Deconstructing Fufuture: Perpetualization of "Doomsday Rights" and Rhapsody of On-Chain Derivatives Leveraging Long-Tail Assets?

Written by: Web3 farmer Frank

In the past 5 years, from dYdX to GMX, and now to Hyperliquid, the battle for the high-leverage narrative of on-chain derivatives has always revolved around "contracts".

From the perspective of "CEX alternatives", some protocols have tried to strike a balance between higher leverage, more decentralization, and better trading depth, and have also successfully dominated the on-chain trading structure.

In fact, in the field of on-chain derivatives, the "non-linear return" feature of options (limited buyer's loss and unlimited return) is an ideal product form that naturally adapts to the high volatility environment of Crypto - not only avoiding the risk of liquidation/liquidation, but also achieving a better risk-return ratio under the premise of controllable costs through "time value leverage".

In the past few years, although Hegic, Opyn, Lyra, etc. have their own bright spots, and have also played a pioneering role in the on-chain options narrative, they are all subject to structural difficulties and have failed to build a large-scale user ecology

- On the one hand, options products themselves have a high degree of complexity, from pricing models to strategy construction to exercise rules, user education costs and transaction participation thresholds are much higher than those of contract futures.

- On the other hand, on-chain infrastructure is still difficult to solve practical bottlenecks such as decentralized liquidity, low capital utilization, and high transaction costs, resulting in poor actual product experience and serious user loss.

Therefore, it is generally difficult for on-chain options products to form enough user retention and market flywheel, almost into a dead end, how to take the low participation threshold and flexible trading structure as the starting point, and use options as a tool to better adapt to on-chain derivatives has gradually become a new exploration path.

As a decentralized perpetual options protocol, Fufuture does not copy traditional options on the chain, but through the dual architecture of "coin-margined + perpetual (doomsday) options", while ensuring the non-linear return attributes, it abandons the complex exercise mechanism and term limit, and instead builds a more lightweight and sustainable on-chain derivatives interaction paradigm.

In short, in the design of Fufuture, the option structure is not an end in itself, but a tool to activate the new paradigm of on-chain derivatives, which reconstructs the cost structure and position logic of traditional options with the mechanism of "dynamic premium payment + unlimited rollover", so that it is no longer limited by "elite strategy" or "mainstream assets", but can be widely applied to long-tail assets, high-volatility varieties, and even various non-Crypto Assets are highly leveraged in trading scenarios.

In this context, a decentralized options system that is more combinable, easier to understand, more able to activate the value of long-tail assets, and more able to reach the leveraged trading of global core assets may be quietly taking shape.

The "impossible triangle" of end-date options and on-chain derivativesHave

you heard of or traded 0DTE options (end-date options)?

At present, many Crypto players have intersections with U.S. stock trading, and an interesting trend should be found, that is, in the U.S. stock market, more and more investors have begun to contact options, especially terminal options trading, in the past two years, with the prevalence of "financial nihilism" in the context of the new crown epidemic, 0DTE options trading in the traditional financial market has almost become a carnival for retail investors in the past 5 years

Since 2016, small traders have started to flock to options in droves, with 0 DTE options trading rising from 5% to 43% of total SPX options volume.

Source: moomoo.com

This also reflects a reality that we must face up: options are not just an elite tool for institutions, they are evolving into an excellent tool for retail investors to unleash their demand for high-leverage trading.

The question is, what about on-chain DeFi? Objectively speaking, perpetual contracts still dominate Crypto's highly leveraged narrative, after all, its simple structure, low threshold, and instant liquidation are extremely suitable for the preferences of "low-attention" users.

However, the complex structure and high threshold of traditional option products (pricing model, exercise mechanism, strategy construction, etc.) require extremely high user cognition, and at the same time, the on-chain infrastructure is difficult to meet the needs of low-cost, high-precision, and continuous liquidity, which ultimately leads to most DeFi option protocols either stopping at niche players or falling into the unsolvable hedge between "product elitism vs user scale".

