Entering mid-May 2025, Ethereum caught up with Bitcoin's gains, but Bitcoin has been consolidated, its volatility has fallen to a low point, and the market expects a key breakthrough, at about eight o'clock in the morning on the 19th, Bitcoin once exceeded $107,000, and most traders expect Bitcoin to enter a new [PriceDiscovery] stage. Bullish sentiment on the current market structure, with the expectation that prices will retest new all-time highs.

However, there is also caution in the market, and given that Bitcoin has not been able to effectively break through resistance so far, there may be a temporary pullback in the near term. Bitcoin has not moved significantly higher relative to equities recently, especially after the US-China trade deal, which may indicate that investors are more inclined to seek Bitcoin purchases when there are outflows or uncertainty elsewhere.

Bitcoin once broke through $107,000 on the morning of the 19th, and may have fallen sharply due to selling pressure, as of about half past two in the afternoon of the 19th, the lowest touched the $102,000 line, a pullback of nearly $5,000, and the price rebounded at $105,000 as of the time of writing, down about 0.47% in the past 24 hours.

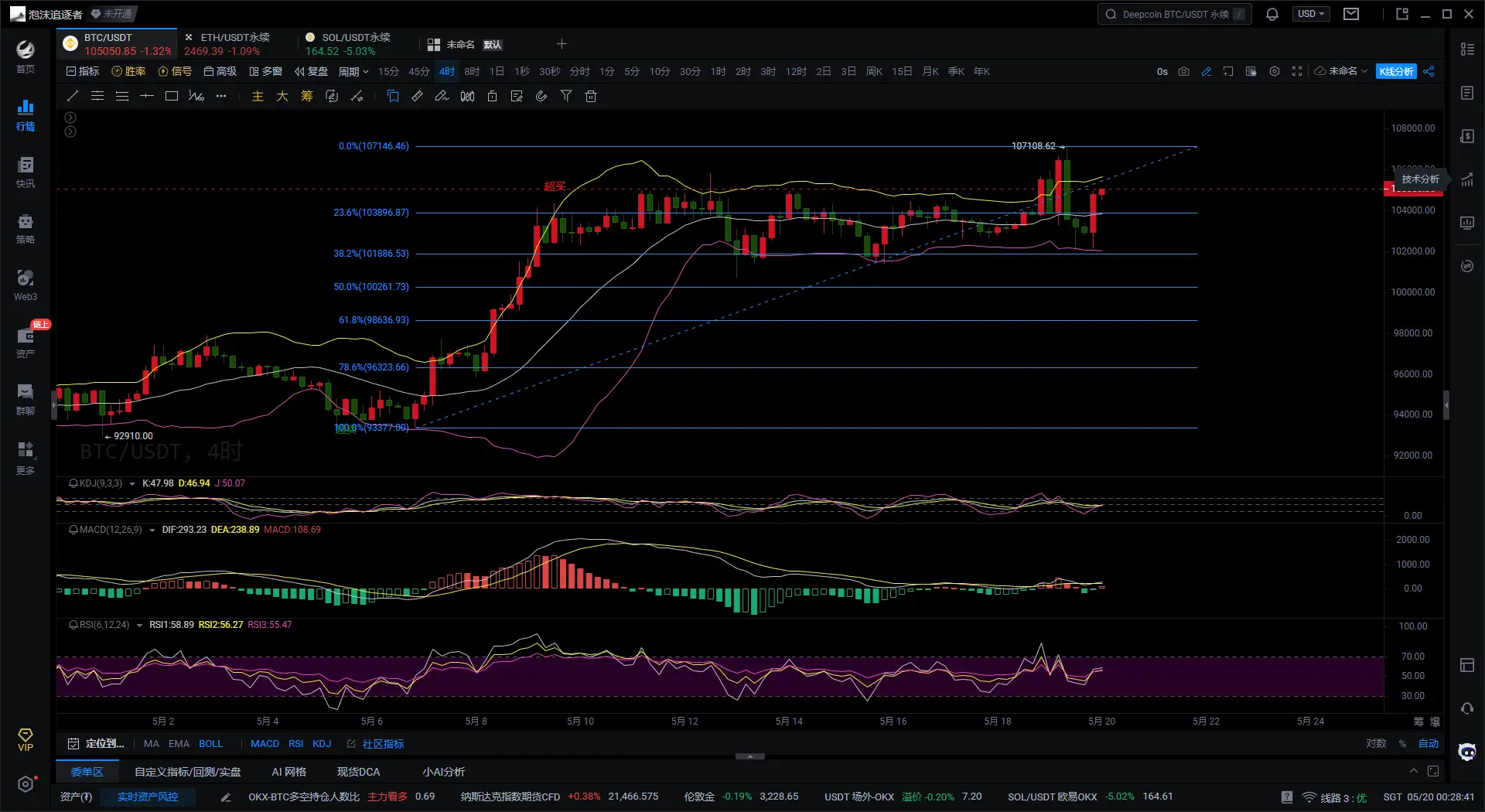

Bitcoin four-hour chart

The price of bitcoin is currently fluctuating back and forth between the upper and middle bands, with the upper band starting to narrow and the lower band still going down, indicating that the market volatility is decreasing. If you can hold the middle band, you may enter a new consolidation phase or try to break out. Now the price is in a transition period, and there is no clear direction to choose.

Judging from the KDJ indicator, the three line values are all in the middle position, just forming a golden cross upward from the low, and have neither entered the overbought area nor the oversold area. In the short term, there may be a chance of a rebound, but it will take volume to confirm the strength of the rebound. As for the MACD indicator, both the DIF and DEA lines are below the zero line, and although the green histogram has shortened, the bearish power has not completely faded. At present, a golden cross has not yet been formed, and the whole is still in the stage of weak repair.

The price is now oscillating around the Fibonacci 23.6% (103896) level. If it does not hold at this level, it may continue to test the 38.2% support level 101886 below. Overall, the market sentiment is cautious and needs to wait for clearer signals.

To sum up, Daisen gives the following suggestions for reference

Bitcoin pulls back to around 103900 to go long, target 105000-106000, defend 103300.

To give you a 100% accurate suggestion, it is better to give you a correct idea and trend, after all, it is better to teach people and fish than to teach people and fish, it is recommended to earn a while, and learn to earn a lifetime! What I can do is to use my practical experience to help you with my practical experience, so that your investment decisions and operation management can go in the right direction.

Writing time: (2025-05-20, 00:30).

(Text-Daxian said coin).