When the "Meme Hunter" Meets the "Insider Gambler": Review of BTC's billion-level leverage battle

Original title: "Giant Whale Fight, Billions of Dollars Bet, One Article Sorts Out the Whole Process of High-Leverage Long-Short Wonderful Confrontation"

Original Author: Fairy, ChainCatcher

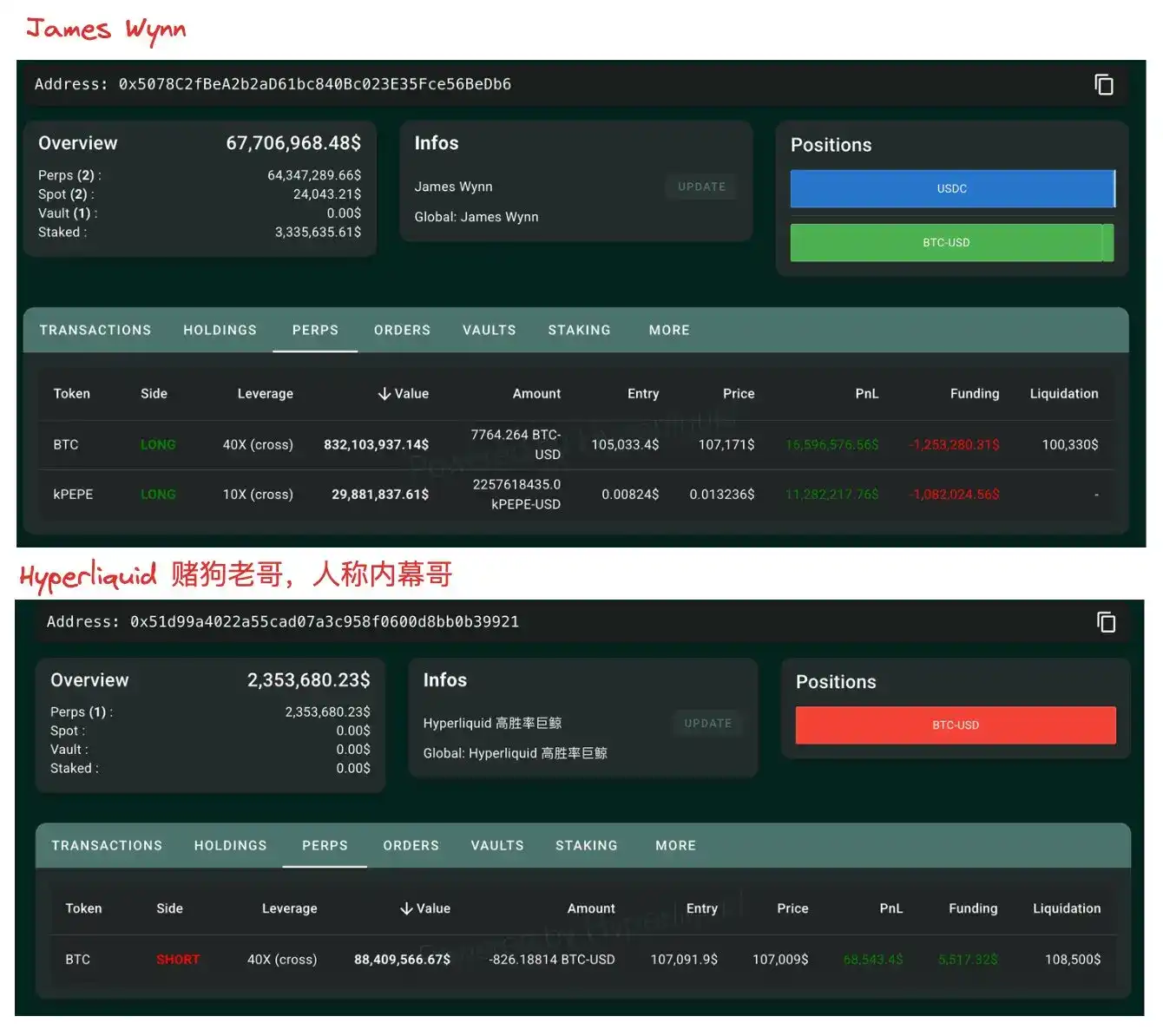

Last night, when Bitcoin was poised to break through a record high, a "100 million-level duel" long and short confrontation was staged on the chain. Two aggressive, high-stakes trading giants face each other: legendary trader James Wynn on one side and a high-win player known as the "Hyperliquid 50x Insider" on the other. The duo opened a 40x leveraged BTC counterparty, which instantly attracted high attention from the market. Leverage magnifies gains, but it also amplifies greed. Let's review the ins and outs of this late-night battle together.

who are they?

James Wynn, a bull player, was once known as the "legendary meme coin hunter" on the chain. His trading started from an extremely low-key point, initially just a "10U God of War", and the amount of wallet interactions hovered in the range of tens of dollars. But in the midst of the PEPE boom, he suddenly changed his style, became aggressive, and became famous. James Wynn took advantage of PEPE's skyrocketing market and earned more than $25 million from his initial investment of $7,644.