For example, in the Web3 world, the "impossible triangle" has become a common framework for describing systemic trade-off puzzles (such as the game between scalability, security, and decentralization of L1), while in the field of on-chain derivatives, there is also a structural paradox that is difficult to achieve - liquidity, capital efficiency, and protocol risk, and the choice of the three is often the only one

- Liquidity: The foundation of all on-chain derivatives trading, and the market without liquidity cannot achieve effective pricing;

- Capital efficiency: the core indicator of product survival and growth, which determines the motivation of users to continue to participate;

- Protocol risk: price manipulation, slippage, and liquidity depletion can all become systemic flashpoints, which has also been confirmed by Hyperliquid's recent crises;

Therefore, non-linear tools such as options, which far exceed futures in TradFi, have never been able to find a mature landing scenario on the chain, but are there really no opportunities for "on-chain options"?

In fact, just as the end-of-date options are popular in the TradFi market, the "coin-margined perpetual options" proposed by Fufuture are not a good entry point to avoid a series of classic traps of on-chain options - it abandons the complex structure of "exercise date + order book + Black-Scholes pricing" in traditional options, and instead builds a complete set of "unlimited rollover + premium settlement" based on Crypto infrastructure A new system of mechanism:

users do not need to choose the exercise date, and can renew the premium every day to maintain the position; The buyer's maximum loss is still the premium paid, and there is no upper limit on the profit margin; The price is anchored by an external oracle, and the profit and loss of the core asset is calculated on the currency basis (e.g., ETH/USDT is settled in ETH).

This minimalist design greatly lowers the user's cognitive threshold (regardless of the exercise time and strategy construction), making the options trading experience closer to the rhythm and habits of perpetual contracts, and for users who pursue short-term volatility arbitrage and emotion-driven trading, Fufuture structured option products are more like a "day contract + time leverage hybrid" with explosive odds.

So the core design concept of Fufuture can be summarized in one sentence: to make options have a "contract-like smooth trading experience", but retain "the original non-linear return logic of options".

So the core design concept of Fufuture can be summarized in one sentence: to make options have a "contract-like smooth trading experience", but retain "the original non-linear return logic of options".

This structure essentially disassembles the "time dimension" of traditional options into "daily dynamic positions", which not only solves the cognitive barriers of complex option exercise paths and users not understanding when to close positions, but also integrates the high-odds structure into the on-chain financial context in a more sustainable way through the daily premium model.

Perpetualizing the "end option" is undoubtedly the most attractive choice for users with "gambling" and high odds, especially when users find that they can even directly participate in high-leverage derivatives trading with meme coins sleeping in their wallets without worrying about the risk of liquidation, the balance of the game between the chain and the CEX may begin to really tilt.

Deconstructing Fufututre: Coin-based, perpetual "end-date right", trading systemTo

understand the innovation of Fufuture, we must start with three key words: coin-standard, perpetual options, and trading system, which do not exist in isolation, but together constitute the core password of Fufuture's innovative architecture.

Among them, the design of the coin-margined + perpetual "end-date option" is to provide users with an option scenario similar to a "contract-like trading experience", which not only retains the high odds characteristics of the non-linear leverage structure, but also simplifies the complex cognitive threshold of options, and the specific mechanism will be dismantled in detail later.

Before that, it is necessary to clarify the premise of the "trading system" again, that is, Fufuture is not just a simple on-chain option product, but through a more friendly option structure, it is deeply adapted to the needs of on-chain transactions, and a new paradigm of on-chain derivatives that allows users to better use Crypto long-tail assets and trade mainstream assets with low threshold and high leverage.

To put it bluntly, Fufuture's ambition is far more than "putting an option product on the chain", but to create a trading paradigm with high adaptability, composability and scalability in the on-chain derivatives track. Therefore, it is not a "CEX substitute", but through structural innovation, it captures those unreleased but real trading potential, especially long-tail assets to participate in derivatives trading, and retail investors have a low threshold and high leverage gaming needs.

