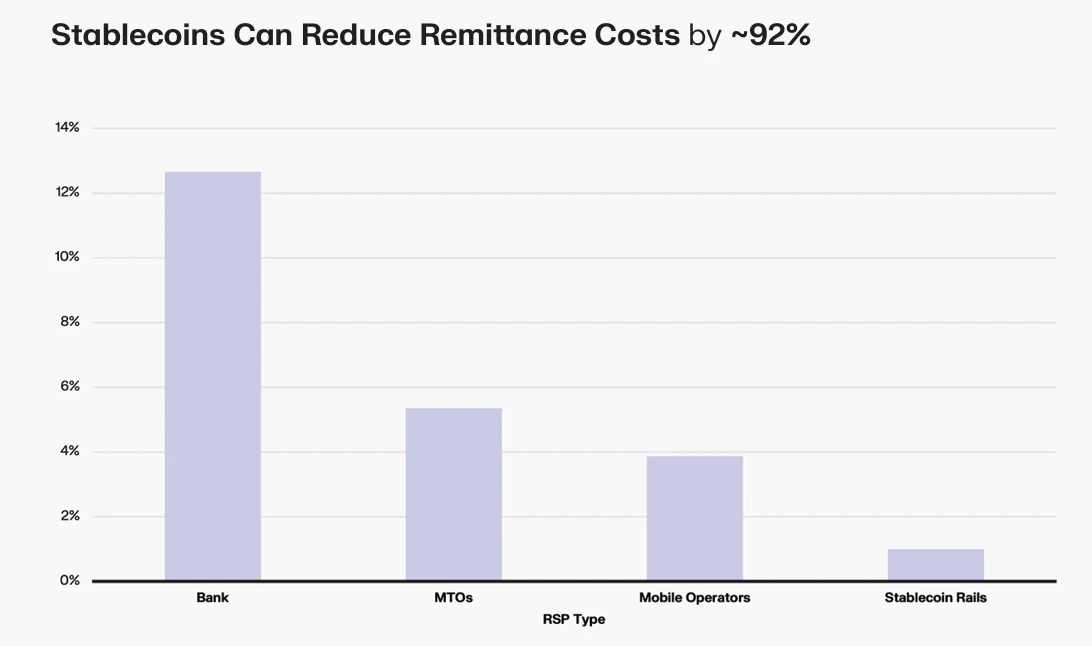

According to Keyrock, the fee for cross-border remittances of $200 from traditional banks is about 12.66%, MTOs (remittance operators) are about 5.35%, and mobile operators are about 3.87%, while stablecoin platforms can reduce the cost of similar transfers to less than 1%, greatly improving the efficiency of capital flow Not at all on an order of magnitude.

Source: Keyrock

Secondly, in addition to efficiency and cost, whether the payment can be widely adopted depends on whether the other party is willing to accept it.

This is due to the mutual fulfillment of the crypto market and stablecoins over the years - USDT, as the world's largest stablecoin, has a long-term stable market value at the level of 100 billion US dollars, and is the most widely accepted payment medium.

Under the continuous penetration, in countries such as Turkey, Argentina, and Nigeria that have severely depreciated their local currencies, USDT has almost become a de facto "savings currency"; USDC attracts institutions with transparent reserves and compliance, and has high penetration in the European and American markets. EURC, although smaller, has an irreplaceable role in cross-border settlements in the European region.

Finally, speed and cost are important for payments, but whether the funds are really safe is even more critical.

With the implementation of the GENIUS Act in the United States, the implementation of the Stablecoin Ordinance in Hong Kong, and the successive pilots in markets such as Japan and South Korea, compliance issuance has gradually become a "passport" for stablecoins.

In the future, stablecoins that can enter the global payment system will most likely be "whitelisted players" on the path to compliance (read more "Gray Behemoth vs. Whitelist Players: A Perspective on the "Fork Moment" brought about by compliant stablecoins).

In summary, the reason why stablecoins are becoming the infrastructure for "global payments" is not accidental, but because they have formed an alternative advantage to traditional cross-border payments in terms of efficiency, cost, acceptance, and transparency.

