Bitcoin falls below $105,000, bullish or consolidating?

Original author: 1912212.eth, Foresight News

On May 30, the last day of the Bitcoin 2025 conference, the market once again fulfilled the curse of a sharp decline.

Bitcoin briefly fell below $105,000 this morning, dipping as low as $104,600. Ethereum also fell from a high of $2,788 all the way to a low of $2,557. The copycat market has generally ushered in a pullback, with some copycats such as BERA even hitting record lows.

In terms of the contract market, according to Coinglass data, in the past 1 hour, the entire network liquidated $330 million, of which $321 million was liquidated by long orders and $7.89 million by short orders.

In the macro market, COIN and MSTR in U.S. crypto stocks both fell after hours. On the Fed's interest rate cuts, which has been repeatedly vacillating, Fed's Daly said on Thursday that while policymakers are still likely to cut rates twice this year, interest rates should remain stable for now to ensure that inflation can meet the Fed's 2% target. Daly stressed that as long as inflation is above target and there is uncertainty, inflation will be in focus because of solid labor market conditions. In addition, the U.S. Trade Court's ruling to block Trump's tariff measures on Wednesday was overturned by an appeals court on Thursday, highlighting the uncertainty over trade policy that many businesses and the Federal Reserve are uneasy about.

Is this retracement a healthy short-term pullback, or is it about to enter a long-term consolidation shock again? Let's listen to the market views of big names and analysts.

Placeholder Partner: A small market correction does not mean the end of the market, the risk structure is still

goodChris Burniske, a partner at Placeholder, posted on social media, "Don't mistake a small correction for the end of the market, the overall risk/return structure is still good."