This is also Fufuture's biggest imagination, injecting a new possibility into the on-chain derivatives market - with the innovation of perpetual options, it is not only to serve existing trading behaviors, but to create an ability to serve "uncaptured trading needs".

1. Currency standard:

Compared with traditional options, which mostly use stablecoins as the margin and settlement unit, Fufuture's "currency standard" design essentially reconstructs the leveraged trading relationship between users and assets from two core dimensions:

- Margin dimension:Fufuture allows users to use any on-chain assets (including meme coins, small-cap governance tokens, and even some tokenized RWAs) as margin for opening positions, opening up derivatives participation channels for assets that have been excluded from mainstream trading systems for a long time.

- Settlement dimension: The profit and loss is no longer anchored to USD, but is directly settled with the original underlying token, so that the asset transaction is closer to the asset structure and cognitive habits of real holders;

After all, many meme tokens and small and medium-sized projects are not supported by futures contracts and cannot be placed on traditional trading platforms, and the value is difficult to be reasonably discovered and utilized, while coin-margined perpetual options can become the most cost-effective derivatives path, providing holders of these long-tail tokens with more investment options and risk management tools.

At the same time, for coin holders, they often hold a large number of ALT tokens, and in the traditional transaction mode, they need to exchange the underlying tokens for stablecoins for trading, which not only faces the risk of exchange costs and exchange rate fluctuations, but also needs to exchange back the underlying tokens again at the time of settlement, which is cumbersome and increases uncertainty.

Fufuture's "coin-standard" settlement method allows profits and losses to be directly reflected in the underlying token, avoiding the conversion loss of intermediate links, and is more in line with users' asset structure and investment habits, enabling them to manage their investment portfolios and risks and returns more clearly and conveniently.

Fufuture's "coin-standard" settlement method allows profits and losses to be directly reflected in the underlying token, avoiding the conversion loss of intermediate links, and is more in line with users' asset structure and investment habits, enabling them to manage their investment portfolios and risks and returns more clearly and conveniently.