James Wynn's contract style can be summarized in three key words: large positions, high leverage, and high frequency. Almost every time he opened a position, he was accompanied by a shouting order. Recently, in the BTC long order, he repeatedly shouted that "$100,000 in bitcoin is very cheap".

The background of the bearish player "Hyperliquid 50x Insider" is even more bizarre. Since January of this year, multiple addresses behind it have frequently used high leverage on GMX, and have made a cumulative profit of about $2.53 million. He is active on gambling platforms Roobet and AlphaPo, has a history of interacting with ChangeNOW, a popular exchange for hackers, and single-handedly snatched $1.8 million from Hyperliquid. (Related reading: Even the exchange is cut if you are ruthless!) How did Hyperliquid get swept away for $1.8 million?

As for his real identity, ZachXBT has posted that this "insider brother" is likely to be related to William Parker (WP). WP is a "professional gambler" with a history of fraud who was arrested in Finland for stealing a total of $1 million from two online casinos in 2023. He has made headlines in the UK for hacking and gambling-related fraud.

According to the data provided by on-chain analyst Aunt Ai, in the early morning of May 21, a legendary showdown on the chain quietly began.

2 a.m. – 4 a.m.: Two players add to their

2 a.m., and James Wynn takes the lead to increase his long position in 40x leveraged BTC to 7,764.26 BTC (worth about $832 million).

· Opening Price: $105,033.4

· Liquidation Price: $100,330

· At that time, the floating profit: about $16.59 million

4 o'clock in the morning, the insider entered the market short, and the gambling was full. Open a 40x short position on the backhand when BTC hits a short-term high:

· Opening size: 826.18 BTC (about $88.41 million)

· Opening Price: $107,091.9

· Liquidation Price: $108,500 Floating profit at the time: $68,000

Source: Aunt

2 p.m.: BTC broke through $107,500, and the divergence began to appear

performance of the positions of the two sides began to diverge:

James Wynn: Long floating profit rose to $19.83

millionInsider brother: Short single floating loss of $375,000

3 p.m. to 6:30 p.m.: James Wynn took profit in batches, and the position continued to decline

3 points: the long position fell to 5625.43 BTC, the floating profit was $9.43 million, and the realized profit was 10.48 million

4 points: the position continued to be reduced to 46.40.26 BTC, the floating profit was 7.68 million US dollars, and the realized profit was 11.92 million

6:30 a.m.: Closed part of the position again, leaving only 2524.86 BTC, the floating profit fell to $2.72 million, and the cumulative realized profit was $14.57 million

.

9 p.m.: The battle line is held for the time being, James Wynn holds a low-key position, and the insider brother leaves BTC to

pull back to $106,500.

James Wynn did not immediately increase his position, holding long positions: 18.1958 BTC ($193 million), floating profit of $2.65 million, realized profit of 15.42 million

Insider brother short position: 826.18 BTC, floating profit of $

After 11 points: peak collision, both increased positions, and the smell of gunpowder was full

As BTC broke through $108,000, James Wynn increased his heavy position, and the insider brother also recharged and added margin to open a short backhand:

· James Wynn

adds position to 7444.97 BTC ($815 million)Average new opening price: $107,726.7Liquidation

price: $101,420Current

floating profit: $13.46 million

· Insider Brother

Short Position Increases to 597.4 BTC ($65.43 Million)

New opening price: $108,185.5The

liquidation price has been increased to: $112,320 (replenishing 2 million USDC margin)

Current floating loss: $

11:30 to midnight: Historical-level head-to-head bombardment, the position exceeded 1 billion

Near 11:30, James Wynn's long position exceeded $860 million, and the liquidation price rose to $101,980, and the insider's short position expanded to $101 million, with a liquidation price of $110,780.

Near 11:45, James Wynn's long position approached 900 million.

Approaching midnight: James Wynn's holdings exceed one billion, reaching the peak of the round, and the head-to-head collision between the two heroes reaches its climax

May 22 morning battle report: James won by a big margin

BTC fluctuated sharply and broke through 110,000, reaching an all-time high. James Wynn added his position to 10,200 BTC worth $1.12 billion and a floating profit of $20.19 million. Insider Brother originally made a large floating profit on short orders, but continued to increase his position in the range of $106,670-$107,410 and missed the take profit, and the cumulative loss in 24 hours expanded to $5.61 million, and he still held 40x short orders of 449.43 BTC.

, the blade of

writes victory, while the insider pays the price for greed and hesitation. This "100 million-level showdown" not only exploded the data surface, but also sounded the double alarm bell of risk and discipline for the market. And a similar game may be playing out around you and me. The current open interest in BTC contracts has soared to an all-time high of $80.263 billion. In the past 24 hours, the total liquidation of the crypto market reached $407 million, of which 240 million were short orders and 167 million were long orders.

Under high leverage, floating profit and liquidation are only one line.

Link to original article