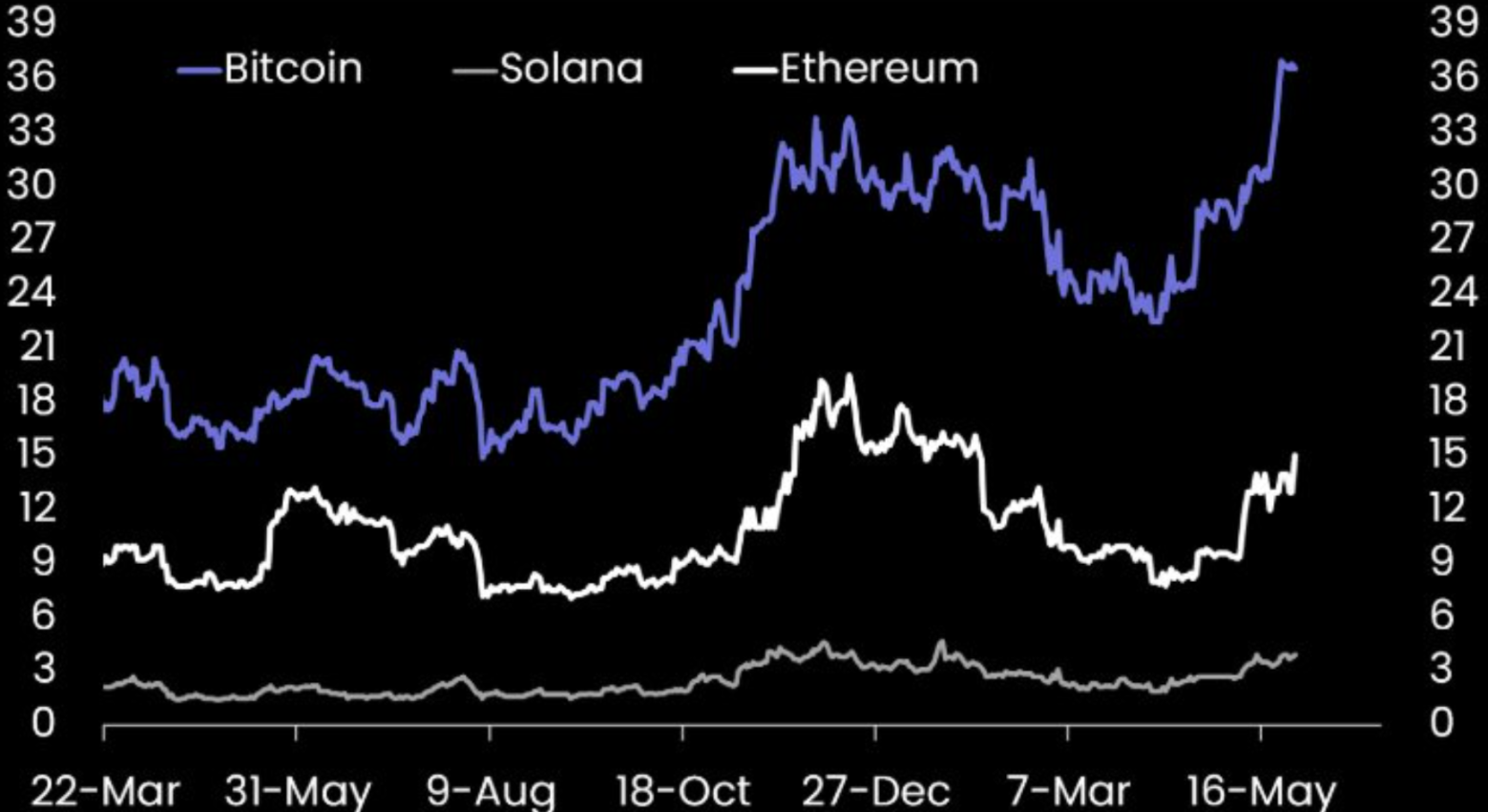

Matrixport: Futures open interest has

climbed sharply since the April lows, according to Matrixport's latest report, Markus Thielen of 10x Research. While Solana took a back seat as the meme coin and Pump.fun craze cooled, open interest in Bitcoin saw a significant increase. The surge may reflect a shift in market risk appetite, especially in the wake of Trump's recent reversal of tariffs. Bitcoin continues to play the dual role of "risk appetite" and "risk aversion", and is increasingly in line with the narrative of "digital gold".

However, open interest seems to be leveling off for now, which may confirm our view – traders are starting to take profits and plan to re-enter at lower levels.

Bitfinex Report: Bitcoin Enters Healthy Consolidation Phase, Short-term Holders Take Profits or Trigger Selling Pressure

Bitfinex Alpha reported on May 26 that Bitcoin experienced a 32% pullback after hitting a new all-time high in January, but has since rebounded strongly by more than 50% to a new high of $111, 880, and has now entered a healthy consolidation phase. Strong ETF inflows, surging participation in the spot market, and positive "net realized capital" growth have driven structural buying in the market, rather than excessive speculation. Despite the pullback in macro risk appetite, such as rumors that the US may impose a 50% tariff on European imports, bitcoin has remained resilient – without significant declines in the process of deleveraging and profit-taking.

This resilience is raising concerns about Bitcoin's evolution into a "macro-sensitive, belief-driven asset" whose trading behavior is now more tied to global liquidity than to retail sentiment. Notably, Japan's Metaplanet increased its holdings of Bitcoin worth $104 million, and the US state of Michigan's proposal to introduce legislation in favor of crypto assets, further validates the growing institutional and policy support for digital assets.

Looking ahead, whether Bitcoin can continue to consolidate above its short-term holding cost base (around $95, 000) will be key. Over the past month, short-term holders have realized more than $11.4 billion in profits, so there may be some selling pressure in the near term, but structural demand remains. The strength of ETF buying, low volatility, and premium signals in the cash market all suggest that the market is maturing and that further gains could follow, once the macro environment is clear. For now, the next few weeks will determine whether Bitcoin's breakout is a phased top or a prelude to a stronger rally in Q3.

Arthur Hayes: Ethereum price on track to double to $5,000 this year

BitMEX co-founder Arthur Hayes said at the Bitcoin 2025 conference that Ethereum price is on track to reach $4,000-$5,000 this year. Hayes believes that Ethereum is currently the "least popular Layer 1 public chain", but it could instead be an investment opportunity during a period of market cycle transition.