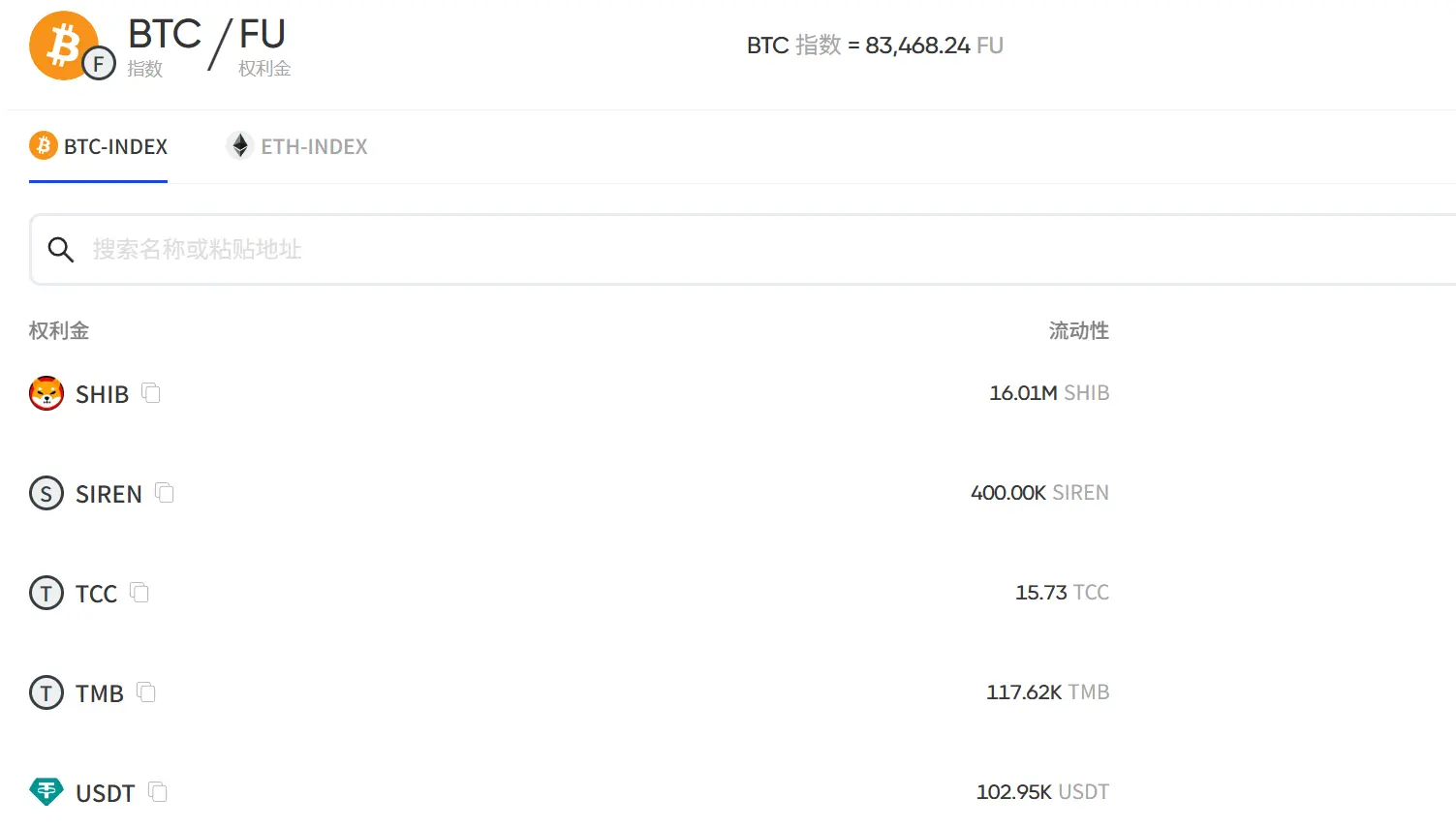

In addition, the "coin-margined" profit and loss settlement method also provides an effective means of market-making for these assets - firstly, users can directly use meme tokens such as SHIB and SIREN to participate in options trading, which alleviates the market selling pressure, and in addition, users and even project parties can also play the role of market makers and provide liquidity to earn income by participating in "double pools" (see below for details), thereby stabilizing the balance of supply and demand of Alt tokens from multiple dimensions.

2. Perpetual mechanism:

Aswe all know, the biggest difference between options and contracts is that they will not be "liquidated" due to price fluctuations, while Fufuture reconstructs this risk-return structure through "perpetualization", allowing users to speculate or hedge with high leverage without the risk of liquidation.