Payments are the starting point and a bigger future

Because of this, for stablecoins, which have gradually expanded their "global payment" attributes, they are far more than just the transaction needs of Crypto native users, but extend to a wider range of groups:

Individuals and businesses with cross-border remittance or payment needs;

Crypto traders who need to quickly transfer funds between different exchanges;

Users facing the depreciation of their home currency and seeking safe haven against stable assets such as US dollars or euros;

From this perspective, "global payments" are not only the original intention of stablecoins, but also their most realistic and urgent landing scenario - they are not intended to overthrow the traditional banking system, but provide a more efficient, lower-cost, and more inclusive supplementary solution, turning cross-border settlements that used to require multiple correspondent banks and arrive in days into an action that can be completed in "minutes + cents".

With the implementation of the GENIUS Act in the United States, the entry into force of the Stablecoin Ordinance in Hong Kong, and the launch of pilots in markets such as Japan and South Korea, global payment stablecoins will become an indispensable part of the financial system, whether it is cross-border payments, corporate treasuries, or personal hedging.

When we look back at the experimental attempt of Yiwu merchants to collect USDT, we may find that this is not a story of a city, but a global microcosm - stablecoins are moving from the edge to the mainstream, from the chain to reality, and eventually become a new infrastructure for global value flow.

From this perspective, payments are the starting point of stablecoins and their larger future towards global financial infrastructure.

Guides

Find out how to buy EURC

Getting started with crypto can feel overwhelming, but learning where and how to buy crypto is simpler than you might think.

Predict EURC’s prices

How much will EURC be worth over the next few years? Check out the community's thoughts and make your predictions.

View EURC’s price history

Track your EURC’s price history to monitor your holdings’ performance over time. You can easily view the open and close values, highs, lows, and trading volume using the table below.

EURC FAQ

Currently, one EURC is worth $1.163. For answers and insight into EURC's price action, you're in the right place. Explore the latest EURC charts and trade responsibly with OKX.

Cryptocurrencies, such as EURC, are digital assets that operate on a public ledger called blockchains. Learn more about coins and tokens offered on OKX and their different attributes, which includes live prices and real-time charts.

Thanks to the 2008 financial crisis, interest in decentralized finance boomed. Bitcoin offered a novel solution by being a secure digital asset on a decentralized network. Since then, many other tokens such as EURC have been created as well.

Check out our EURC price prediction page to forecast future prices and determine your price targets.

Dive deeper into EURC

EURC, issued by Circle, is a fully regulated, Euro-backed stablecoin designed to provide a stable digital currency option for the European market and beyond. It is backed 1:1 by Euro reserves held in leading financial institutions, ensuring full transparency and liquidity.

Disclaimer

The social content on this page ("Content"), including but not limited to tweets and statistics provided by LunarCrush, is sourced from third parties and provided "as is" for informational purposes only. OKX does not guarantee the quality or accuracy of the Content, and the Content does not represent the views of OKX. It is not intended to provide (i) investment advice or recommendation; (ii) an offer or solicitation to buy, sell or hold digital assets; or (iii) financial, accounting, legal or tax advice. Digital assets, including stablecoins and NFTs, involve a high degree of risk, can fluctuate greatly. The price and performance of the digital assets are not guaranteed and may change without notice.

OKX does not provide investment or asset recommendations. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition. Please consult your legal/tax/investment professional for questions about your specific circumstances. For further details, please refer to our Terms of Use and Risk Warning. By using the third-party website ("TPW"), you accept that any use of the TPW will be subject to and governed by the terms of the TPW. Unless expressly stated in writing, OKX and its affiliates (“OKX”) are not in any way associated with the owner or operator of the TPW. You agree that OKX is not responsible or liable for any loss, damage and any other consequences arising from your use of the TPW. Please be aware that using a TPW may result in a loss or diminution of your assets. Product may not be available in all jurisdictions.

OKX does not provide investment or asset recommendations. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition. Please consult your legal/tax/investment professional for questions about your specific circumstances. For further details, please refer to our Terms of Use and Risk Warning. By using the third-party website ("TPW"), you accept that any use of the TPW will be subject to and governed by the terms of the TPW. Unless expressly stated in writing, OKX and its affiliates (“OKX”) are not in any way associated with the owner or operator of the TPW. You agree that OKX is not responsible or liable for any loss, damage and any other consequences arising from your use of the TPW. Please be aware that using a TPW may result in a loss or diminution of your assets. Product may not be available in all jurisdictions.

Market cap

$238.14M

Circulating supply

204.56M / 204.56M

All-time high

$0.00

24h volume

$38.33M