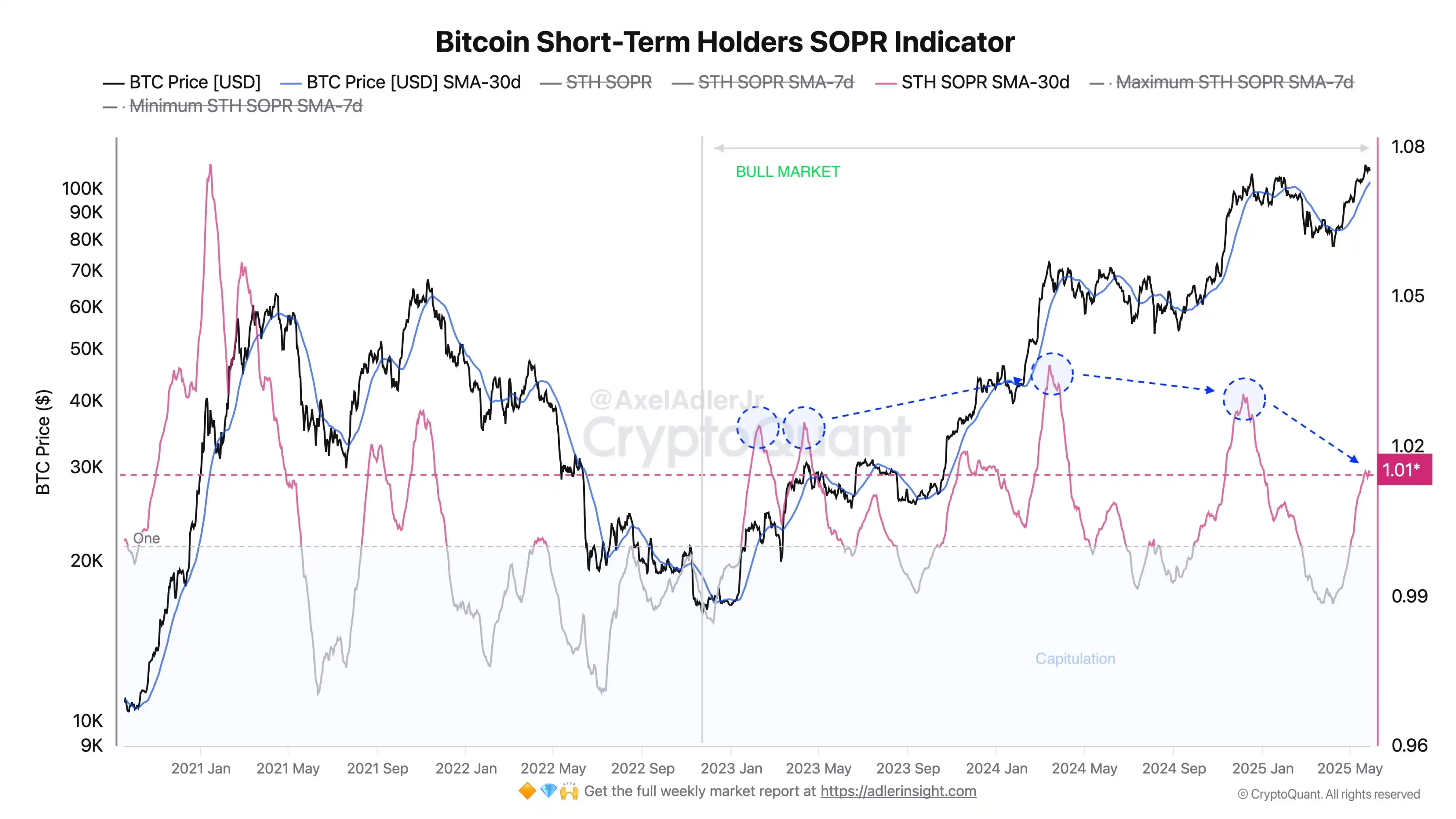

CryptoQuant analysts: BTC short-term holders have realized profits to local highs, but have not yet reached the peak level of the previous bull

marketCryptoQuant analyst Axel Adler Jr posted on social platforms that STH SOPR (30-day moving average), a measure of the average realized profit and loss of short-term investors when spending tokens on-chain, has recently hit a local high, indicating that short-term holders have realized profits that have risen significantly.

Despite this, the demand for the token remains strong and has not affected the current upward trend. The indicator has not yet reached the frenzied levels seen at the previous important price highs.