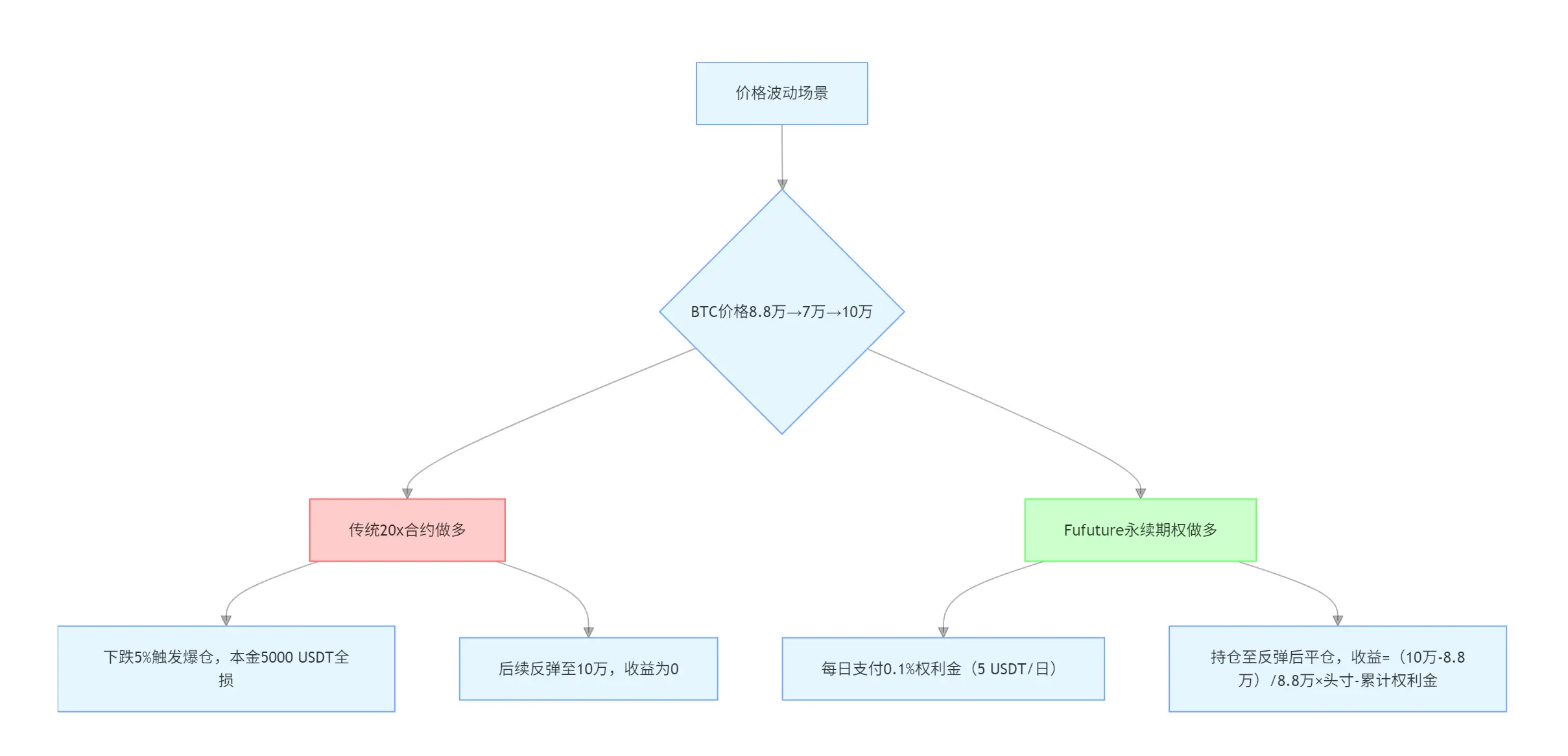

Let's use a simple example to understand the charm of its "non-linear return", let's say you have 5,000 USDT, when the BTC price is $88,000:

- If you use a 20x perpetual contract to go long, once BTC falls by more than 5%, it will trigger a liquidation and lose all the principal, even if the subsequent price rises to $100,000, the return will be 0;

- If you use Fufuture perpetual options, you only need to pay a daily premium (e.g., 0.1%) to maintain the position, even if BTC first falls to $70,000 and then rises to $100,000, you can still close the position and make a profit.

And Fufuture's perpetual options also solve the problem of "time cost mismatch" in the traditional options market: for example, if you buy a 3-month BTC call option, you need to pay 20% of the premium upfront (e.g., a 10,000 USDT position corresponds to 2,000 USDT cost), even if the market rises sharply in the first week, Early liquidation still incurs the sunk cost of the premium for the remaining period.

Fufuture, on the other hand, uses "dynamic installment payment" to enable investors to obtain position holdings at a "rental" cost - the premium is paid as you go, no longer prepaying a high premium for 3 months, but a daily dynamic payment, in which the system automatically settles and updates the position every 24 hours, and the user does not need to operate manually, if the premium balance is sufficient, the position can theoretically be extended indefinitely.

At the same time, this also pushes the break-even point forward, still for example, if the premium is 20%, it means that the underlying asset needs to rise by at least 20% within 90 days to cover the cost; However, Fufuture's perpetual options make the holding period and corresponding costs flexible parameters that can be adjusted at any time:

if the position is only held for 9 days, it only needs a 2% increase to achieve breakeven; If you hold a position for only 18 days, you only need a 4% increase to break even (a simple calculation, but it doesn't change strictly linearly).